Shareholder Information

- Markets

-

As at 31 December 2010, A shares of NWR were listed on the London Stock Exchange (the ‘LSE’), the Prague Stock Exchange (the ‘PSE’) and the Warsaw Stock Exchange (the ‘WSE’).

The trustees, share registrars and transfer offices are shown in Ancillary Information for Shareholders.

- Share ownership

-

Share capital

Details about NWR’s share capital are presented in Note 25 of the Consolidated Financial Statements

Shareholder structure

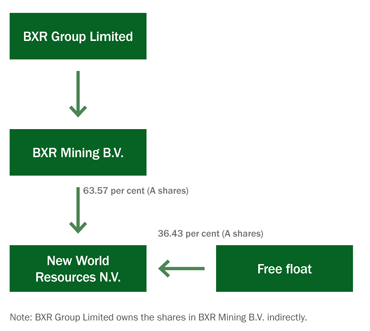

Majority shareholder

As of the date of this Annual Report, the controlling shareholder of NWR, BXR Mining B.V. (‘BXRM’), owns approximately 63.57 per cent of the A shares and as a result, has effective control of NWR.

BXRM is indirectly owned by BXR Group Limited (‘BXRG’). BXRG also owns indirectly, through RPG Property B.V. (‘RPG Property’), 100 per cent of the B shares. Accordingly, BXRG has a 63.57 per cent indirect interest in the A shares and a 100 per cent indirect interest in the B shares.

BXRG is an international private investment group. To date its principal investments have been in the Central and Eastern European region. It also has investments outside of this region. BXRG typically takes large or controlling stakes in investment companies and is active in the management of its investments. In addition to its investment in NWR, BXRG currently has investments in real estate, logistics, green energy, financial services and other industries.

At the date of this Annual Report, Zdeněk Bakala, a Non-Executive Director of NWR, holds no direct interest in A shares or B shares but he is considered as being interested in the A shares and B shares as a result of certain affiliated companies and trusts relating to him and his family (collectively the ‘Bakala entities’) holding an indirect ownership interest in BXRM. Mr. Bakala, through the Bakala entities, owns 50 per cent of the outstanding voting capital in BXRG.

Peter Kadas, a Non-Executive Director of NWR, holds no direct interest in A shares or B shares but he is considered as being interested in A shares and B shares because of BXRG’s indirect ownership interest in such shares. Certain trusts associated with the family of Mr. Kadas own a minority interest in BXRG.

For biography of Mr. Bakala and Mr. Kadas please refer to the ‘Board and Management’ section on page.

Changes in the majority shareholder structure during 2010

In April 2010, BXRM informed NWR that BXRG had replaced RPG Partners Limited as the ultimate parent company of BXRM.

As a result of the share issuances in May and December 2010, the shareholding of BXRM in NWR decreased from 63.66 per cent to 63.63 per cent and 63.57 per cent, respectively. More details can be found in the ‘Purchase and issue of shares’ paragraph of this section.

Free float

At the date of this Annual Report, public shareholders hold approx. 36.43 per cent of the A shares. The A shares are in registered form. NWR maintains the principal shareholders’ register in the Netherlands with a sub-register in Jersey, which forms part of NWR’s principal register.

A shares trading on the PSE or the WSE are registered in the name of The Bank of New York (Depository) Nominees Limited (‘BoNY’), as common depository for Clearstream and Euroclear.

A shares trading on the LSE are represented by Depository Interests (‘DIs’) and the underlying A shares are registered in the name of the custodian, Computershare Company Nominees Limited.

The Company has received no filings under the Dutch Disclosure of Major Holdings in Listed Companies Act, and no public information is available with respect to the ownership of shares. A study conducted in January 2011 into the ownership of shares in NWR identified 70.5 per cent of the free float (i.e. excluding shares held by BXRM). Of these indentified shares, institutional investors held 61.3 per cent and retail investors held 7.6 per cent.

Source: Capital Precision Global Shareholder

Identification Analysis, January 2011Geographical concentration of the free float held by institutional investors - Purchase and issue of shares

-

In 2010, NWR did not purchase its own shares. The Annual General Meeting of Shareholders held in April 2010 authorised the NWR’s Board of Directors (the ‘Board’), for the period until the date of the next Annual General Meeting of Shareholders of NWR following the date of the resolution, to acquire up to 13,216,505 A shares of NWR (which represented 5 per cent of the issued A share capital as at the day of the meeting), subject to certain terms and limitations.

The Annual General Meeting of Shareholders held in April 2010 also authorised the Board, for the period until the date of the next Annual General Meeting of Shareholders of NWR following the date of the resolution, to: (i) issue A shares and grant rights to subscribe for A shares; and (ii) exclude or limit any pre-emptive rights with respect to the issue of A shares of granting of rights to subscribe for A shares. Such authorities were limited to the aggregate nominal amount of EUR 5,286,602, being 13,216,505 A shares (which represented five per cent of the issued A share capital as at the day of the meeting).

A further renewal of the authorisations above will be submitted for approval to the Annual General Meeting of Shareholders on 28 April 2011.

The Extraordinary General Meeting of Shareholders held in November 2010 also authorised the Board to: (i) issue A shares and/or grant rights to subscribe for A shares; and (ii) to limit or exclude any pre-emptive rights with respect to the issue of A shares and/or granting of rights to subscribe for A shares. Such authorities are limited to the aggregate nominal amount of EUR 15,866,013.60, being 39,665,034 A shares (which represented approximately 15 per cent of the issued A share capital as at 13 October 2010); and such authorities may only be used for the purpose of one or more equity offerings.

During 2010, the Company issued a total of 368,615 of A shares as follows: in May 2010, NWR issued 103,465 new A shares to the respective Independent Non-Executive Directors under their share plan. In December 2010, NWR issued 265,150 new A shares to the Board’s Chairman under his stock option plan.

- Operation of the Annual General Meeting of Shareholders

-

The powers and operation of the Annual General Meeting of Shareholders are set out by Book 2 of the Dutch Civil Code (Burgerlijk Wetboek) and the Company’s Articles of Association (the ‘Articles of Association’). The description below should be read in conjunction with the Articles of Association and the document is available on the Company’s website.

The Annual General Meeting of Shareholders of the Company (the ‘General Meeting’) shall be held within six months after the end of the Company’s financial year. The General Meeting may be called by the Board or by the Board’s Chairman. Any person or persons who are together entitled to cast at least one-tenth of the total number of votes that may be cast may request the Board or its Chairman to convene the General Meeting, and state items to be discussed. If neither the Board nor the Chairman convenes the General Meeting such that the meeting is held within four weeks of this request, any of the persons requesting the General Meeting shall be authorised to convene the meeting.

General Meetings shall be held in Amsterdam or Haarlemmermeer (Schiphol Airport). Notice shall be given not later than on the 42nd day prior to the date of the General Meeting. The notice shall be published in national daily distributed newspapers in the Netherlands, the United Kingdom, the Czech Republic and Poland.

The agenda of the General Meeting shall in any case include the discussion of the Annual Report, the adoption of the annual accounts and the discharge of the Directors from liability in relation to the exercise of their duties in the previous financial year, to the extent that such exercise is apparent from the financial statements relating to the previous financial year or other public disclosures prior to the adoption of these financial statements. Shareholders who represent at least 1 per cent of the issued share capital or shares of at least EUR 50 million are entitled to request the Board in writing to place items on the agenda. Such requests must be delivered to the Board at least 60 days before convening the General Meeting. No valid resolutions can be adopted at the General Meeting in respect of items not specified on the notice.

The General Meeting shall inter alia decide on matters regarding appointment and dismissal of Directors, adoption of the annual accounts, amendments to the Articles of Association, liquidation of the Company and approval of resolutions of the Board regarding a significant change in the identity or nature of the Company or the enterprise, including in any event the transfer of the business or the majority business of NWR to a third party; the conclusion or cancellation of any long-lasting cooperation by NWR or a subsidiary with another entity if such cooperation is of essential importance to NWR; and the acquisition or disposal of a participating interest in the capital of a company with a value of at least one-third of the sum of the assets according to the consolidated balance sheet according to the last adopted annual accounts of NWR, by NWR or a subsidiary.

In addition to the various shareholder rights mentioned in the paragraphs above, holders of B shares and other shareholders representing at least one-tenth of the issued share capital or an aggregate nominal share value of EUR 225,000 may request an investigation into the affairs of the Company (enqueterecht) with the Enterprise Chamber of the Court of Appeal in Amsterdam.

Each share confers the right to cast one vote. Resolutions proposed for voting at the General Meeting require an absolute majority of votes. In a tie vote, the proposal shall be rejected. Resolutions to restrict or exclude pre-emptive rights and to reduce the Company’s share capital require a majority of at least two-thirds of the votes cast if less than half of the issued share capital is represented. Resolutions to appoint a Director not proposed by the meeting of holders of B shares or the Board shall be adopted by at least a two-thirds majority of the votes cast in a General Meeting in which at least half of the issued share capital is represented. Furthermore, resolutions to amend the Articles of Association or to dissolve the Company other than on the proposal of the Board shall only be valid if adopted in a General Meeting in which at least three-quarters of the issued share capital are represented and with a majority of at least two-thirds of the votes cast. All matters regarding the exercise of voting rights shall be decided by the Chairman of the General Meeting.

Shareholders who hold shares on a predetermined registration date are entitled to attend the General Meeting, vote at the General Meeting and address it. By the shareholders are meant the registered shareholders, holders of B shares, holders of A shares listed on the LSE represented by DIs and beneficial holders of A shares listed on the WSE or the PSE (‘Listed Shares’). Holders of DIs and beneficial holders of Listed Shares shall contact the bank or broker through which they hold their DIs or Listed Shares for information on how to: (i) exercise their voting rights in writing; (ii) attend the General Meeting and exercise their voting rights in person; or (iii) authorise another person to attend the General Meeting and to exercise voting rights on their behalf. The registration date for the Annual General Meeting of Shareholders of 28 April 2011 is 28 days before the meeting, i.e. on 31 March 2011. The Board may decide that shareholders entitled to vote may, within a period prior to the General Meeting to be set by the Board, which period cannot begin prior to the registration date, cast their votes electronically in a manner to be decided by the Board.

To the best of the Company’s knowledge, there is no agreement involving a shareholder of NWR that could lead to a restriction of the transferability of shares or of voting rights on shares.

The A shares sold to qualified institutional buyers (‘QIBs’) in the United States in connection with the initial public offering in reliance on Rule 144A under the US Securities Act of 1933, as amended, are subject to certain transfer restrictions under applicable US securities laws.

- Share price information

-

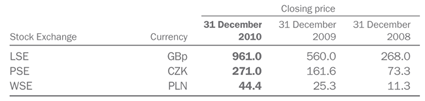

The table below shows the closing share prices for the period indicated for the A shares at each of the stock exchanges respectively.

- Allotments of equity securities

-

During the period under review, no allotments of equity securities in NWR were made in exchange for cash other than the share grants to the Independent Non-Executive Directors (as described in the Remuneration Report) and delivery of shares to the Chairman of the Board (also as described in the Remuneration Report).

- Dividend policy

-

NWR paid interim dividend for the half-year ended 30 June 2010 of EUR 0.21 per A share.

The Directors of NWR have declared a final dividend for the year ended 31 December 2010 of EUR 0.22 per A share paid to A shareholders in the form of an interim dividend. Together with the interim dividend of EUR 0.21per A share paid in October 2010, this takes the full year dividend payable to A shareholders to EUR 0.43 per share in respect of the year ended 31 December 2010. This represents approximately 50 per cent payout ratio for 2010.

- Dividends on A shares

-

NWR paid interim dividend for the half-year ended 30 June 2010 of EUR 0.21 per A share.

The Directors of NWR have declared a final dividend for the year ended 31 December 2010 of EUR 0.22 per A share paid to A shareholders in the form of an interim dividend. Together with the interim dividend of EUR 0.21per A share paid in October 2010, this takes the full year dividend payable to A shareholders to EUR 0.43 per share in respect of the year ended 31 December 2010. This represents approximately 50 per cent payout ratio for 2010.

- Provision of the Annual Report and Accounts

-

The Annual General Meeting of Shareholders held in April 2009 approved to provide certain information electronically in the future, to the extent permitted by law. The 2010 Annual Report and Accounts of NWR have been made available at NWR’s website. Shareholders may also inspect the 2010 Annual Report and Accounts at the office of the Company and request to receive a hard copy by registered mail.

For further information, please refer to the Company’s website or email the Investor Relations team.

Agnes Blanco Querido Head of Investor Relations