F-27

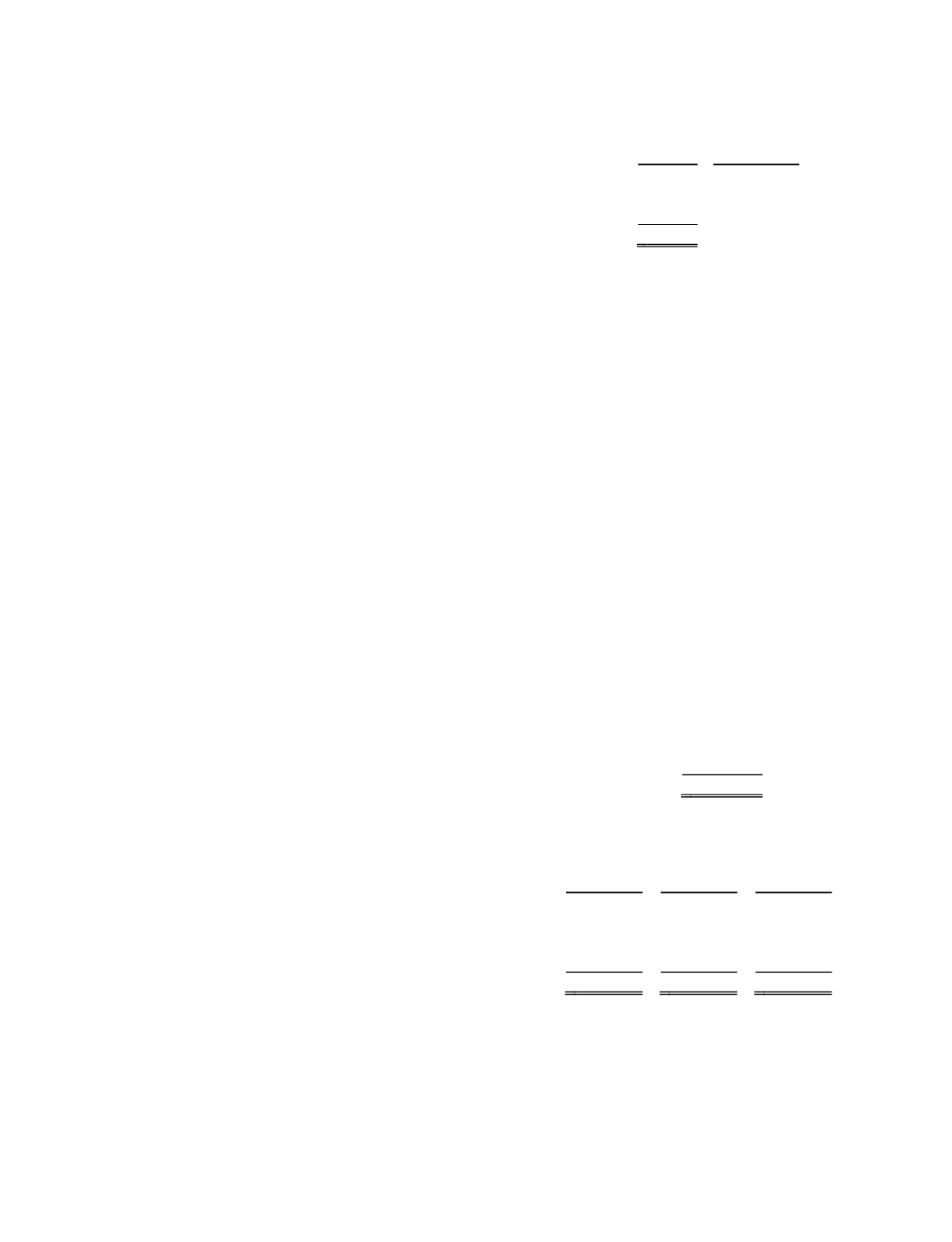

A summary of our restricted stock activity consisted of the following (all share amounts in thousands):

Nonvested

Shares

Weighted

Average

Grant Date

Fair Value

Nonvested at December 31, 2012................................................................ 1,344 $

3.10

Granted ........................................................................................................ 1,444

2.38

Vested and surrendered ...............................................................................

(570)

3.06

Nonvested at December 31, 2013................................................................ 2,218 $

2.68

The restrictions expire at the end of one year for directors and expire in annual increments over two and three years for

employees and executives, respectively, conditional on continued employment. The fair value of the restricted stock on the date of

issuance is recognized as non-cash stock based compensation expense, net of forfeiture adjustments, over the period over which the

restrictions expire. The total fair value of restricted stock of shares vested during the years ended December 31, 2013, 2012, and 2011

was $1,959, $1,058, and $241. We recognized $2,589, $1,873, and $1,015 of non-cash stock compensation expense related to these

grants for the years ended December 31, 2013, 2012, and 2011, respectively. We expect to record future stock compensation expense

of $3,724 as a result of these restricted stock grants that will be recognized over the remaining vesting period.

Employee Stock Purchase Plan.

We have an employee stock purchase plan (the Plan) that gives all employees an opportunity to

purchase shares of our Class A Common Stock. The Plan allows for the purchase of 4,385 shares of our Class A Common Stock at a

discount of 15% of the fair market value. The discount of 15% is calculated based on the average daily share price on either the first or

the last day of each quarterly enrollment period, whichever date is more favorable to the employee. Option periods are three months in

duration. As of December 31, 2013, 2,384 shares of Class A Common Stock have been issued under the Plan. The Plan will continue

until the earlier of termination by the board of directors or the date on which all of the share available for issuance under the plan have

been issued. We did not recognize any compensation expense related to the Employee Stock Purchase Plan in 2013. Compensation

expense relating to the Employee Stock Purchase Plan was $288, and $349 for the years ended December 31, 2012 and, 2011,

respectively.

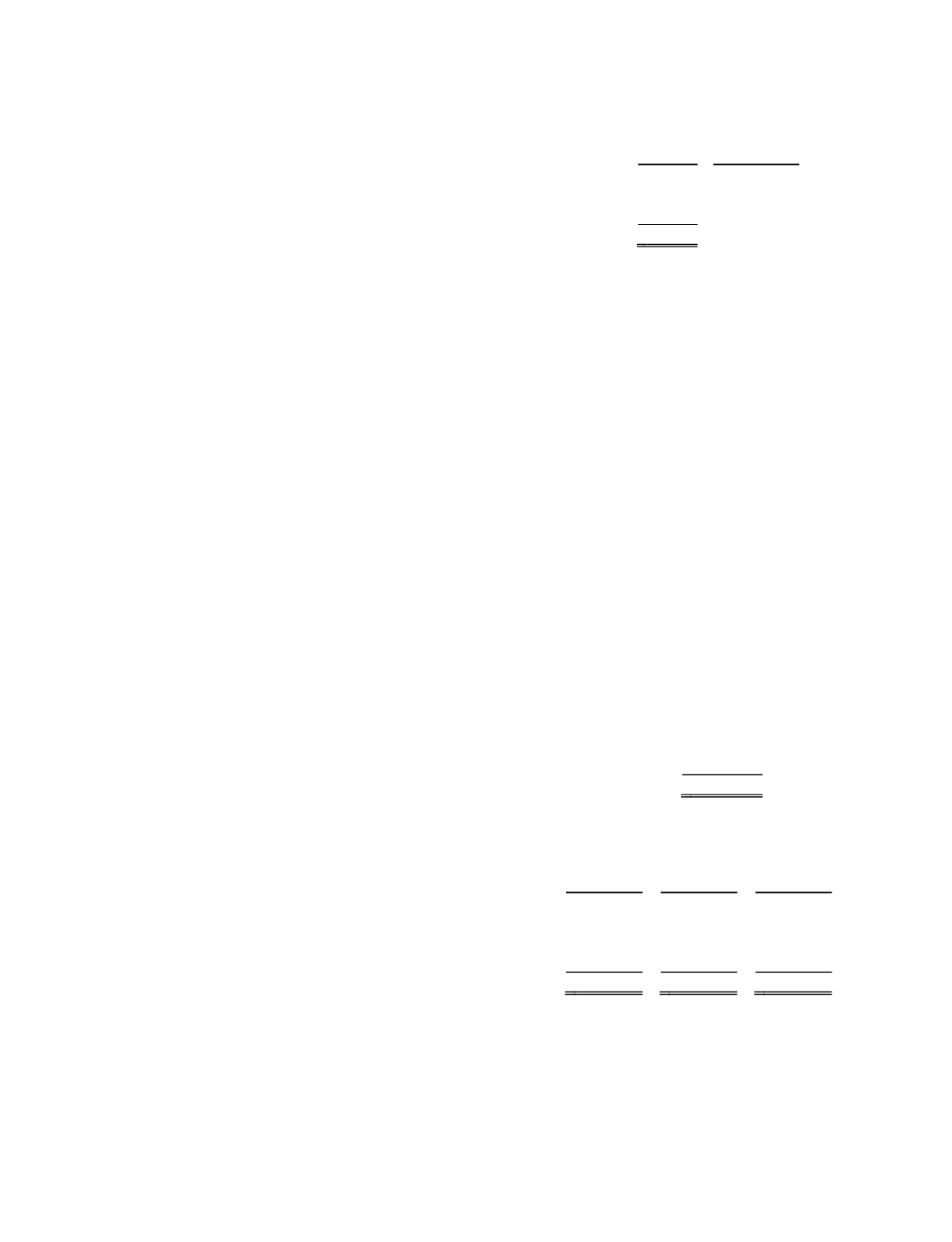

As of December 31, 2013, our total shares of Class A Common Stock reserved for future issuance is comprised of:

(in thousands)

Stock incentive plan......................................................................................

3,529

Outstanding stock options.............................................................................

17,177

Convertible notes (see Note 12)....................................................................

1,407

Note warrant hedge (see Note 12) ................................................................

10,001

For B to A conversion...................................................................................

4,998

Employee stock purchase plan......................................................................

2,001

Total shares restricted for future use ...................................................

39,113

Non-cash stock based compensation expense was included in the following income statement captions for the years ended

December 31:

2013

2012

2011

Direct costs of revenue...................................................................... $

4,802 $

6,131 $

6,476

Research and development expense..................................................

1,106

1,599

1,873

Sales and marketing expense ............................................................

513

483

501

General and administrative expense .................................................

615

808

822

Total non-cash stock compensation expense........................... $

7,036 $

9,021 $

9,672