F-22

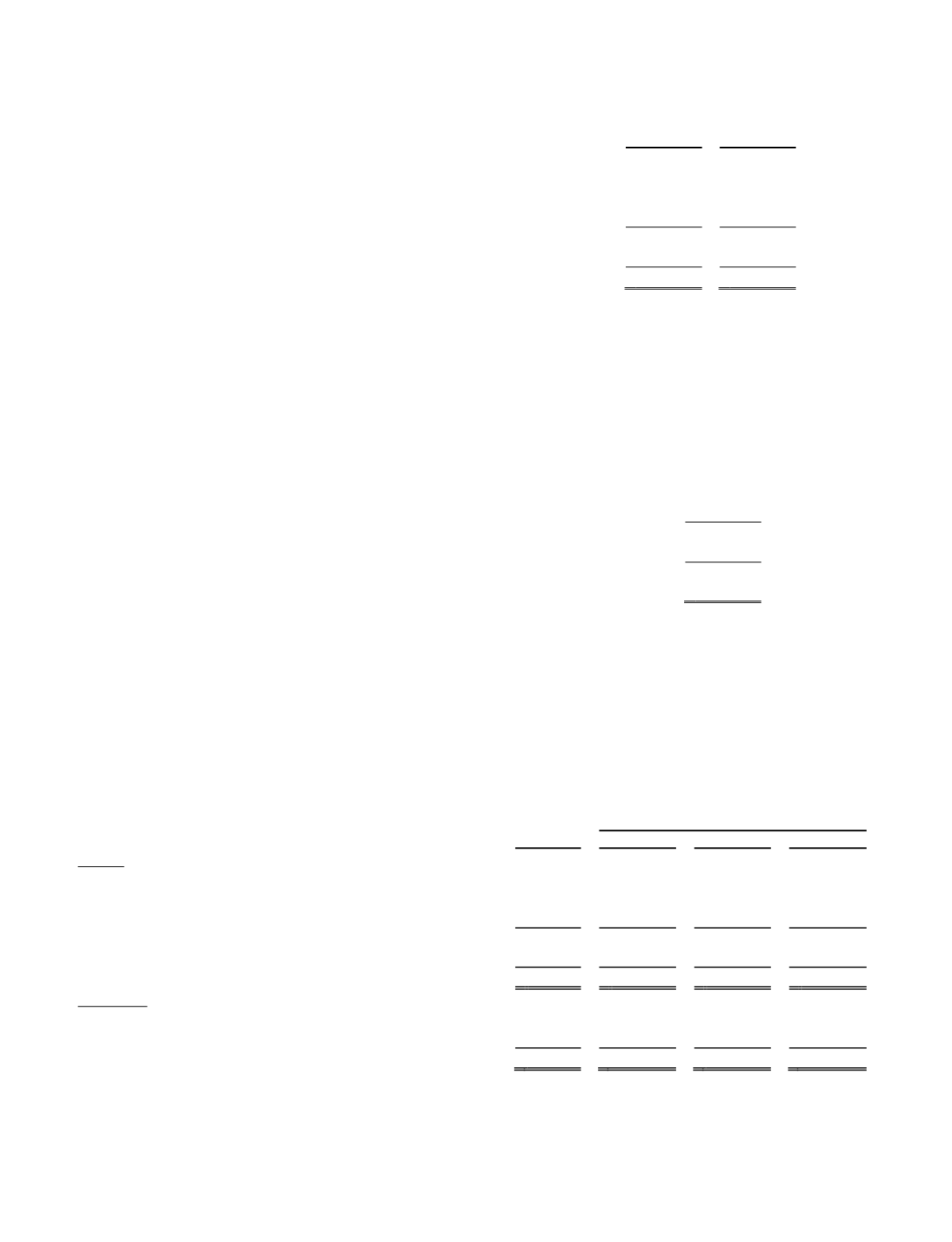

13. Capital Leases

We lease certain equipment under capital leases. Property and equipment included the following amounts for capital leases at

December 31:

2013

2012

Computer equipment ................................................................................. $ 20,409 $ 23,107

Computer software ....................................................................................

3,304

4,302

Furniture and fixtures ................................................................................

90

176

Leasehold improvements...........................................................................

42

51

Total equipment under capital lease at cost .....................................

23,845

27,636

Less: accumulated amortization ................................................................

(9,886) (13,529)

Net property and equipment under capital leases ............................ $ 13,959 $ 14,107

Capital leases are collateralized by the leased assets. Our capital leases generally contain provisions whereby we can purchase

the equipment at the end of the lease for a one dollar buyout. Amortization of leased assets is included in depreciation and

amortization expense.

Future minimum payments under capital lease obligations consisted of the following at December 31, 2013:

2014 ................................................................................................................. $

5,501

2015 .................................................................................................................

3,858

2016 .................................................................................................................

2,319

2017 .................................................................................................................

1,206

2018 .................................................................................................................

20

Total minimum lease payments..............................................................

12,904

Less: amounts representing interest .......................................................

(830)

Present value of net minimum lease payments (including current

portion of $5,056).............................................................................. $ 12,074

14. Common Stock

Our Class A common stockholders are entitled to one vote for each share of stock held for all matters submitted to a vote of

stockholders. Our Class B stockholders are entitled to three votes for each share owned.

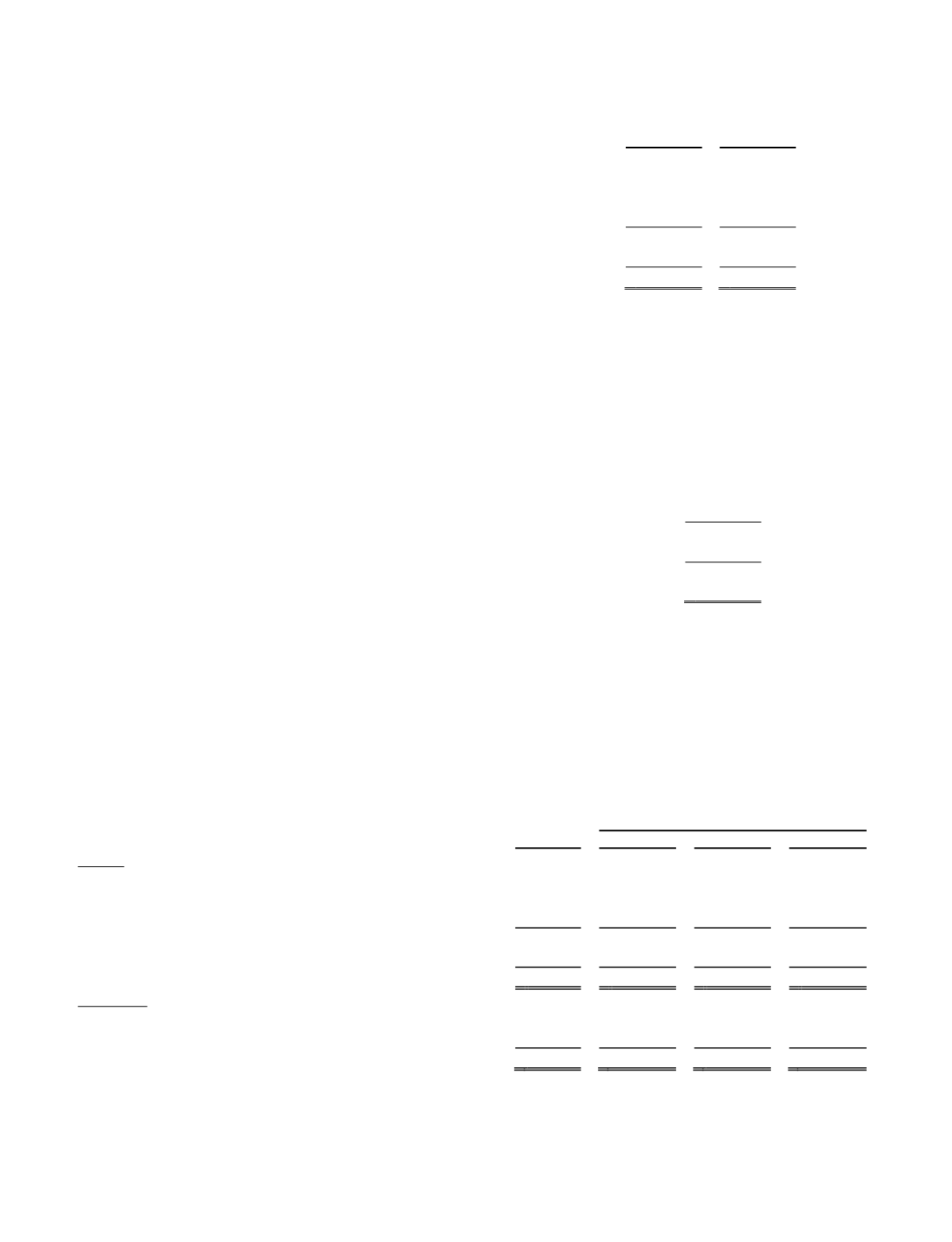

15. Fair Value Measurements

Our assets and liabilities subject to fair value measurements on a recurring basis and the required disclosures are:

As of December 31, 2013

Fair Value

Fair Value Measurements

Using Fair Value Hierarchy

Total

Level 1

Level 2

Level 3

Assets:

Cash and cash equivalents.................................................... $ 41,904 $ 41,904 $

— $

—

Corporate bonds ......................................................... 18,498

18,498

—

—

Mortgage-backed and asset-backed securities............

1,506

1,506

—

—

Marketable securities ........................................................... 20,004

20,004

—

—

Deferred compensation plan investments ............................

1,003

1,003

—

—

Assets at Fair Value .......................................... $ 62,911 $ 62,911 $

— $

—

Liabilities:

Deferred compensation ........................................................ $

637 $

637 $

— $

—

Contractual acquisition earn-outs.........................................

369

—

—

369

Liabilities at Fair Value .................................... $ 1,006 $

637 $

— $

369