F-25

We have state net operating loss carryforwards available which expire through 2027, utilization of which will be limited in a

manner similar to the federal net operating loss carryforwards. At December 31, 2013, we had federal alternative minimum tax credit

carryforwards of $2,091, which are available to offset future regular federal taxes. Federal research and development credits of

approximately $7,719 will begin to expire in 2019.

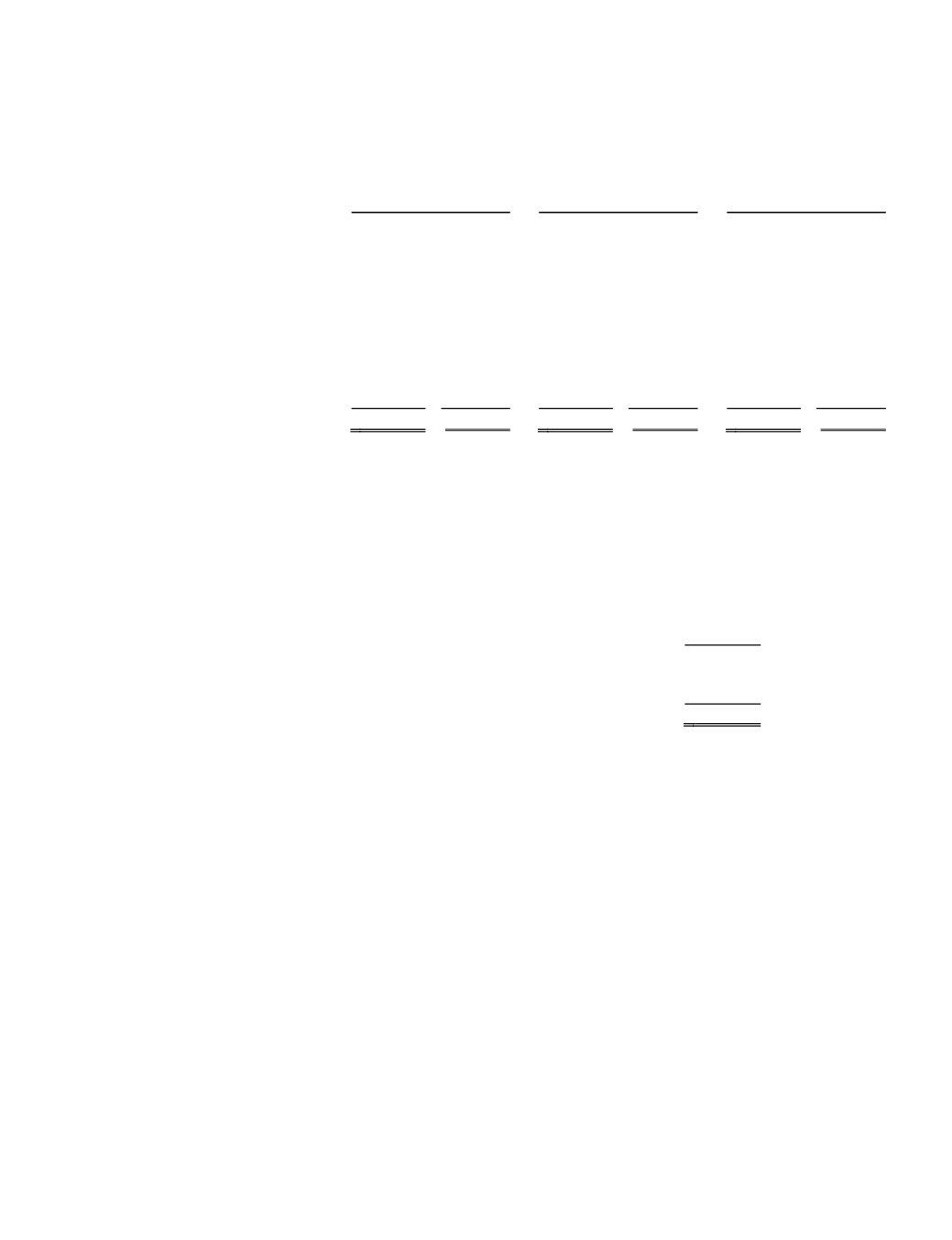

The reconciliations of the reported income tax provision to the amount that would result by applying the U.S. federal statutory

rate of 35% to the income for the years ended December 31 as follows:

2013

2012

2011

Income tax (benefit) statutory rate ................ $ (14,702)

35.0% $ (39,718)

35.0% $

4,346

35.0%

Goodwill impairment charge.........................

1,758

(4.2%)

30,136

(26.6%)

—

—

Change in valuation allowance .....................

30,284

(72.1%)

—

—

—

—

Non-deductible stock-based compensation

expense.....................................................

1,258

(3.0%)

1,849

(1.6%)

2,024

16.3%

Research and development tax credit............

(639)

1.5%

(858)

0.8%

(485)

(3.9%)

Worthless stock deduction ............................

—

—

(1,646)

1.5%

—

—

State income tax (benefit) .............................

(692)

1.7%

(1,156)

1.0%

424

3.4%

Original issue discount amortization.............

(2,993)

7.1%

(1,678)

1.5%

(1,520)

(12.2%)

Other .............................................................

2,317

(5.5%)

(2,420)

2.1%

623

5.0%

Income tax (benefit) provision ............ $ 16,591

(39.5%) $ (15,491)

13.7% $

5,412

43.6%

We do not currently anticipate that the total amounts of unrecognized tax benefits will significantly increase within the next 12

months. We recorded the estimated value of uncertain tax positions by adjusting the value of certain tax assets.

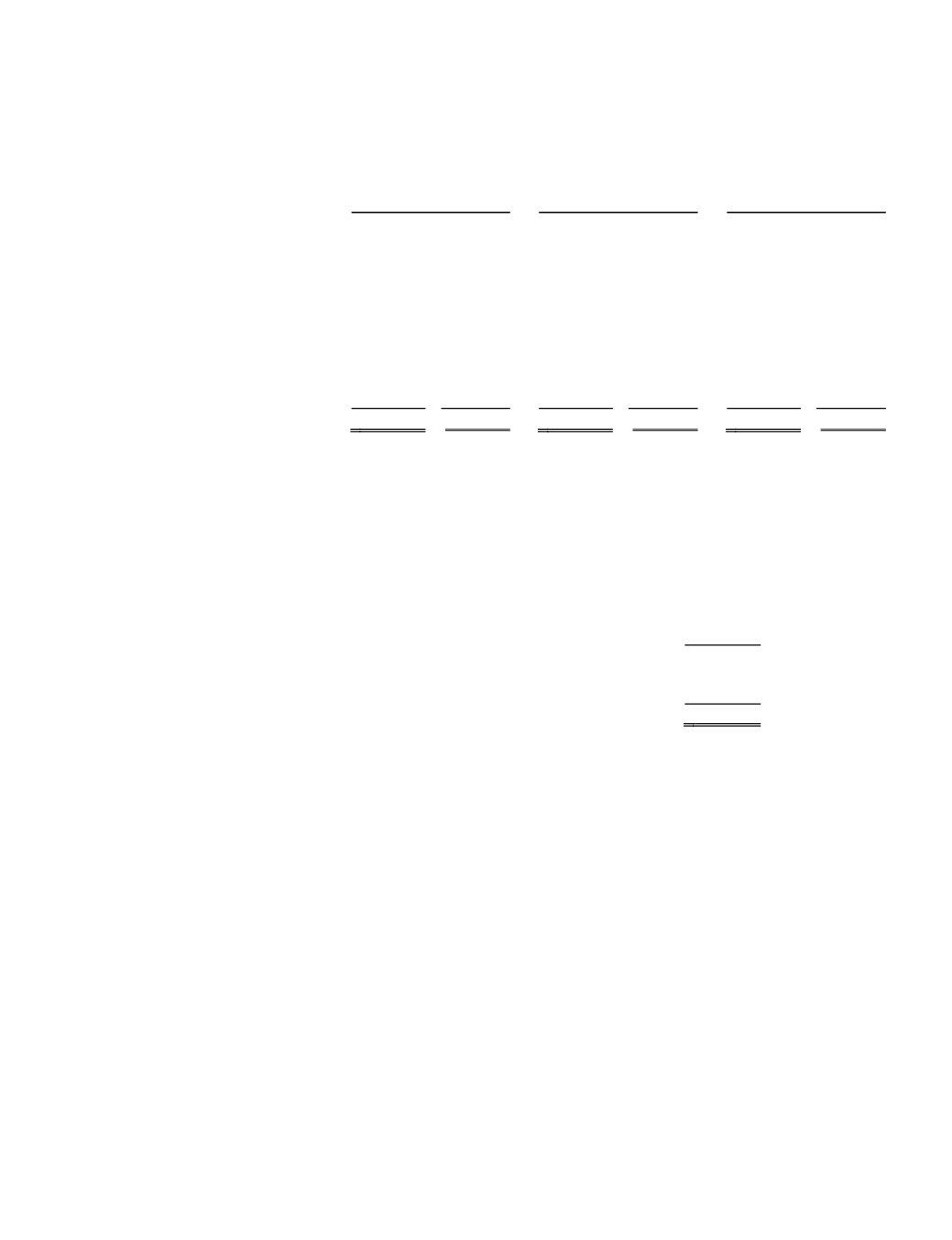

The following table summarizes the 2012 and 2013 activity related to the unrecognized tax benefits (excluding interest,

penalties and related tax carryforwards):

Balance at December 31, 2011 ...................................................................... $

3,291

Increases related to prior year tax positions .........................................

117

Decreases related to prior year tax positions ........................................

(149)

Increases related to current year tax positions......................................

187

Balance at December 31, 2012 ......................................................................

3,446

Increases related to prior year tax positions .........................................

1,040

Increases related to current year tax positions......................................

294

Balance at December 31, 2013 ...................................................................... $

4,780

If the Company’s positions are sustained by the taxing authority in favor of the Company, $4,780 (excluding interest and

penalties) of uncertain tax position benefits would favorably impact the effective tax rate. Our policy is to classify any interest and

penalties accrued on any unrecognized tax benefits as a component of the provision for income taxes. There were no interest or

penalties recognized in the Consolidated Statements of Operations for the year ended December 31, 2013.

We file income tax returns in the U.S. and various state and foreign jurisdictions. As of December 31, 2013, open tax years in

the federal and some state jurisdictions date back to 1996, due to the taxing authorities’ ability to adjust operating loss and credit

carryforwards.

17. Employee Retirement Plan

We maintain a 401(k) plan covering defined employees who meet established eligibility requirements. Under the provisions of

the plan, we may contribute a discretionary match. The plan may also contribute a non-elective contribution. For 2013, we matched

40% of employee deferrals. Our contribution was $1,868, $2,853, and $2,661for the years ended December 31, 2013, 2012, and 2011,

respectively.

18. Stock-based Compensation Plans

We maintain two stock-based compensation plans: a stock incentive plan and an employee stock purchase plan.

Stock Incentive Plan.

We maintain a stock incentive plan that is administered by the Compensation Committee of our Board of

Directors. Options granted under the plan vest over periods ranging from one to five years and expire ten years from the date of grant.

Under the plans, we may grant certain employees, directors and consultants options to purchase common stock, stock appreciation