Coal

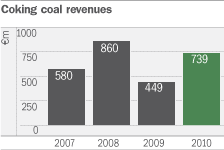

- Coal revenues up 35 per cent to EUR 1,082 million, with revenues for coking coal up 65 per cent to EUR 739 million

- 11.4Mt of coal produced

- Overall longwall productivity up 15 per cent

- LTIFR down 24 per cent

- Strong recovery in demand for coking coal, with vehicle production up 9 per cent and steel production up 28 per cent

- Thermal coal market remains stable

Our subsidiary, OKD, a.s. (‘OKD’) is the sole producer of hard coal in the Czech Republic and a significant player in the Central European market. Its four operating mines are located in the Karviná and Ostrava region, situated just south of the Polish border on the Upper Silesian coal basin.

We produce quality coking coal and thermal coal (also known as steam coal) sold to markets in Central and Eastern Europe; our coking coal provides the raw material for the steel industry and our thermal coal powers energy suppliers including electricity and heat producers and other industrial users.

- Key achievements in 2010

-

Our coal mining business delivered a robust performance in 2010. We achieved our production targets, increased our productivity and improved our safety results – one of the most important measures of success for our business.

Delivering significant improvements in both productivity and safety during 2010 is a source of considerable pride within OKD. As part of our EUR 350 million Productivity Optimisation Programme (‘POP 2010’), we installed 10 new longwalls over the course of 2008 and 2009, which generated significant productivity gains in 2010. As a result overall longwall productivity was 1,750t of coal per longwall per day in 2010, an increase of just over 15 per cent compared with 2009. Some new longwall sets achieved, under good conditions, average daily production levels of as high as 6,000t of coal.

Our ongoing focus on productivity continued to generate impressive results due to the introduction of the new longwall equipment. We produced 11.4Mt of coal, slightly ahead of last year (2009: 11.0Mt), with fewer longwalls sets in operation thanks to POP 2010: 17.6 constant operating longwall sets delivered 15 per cent higher volume of coal as 20 sets for the same period in 2009.

The new mining equipment is also contributing to safer operations in our mines. The Lost Time Injury Frequency Rate (‘LTIFR’) fell by 24 per cent to 9.13 down from 12.00 in 2009 reflecting the benefits of the new equipment, a consistent focus on health and safety training and the completion of our SAFETY 2010 project, a EUR 17 million capital investment programme focused on improving personal safety equipment for every miner.

- Operational performance

-

The geological environment we are operating in is a challenging one: we are mining down to a depth of 1,100 metres below the surface, and also down to a seam thickness of 0.8 metres. Combined with our skills and capabilities in mining at these depths, the new equipment enhances our ability to mitigate the additional cost required to mine deeper each year.

- Sales

-

Our comprehensive service enables us to deliver coal in a timely manner and build stronger relationships with our customers. We can also ensure the quality and consistency of our products and the reliability and timeliness of deliveries.

We have well-established relationships governed by long-term framework agreements. In some cases, customers have relied on our coal for decades.

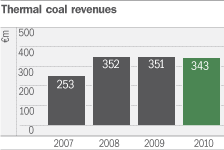

Demand for both thermal and coking coal has remained robust throughout the year, with total coal revenues rising strongly, up 35 per cent to EUR 1,082 million compared to EUR 800 million in 2009. Although volumes were evenly split between coking coal and thermal coal at 49:51 per cent, coking coal accounted for 68 per cent of total coal revenues due to the higher prices and margins it commands.

- Coking coal

-

Revenues for 2010 rose strongly to EUR 739 million, up 65 per cent on the previous year (2009: EUR 449 million). This reflected the marginal increase in sales volume to 5,257kt as economic conditions improved, as well as the recovery in demand, which drove prices substantially higher. Coking coal prices reached an average of EUR 141 per tonne, compared with the EUR 87 achieved in 2009. For the first time in our history we priced 80 per cent of our coking coal volumes on a Japanese Fiscal Year (‘JFY’) basis, setting prices from April 2010 to March 2011 and ensuring that our prices better reflected the global supply and demand situation. Around 42 per cent of coking coal sales in 2010 were hard coking coal and 58 per cent were semi-soft grades.

- Average sales price per tonne

- Thermal coal

-

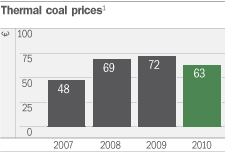

By contrast, prices for thermal coal softened to EUR 63 per tonne, a 13 per cent decrease on 2009 when prices were positively affected by growing customer concerns about the ability of local supply to meet market demand. All our thermal coal is priced on a calendar year basis.

Revenues reached EUR 343 million (2009: EUR 351 million) and volumes rose, up 12 per cent on 2009 to 5,455kt reflecting improved demand. Thermal coal sales were composed of approximately 80 per cent coal and 20 per cent middlings.

- Average sales price per tonne

- Costs

-

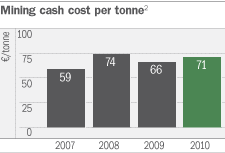

Several factors contributed to a 4 per cent rise in our mining cash costs per tonne (on a constant currency basis), to EUR 71 compared with EUR 66 in 2009.

In 2010 we intensified our underground development works, which combined with the fact that we mine deeper each year, increased our materials and energy costs and also additional shifts were required resulting in higher contractor expenses and maintenance costs.

Although base salaries did not rise following extensive consultations with the trade unions, good operational results led to performance-related bonus payments during the year, leading to a modest increase in total personnel costs.

We remain focused on containing our mining unit costs, driving further efficiency gains to counter general mining sector inflationary pressures and rising costs related to the increasing depths at which we mine. However, these efficiency gains can only partially offset the impact of higher prices for steel and other materials, the cost of electricity, compressed air and heat and the overhaul and maintenance of older equipment.

- 2007 and 2008 figures include transportation costs.

- Reserves

-

One of the largest, richest sources of hard coal in Central Europe, the Upper Silesian Coal Basin underpins the long-term sustainability of our mining operations in the region. Our JORC reserves from our four mines were 396 million tonnes as at 1 January 2011 including 190 million tonnes in our Dębieńsko site in Poland.

- Looking ahead

-

We will continue to focus on improving productivity in the coming year to help us address the challenges of mining at ever increasing depths. We mine approximately 20m deeper each year and this generates geological issues and tougher working conditions. Investment in 2011 will also focus on a fully integrated IT system (SAP), which includes more sophisticated planning and engineering procedures, more precise online control and monitoring features of production and infrastructure activities. Successfully implementing culture change in our workforce to encourage a proactive, participative approach is another focus for the year ahead. Communications and training are at the heart of this, with every worker briefed on the Company’s targets and strategy and extensive training programmes focusing on health and safety as a priority but also including softer issues such as interpersonal skills. Our contractors form an integral part of our workforce and are included in all our programmes to ensure standards and behaviours are consistent throughout.

Whilst we were pleased to see further improvement on our LTIFR results this year, safety will always remain our top priority and we remain focused on reaching zero harm levels. To get there we want safety fully intergrated into our working culture, with everyone alert to safety issues at all times.

Following the completion of POP 2010, which marked a huge step forward for the Company in terms of its technology, the PERSPective 2015 Programme (‘PERSP 2015’), launched in 2010, sets out our objectives and targets for improving performance over the next five years. It covers our approach to dealing with our people fairly, our targets for increasing productivity and our plans to open up new reserves. It also aims to enhance our interaction with the local communities, drive up safety standards and build upon our reputation of being a reliable business partner.

Klaus-Dieter BeckExecutive Director of NWR, Chief Executive Officer of OKD and Chairman of the Board of Directors of OKD