Corporate and Shareholder Information

Corporate Headquarters

3033 Campus Drive

Suite E490

Plymouth, MN 55441

763.577.2700 (phone)

800.918.8270 (toll-free)

763.559.2860 (fax)

Stock Exchange

New York Stock Exchange

Ticker Symbol: MOS

The annual certification requested by Section 303A.12(a)

of the New York Stock Exchange Listed Company

Manual was submitted by Mosaic on November 3, 2008.

Transfer Agent

American Stock Transfer & Trust Company

59 Maiden Lane

New York, NY 10038

877.777.0800

Independent Registered Public Accounting Firm

KPMG LL P

90 South Seventh Street

Minneapolis, MN 55402

Media Contact

Linda Thrasher

Vice President – Public Affairs

763.577.2864 (phone)

763.577.2987 (fax)

media@mosaicco.com

Investor Contact

Christine Battist

Director – Investor Relations

763.577.2828 (phone)

763.577.2986 (fax)

investor@mosaicco.com

Mosaic’s 10-K Report, filed in July 2009 with the Securities

and Exchange Commission, is available to shareholders

and interested parties without charge by contacting

Christine Battist.

Mosaic’s 10-K Report included the certifications from its

Chief Executive Officer and Chief Financial Officer required

pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

regarding the quality of Mosaic’s public disclosure.

Website

www.mosaicco.com

Annual Meeting of Stockholders

Mosaic shareholders are invited to attend our 2009 Annual

Meeting of Stockholders which will be held on Thursday,

October 8, 2009 at 12:00 noon Eastern Time. The meeting

will be at the Radisson Plaza Hotel Saskatchewan,

2125 Victoria Avenue, Regina, SK S4P 0S3, Canada.

Safe Harbor

Certain statements in the Annual Report that are neither

reported financial results nor other historical information

are forward-looking statements. Such forward-looking

statements are not guarantees of future performance and

are subject to risks and uncertainties that could cause actual

results and Mosaic's plans and objectives to differ materially

from those expressed in the forward-looking statements.

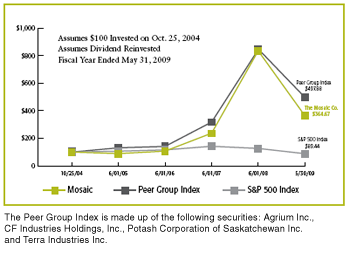

Shareholder Return Information

The following performance graph compares the cumulative

total return on our common stock for a period beginning

October 25, 2004 (the date our common stock began trading

on the NYSE ) with the cumulative total return of the Standard

& Poor’s 500 Stock Index, and a peer group of companies

selected by us.

Our 2009 peer group is comprised of Agrium Inc.,

CF Industries Holdings, Inc., Potash Corporation of

Saskatchewan Inc. and Terra Industries Inc. Our stock price

performance differs from that of our peer group during

some periods due to differences in the market segments in

which we compete or in the level of our participation in such

segments compared to other members of the peer group.

In accordance with Standard & Poor’s policies, companies

with less than a majority of their stock publicly traded are

not included in the S&P 500 Index, and, accordingly, we

are not included in the S&P 500 Index on account of our

controlling stockholder. The comparisons set forth below

assume an initial investment of $100 and reinvestment of

dividends or distributions.

Stock Performance

Comparison of Cumulative Total Return Among The Mosaic

Company, S&P 500 Index and Peer Group Index.