Schlumberger recorded $32 million of pretax merger and integration-related charges ($24 million after-tax)

in connection with the acquisitions of Smith and Geoservices.

First quarter of 2011:

Š

Schlumberger recorded $34 million of pretax merger and integration-related charges ($28 million after-tax)

in connection with the acquisitions of Smith and Geoservices.

The following is a summary of these charges:

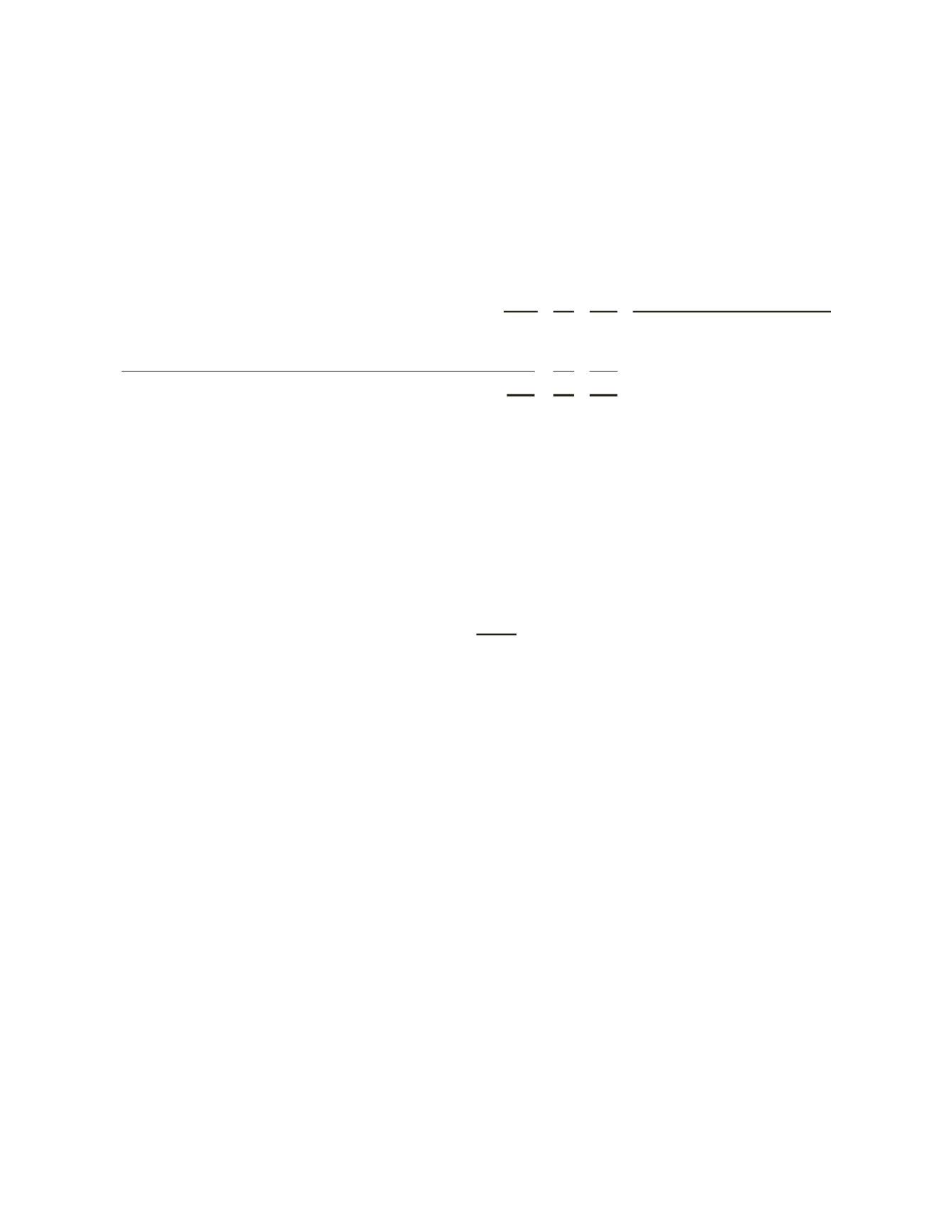

(Stated in millions)

Pretax Tax Net

Consolidated Statement

of Income Classification

Merger-related integration costs

$115 $19 $ 96

Merger & integration

Donation to the Schlumberger Foundation

50 10 40

General & administrative

Write-off of assets in Libya

60 – 60

Cost of revenue -Oilfield Services

$225 $29 $196

2010

Fourth quarter of 2010:

Š

In connection with the acquisition of Smith, Schlumberger recorded the following pretax charges: $115

million ($73 million after-tax) relating to the amortization of purchase accounting adjustments associated

with the write-up of acquired inventory to its estimated fair value, $17 million ($16 million after-tax) of

professional and other fees and $16 million ($12 million after-tax) relating to employee benefits.

Š

Schlumberger repurchased the following debt:

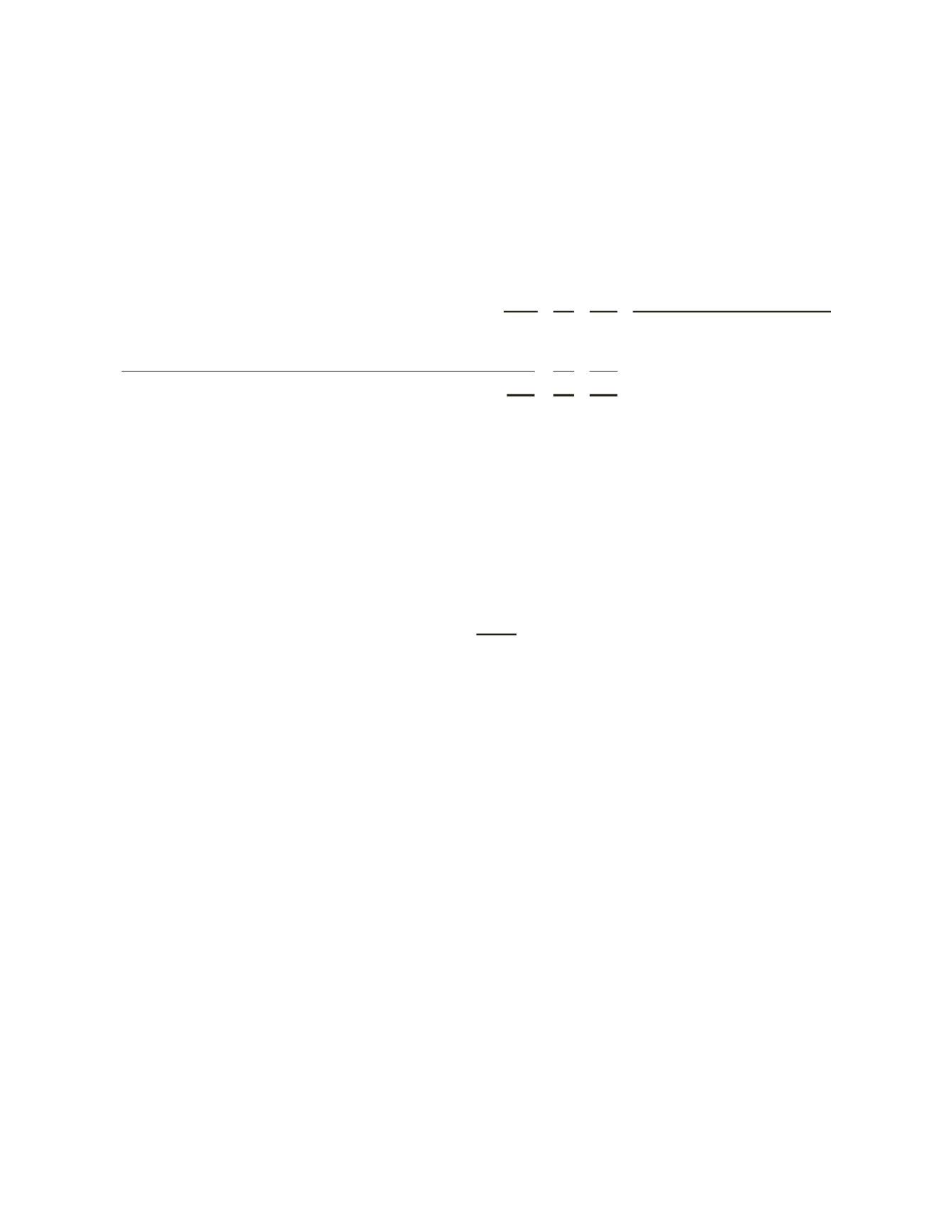

(Stated in millions)

Carrying

Value

6.50% Notes due 2012

$297

6.75% Senior Notes due 2011

$123

9.75% Senior Notes due 2019

$212

6.00% Senior Notes due 2016

$102

8.625% Senior Notes due 2014

$ 88

As a result of these transactions, Schlumberger incurred pretax charges of $32 million ($20 million after-tax).

Third quarter of 2010:

Š

As a result of the decision to rationalize support costs across the organization as well as to restructure the

North America land operations to provide greater operating efficiency, Schlumberger recorded a pretax

charge of $90 million ($77 million after-tax).

Š

Following the successful introduction of UniQ, a new generation single-sensor land acquisition system,

Schlumberger recorded a $78 million pretax charge ($71 million after-tax), related to the impairment of

WesternGeco’s first generation Q-Land system assets.

Š

A pretax and after-tax charge of $63 million primarily relating to the early termination of a vessel lease

associated with WesternGeco’s electromagnetic service offering as well as related assets, including a $30

million impairment related to an equity-method investment.

Š

In connection with the acquisition of Smith, Schlumberger recorded the following pretax charges: $56 million

($55 million after-tax) of merger-related transaction costs including advisory and legal fees, $41 million ($35

million after-tax) relating to employee benefits for change in control payments and retention bonuses and $38

million ($24 million after-tax) relating to the amortization of purchase accounting adjustments associated

with the write-up of acquired inventory to its estimated fair value.

44