Platts: Meeting the Information Needs

of the Global Energy and Metals Markets

|

Oil

|

news, price assessments, market commentary, and conferences enable thousands of traders, risk managers, analysts, and industry leaders in more than 150 countries to make informed and up-to-the-minute trading and investment decisions. An independent provider, Platts has been a respected source for actionable information and global benchmarks for more than a century.

Platts is noted for facilitating price discovery and transparency in the commodity markets it covers. Every day, Platts collects details on bids, offers and completed trades from market participants. Platts then uses clearly defined methodologies to assess and publish prices for the markets it serves. More than 8,500 price assessments, references and indexes are produced daily and disseminated to subscribers through Platts’ newsletters and real-time alert services.

How the Market Uses a Platts Price Assessment

Platts’ price assessments are the basis for billions of dollars of transactions annually in the physical and futures markets.

| Buyers and sellers use them as a basis for pricing spot transactions and term contracts |

| Risk managers use them to settle contracts and to place a market value on the product they hold |

| Analysts use them to identify trends and patterns in supply and demand |

| Governments use them to set royalty payment and retail prices |

| Exchanges and investors use them to price over-the-counter derivatives contracts |

Platts is boosting its presence in the Middle East by expanding its editorial and sales staff, and deepening its penetration in the Chinese market through a distribution partnership with a leading local information provider. Platts continually develops new price assessments to address new market realities and bring greater transparency and efficiency to rapidly changing markets:

- Platts’ new assessments for crude flowing through the Eastern Siberian Pacific Ocean (ESPO) pipeline to Asia reflect the changing dynamics of Russian oil exports.

- New daily price points for Indian oil product exports and imports of liquefied natural gas (LNG) underscore India’s growing role in the global energy markets.

- Platts’ new assessments for coking coal in Asia-Pacific and its well-established prices for iron ore imported into China provide miners and steel mills with key independent references as the market shifts from long-term to spot pricing.

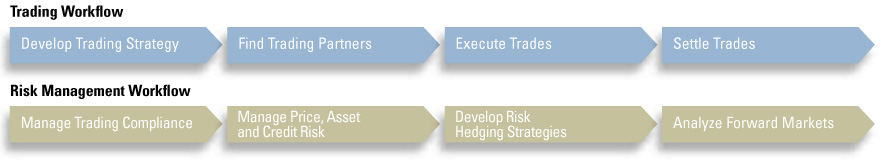

Embedded in the Industry’s Workflows

The strength of Platts’ “benchmarks” has resulted in customers embedding its information directly into their workflows. These price assessments support end-to-end trading and risk management workflows, enabling customers to identify opportunities to profit from market movements and better manage their risks.

Flexible Digital Delivery Options for Platts’ News and Pricing Information

Delivery options include:

| Real-time alerts via Platts on the Net, Platts’ proprietary platform, and multiple third-party market data service vendors, including Thomson Reuters and Bloomberg® |

| End-of-day prices fed directly into customers’ risk management and accounting systems |

Employing Technology to Improve Processes and Better Serve Customers

eWindow enables:

| Traders to convey bids, offers, and other deal information directly to the marketplace and to Platts’ editors simultaneously |

| MOC participants to clearly view all bids and offers, and submit and confirm bids and offers at the click of a mouse |