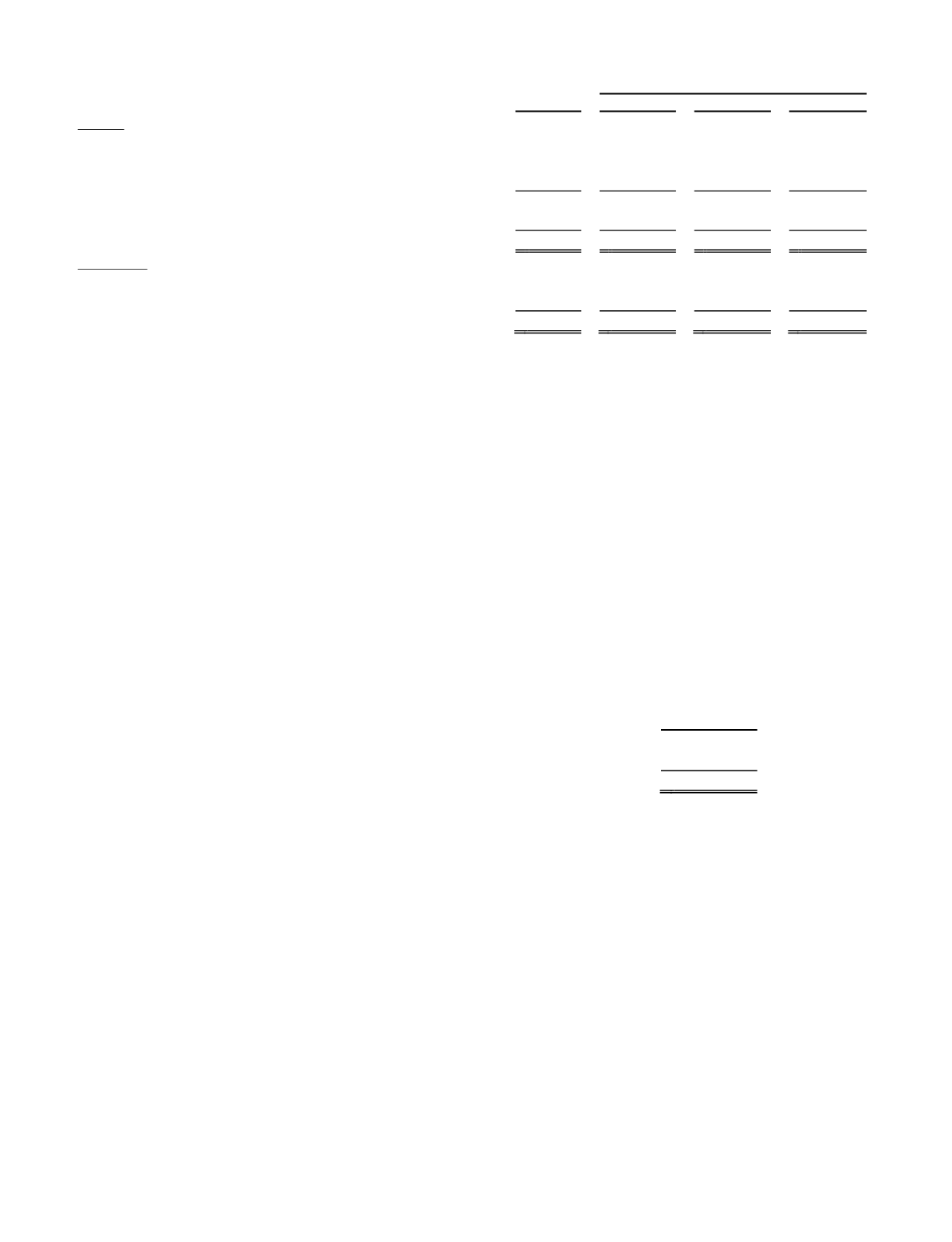

F-23

As of December 31, 2012

Fair Value

Fair Value Measurements

Using Fair Value Hierarchy

Total

Level 1

Level 2

Level 3

Assets:

Cash and cash equivalents.................................................... $ 36,623 $ 36,623 $

— $

—

Corporate bonds ......................................................... 13,141

13,141

—

—

Mortgage-backed and asset-backed securities............

1,734

1,734

—

—

Marketable securities ........................................................... 14,875

14,875

—

—

Deferred compensation plan investments ............................

690

690

—

—

Assets at Fair Value .......................................... $ 52,188 $ 52,188 $

— $

—

Liabilities:

Deferred compensation ........................................................ $

394 $

394 $

— $

—

Contractual acquisition earn-outs.........................................

508

—

—

508

Liabilities at Fair Value .................................... $

902 $

394 $

— $

508

We hold marketable securities that are investment grade and are classified as available-for-sale. The securities include corporate

bonds, agency bonds, mortgage and asset backed securities that are carried at fair market value based on quoted market prices; see

Note 5.

We hold trading securities as part of a rabbi trust at December 31, 2013 to fund supplemental executive retirement plans and

deferred income plans. The funds held are all managed by a third party, and include fixed income funds, equity securities, and money

market accounts, or other investments for which there is an active quoted market. The related deferred compensation liabilities are

valued based on the underlying investment selections in each participant’s account.

The contractual acquisition earn-outs were part of the consideration paid for the 2012 microDATA acquisitions. The fair value

of the earn-outs is based on probability-weighted payouts under different scenarios, discounted using a discount rate commensurate

with the risk.

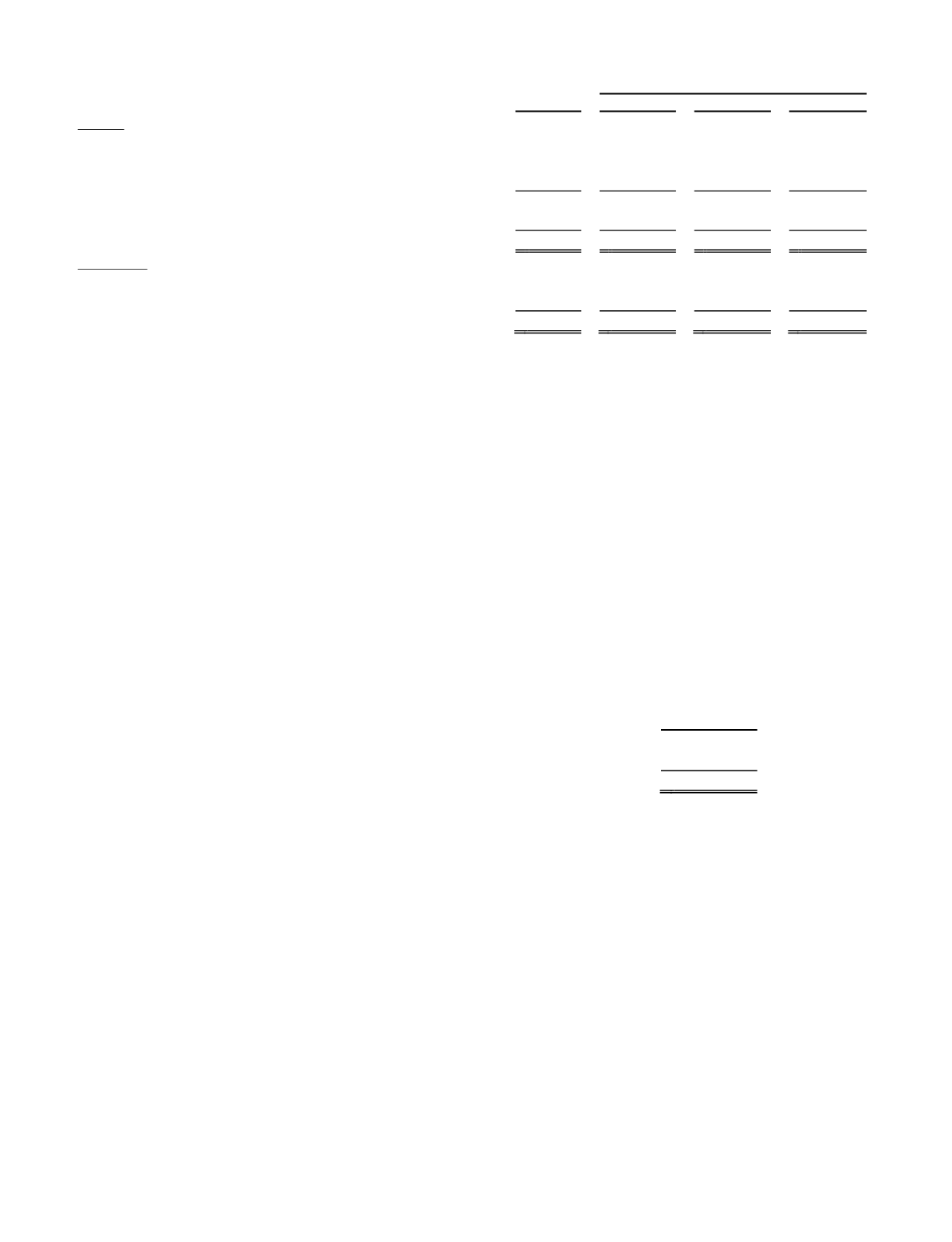

The following table provides a summary of the changes in the contractual acquisition earn-outs measured at fair value on a

recurring basis using significant unobservable inputs (Level 3) during the year ended December 31, 2013:

Fair Value

Measurements

Using Significant

Unobservable

Inputs (Level 3)

Balance at January 1, 2013 ...................................................................... $

508

Fair value adjustment recognized in earnings ................................

(139)

Balance at December 31, 2013 ................................................................ $

369

Assets and liabilities that are measured at fair value on a non-recurring basis include long-lived assets, intangible assets, and

goodwill. These items are recognized at fair value when they are considered to be other than temporarily impaired using significant

unobservable inputs (Level 3). Our Platforms and Applications reporting unit’s goodwill and long-lived assets with a carrying value of

$65,406 were written down to their estimated fair value of $33,429, resulting in an impairment charge of $31,977 in 2013. In 2012,

our Navigation reporting unit’s goodwill and long-lived assets with a carrying value of $164,500 at March 31, 2012 were written

down to their estimated fair value of $38,797, resulting in an impairment charge of $125,703; see Note 9, Acquired Intangible Assets,

Capitalized Software Development Costs, and Goodwill for further information regarding the valuation inputs.

Long-term debt, excluding leases, consists of borrowings under a commercial bank term loan agreement, 4.5% convertible

senior notes, 7.75% convertible senior notes, and promissory notes; see Note 12. The long-term debt, excluding leases, is currently

reported at the borrowed amount outstanding. At December 31, 2013, the estimated fair value of the long-term debt, excluding leases,

was $133,427 versus a carrying value of $135,455. At December 31, 2012, the fair value of long-term debt, excluding leases, was

$144,106 versus a carrying value of $149,289. The estimated fair value is based on a market approach using quoted market prices or

current market rates for similar debt with approximately the same remaining maturities, where possible.