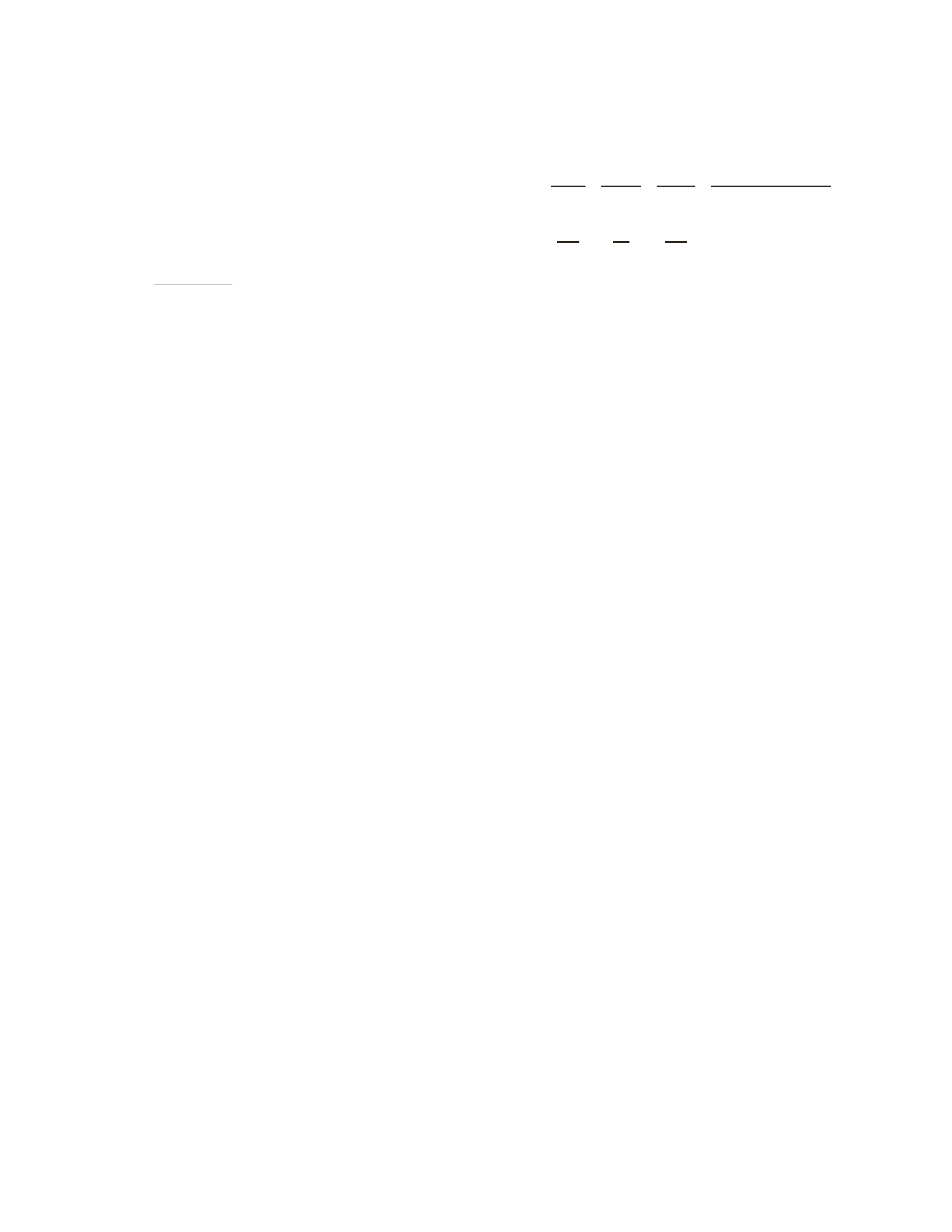

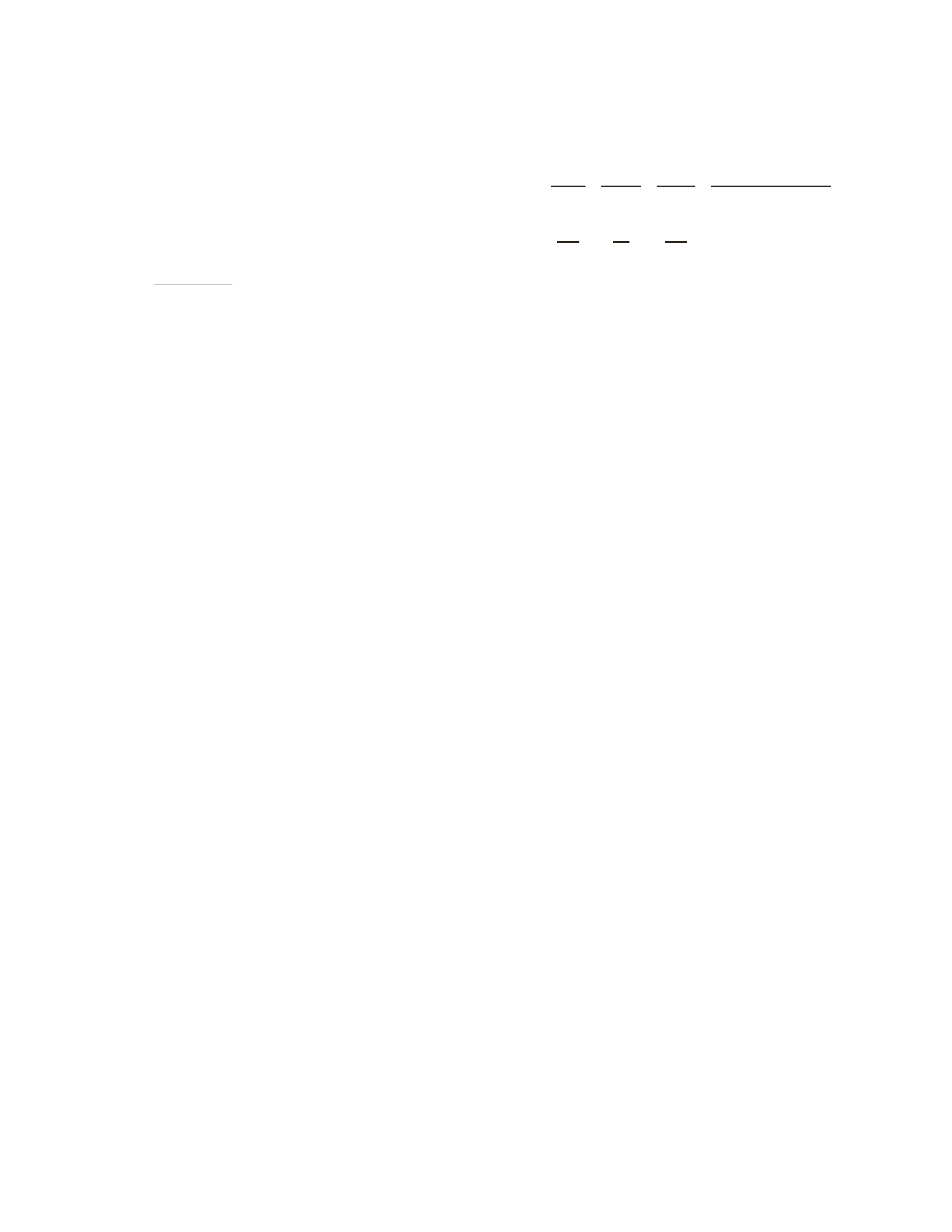

The following is a summary of these charges:

(Stated in millions)

Pretax

Tax

Net

Consolidated Statement

of Income Classification

Workforce reductions

$102

$17

$ 85

Restructuring & other

Postretirement benefits curtailment

136

14

122

Restructuring & other

$238

$31

$207

4. Acquisitions

Acquisition of Smith International, Inc.

On August 27, 2010, Schlumberger acquired all of the outstanding shares of Smith, a leading supplier of premium

products and services to the oil and gas exploration and production industry. The transaction brought together the

complementary drilling and measurements technologies and expertise of Schlumberger and Smith in order to facilitate

the engineering of complete drilling systems which optimize all of the components of the drill string. Such systems will

enable Schlumberger’s customers to achieve improved drilling efficiency, better well placement and increased

wellbore assurance as they face increasingly more challenging environments. In addition, Schlumberger’s geographic

footprint will facilitate the extension of joint offerings on a worldwide basis.

Under the terms of the transaction, Smith became a wholly-owned subsidiary of Schlumberger. Each share of Smith

common stock issued and outstanding immediately prior to the effective time of the acquisition was converted into the

right to receive 0.6966 shares of Schlumberger common stock, with cash paid in lieu of fractional shares.

At the effective time of the acquisition, each outstanding option to purchase Smith common stock was converted

into a stock option to acquire shares of Schlumberger common stock on the same terms and conditions as were in

effect immediately prior to the completion of the transaction. The number of shares of Schlumberger common stock

underlying each converted Smith stock option was determined by multiplying the number of Smith stock options by the

0.6966 exchange ratio, and rounding down to the nearest whole share. The exercise price per share of each converted

Smith stock option was determined by dividing the per share exercise price of such stock option by the 0.6966

exchange ratio, and rounded up to the nearest whole cent. Smith stock options, whether or not then vested and

exercisable, became fully vested and exercisable and assumed by Schlumberger at the effective date of the acquisition

in accordance with preexisting change-in-control provisions. Smith stock options were converted into 0.6 million of

Schlumberger stock options.

At the effective time of the acquisition, Smith restricted stock units, whether or not then vested, became fully vested

(except for grants between the date of the acquisition agreement and closing, which were not significant and did not

automatically vest) and were converted into shares of Schlumberger common stock, determined by multiplying the

number of shares of Smith common stock subject to each award by the 0.6966 exchange ratio, rounded to the nearest

whole share (assuming, in the case of performance-based Smith restricted stock unit awards, the deemed attainment

of the performance goals under the award at the target level).

Smith’s results of operations have been included in Schlumberger’s financial statements for periods subsequent to

the effective date of the acquisition. Smith contributed revenues of $3.3 billion and net income of $160 million

(including the recurring effects of purchase accounting) to Schlumberger for the period from the closing of the

transaction through December 31, 2010. Smith reported revenue of approximately $6.0 billion (unaudited) for the

period from January 1, 2010 to August 27, 2010 and $8.2 billion in 2009.

Calculation of Consideration Transferred

The following details the fair value of the consideration transferred to effect the acquisition of Smith.

46