Our Business

BlackRock serves institutional, retail and high net worth investors in more than 100 countries. Through the efforts of professionals located in 25 countries, we strive to leverage our global expertise and scale, together with our understanding of local requirements and business customs, to most effectively serve our clients. Portfolios may be invested in local, regional or global capital markets. Products may be structured to address location-specific issues, such as regulations, taxation, operational infrastructure, market liquidity, and client-specific issues, such as investment policy, liability structure and ratings.

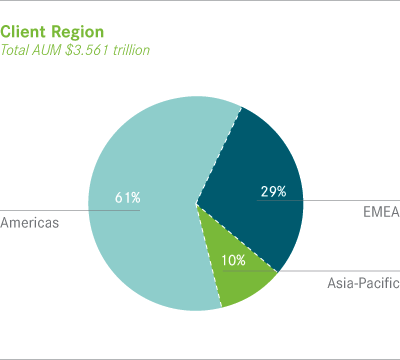

In order to enhance our ability to best serve our clients and develop our talent, we modified our matrix organizational structure in 2010 to reinforce the teamwork required among global functions and regions. The global functions — Portfolio Management, BlackRock Solutions® ("BRS,") Global Clients, and Corporate & Business Operations — are key to driving coordination and consistency, and to achieving the benefits of our scale. The regions — Americas, EMEA, and Asia-Pacific — support local clients, employees, regulators and business strategy. At December 31, 2010, 44% of our assets under management ("AUM") was managed for clients outside the U.S., and 41% of our employees were based outside the U.S. We expect these figures to approach 50% over the coming years.

Global Clientele

Americas

At year-end 2010, assets managed on behalf of clients domiciled in the Americas (defined as the U.S., Caribbean, Canada, Latin America and Iberia), totaled $2.177 trillion or 61% of total AUM, an increase of $118.8 billion or 6% in 2010. Growth was driven by $78.4 billion in net new business in long-term products and $177.3 billion in investment performance and market appreciation. Clients are served through offices in Brazil, Canada, Chile, Mexico, Spain and throughout the U.S.

Offerings include closed-end funds and iShares® traded on domestic stock exchanges, a full range of open-end mutual funds, collective investment funds, common trusts, private funds and separate accounts. The long-term product mix is well diversified and proportional to the firm's mix: 57% in equities, 34% in fixed income, 6% in multi-asset class and 3% in alternatives. By comparison, cash management offerings predominantly serve clients in the Americas. We also have a wide variety of BRS assignments for institutional investors and governmental entities in the U.S. and Canada.

The mix by investment style is also balanced, with 39% of long-term AUM managed in active products, 35% in institutional index accounts and 26% in iShares and other exchange traded products ("ETPs") at year-end. Note that the iShares figures are based on the jurisdiction of the fund, rather than the underlying investor. Non-U.S. investors often prefer U.S. iShares, primarily due to the depth of the markets and liquidity of the products.

Europe, Middle East, Africa

AUM for clients based in Europe, the Middle East and Africa ("EMEA") ended the year at $1.017 trillion or 29% of total AUM, an increase of $79.7 billion from 2009. During the year, clients awarded us net new business of $28.0 billion, including inflows from investors in 24 countries across the region. Our offerings include fund families in the U.K., Luxembourg and Dublin, and iShares listed on stock exchanges throughout Europe, as well as separate accounts and pooled investment products.

Clients invested across the entire product spectrum with 51% of long-term AUM in equities, 40% in fixed income, 6% in multi-asset class and 3% in alternatives. EMEA clients constitute the remaining 25% of our cash management AUM, and represent just 3% of our advisory AUM, which are long-term portfolio liquidation assignments. BRS has steadily built its presence in EMEA, including Aladdin® relationships with a variety of institutional investors and Financial Markets Advisory ("FMA") engagements for financial services companies and official institutions, including the valuation assignment announced in January 2011 for the Central Bank of Ireland.

The mix by investment style is slightly more concentrated than in the Americas, with 36% invested in active products, 53% in institutional index accounts and 11% in iShares and other ETPs. The relatively higher percentage in institutional index is driven by low fee institutional liability hedging portfolios which account for approximately 25% of total institutional index assets. The relatively lower percentage in iShares primarily reflects the fact that the European ETP market is at an earlier stage of development.

Asia-Pacific

Clients in the Asia-Pacific region are served through offices in Japan, Australia, Hong Kong, Singapore, Taiwan and Korea, and joint ventures in China and India. At December 31, 2010, we managed $367.2 billion of AUM for clients in the region, an increase of 5% or $16.2 billion from 2009. Net new business contributed $15.4 billion, and the remainder of the increase was attributable to investment performance and favorable market movements. We also acquired the Taiwan-based asset manager Primasia Investment Trust Co. Ltd, strengthening our onshore investment capabilities by offering locally managed investment solutions.

Clients in the Asia-Pacific region are served through offices in Japan, Australia, Hong Kong, Singapore, Taiwan and Korea, and joint ventures in China and India. At December 31, 2010, we managed $367.2 billion of AUM for clients in the region, an increase of 5% or $16.2 billion from 2009. Net new business contributed $15.4 billion, and the remainder of the increase was attributable to investment performance and favorable market movements. We also acquired the Taiwan-based asset manager Primasia Investment Trust Co. Ltd, strengthening our onshore investment capabilities by offering locally managed investment solutions.

At year-end, the mix of long-term products managed for these clients consisted of 46% equities, 43% fixed income, 5% multi-asset class and 6% alternative investments. Asia-Pacific clients represented 2% of our advisory AUM and less than 1% of our cash management AUM. BRS served a select number of the largest and most sophisticated investors in the region.

The mix among investment styles was more tilted toward institutional index accounts than in the other regions, with $219.9 billion or 61% of long-term AUM in these products. This bias can be traced to the presence of very large governmental institutions and pensions that are heavy users of index products. Asia-Pacific institutional investors also use iShares for tactical allocation, but often favor the liquidity of the U.S. products (which are counted in Americas iShares). Active mandates represented 36% of AUM managed for investors in the region at year-end.

Clients Served

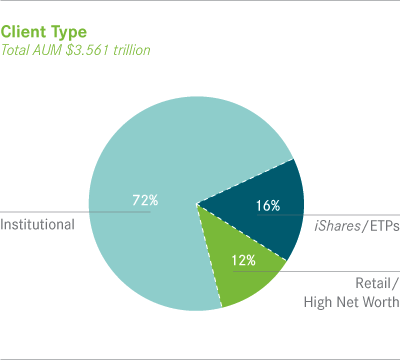

We serve a diverse mix of institutional and retail investors worldwide. Clients include tax-exempt institutions, such as defined benefit and defined contribution pension plans, charities, foundations and endowments; official institutions, such as central banks, sovereign wealth funds, supranationals and other government entities; taxable institutions, including insurance companies, financial institutions, corporations and third party fund sponsors; and retail and high net worth investors. We also serve both institutional and retail and high net worth investors who acquire iShares on exchanges worldwide.

At December 31, 2010, 44% of our AUM was managed for clients outside the U.S.

Institutional Investors

Assets managed for institutional investors totaled $2.556 trillion or 72% of total AUM at year-end 2010. During the year, net new business, excluding merger-related outflows, in long-term products totaled $60.3 billion, which was partially offset by $38.4 billion of net outflows in cash management and $12.0 billion of net distributions in advisory assignments. Investment performance and market appreciation contributed $201.2 billion of additional AUM growth.

BlackRock's institutional AUM is well diversified by both product and region. Long-term AUM was $2.167 trillion at year-end, 49% of which was in equities, 42% fixed income, 5% multi-asset class and 4% alternatives. The mix by investment style was 38% active and 62% passive (excluding institutional investors in iShares). As noted earlier, institutional index accounts tend to be very large mandates managed for relatively low fee rates and subject to higher turnover.

We serve institutional investors on six continents, with 55% of AUM managed on behalf of investors in the Americas, 32% in EMEA and 13% in Asia-Pacific. Institutional clients are further diversified by sub-segments: tax-exempt, official institutions, taxable and cash investors, as described below.

- BlackRock is among the largest managers of pension plan assets in the world, with $1.487 trillion, or 58%, of institutional AUM managed for defined benefit, defined contribution and other pension plans for corporations, governments and unions at December 31, 2010. An additional $57.0 billion was managed for other tax-exempt investors, including charities, foundations and endowments. Assets managed for these clients grew $90.4 billion during 2010, including $18.4 billion of net inflows from defined contribution plans, which represent an important and growing component of the retirement market.

- We also managed $245.4 billion or 10% of institutional AUM for official institutions, including central banks, sovereign wealth funds, supranationals, multilateral entities and government ministries and agencies. These clients often require specialized investment policy advice, the use of customized benchmarks and training support. In addition, BRS has been selected by a number of official institutions to provide a range of services, including Aladdin, risk management and financial markets advisory assignments.

- BlackRock is the top independent manager of assets for insurance companies, which accounted for $218.6 billion or 9% of institutional AUM at year-end. These clients awarded us $4.6 billion of net new business, driven by a trend toward outsourcing, particularly in Europe last year. Assets managed for other taxable institutions, including corporations, banks and third party fund sponsors for which we provide sub-advisory services, totaled $326.6 billion or 13% of institutional AUM at year-end.

- The remaining $221.7 billion or 9% of institutional AUM was managed on behalf of taxable and tax-exempt institutions invested in our cash management products at December 31, 2010. See "Cash Management and Securities Lending" section for additional information on cash management AUM.

Retail and High Net Worth Investors

BlackRock serves retail and high net worth investors globally through separate accounts, open-end and closed-end funds, unit trusts and private investment funds. At December 31, 2010, assets managed for retail and high net worth investors totaled $414.7 billion, up 8%, or $31.3 billion, versus year-end 2009 AUM. During the year, net inflows of $26.9 billion in long-term products were partially offset by $21.9 billion of net outflows in money market funds. Investment performance and market appreciation contributed $31.1 billion of additional AUM growth.

BlackRock serves retail and high net worth investors globally through separate accounts, open-end and closed-end funds, unit trusts and private investment funds. At December 31, 2010, assets managed for retail and high net worth investors totaled $414.7 billion, up 8%, or $31.3 billion, versus year-end 2009 AUM. During the year, net inflows of $26.9 billion in long-term products were partially offset by $21.9 billion of net outflows in money market funds. Investment performance and market appreciation contributed $31.1 billion of additional AUM growth.

Retail and high net worth investors are served principally through intermediaries, including broker-dealers, banks, trust companies, insurance companies and independent financial advisors. Clients invest primarily in mutual funds, which totaled $318.2 billion or 77% of retail and high net worth AUM at year-end, with the remainder invested in private investment funds and separately managed accounts. The product mix is well diversified, with 47% of long-term AUM in equities, 29% in fixed income, 22% in multi-asset class and 2% in alternatives. The vast majority (98%) of long-term AUM is invested in active products, although this is partially inflated by the fact that iShares is shown independently, since we cannot identify all of the underlying investors.

The client base is also diversified geographically, with 68% of long-term AUM managed for investors based in the Americas, 23% in EMEA, and 9% in Asia-Pacific. The remaining $40.7 billion, or 10%, of retail and high net worth AUM is invested in cash management products, principally money market funds offered in the U.S. Our success in each of these regions reflects strong relationships with intermediaries and an established ability to deliver our global investment expertise in funds and other products tailored to local regulations and requirements.

Our retail and high net worth offerings include the BlackRock Funds in the U.S., our Luxembourg cross-border fund families, BlackRock Global Funds ("BGF"), BlackRock Strategic Funds and a range of retail funds in the U.K. BGF is comprised of 61 funds and is registered in 35 countries. Over 60% of the funds are rated by S&P. In 2010, we were ranked as the second largest cross border fund provider.1 In the U.K., we ranked among the six largest fund managers,1 and are known for our innovative product offerings, including the absolute alpha products we introduced in 2005. In the U.S., we had over 50 product placements on broker-dealer platforms during the year and have grown our market position from tenth to fourth largest fund manager since we acquired Merrill Lynch Investment Managers ("MLIM") in late-2006.2 In 2010, BlackRock won the Dalbar award for customer service in financial services, the eleventh occasion on which we have been recognized for outstanding achievement in this area.

1 Source, Lipper Feri

2 Source, Simfund

* Important Notes

On December 1, 2009, BlackRock acquired from Barclays Bank PLC all of the outstanding equity interests of subsidiaries of Barclays conducting the business of Barclays Global Investors ("BGI") ("the BGI Transaction").

Unless stated otherwise, net new business figures are before giving effect to merger related outflows resulting from manager concentration considerations and scientific active equity performance totaling $121.0 billion, or 7%, of the $1.8 trillion of AUM acquired in the BGI Transaction — well within overall tolerances in BlackRock's valuation model.

Past performance is not indicative of future results. The performance information for actively managed accounts reflects U.S. open-end and closed-end mutual funds and similar EMEA-based products with respect to peer median comparisons, and actively managed institutional and high net worth separate accounts and funds located globally with respect to benchmark comparisons, as determined using objectively based internal parameters, using the most current verified information available as of December 31, 2010. Accounts terminated prior to December 31, 2010 are not included. If such terminated and other accounts had been included, the performance information may have substantially differed from that shown. The performance information does not include funds or accounts that are not measured against a benchmark, private equity products, CDOs, or accounts managed by BlackRock's Financial Markets Advisory Group. Comparisons are based on gross-of-fee performance for U.S. retail, institutional and high net worth separate accounts and EMEA institutional separate accounts and net of fee performance for EMEA based retail products. The performance tracking information for institutional index accounts is based on gross-of-fee performance as of December 31, 2010, and includes all institutional accounts globally using an index strategy. AUM information is based on AUM for each account or fund in the asset class shown without adjustment for overlapping management of the same account or fund, as of December 31, 2010. Source of performance information and peer medians is BlackRock, Inc. and is based in part on data from Lipper Inc. for U.S. funds and Morningstar, Inc. for non-U.S. funds. Fund performance reflects the reinvestment of dividends and distributions, but does not reflect sales charges.

S&P 500® Index is a widely recognized, unmanaged index of common stock prices of industrial, utility, transportation and financial companies in U.S. markets.

Barclays Capital U.S. Aggregate Index is an unmanaged index considered representative of the U.S. investment-grade, fixed-rate bond market.

These opinions, expressed through page 40 of the 2010 BlackRock Annual Report, are those of BlackRock, Inc. as of April 2011 and are subject to change.

This is an interactive electronic version of the BlackRock 2010 Annual Report to Shareholders. The contents of this version are qualified in their entirety by reference to the printed version. A reproduction of the printed version is available in PDF in the "Investor Relations" section on this Web site.