To Our Shareholders:

Mosaic’s balanced crop nutrition portfolio comprises one of the world’s most unique asset bases in the sector. As an industry leader, no other enterprise has the capability to supply two essential crop nutrients – phosphate and potash – on a scale comparable to Mosaic’s, and the advantages are significant. Our production and distribution of two major crop nutrient products frequently offsets the short-term market dynamics of each. Mosaic’s vertical integration and operating scale, in both Phosphates and Potash, provide us a solid, competitive cost position. Existing potash mines and mineral reserves offer expansion and growth opportunities well into the foreseeable future. Mosaic’s distribution infrastructure provides us an enviable position in the fastest-growing agricultural regions in the world. In short, we have not one, but two of the most important nutrients necessary to help the world grow the food it needs for years to come.

The 2009 fiscal year tested our company's strength and resilience to a new level. The broad-ranging effects of the global economic crisis tempered a strong first-quarter. This led to a sharp decline in U.S. phosphate and potash use in fiscal 2009 and, as a consequence, reduced demand for Mosaic products. As a leader in this industry, our charge is to capitalize on the best of times and to make the best of the more challenging times. The Mosaic team successfully accomplished that task in fiscal 2009.

In fiscal 2009, net sales climbed 5% to $10.3 billion due to higher selling prices for both DAP and MOP; this helped offset the effects of reduced sales volumes. Operating earnings, however, declined to $2.4 billion in fiscal 2009 from $2.8 billion in fiscal 2008, due to higher average raw material costs in Phosphates and overall weaker market conditions in the second half of the year. Diluted earnings per share increased to $5.27 in fiscal 2009 from $4.67 in fiscal 2008. This increase included a $673.4 million gain of net proceeds from the divestiture of an interest in Saskferco, a nitrogen plant in Saskatchewan.

Our seasoned team of leaders and managers has grown up in the cyclical world of commodity markets. We understand the importance of building our financial strength during times of strong markets and of exercising operational discipline to weather inevitable downturns. This year, we managed the variables in our business that were controllable and aligned production and operating rates with lower demand levels. We scrutinized costs and made necessary adjustments. As challenging as 2009 was, Mosaic managed well and was able to blunt the impact of the downturn.

Mosaic is taking advantage of these challenging economic times in order to build a stronger, more resourceful company: to expand our capabilities, to develop innovative products, to create efficient processes and to think in new ways.

Mosaic's solid balance sheet supported our enterprise through the downturn. Our emphasis on strong cash generation has given us the capacity to pay down debt, achieve investment-grade status and build a "fortress balance sheet" with $2.7 billion of cash at year end. As a result, our liquidity position is among the strongest in the industry. Mosaic has continued to return value to shareholders through a quarterly dividend that commenced in July 2008. We also continued to make significant reinvestments in our business, more than doubling our historical rate of capital investment to $781 million in fiscal 2009.

Continued capital investment on this scale demonstrates Mosaic's confidence in the world's growing demand for our products. Despite short-term market volatility, we maintain our resolve to pursue growth. Mosaic is taking advantage of these challenging economic times in order to build a stronger, more resourceful company: to expand our capabilities, to develop innovative products, to create efficient processes and to think in new ways. Though many companies have been forced to postpone expansion plans for the foreseeable future, Mosaic is executing on growth opportunities.

Growth Initiatives Solidly On Track

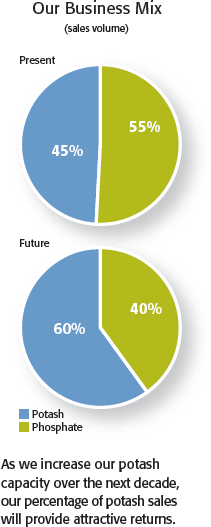

Nowhere is the potential for growth and return on investment more evident than in our Potash business. Steady and robust potash demand growth is forecast for years to come due to historically low application rates in developing countries and the key nutritional value of potash in optimizing crop yield. Potash deposits are only found in limited regions of the world.

We estimate Mosaic's potash reserves at over 100 years and we are now well into a phased, multi-year capacity expansion of our world-class Saskatchewan mining operations.

In fiscal 2009, Mosaic commenced the second phase of a long-term expansion initiative of our Canadian mines. We are making these investments at an estimated average capital cost that is significantly lower than that of developing new mines. By 2020, we expect to be producing approximately 17 million tonnes annually, thereby ensuring that Mosaic remains one of the premier potash companies in the world.

In addition to potash, phosphate is also essential to crop production. Mosaic produces more finished phosphate fertilizers than any other producer in the world. Scale, geographic location and vertical integration all combine to position Mosaic as one of the world's lowestcost producers. Our Florida-based rock reserves provide a significant competitive advantage over non-integrated producers who must incur rock input costs.

Though our Florida reserves provide decades of mining opportunity, acquiring additional high-quality rock resources is a priority. We are making ongoing investments in this business to ensure we maintain our world-class competitiveness. Cost and quality improvement initiatives include becoming energy self-sufficient and developing premium products that differentiate our position in the marketplace.

When phosphate demand is high, our Phosphates business provides exceptional returns and cash flows. Our goal is to ensure that the Phosphates business generates attractive returns on a through-business-cycle basis with the most compelling returns at the top of the cycle. With global phosphate demand forecasted to grow between 2.0% and 2.5% annually, we are excited about the value creation opportunities Mosaic can capture.

Our potash and phosphate facilities are well situated to serve the agricultural regions of North America. In other regions of the world, particularly in developing countries, we support our products with on-the-ground infrastructure and personnel to fully capitalize on growth potential. Mosaic's Offshore business is integral to this effort. We are examining our strategic global focus to ensure that we align our investments with opportunities that support our production assets and offer meaningful returns.

As we execute our strategic growth plan, our strong balance sheet and strong cash returns remain two of our most powerful assets. Funding growth opportunities and internal investments to sustain peak operational efficiency is a top cash priority and one that is creating value for our shareholders. Return on these capital investments is high and well in excess of our weighted average cost of capital.

Food Demand Fundamentals Remain Strong

The investments being made to grow Mosaic into the future are designed to capitalize on the growing global demand for food, feed and fuel. Even with the volatility of the past year, long-term fundamentals remain intact. There are 75 million more people to feed in the world each year. By the year 2020, the world's farmers will need to provide for 7.6 billion people, requiring that world grain and oilseed production grow by about 20%.

The world is also becoming more affluent. While much of the developed world has grappled with recession, the economies of many developing countries have continued to grow. With this growth, a new middle class is emerging that has the financial wherewithal to seek a better life for their families. That starts with eating a healthier, more protein-rich diet. It also includes other lifestyle changes, like consuming more fuel and electricity.

These factors increase the pressure on the world's farmers to grow more grain and oilseeds. With a limited amount of arable land, the agricultural sector is challenged to meet these needs by increasing crop yields. Crop nutrients will continue to be an essential part of the solution. Crop nutrient use today contributes 40% to 60% of the world's crop yield. For Mosaic, the long-term challenge to play an ever-expanding role in addressing the world's growing food needs is both a compelling business opportunity and a profound responsibility.

While our long-term view is clear, the near-term continues to evolve, particularly in terms of the overall global economy. Farmers have grown record amounts of crops in the past two years, yet still have not built adequate food stocks. In fact, food stocks as a percentage of use are forecast to remain at historically low levels. Another bumper crop will be required in 2010 to build stocks to more secure levels. Having skipped at least one, if not two, seasons of crop nutrient application, we expect farmers will be ready to replenish soil nutrients this fall, with most of the world's farmers well capitalized to fund their crop nutrition purchases.

The investments being made to grow Mosaic into the

future are designed to capitalize on the growing global

demand for food, feed and fuel. Even with the volatility

of the past year, long-term fundamentals remain intact.

Significant Achievements In The First Five Years

For a company that is approaching its fifth anniversary, Mosaic has established an extraordinary track record. It is difficult to imagine experiencing more dramatic market conditions within such a short time. I want to acknowledge the accomplishments of the Mosaic team of 7,500 people around the world. In an era when more corporate mergers fail than succeed, Mosaic has demonstrated exceptional performance in building a value-creating enterprise.

We have worked closely with our customers through this unprecedented period. We have also kept in close contact with our investors, sharing our viewpoints and outlook in a candid, transparent and straightforward manner. Our organization has matured rapidly and has emerged as an industry leader. We have established a goal to be the best company in the crop nutrition industry and built the foundation necessary to relentlessly pursue this goal.

I believe our success to date and in the future is closely tied to the values that define Mosaic. We are a company that recognizes the value of integrity in the marketplace, and we are thoughtful of all stakeholders – employees, customers, suppliers, communities, and shareholders. Mosaic is committed to making responsible choices about stewardship of the environment and knows that this will ensure lasting success. We have sharpened our focus on safety and are relentlessly pursuing an injury-free workplace. Mosaic has fostered a culture that values results and has a vested interest in helping our people realize professional and personal growth. Mosaic strives for excellence and expects that our high standard of ethics be reflected in all that we do.

The past five years have proven that constant change is a given in our industry. Mosaic's goal, however, does not change – to grow value for our customers and our shareholders. We are honored and excited to accomplish both for you.

Sincerely,

James T. Prokopanko

President and Chief Executive Officer

August 2009