Š

$40 million pretax charge ($36 million after-tax) for the early termination of rig contracts and workforce

reductions in Mexico due to the slowdown of project activity.

Š

Schlumberger repurchased $352 million of its 6.50% Notes due 2012 and, as a result, incurred a pretax charge

of $28 million ($18 million after-tax).

Š

Schlumberger recorded a pretax gain of $1.27 billion ($1.24 billion after-tax) as a result of remeasuring its

previously held 40% equity interest in the M-I SWACO joint venture. Refer to Note 4—

Acquisitions

for further

details.

First quarter of 2010:

Š

Schlumberger incurred $35 million of pretax and after-tax merger-related costs in connection with the Smith

and Geoservices transactions. These costs primarily consisted of advisory and legal fees.

Š

During March 2010, the Patient Protection and Affordable Care Act (PPACA) was signed into law in the

United States. Among other things, the PPACA eliminates the tax deductibility of retiree prescription drug

benefits to the extent of the Medicare Part D subsidy that companies, such as Schlumberger, receive. As a

result of this change in law, Schlumberger recorded a $40 million charge to adjust its deferred tax assets to

reflect the loss of this future tax deduction.

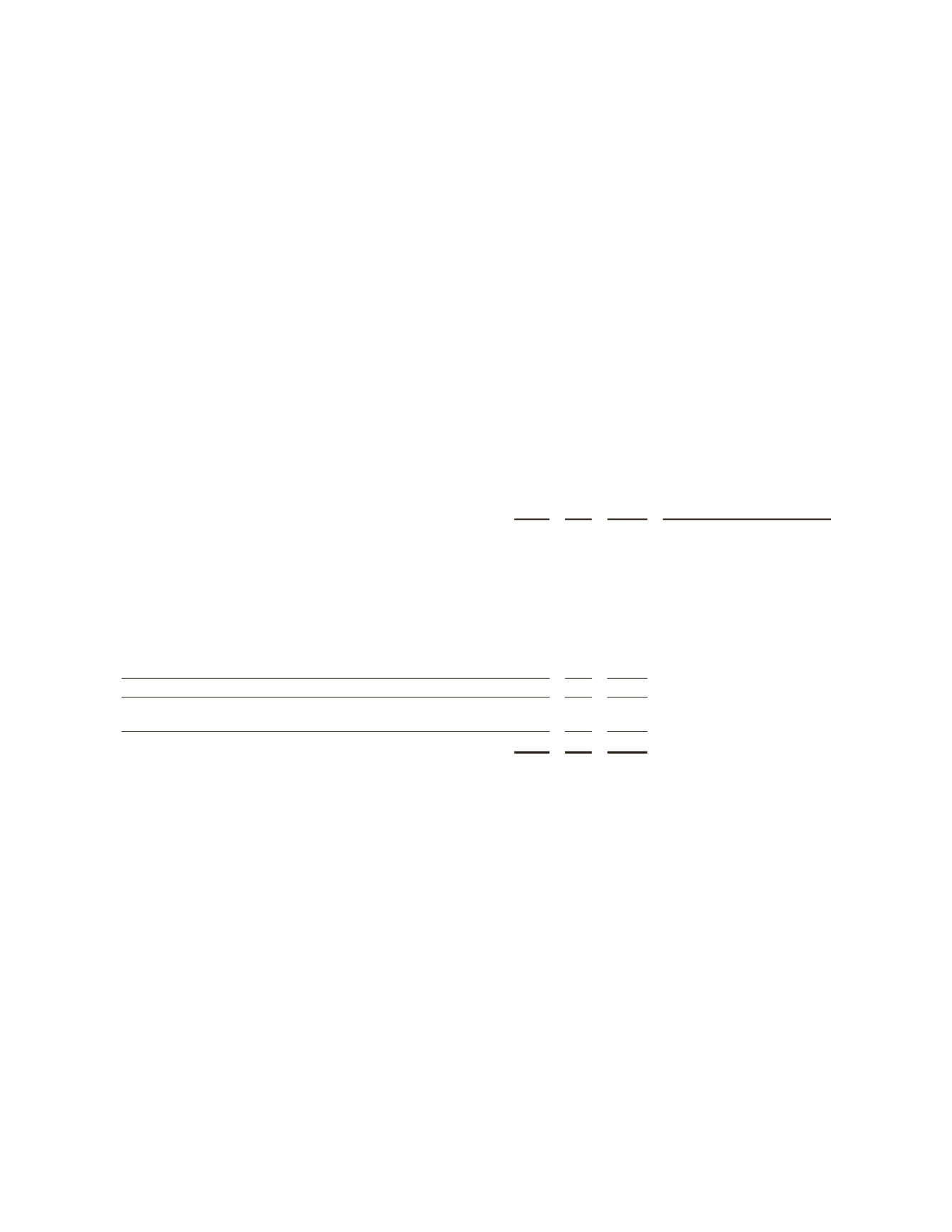

The following is a summary of 2010 Charges and Credits:

(Stated in millions)

Pretax Tax

Net

Consolidated Statement

of Income Classification

Restructuring and Merger-related Charges:

Severance and other

$ 90 $ 13 $ 77

Restructuring & other

Impairment relating to WesternGeco’s first generation Q-Land acquisition

system

78

7

71

Restructuring & other

Other WesternGeco-related charges

63

–

63

Restructuring & other

Professional fees and other

107

1

106

Merger & integration

Merger-related employee benefits

58

10

48

Merger & integration

Inventory fair value adjustments

153

56

97

Cost of revenue -Oilfield Services

Mexico restructuring

40

4

36

Restructuring & other

Repurchase of bonds

60

23

37

Restructuring & other

Total restructuring and merger-related charges

649 114

535

Gain on investment in M-I SWACO

(1,270) (32) (1,238)

Gain on Investment in M-I SWACO

Impact of elimination of tax deduction related to Medicare Part D subsidy

– (40)

40

Taxes on income

$ (621) $ 42 $ (663)

2009

Second quarter of 2009:

Š

Schlumberger continued to reduce its global workforce as a result of the slowdown in oil and gas exploration

and production spending and its effect on activity in the oilfield services sector. As a result of these actions,

Schlumberger recorded a pretax charge of $102 million ($85 million after-tax). These workforce reductions

were completed by the end of 2009.

Š

As a consequence of these workforce reductions, Schlumberger recorded pretax non-cash pension and other

postretirement benefit curtailment charges of $136 million ($122 million after-tax). Refer to Note 18 –

Pension and Other Benefit Plans

for further details.

45