Coke

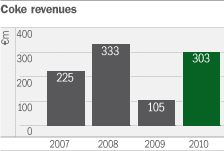

- Coke revenues up significantly by 188 per cent to EUR 303 million

- 1.0Mt of coke produced

- Production consolidated onto a single site

- Refurbishment of existing battery complete

- Additional new coking battery brought on-stream

- Improved demand for steel drove up volumes and prices

Our coking subsidiary, OKK Koksovny, a.s. (‘OKK Koksovny’) is the largest producer of foundry coke in Europe, now operating from one site, Svoboda in Ostrava. OKK Koksovny produces both foundry and blast furnace coke from four batteries with a maximum capacity of 850kt per year, following the conclusion of the consolidation process.

Coke is produced by heating up coking coal in furnaces at temperatures of up to 1,200ºC without access to oxygen, to extract volatile components such as gases and produce a highly efficient, high carbon fuel. There are two types of coke: blast furnace coke which is used as a reducing agent in smelting iron ore to produce steel and foundry coke which is used to melt pig iron in the manufacture of iron castings by the iron founding industry.

- Key achievements in 2010

-

It has been an outstanding year for OKK Koksovny as we completed the consolidation of production onto one site, built a new coking battery, and completely refurbished another whilst production continued. Health and safety remained our highest priority during this period of intense activity and we maintained our strong track record delivering a coking Lost Time Injury Frequency Rate LTIFR of 2.55 with only four registered accidents (2009: 2.39; four registered accidents).

In line with our strategy to enhance profitability by investing in equipment and technology, we successfully completed our Coking Plant Optimisation Programme 2010 (‘COP 2010’), which aimed to increase the efficiency and reduce the cost base of our coking operations by consolidating all operations at one site on time and to budget. Notably, we maintained high safety standards throughout the project.

A key achievement of COP 2010 was successfully consolidating all production at our Svoboda site. Shutting down the Jan Šverma site by the end of 2010 posed a significant environmental challenge as health and safety standards needed to be maintained whilst dealing with the gas and chemical outputs of the shut down process. Extensive consultation with the labour unions meant that approximately 50 per cent of the workforce at the Jan Šverma site was transferred to the Svoboda site and the remainder left the Company by mutual agreement.

We also constructed a new battery, one of the few coking batteries that have been built in the region recently, which will enable us to respond to the demand for foundry and blast furnace coke more flexibly. With 56 chambers and a maximum production capacity of 225kt per year, the new battery no. 10 has a state of the art device to capture the air pollutants generated during production, significantly reducing environmental impact. The new battery was slowly heated from June 2010, trial production started in October 2010 and moved into full production at the beginning of 2011.

A further phase of COP 2010 was the refurbishment of battery no. 8, prolonging its life for more than 20 years. This was a complex project as the chambers were refurbished in stages whilst the battery continued to operate.

- Operational performance

-

Our operations performed strongly in 2010, producing 1.0Mt of coke during the year, up 19 per cent on 2009 when volumes were reduced to 843kt in response to weak customer demand. This is a very good result considering that parallel to normal operations we completed COP 2010.

- Sales

-

Significantly improved coke market conditions pushed sales up to 1.1Mt; split by 55 per cent blast furnace coke, 33 per cent foundry coke and 12 per cent other types. Blast furnace coke sales were driven by improved demand in the steel industry where our customers started to reach their integrated coke production capacities and source supplies externally. In the foundry coke market, we are one of the main suppliers in the region to a wide range of customers who were faced with rising demand in the automotive industry.

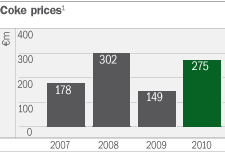

Revenues for 2010 accelerated to EUR 303 million compared with EUR 105 million the previous year as prices rose to an average of EUR 275 per tonne. Coke prices are set quarterly and have remained well ahead of 2009’s average of EUR 149 per tonne reflecting the recovery in demand and reduced coking capacity in the region.

- Average sales price per tonne

- Costs

-

Coke conversion cash cost per tonne (production costs incurred excluding coal charges), fell substantially during the year to EUR 70 mainly on the back of rising volumes (2009: EUR 84 per tonnes).

The key drivers of total coke production costs are materials and energy. These rose in line with higher production levels as more coking coal was needed to meet the increased production requirements together with increased coking coal price.

Personnel costs decreased mainly due to the reduction in headcount as we proceeded with the closure of the Jan Šverma Coking Plant.

- Coke conversion cash cost per tonne reflects the operating costs incurred in converting coking coal into coke. It does not include the cost of internally or externally purchased coking coal.

- Outlook

-

Coke conversion cash costs per tonne are forecast to reduce by approximately 15 per cent in 2011 as the full benefits of consolidating production on one site and the increased efficiency of the new battery continue to deliver improved performance.

We start 2011 in a strong position to capitalise on our investment programmes with an efficient operating base and the production flexibility to respond effectively to fluctuations in demand.

Ján FábianChief Operating Officer of NWR,

Vice Chairman of the Board of OKD