Ivona Ročárková Company Secretary

Corporate Governance

The Corporate Governance Policy of NWR is based primarily on the Dutch Corporate Governance Code and also complies with the spirit of the broad requirements of codes in the UK, the Czech Republic and Poland. The policy formulates the standards of governance that NWR’s Board of Directors (the ‘Board’) intends to uphold and ensures the maintenance of a coherent and effective system of governance. The policy can be found on NWR's website.

The Company has announced its intention to re-incorporate in the United Kingdom during the first half of 2011, subject to regulatory clearances. The Company believes that this should allow FTSE UK Series Index eligibility, raising the profile of the Group with international investors and further demonstrating the Group’s commitment to the high governance and control standards according to which it operates its business.

Highlights 2010

- Board evaluation review concluded that considerable progress had been made since the first external evaluation in 2009.

- Marked improvement in communications between the Board and its Committees.

- Launch of a new Remuneration Policy for the Board and implementation of a new remuneration plan across NWR Group.

- Ongoing review of Group-wide risks and adoption of a Group Risk Management Policy.

- Improvement of the structure and content of Board meetings to increase the focus and time spent on strategic matters.

- Two-day strategy meeting of the Board including a site visit to the Czech operations.

- Improvement to the Whistleblower Procedure applied at OKD, a.s. (‘OKD’), meaning that complaints are now dealt with by an independent internal committee, to increase employees’ trust in the system.

- Directors

-

Composition of the Board

NWR has a one-tier Board comprising both Executive and Non-Executive Directors. The Board is presided over by its Executive Chairman, Mike Salamon. As at 31 December 2010, the Board had 13 members in total. Of these, three were Executive Directors and five were Independent Non-Executive Directors. Non-Executive Directors assist in developing NWR’s strategy and also monitor the performance of Executive Directors and Group management. Non-Executive Directors are also responsible for proposing appropriate levels of remuneration of Executive Directors and are entrusted with such duties as are or will be determined by or pursuant to the Articles of Association or a resolution of the Board.

The Chairman facilitates the work of the Board and ensures its effectiveness in all aspects of its role. Assisted by the Company Secretary, the Chairman is responsible for setting the Board agendas, ensuring that Directors receive all the information and support necessary to carry out their role, including adequate induction and training. The Chairman has authority to act and speak for the Board between its meetings, and, together with the Chief Financial Officer, acts as the main point of contact between Non-Executive Directors and senior management of the Group. The Chairman also decides on certain executive matters once the Board has granted him authority.

The Chief Financial Officer of NWR, Marek Jelínek, has been delegated authority to achieve the corporate objectives of NWR Group. He is responsible for the Group finance and administration, and reports to the NWR Board and its Executive Chairman. He oversees the planning, financial control, accounting, restructuring, mergers and acquisitions, strategic expansion, and investor relations functions throughout the Group. He is also responsible for ensuring that financial and other information disclosed publicly is timely, complete and accurate.

Klaus-Dieter Beck, Chief Executive Officer of OKD, a.s. (‘OKD’) and Chairman of OKD’s Board of Directors is responsible for the operation of OKD. Ján Fabián, NWR’s Chief Operating Officer has the overall responsibility for OKK Koksovny and NWR KARBONIA. They both report to NWR’s Board.

Role of the Board

The Board sets the Group’s strategy and reviews management and financial performance. Its role is to create and deliver strong, sustainable financial performance and long-term shareholder value while protecting the interests of NWR Group and representing NWR, holders of A and B shares and other stakeholders. Matters specifically reserved for the Board’s decision include:

- approval of the overall strategy and annual budgets of the business;

- appointment of the Board’s Chairman;

- approval of internal policies (such as the Corporate Governance Policy, Code of Ethics and Business Conduct, Divisional Policy Statements, Share Dealing Code, the terms of reference of the Board’s committees, etc.);

- determination of the annual remuneration of Executive and Non-Executive Directors within the scope of the Remuneration Policy and adoption of the Group’s compensation plan;

- review of the financial and Annual Reports; and

- approval of major transactions, including acquisitions, by NWR and its subsidiaries.

Decisions of the Board regarding a major change in the identity or character of the Company or the enterprise shall be subject to the approval of the General Meeting of Shareholders. In particular, shareholders would need to approve:

- transfer of the business or the majority business of NWR to a third party;

- conclusion or cancellation of any long-lasting cooperation by NWR or a subsidiary with any other legal person if such cooperation is of essential importance to NWR; and

- acquisition or disposal of a participating interest in the capital of NWR with a value of at least one-third of the sum of the assets according to the consolidated balance sheet of the last adopted annual accounts of NWR, by NWR or a subsidiary.

In addition, pursuant to the Listing Rules, shareholders need to approve certain other significant transactions.

The Board manages the Mining Division and the Real Estate Division. Day-to-day operational decisions relating to these divisions are taken by NWR’s employees and overseen by the Board (as described in more detail in the report of the Real Estate Committee).

Main activities of the Board in 2010

The Board holds scheduled meetings regularly during the year and meets on an ad hoc basis as required. In 2010, the Board met seven times and also held a special two-day strategic meeting, which included a site visit to our Czech operations.

At its strategy meeting, the Board discussed the strategy, business development and critical issues of NWR Group. Topics for discussion included a long-term outlook for the global and regional coal markets as well as a long-term vision for the coking industry. The Board also considered the strategic opportunities open to the Group to pursue future growth. Directors visited the Company’s operations, namely the Lazy site of the Karviná Mine IOU and the Svoboda coking battery at OKK Koksovny. It was agreed that the two-day event had been extremely useful and that it will now take place on an annual basis.

In line with its strategic investment plans to expand the Group’s activities and its reserve base, the Board considered and approved a tender offer to acquire all of the issued and outstanding shares of a Polish mining company Lubelski Węgiel ‘BOGDANKA’ S.A. (‘Bogdanka’). As announced closer to the year-end, the offer lapsed due to the acceptance threshold of 75 per cent of Bogdanka’s issued share capital not being met and NWR refusing to increase its offer. NWR’s decision not to proceed with the transaction demonstrates the Company’s determination to maintain strict financial discipline.

NWR remains thoroughly committed to its development projects and investments in Poland. The Board therefore adopted a project execution strategy and established a Project Executive Committee to complete a definitive feasibility study for Dębieńsko.

Further, in line with NWR’s strategy of focusing on its core activities of coal mining and coke production, the Board approved the final terms of the sale of the Group’s energy assets to a third party.

The Board also reviewed the annual remuneration of the Executive and Non-Executive Directors. Further to the Directors’ request raised during the 2009 evaluation process to align executive remuneration with industry best practice, the Board approved, upon a proposal of the Remuneration Committee, the rules of a new share-based incentive plan for the Executive Directors and senior and key employees of the Group (the ‘Deferred Bonus Plan’), which applies from January 2011. Subsequently, the Board proposed an amendment to the Remuneration Policy of the Board, which was adopted by the Annual General Meeting of Shareholders in April 2010, and approved a Compensation Manual describing the Group-wide remuneration principles. Due to the implementation of the Deferred Bonus Plan, the Board decided to discontinue the Company’s Stock Option Plan as per 31 December 2010. A full description of the changes in remuneration and other relevant information can be found in the ‘Remuneration Report’.

In the area of corporate governance, the Board adopted a Group Risk Management Policy, which sets out objectives of risk management within NWR Group, risk evaluation, documentation and reporting processes. The Board also proposed an amendment to the Articles of Association to reflect the changes in the organisation since the Initial Public Offering in May 2008 and clarify certain provisions. The amendment was adopted by the Annual General Meeting of Shareholders in April 2010.

The Board also approved an amendment to the charter of the Health, Safety and Environment Committee, reflecting the committee’s new role in terms of reviewing sustainability reports and taking responsibility for the HSE components of the reports.

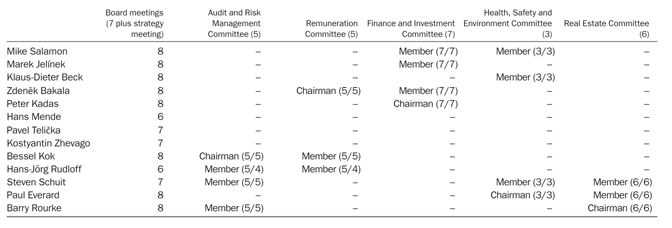

Attendance at Board and committee meetings

There are five committees of the Board: the Audit and Risk Management Committee; the Remuneration Committee; the Finance and Investment Committee; the Health, Safety and Environment Committee; and the Real Estate Committee. The members of the committees are members of the Board. Attendance at Board meetings including the strategy meeting and committee meetings during the year is outlined below. A description of the activities of the committees during 2010 is included in separate reports of the committees.

Terms of reference of each committee can be found on NWR's website.

The Board has also established the Sponsorship and Donations Committee to consolidate the donor and sponsorship activities of NWR Group. The committee comprises of the Senior Independent Director and employees of the Group responsible for this area. In 2010, the committee met once and the meeting was attended by all its members but one.

Non-Executive Directors

Dutch law currently only provides for a two-tier governance structure, i.e. a management board and a separate supervisory board. It is, however, established practice in the Netherlands to have a board structure similar to a one-tier structure. Although in such cases all members of the Board of Directors are formally directors, the articles of association of the relevant company may provide that certain directors have tasks and obligations, which are similar to those of executive directors and that other directors have tasks and obligations which are similar to those of non-executive directors.

In addition to their attendance at Board and, as appropriate, committee meetings, the Non-Executive Directors also met once during 2010 – without Executive Directors being present – to discuss the performance of the Board’s Chairman and other Executive Directors. The session was chaired by the Senior Independent Director.

- Board effectiveness

-

Director independence

The Board determines whether or not a Director is independent, based on the independence criteria contained in NWR’s Corporate Governance Policy. A Director shall not be deemed to be independent if the Director concerned (or his wife/her husband, registered partner or other life companion, foster child or relative by blood or marriage up to the second degree) has been an employee of the NWR Group within the last five years; receives personal financial compensation from any NWR Group company other than the compensation received as Director; has had an important business relationship with NWR or a company associated with it in the year prior to the appointment; holds a cross-directorship or has any significant links with other Directors through involvement in other companies or bodies where these cross-directorships or links would materially interfere with the Director’s objective, unfettered or independent judgement or ability to act in the best interests of NWR; holds directly or indirectly more than 10 per cent of the A shares or B shares; or is a member of the (management or supervisory) board or senior management of an entity, which holds directly or indirectly at least 10 per cent of the A shares or B shares.

Director appointment and reappointment

In compliance with the Articles of Association of NWR, the Annual General Meeting of Shareholders (the ‘AGM’) appoints Directors based on the binding proposal of the Board. While no Director has been appointed by holders of B shares, the B shareholders have the right to nominate one Director pursuant to the Articles of Association. Such proposals must include the names of at least two candidates as well as an indication of whether the Director proposed is to be an Executive or a Non-Executive Director. In the event the Board or the holders of B shares, as the case may be, have not made or have not made in time a binding nomination, the AGM may appoint a Director at its discretion.

The AGM may at all times overrule the binding nature of a proposal by resolution adopted with an absolute majority of the votes cast representing at least one-third of the issued share capital. If an absolute majority of the votes cast is in favour of the resolution to overrule the binding nature of a proposal, but such majority does not represent at least one-third of the issued share capital, a second meeting may be convened at which the resolution may be passed by an absolute majority of the votes cast, regardless of the portion of the issued share capital that this majority represents. If a binding proposal has been overruled by the AGM, the AGM may appoint a Director at its discretion.

The Directors may be suspended or dismissed at any time by the AGM. Directors are appointed for a term of four years and retiring Directors are eligible for reappointment. The AGM held in April 2010 approved the Board’s proposal to reappoint Mr. Bakala, Mr. Kadas and Mr. Mende for a second term since they had served as Directors since 2006. The Board will propose reappointment of Mr. Beck, Mr. Telička, Mr. Rudloff and Mr. Kok for a second term at the AGM in 2011 since they have served as Directors since 2007. A Director may be appointed for a maximum of three four-year terms. NWR has adopted a retirement scheme for Directors in order to prevent the simultaneous departure of more than one-third of its Directors; details of this scheme may be found on NWR’s website. Reappointment is not automatic and the Board will not endorse a Director for reappointment if his performance is not considered satisfactory. Retiring Directors who are seeking reappointment by shareholders are subject to a performance appraisal.

Board expertise

The Board has the appropriate skills and experience necessary to discharge its functions. Executive and Non-Executive Directors have the experience required to contribute meaningfully to the Board’s deliberations and resolutions, including international operational and financial experience, knowledge of the mining sector and capital markets, as well as command of health, safety and environmental issues. The Board believes that this complies with best practice provisions III.3.2 of the Dutch Corporate Governance Code. Full biographical details for each Director are given here.

Information and professional development

Directors receive a tailored induction upon joining the Board. They have full access to a regular supply of financial, operational, strategic and regulatory information to help them discharge their responsibilities. Much of this information is provided in presentations by senior management and the normal management reporting process. They also have access to training and seminars in respect of their duties as Board members.

Directors are also entitled to seek, at NWR’s expense, independent professional advice where they judge it necessary. To this effect, the Board and its committees have retained legal, compensation, mining, internal audit and general advisors in 2010.

Company Secretary

The Board has appointed Ivona Ročárková to act as Company Secretary. The Company Secretary is responsible for advising the Board on all governance matters and ensuring that Board procedures and functions comply with relevant laws and regulations, and as such, the Company Secretary, inter alia, administers, attends and drafts minutes of Board meetings, its committees and the General Meetings of Shareholders, and discharges such other responsibilities the Board has assigned to her.

Board effectiveness and evaluation

The Board conducted the first external evaluation of its effectiveness in 2009. The internal evaluation process conducted by the Company Secretary in 2010 and confirmed by the Board concluded that the vast majority of the Directors’ concerns raised in 2009 had been addressed. The request to extend strategic discussions and Board’s induction was partly addressed at the special two-day strategy meeting. The call for a systemisation of executive remuneration was fully satisfied by implementing the Deferred Bonus Plan, the rules of which are well defined, understood and adopted by all Group entities. The budget setting process and succession planning for key executives were recognised as areas that will acquire special attention in 2011.

- Audit and Risk Management Committee (‘ARMC’) report

-

ARMC members

The ARMC is staffed solely by independent Directors to reflect the independent nature of the work that the committee undertakes:

- Bessel Kok (Chairman and Senior Independent Director)

- Hans-Jörg Rudloff

- Barry Rourke

- Steven Schuit

The Board has determined that ARMC members have the skills and experience necessary to contribute meaningfully to the ARMC’s deliberations. In addition, all members have requisite experience in accounting and financial management.

Main responsibilities

The role of the ARMC is to ensure the integrity of financial reporting and the audit process and to ensure the effectiveness of the internal audit and risk management systems. To this end, the ARMC of NWR supports and advises the Board in its work by:

- ensuring the integrity of consolidated financial statements and consolidated accounts;

- advising the Board on audit, accounting and financial disclosure matters regarding the Real Estate Division of NWR;

- reviewing with the Board and auditors the integrity of the financial statements and other formal announcements relating to NWR’s financial performance;

- overseeing the process for selecting the external auditor and making recommendations to the Board on the appointment, dismissal, terms of engagement and fees of the external auditor;

- assessing the external auditor’s effectiveness, independence and objectivity, and the provision of non-audit services;

- reviewing the annual audit plan and reports by the external auditor on internal control systems and procedures;

- making recommendations to the Board on the appointment and dismissal of the internal auditor of NWR, reviewing the remit of the Group internal audit and the annual audit plan, and ensuring that the internal audit function is adequately resourced;

- reviewing the effectiveness of the systems for internal control, compliance, budgeting, forecasting and financial reporting of the NWR Group and procedures for identifying strategic and business risks;

- reviewing compliance issues and advising the Board on conflicts of interests, related party transactions and loans to Directors; and

- monitoring the effectiveness of the Whistleblower Procedures within the NWR Group.

Activities undertaken during the year

In 2010, the ARMC met five times. NWR’s Chief Financial Officer, the Group’s internal auditor and the external audit partners observed all meetings of the ARMC. On one occasion, the Chairman of the Audit Committee of OKD and OKD’s internal auditor were invited to attend a meeting of the ARMC. In accordance with its rules, the ARMC also met with the external audit partner as well as with the Group’s internal auditor without management present.

Integrity of financial reporting

The ARMC assists the Board in ensuring the integrity of financial reports to shareholders and banks by reviewing, together with the external auditor, the quarterly and half-yearly statutory and consolidated financial statements, preliminary announcements and press releases related thereto.

The ARMC receives regular reports from the Real Estate Committee and the Health, Safety and Environment Committee on their activities to ensure adequate oversight by the ARMC of all key Group risks. The ARMC also regularly receives performance updates, treasury reports and information on the Company’s legal affairs, M&A transactions, Group tax position and insurance policies.

The ARMC reports to the Board on its discussions and submits its recommendations to the Board for approval.

Financial policies

At NWR (consolidated) level, the financial statements are produced under IFRS whilst the subsidiaries of NWR produce their stand-alone accounts in accordance with Czech accounting standards. Further to a recommendation of the ARMC, Group financial policies and procedures have been consolidated to enable adequate oversight of internal control over financial reporting and the budgeting process.

External audit

NWR is based in the Netherlands, whilst its largest operations are located in the Czech Republic, therefore both the Dutch and Czech offices of the external auditor must be highly involved in the audit process. The representatives of the external auditor attend all meetings of the ARMC.

The external auditor provides the ARMC with regular status reports on its audit work based on the audit plan for the year that focuses on the evaluation of financial reporting risks and their impact, accounting issues and other areas specific to the Group, including Group financing structure, inventories, mining damages provisions, hedge accounting, employee benefits, share-based payments and impairment charges. In addition, every year the external auditor conducts a preliminary assessment of risks impacting the financial statements, including fraud risks, for the purposes of planning and scoping audit procedures and financial reporting.

The ARMC is also responsible for reviewing related party transactions against internal policies and procedures. Related party transactions are audited by the external auditor. These typically include transactions between the Real Estate Division and the Mining Division, transactions between the Group entities and related party transactions of the Board members of the individual Group entities. The external auditor did not identify any significant issues.

The ARMC assesses the effectiveness, objectivity and independence of the external auditor and has primary responsibility for making recommendations to the Board on the appointment, reappointment and removal of the external auditor. In addition, the external auditor is required to adhere to a rotation policy based on best practice and professional standards. The ARMC is responsible for ensuring that the rotation of the audit engagement partner is carried out in compliance with best practice and applicable regulation.

The ARMC’s assessment of the external auditor includes:

- reviewing and approving the terms of engagement of the external auditor;

- reviewing the scope of the external auditor's work;

- assessing the process for the interim review;

- monitoring the fee levels;

- reviewing and approving the annual audit plan.

The ARMC also monitors the provision of non-audit services by the external auditor to NWR and its subsidiaries and the related fees, in order to preserve the independence of the external auditor. In 2010, the external auditor only provided tax compliance work and comfort letter procedures in relation to a prospectus.

Management responses to issues raised are discussed with the Chief Financial Officer. The reviews of the ARMC confirmed that all significant matters had been satisfactorily resolved in 2010.

Following this process, the ARMC recommended that the Board propose to shareholders the reappointment of KPMG Accountants N.V. at the AGM on 28 April 2011 in Amsterdam in the Netherlands.

Internal audit

The Group internal audit function has been outsourced since November 2008. The Group’s internal auditor is responsible for developing and overseeing the implementation of consistent internal auditing policies within the Group, delivering the audit plans and audit assignments, preparing internal audit charters and reporting on Group risk management and internal control. The Group’s internal auditor functionally reports to the ARMC and its Chairman in particular and administratively to NWR’s Chief Financial Officer. The Group’s internal auditor reports the main findings of the completed audits and the status of their implementation to the ARMC.

The ARMC assesses the performance of the Group’s internal auditor on an annual basis.

At OKD, the internal audit function is performed by an internal audit team, which assesses whether the internal control, risk management, and governance processes are adequate and effective. The head internal auditor reports internal audit findings and recommendations to the senior management team and the audit committee of OKD. He submits annual reports on the activities of the internal audit team to the audit committee, the Board of Directors and the supervisory board of OKD. He has all necessary access to organisation units and their management and the right to request information and explanations, and has unfettered access to the audit committee and supervisory board of OKD. The internal audit team works closely with the Group’s internal auditor. Internal audit in the Polish operations is carried out by the Group internal audit function.

The internal audit functions at NWR and OKD have aligned audit processes on both levels and supervised implementation of their audit recommendations. The communication link between the ARMC and the audit committee of OKD has been further strengthened by engaging the ARMC’s Chairman as a member of the OKD’s audit committee, which also enables the ARMC to adequately monitor the performance of the audit committee of OKD.

Risk management, internal control and compliance

The ARMC is responsible for overseeing Group risk management and reviewing the internal control and risk management system. This supports the Board in discharging its responsibility for ensuring that the wide range of risks associated with the Group’s operations is effectively managed to safeguard shareholders’ investment and the Group’s assets.

NWR’s risk management policy, which applies to all Group entities, sets out the high level objectives of the Group’s risk management, risk evaluation, documentation and reporting processes. The policy was widely discussed by the ARMC and approved by the Board upon the ARMC’s recommendation. The document has implemented, inter alia, a risk map and the risk registers, whilst leaving room for each entity to take their own approach.

The risk management policy can be found on the NWR website.

In 2010, the ARMC continued its review of the Group key risks identified by PricewaterhouseCoopers Advisory N.V. in 2008. The following risks were reviewed:

- internal audit;

- competency;

- dispute;

- external communication;

- change management;

- machinery availability; and

- budgeting and controlling.

The risk on objective setting was excluded from the review due to unconfirmed criteria.

The risk assessment and reporting criteria are designed to provide a consistent, Group-wide perspective of the key risks.

The ARMC has a crucial role in opining and making proposals to the Board in all matters where a potential conflict of interest exists between NWR, its Directors, its controlling shareholder and other shareholders. In 2010, the ARMC examined a limited number of potential cases of conflict of interest.

Whistleblower Procedure

The Whistleblower Procedure is appended to NWR’s Code of Ethics and Business Conduct and enables employees to express, on a confidential basis, concerns over the conduct of Directors, officers, management and other employees. These include suspicions of criminal offences, violation of law, (intentionally) wrongful behaviour, manipulation of information, misconduct, etc. The Company Secretary acts as confidential adviser for NWR and its subsidiaries and is responsible for investigating reports of suspected irregularity. The ARMC is responsible for establishing and reviewing the Whistleblower Procedure and is informed of reported cases through regular reports from the Company Secretary. In 2010, 19 reports were received and reported to the ARMC. Reports received were kept strictly confidential and were referred to appropriate line managers for resolution. Where appropriate, action was taken to address the issues raised.

The whistleblowing rules can be found on the NWR website.

The ARMC believes that it carried out all the responsibilities set out in the ARMC’s charter and finds the charter adequate.

- Remuneration Committee (‘RC’) report

-

RC members

The RC consists of Non-Executive Directors appointed by the Board. Two of them are Independent Directors:

- Zdeněk Bakala (Chairman)

- Bessel Kok

- Hans-Jörg Rudloff

The RC is chaired by Zdeněk Bakala. As a major shareholder representative Mr. Bakala is not considered to be independent. However the Board regards Mr. Bakala’s membership of the RC as critical to the further alignment of executive remuneration with shareholder interests.

The Executive Directors of the Board attend meetings of the RC by invitation only and assist the RC in its discussions, except in matters associated with their own respective remuneration.

Main responsibilities

The RC is responsible for advising the Board in relation to the Board’s responsibilities with respect to:

- Remuneration Policy for Directors of the Board;

- salary levels, bonuses and other benefits for Executive Directors of the Board;

- contractual terms for Executive and Non-Executive Directors of the Board;

- share-based incentive plans for Executive Directors of the Board, selected senior managers and key employees of NWR Group;

- succession plans for selected senior executives across NWR Group; and the

- Remuneration Report of the Board.

The RC does not have decision-making power for setting remuneration for Executive Directors, thus is not compliant with the UK Corporate Governance Code (provision D.2.2). Instead, the RC makes specific proposals to the Board with respect to the salary, bonuses and other benefits for Executive Directors and the Board remains responsible for its decisions with respect to salary, bonuses and other benefits for both Executive and Non-Executive Directors of the Board. This is common practice among companies in continental Europe.

Activities undertaken during the year

The RC met five times during 2010. Further to its engagement as the Company’s compensation adviser in early 2009, Mercer Limited reviewed the RC processes and existing arrangements with Directors and senior executives in line with Dutch and UK Corporate Governance Codes and provided clarification of the role of the RC. Subsequently, Mercer reviewed the Group compensation principles and proposed a modified remuneration scheme for Executive Directors, senior managers and key employees of NWR Group. The new scheme is based on a deferred bonus plan using predetermined performance conditions and includes clawback provisions. The new scheme establishes a universal and transparent Group-wide remuneration policy in line with industry best practice and its principles follow current trends in the remuneration plans of financial institutions. The RC resolved to accept the proposed deferred bonus plan and amended the Remuneration Policy of NWR, which was subsequently approved by the Board. On 27 April 2010 this Policy was also approved at the Annual General Meeting. The deferred bonus plan was implemented throughout NWR Group and began in January 2011. Please see a detailed description of the new remuneration principles in the Remuneration Report.

To ensure uniform application of the remuneration principles across NWR Group, the RC prepared a Compensation Manual, which outlines compensation principles of the Board and the senior and key positions within NWR Group, providing a framework for the Board and the RC. The Board adopted the manual in November 2010. By adopting the Compensation Manual, the Board has delegated its powers and responsibilities to certain authorised officers of NWR and its subsidiaries, who shall decide on the salary, bonuses and other benefits for senior managers and key employees in line with internal rules and practices of the respective entity, which shall however reflect the Compensation Manual and other relevant policies.

The RC further reviewed the remuneration of the Executive Directors and the fee levels for the Non-Executive Directors for 2010. Further details may be found in the Remuneration Report.

Finally, the RC determined whether the performance conditions set up for options granted on 24 June 2009 were met, proposed a grant of new options to several eligible employees under the Company’s Stock Option Plan and proposed the performance conditions for this new grant. The Board terminated the Stock Option Plan as per 31 December 2010 and no further options will be granted under that plan.

The RC believes that it has carried out all the responsibilities set out in the RC’s charter.

- Finance and Investment Committee (‘FIC’) report

-

FIC members

The members are appointed by the Board and include Executive and Non-Executive Directors and NWR’s Chief Financial Officer:

- Peter Kadas (Chairman)

- Zdeněk Bakala

- Mike Salamon

- Marek Jelínek

Main responsibilities

The main functions of the FIC are:

- reviewing and presenting NWR Group’s annual budget to the Board;

- reviewing, approving and recommending to the Board all major strategic or financial investments and divestments and other major capital decisions;

- reviewing the adequacy of NWR Group’s capital structure;

- advising on relationships with banks, rating agencies and financial institutions;

- providing oversight and guidance on funding and treasury management; and

- making decisions on all matters related to NWR subsidiaries.

Activities undertaken during the year

In 2010, the FIC met seven times. Among the main items discussed by the FIC and recommended for the Board’s approval were:

- the Group’s budget for 2010;

- the issuance of 7.875 per cent Senior Secured Notes due 2018;

- the proposal of an all-cash tender offer to acquire all of the issued and outstanding shares of Bogdanka including financing ofthe acquisition;

- the intention to re-incorporate in the United Kingdom; and

- the execution strategy for the Dębieńsko development project.

The FIC further advised the Board in connection with share issuance. It also regularly reviewed financial and operational results and the financing and cash position of the Group including cash investments, cash pooling and hedging arrangements. The FIC continued to monitor the Group’s debt position and compliance with bank covenants and also took a number of decisions regarding financial and operating matters of NWR’s subsidiaries. The FIC reviews, on a regular basis, market analysis, analyst and investor feedback and the performance of NWR’s shares as well as the shareholder register. The FIC reports to the Board.

The FIC is of the view that its composition is appropriate and that its members have carried out all duties and responsibilities set out in the charter.

- Health, Safety and Environment Committee (‘HSEC’) report

-

HSEC members

- Paul Everard (Chairman)

- Mike Salamon

- Klaus-Dieter Beck

- Steven Schuit

The meetings were also regularly attended by Ján Fabián, Chief Operating Officer of NWR who is responsible for the operations of NWR KARBONIA and OKK Koksovny, and by two external experts, Stan Suboleski and Karl Friedrich Jakob, also members of OKD's Board of Directors. Stan Suboleski is an independent mining consultant who was previously a Commissioner with the US Federal Mine Safety and Health Review Commission. Dr. Suboleski previously retired as interim COO of Massey Energy Company and continues to serve on the Massey board. Karl Friedrich Jakob held numerous prominent managerial positions in German as well as international mining companies and also worked for the German State Mining Authority.

Main responsibilities

The HSEC assists the Board in its oversight of health, safety and environmental risks within NWR and its subsidiaries as well as the Group’s compliance with applicable legal and regulatory requirements associated with health, safety and environmental matters.

The HSEC’s main duties are to:

- oversee the Group’s performance on health, safety and environmental matters;

- review the policies and systems within the Group to ensure compliance with applicable health, safety and environmental legal and regulatory requirements;

- review reports and meet with senior management of the subsidiaries to discuss the effectiveness of the Group’s policies and systems for identifying and managing material HSE risks;

- liaise with the ARMC to ensure appropriate oversight of the Group’s systems for managing risks;

- monitor the impact of operations on Group reputation;

- prepare the HSE section of NWR’s Annual Report;

- review sustainability reports prepared by management and assist the Sponsorship and Donation Committee in the area of Corporate Social Responsibility; and

- report to the Board on key global HSE issues and trends.

The HSEC reports the results of its meetings to the Board and to the ARMC.

Activities undertaken during the year

In 2010, the HSEC met three times and conducted one site visit to the OKD mines in the Czech Republic. At its meetings, the HSEC reviews the health, safety and environmental reports of NWR’s core operations and also receives detailed reports on extraordinary events that occur at the operations. These events include fatalities, incidences of spontaneous combustion, coal and gas outbursts, and seismic events (rock bounces). The HSEC also receives regular reports on site visits by the local mining authorities, citations and other HSE-related regulatory matters.

In 2009, the HSEC endorsed key metrics for both health and environment issues in order to improve the reporting system; these metrics also serve to measure performance and generate further improvement in the HSE area.

In 2010, the HSEC was kept informed about the status of a safety project at OKD to replace personal protection devices with the aim of providing each miner with new and better equipment before the year-end.

The HSEC closely followed the investigation into the Massey Energy’s tragic coal mine accident in April 2010, when a massive explosion killed 29 miners. The members also took note of a Fatality Avoidance Protocol produced by the International Aluminium Institute, which suggests general safety principles and prevention guidelines for heavy industry.

In performing its new role in the area of Corporate Social Responsibility for NWR Group, the HSEC assists the Sponsorship and Donation Committee and reviews, amongst others, sustainability reports prepared by management. These new responsibilities were formalised in an amended charter of the HSEC, adopted in early 2010.

A detailed description of the trends in the area of health, safety and environment at NWR’s operations may be found here.

The HSEC believes that it has successfully fulfilled its duties and responsibilities as set out in its charter.

The charter of the HSEC is available on NWR's website.

- Real Estate Committee (‘REC’) report

-

REC members

The REC is wholly composed of Independent Non-Executive Directors appointed by the Board:

- Barry Rourke (Chairman)

- Steven Schuit

- Paul Everard

Main responsibilities

The role of the REC is to oversee the assets and liabilities of the Real Estate Division and the interaction between the Mining Division and the Real Estate Division of NWR.

The REC supports and advises the Board in its work by:

- advising the Board on matters regarding the Real Estate Division of NWR (except in relation to audit, accounting and financial disclosure matters, which fall within the remit of the ARMC);

- monitoring transactions between the Mining Division and the Real Estate Division and advising the Board on any such transactions, which require the prior approval of the Board;

- developing and interpreting the Divisional Policy Statements, proposing amendments, providing guidance on provisions and overseeing implementation; and

- overseeing the compliance of NWR’s subsidiaries with the Divisional Policy Statements.

Activities undertaken during the year

During 2010, the REC met six times. NWR’s Chief Financial Officer attended all meetings.

In line with its responsibility for supervising transactions between the Mining Division and the Real Estate Division, the REC continued to monitor real estate transactions of NWR’s core operations, including transactions with third parties (mainly swaps of the real estate assets with the local municipalities). To assist the REC, the core operations submit monthly reports, which provide details on any such transactions. The REC is notified of all transactions (internal or with third parties) in which qualified valuers are involved, in order to facilitate oversight by the REC of such transactions.

In 2010, the REC considered, amongst other things, the financial implications of the sale of the Group’s energy assets on the Mining Division and Real Estate Division. The REC also reviewed in more detail the sale of the Mining Museum and the transfer of the museum between the Divisions in particular. The REC advises the Board, which is the ultimate body to approve such transfers, whether they will occur on an arm’s length basis, as required by the Divisional Policy Statements. In 2010, all proposed transfers were approved by the Board as well as by the holder of the B shares. The REC further reviewed, on a regular basis, P&L accounts of the Real Estate Division.

The REC regularly reports to the Board and the ARMC on its activities and findings.

Divisional Policy Statements.

The Divisional Policy Statements refer to the Mining Division and the Real Estate Division that were created within the NWR Group on 31 December 2007. The Divisional Policy Statements have been prepared and adopted on the basis that the Mining Division has the right to maintain: (i) the undisturbed continuation of its mining, coking and related operations that are conducted on certain of the assets of the Real Estate Division; and (ii) unrestricted access to such assets of the Real Estate Division in connection with such mining, coking and related operations.

The Divisions operate separately for accounting and reporting purposes. Under the Divisional Policy Statements, OKD, OKD’s subsidiaries and the other subsidiaries of NWR carry out the day-to-day operations of the Real Estate Division. In carrying out such day-to-day operations, they are required to seek prior approval from the Board, after the REC has provided its advice to the Board, when proposing to enter into transactions which: (i) are not considered by the Board to be in the ordinary course of business of the Real Estate Division; or (ii) relate to assets of the Real Estate Division, which have a book value of 5 per cent or more of the total book value of the assets of the Real Estate Division.

The Divisional Policy Statements have been implemented by NWR’s core operations. Compliance is monitored by the REC through monthly reports received from the Company Secretary who has been designated to act as an intermediary between the REC, NWR and its subsidiaries. In 2009, the Group’s internal auditor conducted an internal audit on the implementation of the Divisional Policy Statements and the accuracy of information provided to the Committee. The audit suggested, amongst other things, formalisation of certain procedures to prevent the Divisional Policy Statements from misinterpretation. Thus a Book of Procedures dealing with the accounting aspects of the Divisional Policy Statements has been prepared and endorsed by the REC.

The REC believes that it has carried out all the responsibilities set out in the REC’s charter.

The Divisional Policy Statements are available on the NWR's website.

- Accountability

-

Conflict of interest

In addition to the regulations of the Articles of Associations, the Corporate Governance Policy sets out the rules for dealing with conflicts of interest. Directors are required to immediately report any conflict of interest or potential conflict of interest that is of material significance to the Senior Independent Director, and shall provide all relevant information, including information concerning a related party. If the Senior Independent Director has a conflict of interest or potential conflict of interest that is of material significance, he should immediately report to the Board and provide all relevant information.

The ARMC is responsible for making recommendations to the Board on potential conflicts of interests and related party transactions. Directors do not take part in the assessment by the ARMC of whether a conflict of interest exists.

The Board believes that it has complied with the best practice provisions II.3.2 to II.3.4 and III.6.1 to III.6.3 of the Dutch Corporate Governance Code (which relate to conflict of interest of Directors).

Code of Ethics and Business Conduct

In addition to its Corporate Governance Policy, NWR has adopted a Code of Ethics and Business Conduct, which governs the behaviour of all officers and employees of NWR and its subsidiaries. Appended to it is the whistleblower procedure, which is a reporting mechanism enabling employees to express concerns to the Board’s Chairman, Senior Independent Director and the designated officer in relation to the conduct of NWR, its officers and employees.

The core operations of NWR have implemented a corresponding procedure. To increase the effectiveness of the system, OKD has modified the whistleblower procedure so that complaints are now dealt with by an independent internal committee. The ARMC monitors, through reports received from the Company Secretary, the effectiveness of the procedure. Further details can be found in the report of the ARMC here.

The Code of Ethics and Business Conduct and the Whistleblower Procedure are both available on the NWR's website.

Risk management

The Board recognises the need to continue improving the Group’s internal control processes and structures. Internal control and risk management procedures are described in more detail in 'Principal Risks and Uncertainties'. NWR Group uses the COSO-framework for the evaluation of the internal control system to mitigate risks. To the best knowledge of the Board, the internal risk management and control systems of the Group are adequate and effective with respect to its current operations.

Oversight of risk management and internal control within NWR Group is the responsibility of the ARMC, which closely monitors the measures implemented to mitigate identified risks and also regularly meets with NWR’s Risk Manager and the Group’s Internal Auditor. Details of activities in this area are described in the report of the ARMC here.

Internal audit

The Group’s Internal Auditor oversees the work of internal audit functions in NWR’s subsidiaries. He is responsible for developing and overseeing the implementation of consistent internal auditing policies within the Group, delivering the audit plans and audit assignments, preparing internal audit charters and reporting on Group risk management and internal control. The Group’s internal auditor reports to the ARMC and the Chief Financial Officer of NWR.

Going concern

The Directors consider that NWR Group has adequate financial resources to continue operating for the foreseeable future and that it is, therefore, appropriate to adopt the going concern basis in preparing the financial statements. The Directors have satisfied themselves that NWR Group is in a sound financial position and that it has access to sufficient borrowing facilities and can reasonably expect those facilities to be available to meet NWR Group’s foreseeable cash requirements, particularly those relating to major investments, including capital projects and acquisitions.

Insider trading

In compliance with relevant laws, rules and regulations of the UK, the Netherlands, the Czech Republic and Poland, the Company has a Share Dealing Code that covers dealings in NWR’s shares and other securities, disposal of inside information and disclosure of information relating to the securities by the Directors and certain employees of NWR Group. The document restricts dealings during designated prohibited periods and at any time that the Directors and employees are in possession of unpublished price-sensitive information. The Share Dealing Code has been implemented throughout NWR Group and is monitored by NWR’s Compliance Officer. A copy of the document can be found on NWR's website.

Articles of Association

The Articles of Association may be amended by the General Meeting of Shareholders in which at least three-quarters of the issued share capital is represented and with a majority of at least two-thirds of the votes cast. A resolution to amend the Articles of Association on the proposal of the Board shall be passed by an absolute majority of the votes cast, irrespective of the capital present or represented at the meeting. Certain proposals would require a prior or simultaneous approval of the meeting of holders of B shares. NWR’s Articles of Association are available on NWR's website. As described earlier, the document was amended by the Annual General Meeting of Shareholders held on 27 April 2010.

- Relations with shareholders

-

Market disclosure and relations with shareholders

The Board regards effective communication with shareholders as a priority.

Agnes Blanco Querido, Head of Investor Relations, is responsible for the external financial communications of NWR. Together with her team, she manages the ongoing dialogue with equity and credit analysts and NWR’s shareholders, bondholders and potential new investors. As part of this process, the Board’s Chairman, Chief Financial Officer, Chief Operating Officer and Investor Relations team meet with shareholders and other market participants in the UK, US, the Czech Republic, Poland and other European countries on a regular basis to discuss the Group’s performance, strategy and governance. Additionally, presentations to investors and analysts take place at the time of quarterly, interim and final results as well as sector and broker conferences that the Company participates in throughout the year.

The Board receives regular reports from the Investor Relations department on changes to the shareholding structure, analyst coverage of the stock, feedback from investors including market perception studies, share trading statistics and other information about the views of the capital markets.

Petra Mašínová, Head of Corporate Communications, is responsible for both external and internal corporate communications as well as the corporate social responsibility policy of NWR.

The financial reports, press releases, regulatory announcements, investor presentations and other information on matters of interest to investors can be found on NWR's website.

Senior Independent Director

The Senior Independent Director, Bessel Kok, is available to shareholders if they have concerns, which the Board’s Chairman, the Vice-Chairmen or the Chief Financial Officer have not resolved, or if they have concerns related to Board independence. No such meetings or discussions were held or requested during 2010.

Share capital, controlling shareholder

In April 2010, BXR Mining B.V. (‘BXRM’), the majority shareholder of NWR, informed NWR that BXR Group Limited (‘BXRG’) replaced RPG Partners Limited as the ultimate parent company of BXRM. The shares held by BXRM in NWR were reduced from 63.66 per cent to 63.64 per cent after NWR issued new A shares in May 2010, and further reduced to 63.57 per cent after the share issuance in December 2010.

Full details on the changes in the shareholding structure of NWR occurring in 2010 may be found in the ‘Shareholder Information’ section.

100 per cent of the B shares are owned by RPG Property B.V., which is the indirect subsidiary of BXRG.

The Board is satisfied that NWR is capable of carrying on its business independently of BXRM/BXRG and that all transactions and relationships between them are transparent and are carried out independently. The Board makes its decisions in a manner consistent with its duties to NWR and stakeholders of NWR and gives equal consideration to the potentially divergent interests of the holders of both classes of shares in NWR.

To ensure that all transactions and relationships between the Company and BXRM (and the wider BXRG group) are on arm’s length terms, the Company is party to a Relationship Agreement with BXRM. If a conflict arises between BXRM and the Company, the Directors with a conflict of interest will take no part in the Board’s decisions on that matter. For further information see the ‘Related Party Transactions’ section here.

Annual General Meeting of Shareholders

The AGM is an opportunity for shareholders to communicate with the Board. The Chairman will aim to ensure that the respective Chairmen of the Board committees are present at the AGM to answer shareholders’ questions. The next AGM will be held on 28 April 2011, at 10:00 CET in Amsterdam, the Netherlands.

Compliance with corporate governance standards

NWR is required to state in its Annual Report whether it complies or will comply with the principles and best practice provisions of the Dutch Corporate Governance Code (dated 1 January 2009) and, if it does not comply, to explain the reasons for non-compliance. NWR is also required by the Listing Rules of the UK Listing Authority to disclose the significant ways in which its actual governance practices differ from those set in the UK Combined Code. NWR notes that the UK Corporate Governance Code was introduced by the UK Financial Reporting Council in June 2010 to replace the UK Combined Code, and that this will apply for accounting periods beginning on after 29 June 2010. For the financial year ending 31 December 2011 and following financial years, the Company will instead be required to include a similar statement in relation to the UK Corporate Governance Code.

The following section is a report on compliance with the corporate governance regulations and best practice codes applicable in the Netherlands and the UK.

Dutch Corporate Governance Code

NWR has drawn up internal corporate governance regulations that comply to the extent possible with the Dutch Corporate Governance Code effective from 1 January 2009. As reported in this section, NWR complies with the principles and best practice provisions of the Dutch Code, except for a limited number of best practice provisions described below. Information on the Dutch Corporate Governance Code Monitoring Committee can be found at: www.commissiecorporategovernance.nl. More specific information for the Dutch Corporate Governance Code can be found at: www.commissiecorporategovernance.nl/Corporate_Governance_Code.

Board and committee structure

NWR has a one-tier Board structure consisting of Executive and Non-Executive Directors. The Company complies with the Dutch Code by applying the provisions relating to members of the Management Board to Executive Directors, and the provisions relating to members of the Supervisory Board to Non-Executive Directors. The composition and functioning of the Board allows proper and independent supervision of Executive Directors by Non-Executive Directors.

The Board consists of 13 Directors, which includes five Independent Non-Executive Directors within the meaning of best practice provision III.2.2. The number of Independent Non-Executive Directors is less than the prescribed majority pursuant to best practice provision III.8.4 of the Dutch Code. However, the Board believes that the current proportion of the Independent Non-Executive Directors is adequate given the ownership structure of the Group. Moreover, the quality and deployment of these Directors ensure Board effectiveness. The Independent Non-Executive Directors are entrusted with the key tasks that require independence: staffing of the Audit and Risk Management Committee, which ensures the integrity of financial reporting and monitors the audit functions as well as potential conflicts of interest, and staffing of the Real Estate Committee, which protects the interest of holders of A shares and B shares.

NWR has appointed an Executive Chairman, which does not comply with best practice provision III.8.1 of the Dutch Code. NWR believes that the presence of an Executive Chairman is needed to provide leadership at Group level in a holding structure in which the leadership of operations is exercised at operating company level. The presence of majority shareholder representatives on the Board alongside Independent Non-Executive Directors guarantees that there are appropriate checks and balances in place.

NWR has not established a selection and appointment committee (i.e. nominating committee), which does not comply with principle III.5 and best practice provision III.5.14 of the Dutch Code. The Board believes that NWR’s current ownership structure makes the establishment of such a committee unnecessary. The Board as a whole fulfils the tasks and responsibilities set out by the Dutch Code for such a committee.

Remuneration, share options and awards

The Company does not carry out scenario analysis to determine the level and structure of the remuneration of the Executive Directors as required by best practice provision II.2.2, since their employment terms were determined before the IPO and have not changed since then.

In order for a Director to exercise options, rather than the granting of options to a Director, as set out in best practice provision II.2.4, challenging targets which have been specified before-hand (pursuant to the Company’s Stock Option Plan) must be achieved.

The Independent Non-Executive Directors were granted A shares at the completion of the IPO and on the 12-month anniversary thereof in 2009 and 2010, which does not comply with best practice provision III.7.1, which states that no shares shall be granted to Independent Non-Executive Directors. NWR considers its practice complies with international business practice. The Company also considers the granting of A shares as an important incentive to attract individuals with the required skills and expertise to serve as Independent Non-Executive Directors in an international mining company of moderate size.

Under existing employment arrangements of Mike Salamon with NWR and of Klaus-Dieter Beck with OKD, stock options and share awards are granted under terms, which do not comply with best practice requirements set out in chapter II.2 of the Dutch Code. Details of these awards are fully described in the Remuneration Report.

Dealing in securities

The Company has a Share Dealing Code, which governs dealing in Company’s shares by, inter alia, the Directors, and as such does not comply with best practice provision III.6.5 of the Dutch Code as the Share Dealing Code does not cover ownership of and transactions in other securities. The Company will review the Share Dealing Code in connection with its intended re-incorporation in the UK in 2011.

Contacts with shareholders

The Company has not formulated an outline policy on bilateral contacts with shareholders, as provided for by best practice provision IV.3.13 of the Dutch Code, as it intends to re-incorporate in the UK in 2011.

UK Combined Code

NWR was, for reasons stated above, not in compliance during the financial year 2010 with the following best practice requirements of the UK Combined Code:

- The Company has appointed an Executive Chairman, contrary to the recommendation of the UK Combined Code (provision A.2.1).

- The Executive Chairman did not, upon appointment, meet the independence criteria set out in the UK Combined Code (provision A.3.1).

- The Board does not contain a majority of Independent Non-Executive Directors, as recommended by UK Combined Code (provision A.3.2).

- The Board carries out the tasks and responsibilities of the nominations committee whereas the UK Combined Code (provision A.4.1) recommends the appointment of a separate nomination committee.

- The Remuneration Committee is chaired by Zdeněk Bakala, whereas the UK Combined Code (provision B.2.1) recommends that the Remuneration Committee should be comprised entirely of Independent Non-Executive Directors. In addition, the Remuneration Committee does not have delegated responsibility for setting the remuneration for the Executive Directors, as recommended by the Combined Code (provision B.2.2). Instead, the Remuneration Committee’s responsibility is to, inter alia, prepare specific proposals to the Board with respect to the salary, bonuses and other benefits for the Issuer’s Executive Directors.

UK Corporate Governance Code

NWR is aware of the UK Financial Reporting Council’s introduction of the UK Corporate Governance Code in June 2010 to replace the UK Combined Code. The new Corporate Governance Code will apply for accounting periods beginning on or after 29 June 2010 and NWR will report against the new code in the NWR Annual Report and Accounts 2011.

Czech Corporate Governance Code

NWR is not obliged by the Czech National Bank or the Prague Stock Exchange to comply with the Czech Code of Corporate Governance.

Although NWR does not apply the Czech Corporate Governance Code as such, the Code is generally similar to the UK Combined Code and any material deviations are similar to those described above.

Polish Corporate Governance Code

NWR observes the majority of the principles of corporate governance contained in the Code of Best Practices for Warsaw Stock Exchange Listed Companies (the ‘WSE Code’)1. As the Company is incorporated and organised under Dutch law, certain principles apply to NWR only to the extent allowed by Dutch corporate law and subject to certain reservations stemming from NWR’s corporate structure, especially the one-tier Board structure as opposed to the two-tier system that the WSE Code assumes. Therefore, NWR complies partially or is unable to comply fully with Rules I.6, I.7, II 6, III.1-9 of the WSE Code concerning the Supervisory Board and its members. In cases in which NWR is unable to comply with certain principles directly, NWR endeavours to comply with the spirit of such principles.

- The WSE Code require companies listed on the Warsaw Stock Exchange to publish a detailed statement on any non-compliance or partial compliance with the WSE Code; such a statement shall also be contained within the Company’s Annual Report. The companies are required to indicate ways of eliminating possible consequences of such non-compliance, or describe steps, which the Company intends to take to mitigate the risk of non-compliance. In 2010, NWR did not comply with the following rules contained in the WSE Code:

- refuse to accept unreasonable benefits, which could have a negative impact on the independence of his or her opinions and judgements; and

- raise explicit objections and separate opinions in any case when he or she deems that the decision of the Supervisory Board is contrary to the interest of the Company.

- prepare and present to the Annual General Meeting of Shareholders a brief annual assessment of the Company’s standing including an evaluation of the internal control system and the significant management system;

- prepare and present to the Annual General Meeting of Shareholders an annual evaluation of its work; and

- review and present opinions on issues subject to resolutions of the General Meeting.

Rule I.6. A member of the Supervisory Board should have appropriate expertise and experience and be able to devote the time necessary to perform his or her duties. A member of the Supervisory Board should take relevant action to ensure that the Supervisory Board is informed about issues significant to the Company.

Rule I.7. Each member of the Supervisory Board should act in the interests of the Company and form independent decisions and judgements, and in particular:

Rules I.6 and I.7 do not relate to NWR since it has a one-tier Board structure consisting of Executive and Non-Executive Directors and, therefore, the provisions relating to the Supervisory Board do not apply.

Rule II.6 – General Meetings should be attended by members of the Management Board who can answer questions submitted at the General Meeting.

Directors shall attend General Meetings to answer questions. Dutch law however does not provide for a mandatory presence of Directors. Although NWR aims to ensure the presence of its Directors at the General Meetings of Shareholders, it cannot guarantee that all Directors will be present.

Rules III.1 to III.9 cannot be directly observed by NWR since NWR has a one-tier Board structure and as such has no Supervisory Board; additional explanation to each rule is given below.

Rule III.1

In addition to its responsibilities laid down in legal provisions, the Supervisory Board should:The above responsibilities are performed by the committees established by the Board with the intention to assist the Board in performing its duties regarding internal control and management mechanisms, as described below.

Rule III.2 – A member of the Supervisory Board should submit to the Company’s Management Board information on any relationship with shareholders who hold shares representing not less than 5 per cent of all votes at the General Meeting. This obligation concerns financial, family, and other relationships, which may affect the position of the member of the Supervisory Board on matters decided by the Supervisory Board.

NWR has a one-tier Board structure. Since it does not have a Supervisory Board, it cannot directly observe the above rule.

Rule III.3 – General Meetings should be attended by members of the Supervisory Board who can answer questions submitted at the General Meeting.

In accordance with NWR’s Articles of Association, members of the Board of Directors are entitled to attend the General Meetings of Shareholders and answer questions posed at the General Meeting.

Rule III.4 – A member of the Supervisory Board should notify the Supervisory Board of all conflicts of interest, which have arisen or may arise, and should refrain from taking part in the discussion and from voting on the adoption of a resolution on the issue, which gives rise to such conflict of interest.

In order to avoid conflicts of interest in a one-tier Board structure, NWR has adopted a Corporate Governance Policy enabling the Board to perform its management as well as supervisory functions in an effective and transparent manner. Under the Policy, Directors are required to report any (potential) conflict of interest to the Senior Independent Director (or to the Board as the case may be). If an Executive Director has a conflict of interest with NWR, NWR may be represented by other Executive Directors, unless the General Meeting appoints another person for that purpose.

Rule III.5 – A member of the Supervisory Board should not resign from this function if this action could have a negative impact on the Supervisory Board’s capacity to act, including adoption of resolutions by the Supervisory Board.

This rule is observed by the Board.

Rule III.6 – At least two members of the Supervisory Board should meet the criteria of being independent from the Company and entities with significant connections with the Company. The independence criteria should be applied under Annex II to the Commission Recommendation of 15 February 2005 on the role of non-executive or supervisory directors of listed companies and on the committees of the (supervisory) board. Irrespective of the provisions of point (b) of the said Annex, a person who is an employee of the Company or an associated company cannot be deemed to meet the independence criteria described in the Annex. In addition, a relationship with a shareholder precluding the independence of a member of the Supervisory Board as understood in this rule is an actual and significant relationship with any shareholder who has the right to exercise at least 5 per cent of all votes at the General Meeting.

As at the date of this statement, five out of 10 Non-Executive Directors meet the independence criteria.

Rule III.8 – Annex I to the Commission Recommendation of 15 February 2005 on the role of non-executive or supervisory directors of listed companies and on the committees of the (supervisory) board should apply to the tasks and the operation of the committees of the Supervisory Board.

Each of the five Independent Directors of NWR must meet independence criteria set out by NWR’s Corporate Governance Policy. Those criteria are based on best practice requirements and are typically more stringent than the requirements of the Commission Recommendation of 15 February 2005 regarding the role of Non-Executive Directors.

Rule III.9 – Execution by the Company of an agreement/transaction with a related entity, which meets the conditions of section II.3 requires the approval of the Supervisory Board.

The related party transactions are monitored, through reports received from the external auditor, by the Audit and Risk Management Committee established by the Board. The committee examines and advises the Board on such transactions and agreements to ensure they are on arm’s length terms in line with the aforementioned rule.

As required by the Resolution No. 1013/2007 of the WSE dated 11 December 2007, a description of other relevant information may be found on the following pages of this Annual Report:

Operations and main powers of the General Meeting, shareholders’ rights and the exercise thereof are described in ‘Shareholder Information’ section here.

Composition and operations of the managing and supervising bodies of the Company and their committees are described in the Corporate Governance Report here.

Detailed description of the ‘Principal Risks and Uncertainties’.