Remuneration Report

This Remuneration Report was prepared by the Remuneration Committee and sets out the Company’s Remuneration Policy and practice for the Directors. The report also provides details of Directors’ remuneration for the year ended 31 December 2010.

- Remuneration Committee

-

The Remuneration Committee is chaired by Zdeněk Bakala and the other members are Hans-Jörg Rudloff, and Bessel Kok, all of whom are Non-Executive Directors. As a major shareholder representative Mr. Bakala is not considered to be independent. However the Board regards Mr. Bakala’s membership of the Remuneration Committee as critical to the further alignment of executive remuneration with shareholder interests.

The Remuneration Committee is responsible for advising the Board on remuneration policy for Directors of the Board including salary levels, bonuses and other benefits for Executive Directors and contractual terms for all Directors of the Board.

During the year, Mercer Limited provided independent advice to the Remuneration Committee on executive remuneration. Mercer Limited did not provide any other services to NWR during the year.

- Remuneration policy

-

The remuneration policy for the Board of Directors was adopted by the Annual General Meeting of Shareholders in April 2008 and amended on 27 April 2010 by the Annual General Meeting of Shareholders.

The objective of the remuneration policy is to attract, retain and motivate talented executives by providing a well-balanced remuneration package. The remuneration policy aims to ensure that a competitive remuneration package for the Executive Directors is maintained and benchmarked against other multinational companies based in Europe and operating in global markets. The Remuneration Committee believes that the remuneration policy remains appropriate for 2011.

In order to align executive performance with shareholder value, the remuneration of Executive Directors is linked not only to individual performance but also to NWR Group’s performance. The salary, bonus, if any, and other terms and conditions of employment of the Executive Directors shall be determined by the Board having reviewed proposals submitted by the Remuneration Committee and giving due consideration to the remuneration policy. The remuneration policy also sets out the remuneration of Non-Executive Directors, as described further. The Board has delegated its powers and responsibilities to certain authorised officers with respect to the remuneration of senior managers and key employees of NWR Group, who shall decide on their salary, bonuses and other benefits.

- Remuneration of Executive Directors

-

In 2010 and in previous years, the remuneration package for Executive Directors included a significant variable element in the form of a cash bonus incentive and a long-term incentive in the form of share grants and stock option grants. The Remuneration Committee ensured that an appropriate balance between the fixed and performance-related elements of executive remuneration was maintained.

Upon its engagement by the Board as the Company’s independent remuneration consultants, Mercer Limited proposed to modify the remuneration policy for Executive Directors, senior managers and key employees of NWR Group. Specifically to include, inter alia, a deferred bonus plan using predetermined performance conditions, as described in more detail below (the ‘Deferred Bonus Plan’). The Deferred Bonus Plan has now been implemented throughout NWR Group commencing in January 2011.

- Base salary

-

To ensure remuneration remains effective in supporting the Group’s business objectives, the Remuneration Committee annually reviews base salary levels for Executive Directors, taking into account external benchmarks, and makes subsequent proposals to the Board. When setting salary levels, the Remuneration Committee takes into consideration individual performance, NWR Group performance and changes in responsibilities.

- Bonus salary

-

Executive Directors may be awarded cash bonuses by the Board upon proposal by the Remuneration Committee. The value of the cash bonus is determined by the Remuneration Committee following evaluation of financial and non-financial benchmarks.

- Stock option plan for the Chairman of the Board

-

On 1 September 2008, Mr. Salamon was awarded share options equal to 0.5 per cent of NWR’s share capital as per the date of grant. Each share option gives Mr. Salamon the right to acquire one A share on the vesting date. The exercise price per option is EUR 0.01. The option award will enable Mr. Salamon to ultimately acquire up to 0.5 per cent of NWR’s share capital by 1 September 2012, provided that: (i) he remains an executive member of the Board; and (ii) any other conditions for vesting have been met. The options vest over a period of five years so that 20 per cent of the total awarded options vest annually on each anniversary of 1 September 2008, when the initial 263,800 options vested. The number of options vesting depends on NWR’s share capital on 1 September of that year. Mr. Salamon shall be compensated for any shortfall on each anniversary.

Share awards plan for the chief executive officer of OKD, a.s. (‘OKD’)

Mr. Beck was entitled to receive from OKD and its affiliates, at the cost of OKD, 250,045 A shares of NWR, or cash in lieu of shares, for each full year of his three-year term ending on 30 June 2010. Since Mr. Beck and OKD have agreed to extend Mr. Beck’s employment term beyond the initial three years, his new employment agreement provides that he is entitled to receive 250,045 A shares of NWR for each full year of the term beyond the initial three years up to a maximum of 1,250,225 A shares of NWR.

- Stock option plan for Executive Directors, senior management and key employees

-

NWR operates a stock option plan (the ‘Stock Option Plan’), which was adopted by the Annual General Meeting of Shareholders in April 2008. The Stock Option Plan was designed with the assistance of Mercer Limited. The plan is administered by the Board and the Remuneration Committee.

Due to the implementation of the Deferred Bonus Plan, the Board decided to terminate the Stock Option Plan as of 31 December 2010. Subsequently, no further options may be granted, although the provisions of the Stock Option Plan will continue in relation to options already granted.

Eligibility

Executive Directors, senior managers and key employees of the NWR Group were eligible to participate in the Stock Option Plan. Individual eligibility was determined by the Board upon the recommendation of the Remuneration Committee.

Grant of options

The maximum number of A shares over which options might have been granted under the Stock Option Plan could not exceed 3 per cent of the issued A share capital of NWR at the time of its IPO. Option holders were not required to pay for the grant of an option.

As per January 2010, the total number of options granted (excluding options of holders who had left NWR Group) was 3,792,436 and their total monetary value was GBP 6,101,618 (approximately EUR 6,871,344), which was calculated on the Black-Scholes model.

The total number of options granted in March 2010 was 1,742,631 and their total monetary value at the date of the grant was GBP 5,128,618 (approximately EUR 5,722,627), also calculated on the Black-Scholes model.

Exercise price

The exercise price of options granted upon completion of the IPO in May 2008 was GBP 13.25. The exercise price in respect of any other options granted under the Stock Option Plan was equal to the average opening value of an A share on the London Stock Exchange on the five business days immediately prior to the date of grant. The exercise price of options granted in 2009 was GBP 2.8285 and the exercise price of options granted in 2010 was GBP 7.128.

Exercise of options

Options vest after a three-year period, provided the option holder remains a Director or an employee of NWR Group. The exercise of options is dependent on financial and operational criteria determined by the Remuneration Committee and approved by the Board. For Executive Directors and certain members of senior management and key employees, EBITDA threshold and target performance were used for vesting purposes. For other senior management and key employees of NWR Group, production and cost control thresholds and targets were set, as relevant to the participant and his/her area of responsibility. For each year during the vesting period, one third of the granted options become eligible for vesting. 50 per cent of the stock options vest if the threshold performance is achieved, and 100 per cent of the stock options vest if the target performance is achieved. Vesting between threshold and target is on a straight-line basis. Individual threshold and target performance were proposed each year by the Remuneration Committee and approved by the Board.

Options, which have not been exercised will normally lapse on the eighth anniversary of their grant. Options may, however, be exercised early under certain circumstances, including certain terminations of employment and in the event of a takeover (see below), scheme of arrangement or winding up. Options are not transferable and may only be exercised by the persons to whom they are granted. No options were exercised under the Stock Option Plan during 2010.

Individual limits

Options are not granted to a member of senior management if this would cause the total amount due on the exercise of any options in a single year to exceed his/her fixed annual salary in the 12 months prior to grant, or to exceed five times his/her fixed annual salary in the 60 months prior to grant. Furthermore, options are not granted to a key employee of the NWR Group if this would cause the total amount due on the exercise of any options granted in a single year to exceed 60 per cent of his/her fixed annual salary in the 12 months prior to grant, or to exceed three times his/her fixed annual salary in the 60 months prior to grant.

Termination of employment

If an option holder ceases to be a Director or employee of NWR Group for reasons involving misconduct, all his/her options will lapse. If an option holder dies, retires at normal retirement age, is made redundant or retires through illness or injury, his/her options may be exercised on a proportionate basis dependent upon the time, which has elapsed since the date of grant and the application of any relevant performance condition.

Change in control

In the event of a change in control of NWR Group, all options will vest.

Issue of A shares and variation in share capital

A shares issued in a single year of options will rank equally with A shares in issue at that time, except in respect of rights arising by reference to a prior record date. Options may be adjusted following certain variations in the share capital of NWR Group, including a capitalisation or rights issue, subdivision or consolidation of share capital.

Amendments

The Remuneration Committee has discretion to manage and administer the Stock Option Plan, interpret and propose changes therein to the Board, subject to the provisions of any applicable law, including but not limited to Dutch corporate law and market abuse laws in both the Netherlands and the UK.

- Deferred Bonus Plan

-

The Deferred Bonus Plan undertakes to establish universal and transparent Group-wide remuneration principles in line with industry best practice. The Deferred Bonus Plan may be offered to Executive Directors as well as to senior managers and key employees of NWR Group, subject to approval by the Remuneration Committee. Board approval is required for participation of Executive Directors.

The main principles of the Deferred Bonus Plan applicable to the Executive Directors are set out below:

Main principles

A bonus opportunity will be set as a percentage of base salary. In line with standard practice, Executive Directors would need to achieve of at least 80 per cent of annual EBITDA target for a bonus to be payable. This condition aims to provide a strong connection between business imperative and performance. If this condition is met the bonus may be between 100 per cent and 250 per cent of annual salary on the basis of performance evaluation of performance criteria. Performance will be measured against a balanced scorecard, providing a shared framework within which specific performance criteria shall be set relevant to the Executive Director and his area of responsibility, which may include one or more of EBITDA, CAPEX, cost control, production, safety, etc. At the end of the year, bonus eligibility will be determined using audited results. The Board, upon the proposal of the Remuneration Committee, shall decide on the actual amount of bonus payable. 50 per cent of the annual bonus award will be payable in cash and 50 per cent will be deferred into A shares for a period of three years. The number of A shares granted will be derived using the average of opening prices of an A share as reported by the London Stock Exchange on each of the five business days preceding and including the date of grant. After a period of three years from the date of deferral, the deferred bonus award will vest. The A shares will be delivered to the participant provided that the participant is still employed by NWR Group (otherwise a principal of ‘good’ or ‘bad’ leavers will apply). The maximum number of A shares offered under the Deferred Bonus Plan to an Executive Director in one bonus year may not exceed 250,000 A shares. No dividend will be paid out on the deferred shares during the deferral period. The Deferred Bonus Plan allows ad hoc grants, although the use of such grants should be minimized. The value of any ad hoc grant shall not exceed 250 per cent of annual salary in each case in each financial year.

Put option

Each participant will have a put option, which will give the participant a put at market price at the time the A shares are issued or delivered, as the case may be, to him/her to have him/her benefit from future price increase, but protect him/her from any potential reduction in value that he/she has already earned. The period to exercise the put option will be limited to three years and the put option will cease to exist if the participant leaves NWR Group.

Adjustment and clawback provisions

If the Remuneration Committee or the Board, as the case may be, believes that extraordinary circumstances have occurred during the period in which the predetermined performance criteria have been or should have been achieved, which lead to an unfair result with respect to the deferred bonus amounts awarded to the Executive Director, the Board, upon the proposal of the Remuneration Committee, retains the discretionary power to adjust the value of the deferred bonus amounts as appropriate.

If any variable remuneration, be it in the form of cash or A shares, has been awarded on the basis of incorrect financial or other data, the Board is entitled to recover such remuneration from the Executive Director. This right of recovery exists irrespective of whether the Executive Director has been responsible for the incorrect financial or other data or was aware or should have been aware of the inaccuracy. The right of recovery expires after a period of three years as of the adoption of the annual accounts in which the variable remuneration is accounted for.

Change in control

Upon a change in control of NWR Group, deferred shares will vest on a time pro rated basis unless the Board decides that this is inappropriate given overall performance. Vested A shares shall be issued or delivered, as the case may be, as soon as is practicable.

- Other benefits

-

In addition to the salary, bonus and share-based incentives, additional non-cash benefits may be provided by NWR Group to Executive Directors, such as relocation allowances, accommodation allowances, school fees, medical insurance and company car arrangements. The total annual value of the non-cash benefits provided may not exceed EUR 300,000 for each individual Executive Director. These do not include pension benefits (NWR Group does not operate any pension schemes on behalf of, or for the benefit of, its Directors).

Executive Directors are not entitled to any benefit upon termination of their employment agreement other than the contractual benefits that apply during the notice period.

- Service contracts of Executive Directors

-

- Service contracts of Executive Directors provide for payment of salary alone in lieu of notice.

- The applicable law governing Mr. Beck’s employment agreement provides for a statutory severance payment of three average monthly salaries. However, he would only be entitled to such a severance payment, if the position of Chief Executive Officer has ceased to exist (and not in the event of his replacement).

- Remuneration of Executive Directors in financial year 2010

-

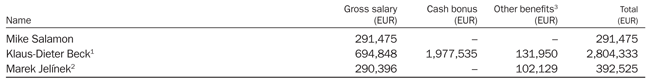

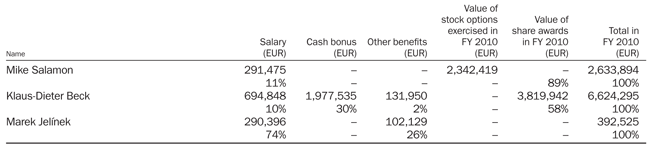

The tables below provide a description of the pre-tax remuneration of Executive Directors for the fiscal year ended 31 December 2010.

- Executive Directors’ emoluments and cash remuneration

-

- Mr. Beck receives his remuneration in CZK. The amounts stated in this table were converted into EUR from CZK at an exchange rate of 25.284 CZK/EUR, which was the average exchange rate in 2010. Gross salary of Mr. Beck includes remuneration received from OKD and OKK Koksovny, a.s. for his Board membership in 2010. The cash bonus was awarded for the year 2009.

- Gross salary of Mr. Jelínek includes remuneration received from OKD for his Board membership in January and February 2010.

- Includes in-kind compensation, e.g. personal travel costs, additional health insurance, housing, etc.

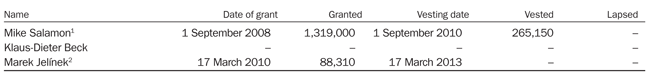

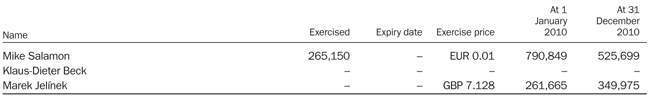

- 2010 Stock option grants

-

- Mr. Salamon received options under his stock option plan. 263,800 options vested on 1 September 2008, 264,351 options vested on 1 September 2009 and 265,150 options vested on 1 September 2010. An additional 20 per cent of granted options will vest on 1 September 2011 and 2012.

- Mr. Jelínek received options under the Stock Option Plan.

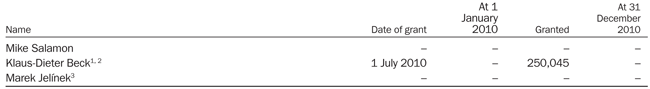

- Share awards

-

- In January 2010, Mr. Beck received a cash amount of CZK 41,724,729 (which is approximately EUR 1,650,242) equal to the then market value of 250,045 A Shares of NWR that Mr. Beck was entitled to receive in July 2009 and which Mr. Beck and OKD agreed, following deferral until 2010 in response to the economic situation of OKD in 2009.

- In July 2010, Mr. Beck received a cash amount of CZK 54,858,713 (which is approximately EUR 2,169,700) equal to the then market value of 250,045 A Shares of NWR that Mr. Beck was entitled to receive in accordance with his share awards plan.

- In the absence of a transitional arrangement for equity incentives to Executive Directors who participate in the Deferred Bonus Plan, for their performance in financial year 2010, the Board resolved, on 3 March 2011, on an ad hoc grant of 30,000 deferred shares to Mr. Jelínek. The deferred shares will vest in three years, provided that Mr. Jelínek is employed with NWR Group on the vesting date. The grant is not subject to any performance criteria but is subject to the continuing provisions of the Deferred Bonus Plan.

- Total remuneration of Executive Directors

-

- Remuneration of Non-Executive Directors

-

Each Non-Executive Director has entered into a letter of appointment with the Company, the relevant terms of which are set out below:

In accordance with NWR’s Articles of Association, the term of appointment of the Non-Executive Directors is four years, subject to satisfactory performance and re-election when appropriate at the Annual General Meeting of Shareholders. No notice period applies for the termination of each Non-Executive Director’s letter of appointment. Unless the appointment as a Non-Executive Director is renewed on or prior to the termination date, the term as a Non-Executive Director shall lapse immediately after the termination date. The appointment may also be terminated at any time by the General Meeting. None of the Non-Executive Directors is entitled to any benefit on termination of his letter of appointment.

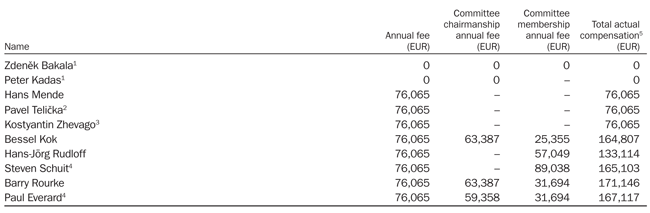

The basic annual fee payable to the Non-Executive Directors is EUR 76,065, which is reviewed annually by the Remuneration Committee. Any amendments to the remuneration of the Non-Executive Directors require a resolution of the General Meeting. The Annual General Meeting of Shareholders held in April 2010 approved a proposal of the Board, as recommended by the Remuneration Committee, to increase the annual fee for the members of the Health and Safety Committee to the levels paid to the members of the Real Estate Committee. The Remuneration Committee believes remuneration rates remain appropriate for 2011.

The 2010 Annual General Meeting of Shareholders further approved the Board’s proposal to continue the share plan for the Independent Non-Executive Directors in 2010. (Details of this plan are described in the 2009 Annual Report on page 81.) Following the approval referred above, each of the Independent Non-Executive Directors were awarded additional A shares valued at EUR 200,000 in May 2010. The number of A shares awarded was equivalent to EUR 200,000 divided by the average opening price of an A share as reported by the London Stock Exchange on each of the five business days preceding and including the date of grant, and each Director received 20,693 A shares valued at a total of EUR 1 million.

Non-Executive Directors are reimbursed for all reasonable and documented expenses incurred in performing their role.

- Remuneration of Non-Executive Directors in financial year 2010

-

- Mr. Bakala and Mr. Kadas waived their fees for the whole of 2010.

- NWR entered into a consultancy agreement with BXL Consulting Ltd; Mr. Telička is the co-founder and director in charge of the Brussels office of BXL. For further details regarding these contracts, see the ‘Related Party Transactions’ section of this 2010 Annual Report.

- Mr. Zhevago agreed to waive his annual fee for the benefit of a charity.

- Includes the increased fee for the membership in the Health, Safety and Environment Committee, which applied from 27 April 2010.

- Excludes the value A shares awarded to Independent Non-Executive Directors.

- The Health, Safety and Environment Committee includes Messrs. Stan Suboleski and Karl-Friedrich Jakob as associate members. Their annual fee corresponds with the annual fee of other members of this committee and amounts to EUR 31,694.

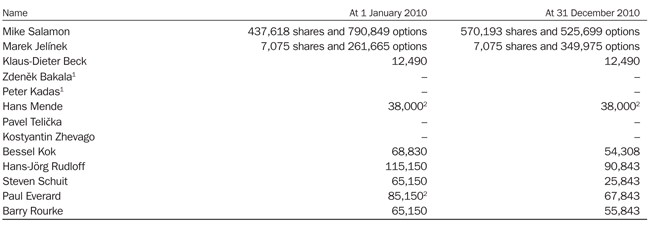

- Directors’ interest in shares

-

The table below sets out information pertaining to the shares held by the Directors in NWR.

- Please refer to the ‘Shareholder Information’ in respect of the individual interests of entities affiliated with Messrs. Bakala and Kadas in the A shares and B shares of NWR.

- Includes shares held in the name of spouse (or other member of family if applicable), fund, trust or other nominee.

- Loans to Directors

-

No personal loans, guarantees or other similar instruments may be provided to the Directors.

- Pension scheme

-

NWR Group does not operate any pension schemes on behalf of, or for the benefit of, its Directors or employees. Accordingly, NWR Group does not set aside or accrue amounts to provide pension, retirement or similar benefits.

However, NWR Group does accrue certain pension liabilities under applicable Czech law for medical leave, employment length of service (which is a special benefit paid to all employees in the mining profession once a year based on length of employment) and termination payments for its employees. For additional information, see Note 28 to NWR Group’s consolidated financial statements for the year ended 31 December 2010.

This Remuneration Report has been approved by the Board.

Zdeněk BakalaChairman of the Remuneration Committee

27 January 2011