S&P Credit Market Services:

Expanding World of S&P Ratings

From pre-issuance to post-issuance, financial decision makers are utilizing a growing range of S&P products and services to identify, measure, and manage credit risk. These S&P offerings are creating additional growth opportunities.

S&P’s Rating Track Record: Meeting the Test of Time

What is an S&P credit rating?

It is an opinion about credit risk—the ability and willingness of an issuer to meet a financial obligation in full and on time. Credit ratings also indicate credit quality—the relative likelihood that an issue may default. S&P’s global ratings scale provides a benchmark for evaluating the relative credit risk of issuers and issues worldwide.

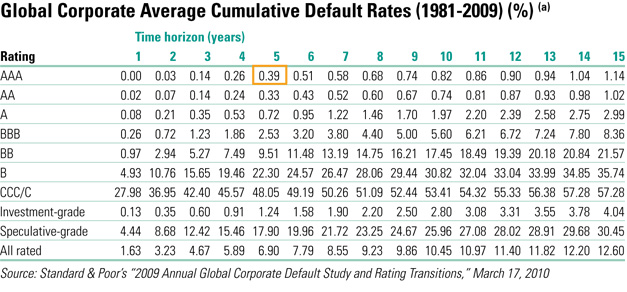

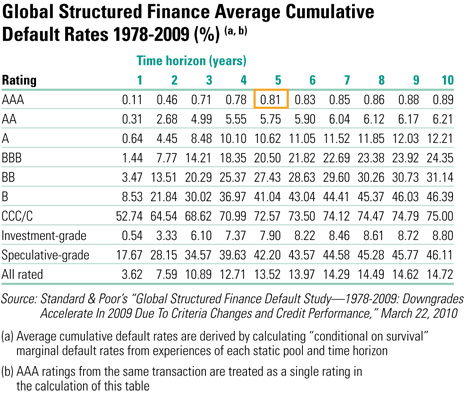

How S&P ratings perform:

The tables (below) show the default rates experienced for each rating category over 30 years. For example, the 5-year cumulative default rate for corporate bonds rated AAA has been 0.39%, or less than four defaults for every 1,000 ratings. The 5-year cumulative default rate for AAA-rated

structured finance issues has been 0.81%.