BlackRock Solutions and Advisory

BlackRock offers investment systems, risk management, outsourcing and advisory services under the BlackRock Solutions brand name. Over $10.0 trillion of positions are processed on our Aladdin operating platform, which serves as the investment system for BlackRock and a growing number of sophisticated institutional investors around the world. BRS also offers comprehensive risk reporting via the Green Package® and risk management advisory services, interactive fixed income analytics through our web-based calculator, AnSer®, middle and back office outsourcing services and investment accounting. Clients have also retained BRS' Financial Markets Advisory group for a variety of engagements, such as valuation and risk assessment of illiquid assets, portfolio restructuring, workouts and dispositions of distressed assets and financial and balance sheet strategies.

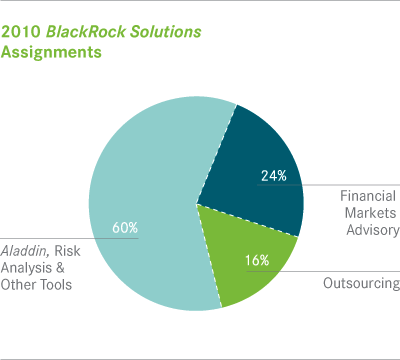

As global capital markets have recovered, clients have focused more on risk management, and demand for BRS services continues to be robust. During the year, BRS added 62 net new assignments. While revenue declined modestly by 4% to $460 million, demand was strong for Aladdin and risk management services, with year-over-year revenue growing 14%, particularly in EMEA where we signed a record number of new BRS clients onto the platform. Aladdin assignments are long-term contracts providing significant recurring revenue.

During the year we added 49 new FMA assignments and completed 33 engagements. The nature of FMA assignments shifted from urgent, short-term risk analyses to longer term advisory and risk monitoring engagements, with year-over-year revenue declining 23%, as the crisis subsided and fewer clients required emergency valuation and liquidation services. Advisory AUM decreased 7% to $150.7 billion, with $1.5 billion of market appreciation insufficient to offset $12.0 billion of client distributions in these long-term liquidation portfolios.

At year-end, BRS served 149 clients, including banks, insurance companies, official institutions, pension funds, asset managers and other institutional investors across North America, Europe, Asia and Australia. During the year, BlackRock acquired and integrated Helix Financial Group LLC to enhance BRS' commercial real estate capabilities, which proved to be critical to BRS' success in winning several high profile assignments. We will continue to consider acquisition opportunities that can expand Aladdin functionality and our risk management expertise.

At year-end, BRS served 149 clients, including banks, insurance companies, official institutions, pension funds, asset managers and other institutional investors across North America, Europe, Asia and Australia. During the year, BlackRock acquired and integrated Helix Financial Group LLC to enhance BRS' commercial real estate capabilities, which proved to be critical to BRS' success in winning several high profile assignments. We will continue to consider acquisition opportunities that can expand Aladdin functionality and our risk management expertise.

The BRS and Aladdin teams are also supporting key aspects of the BGI integration. These efforts are vital to establishing a unified operating platform and consistent operating processes. We expect functionality added in connection with the integration to enhance the Aladdin platform over time. Additionally, we will seek to leverage our scale for the benefit of our clients through the creation of a robust global trading platform and other initiatives.

Transition Management Services

BlackRock also offers transition management services, involving the temporary oversight of a client's assets as they transition from one manager to another or from one strategy to another. We provide a comprehensive service that includes project management and implementation based on achieving best execution consistent with the client's risk management tolerances. We use state-of-the-art tools and work closely with BlackRock's trading cost research team to manage four dimensions of risk throughout the transition: exposure, execution, process and operational risk. The average transition assignment is executed within two weeks, although the duration can be longer or shorter depending on the size, complexity and liquidity of the related assets. These portfolios are not included in AUM unless BlackRock has been retained to manage the assets after the transition phase.

* Important Notes

On December 1, 2009, BlackRock acquired from Barclays Bank PLC all of the outstanding equity interests of subsidiaries of Barclays conducting the business of Barclays Global Investors ("BGI") ("the BGI Transaction").

These opinions, expressed through page 40 of the 2010 BlackRock Annual Report, are those of BlackRock, Inc. as of April 2011 and are subject to change.

This is an interactive electronic version of the BlackRock 2010 Annual Report to Shareholders. The contents of this version are qualified in their entirety by reference to the printed version. A reproduction of the printed version is available in PDF in the "Investor Relations" section on this Web site.