F-30

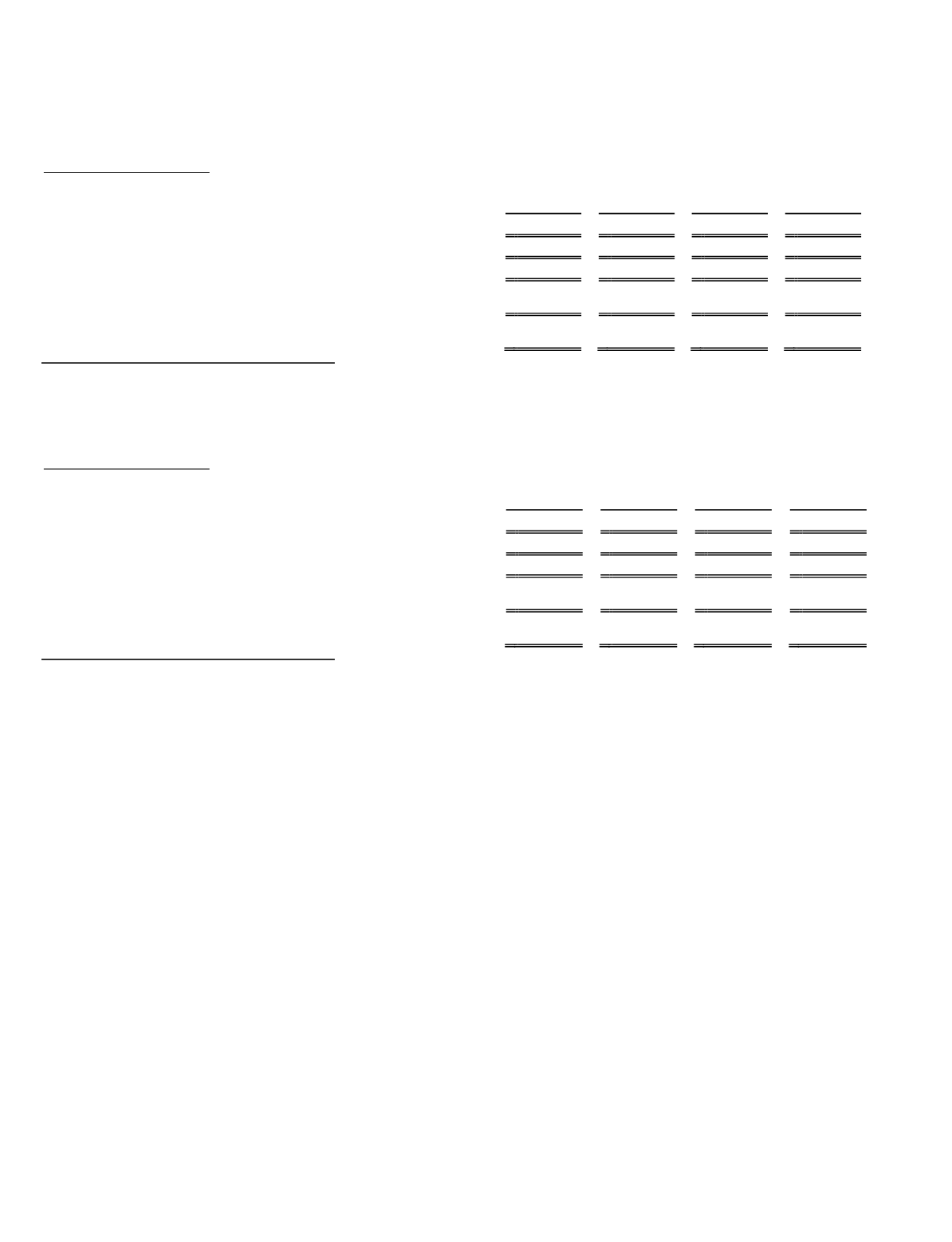

22. Quarterly Financial Information (Unaudited)

The following is a summary of the quarterly results of operations for 2013 and 2012. The quarterly information has not been

audited, but in our opinion, includes all normal recurring adjustments, which are, in the opinion of the management, necessary for fair

statement of the results of the interim periods.

2013 quarters (unaudited)

First

Second

Third

Fourth

Revenue ...................................................................................... $ 94,794 $ 92,842 $ 96,033 $ 78,622

Gross profit................................................................................. $ 35,481 $ 35,907 $ 35,783 $ 31,797

Net loss ....................................................................................... $

(829) $

(1,871) $

(155) $ (55,742)

Net loss per share — basic ......................................................... $

(0.01) $

(0.03) $

(0.00) $

(0.95)

Net loss per share — diluted

1

..................................................... $

(0.01) $

(0.03) $

(0.00) $

(0.95)

1

Shares issuable via the convertible notes are included if dilutive, in which case tax-effected interest expense on the debt is excluded

from the determination of net income (loss) per share – diluted. For all periods reported in 2013 the shares issuable via the

convertible notes were anti-dilutive and the tax-effected interest expense was excluded in determining net income (loss) per share.

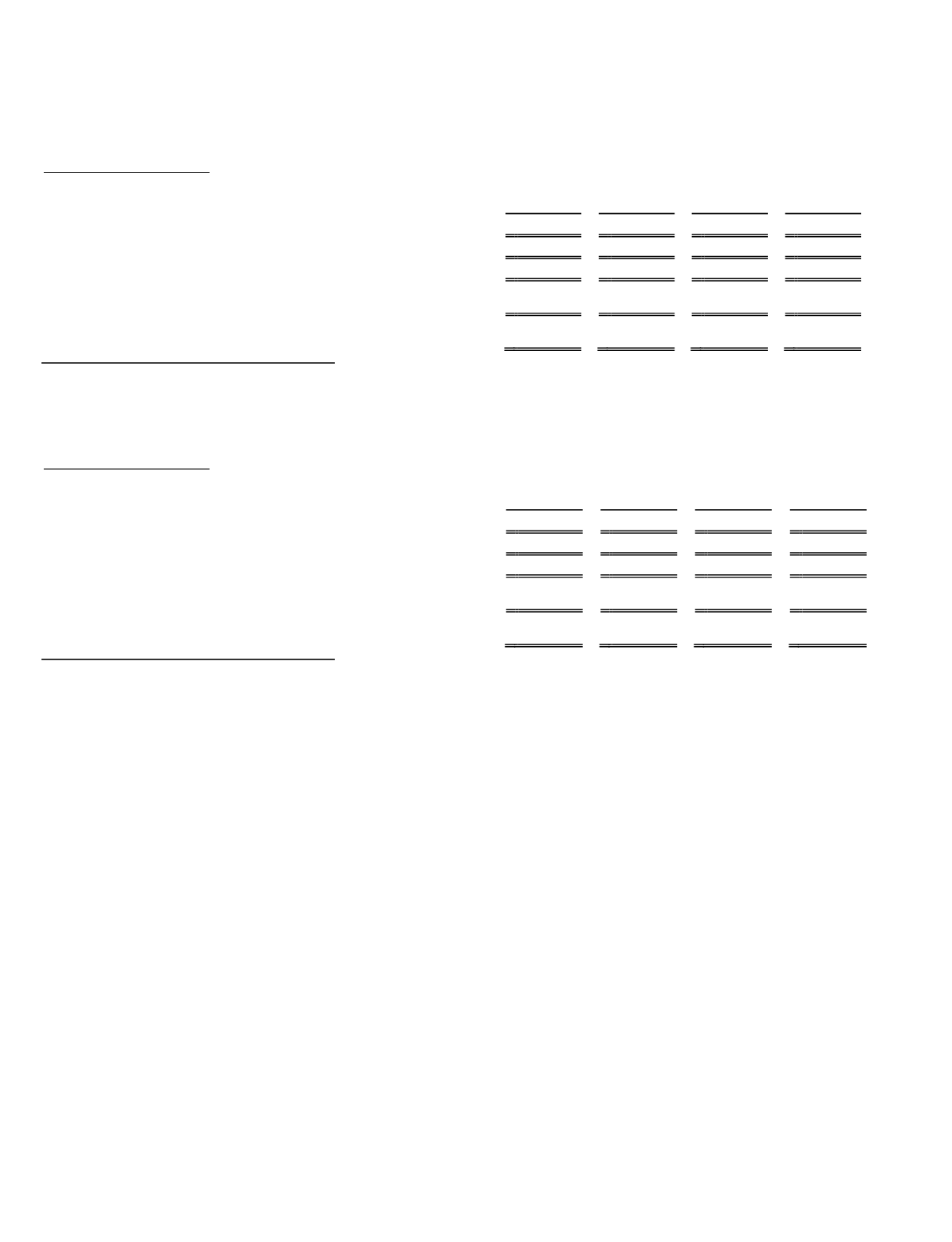

2012 quarters (unaudited)

First

Second

Third

Fourth

Revenue ...................................................................................... $ 100,035 $ 114,622 $ 140,056 $ 132,671

Gross profit................................................................................. $ 34,390 $ 34,526 $ 44,126 $ 47,165

Net income (loss) ....................................................................... $

(369) $ (111,117) $

4,179 $

9,319

Net income (loss) per share — basic .......................................... $

(0.01) $

(1.91) $

0.07 $

0.16

Net income (loss) per share — diluted

1

...................................... $

(0.01) $

(1.91) $

0.07 $

0.15

1

Shares issuable via the convertible notes are included if dilutive, in which case tax-effected interest expense on the debt is excluded

from the determination of net income (loss) per share – diluted. For the third and fourth quarters of 2012 the shares issuable via the

convertible notes were dilutive and the tax-effected interest expense of $718 and $721, respectively, was included in determining

net income (loss) per share.

23. Commitments and Contingencies

Some customers may seek indemnification under their contractual arrangements with the Company for costs associated with

defending lawsuits alleging infringement of certain patents through the use of our products and services, and the use of our products

and services in combination with products and services of other vendors. In some cases we have agreed to assume the defense of the

case. In others, the Company will continue to negotiate with these customers in good faith because the Company believes its

technology does not infringe the cited patents and due to specific clauses within the customer contractual arrangements that may or

may not give rise to an indemnification obligation. The Company cannot currently predict the outcome of these matters and the

resolutions could have a material effect on our consolidated results of operations, financial position or cash flows.

Other than the items discussed immediately above, we are not currently subject to any other material legal proceedings.

However, we may from time to time become a party to various legal proceedings arising in the ordinary course of our business.