F-26

rights and restricted stock units. Options are rights to purchase our common stock at the fair market value on the date of the grant.

Stock appreciation rights are equity settled share-based compensation arrangements whereby the number of shares that will ultimately

be issued is based upon the appreciation of our common stock and the number of awards granted to an individual. Restricted stock

units are equity settled share-based compensation arrangements of a number of share of our common stock. Restricted stock unit

holders do not have voting rights until the restrictions lapse.

We recognize compensation expense net of estimated forfeitures over the requisite service period, which is generally the vesting

period of 5 years. We estimate the fair value of each stock option award on the date of grant using the Black-Scholes option-pricing

model. Expected volatilities are based on historical volatility of our stock. We estimate forfeitures based on historical experience and

the expected term of the options granted are derived from historical data on employee exercises. The risk free interest rate is based on

the U.S. Treasury yield curve in effect at the time of the grant. We have not paid and do not anticipate paying dividends in the near

future.

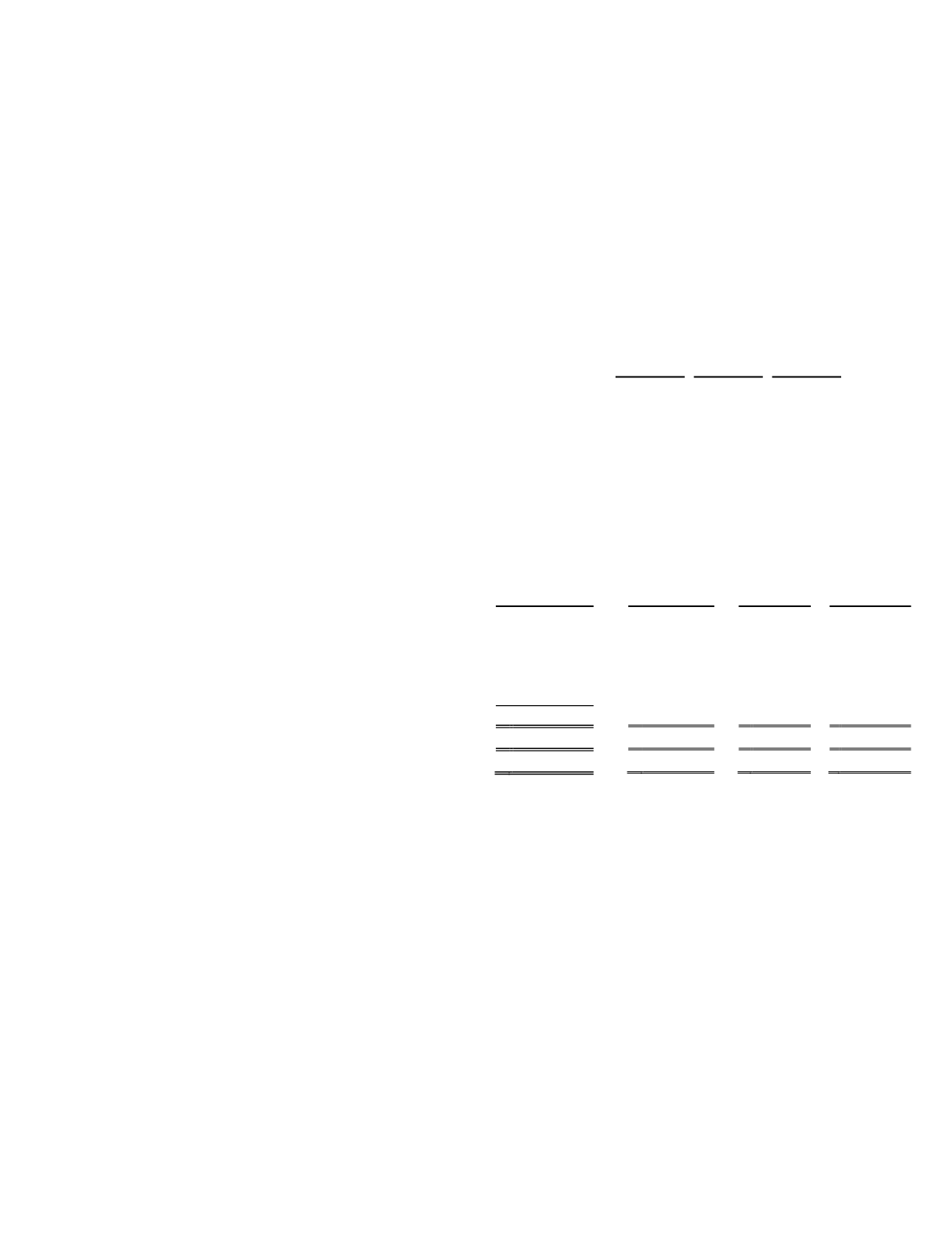

Our assumptions in calculating the fair value of our stock options using Black-Scholes our assumptions for the years ended

December 31 were as follows:

2013

2012

2011

Expected life (in years) ..................................................................................

5.5

5.5

5.5

Risk-free interest rate (%) .............................................................................. 1%-1.5% 1%-1.1% 1%-2.4%

Volatility (%) ................................................................................................. 63%-64% 61%-64% 60%-61%

Dividend yield (%).........................................................................................

0%

0%

0%

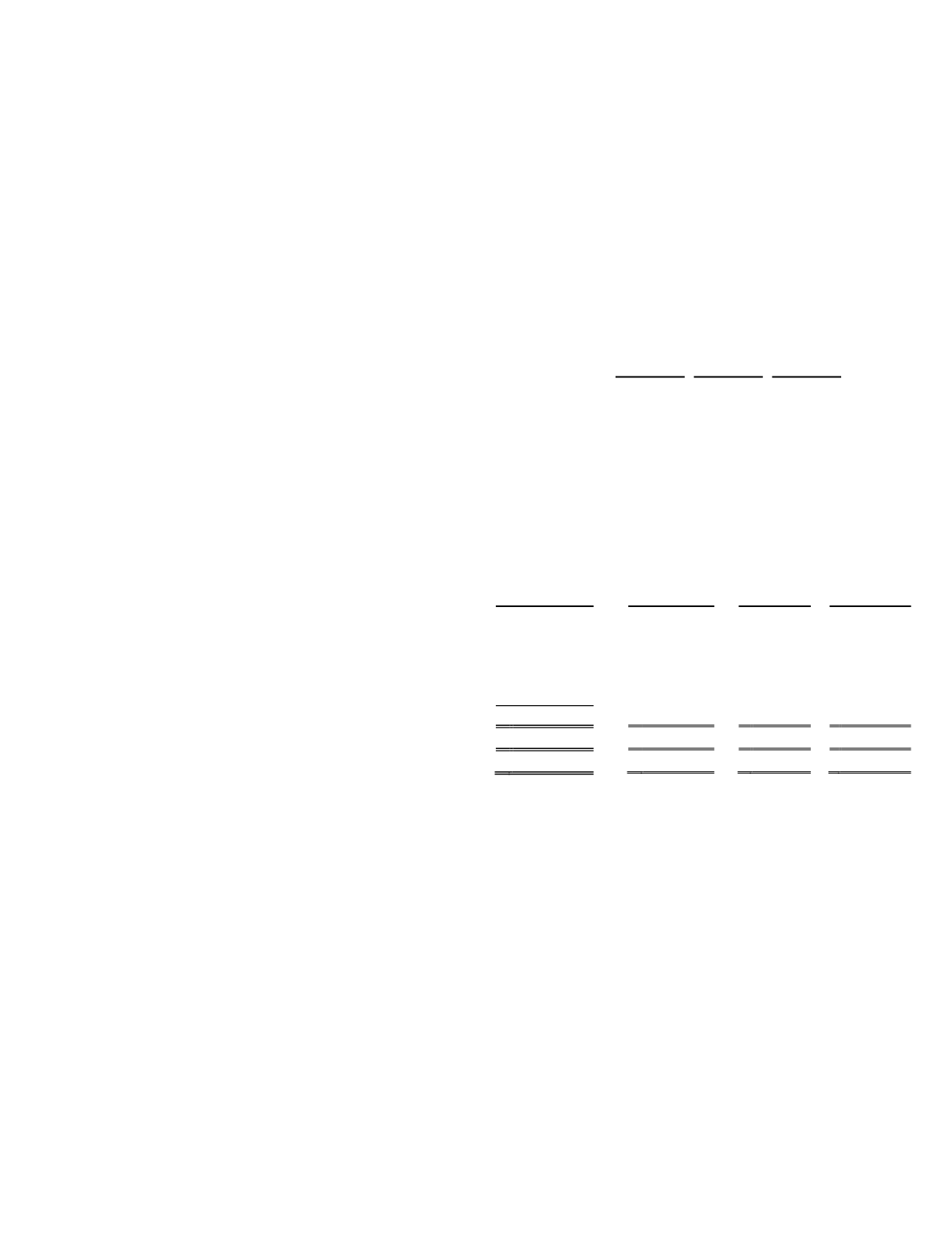

A summary of our stock option activity and related information consisted of the following (all share amounts in thousands):

Number of

Options

Weighted

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

(years)

Aggregate

Intrinsic

Value

($000)

Outstanding at December 31, 2012.......................................................

17,222 $

4.72

Granted .................................................................................................

2,803

2.41

Exercised .............................................................................................

(96)

1.82

Expired..................................................................................................

(946)

5.49

Forfeited................................................................................................

(1,806)

3.26

Outstanding, December 31, 2013..........................................................

17,177 $

4.47

5.3 $

379

Exercisable, December 31, 2013 ..........................................................

12,025 $

4.99

4.0 $

84

Vested and expected to vest, December 31, 2013

16,131 $

4.99

4.0 $

295

The weighted average grant date fair value of options granted during the years 2013, 2012, and 2011 was $1.33, $1.30, and

$2.34, respectively. The total intrinsic value of options exercised during the years ended December 31, 2013, 2012, and 2011, was

$60, $15, and $800, respectively. The total fair value of shares vested during the years ended December 31, 2013, 2012, and 2011, was

$5,948, $7,813, and $8,328, respectively. As of December 31, 2013, we estimate that we will recognize $5,500 in expense for

outstanding, unvested options over their weighted average remaining vesting period of 3 years.