F-18

Segment information

We operate in a single segment, DrugDiscovery andDevelopment operations, because our chief decisionmaker reviews

operating results on an aggregate basis andmanages our operations as a single operating segment.

FairValueMeasurements

We use a three-tier fair value hierarchy to prioritize the inputs used inour fair valuemeasurements. These tiers include:

Level 1, defined as observable inputs such as quotedprices in activemarkets for identical assets, which includes ourmoneymarket

funds and treasury securities classified as available-for-sale securities andour investment in equity securities in publicly-held

biotechnology companies; Level 2, defined as inputs other thanquotedprices in activemarkets that are either directlyor indirectly

observable, which includes our fixed income securities and commercial paper classified as available-for-sale securities; andLevel 3,

defined as unobservable inputs inwhich little or nomarket data exists, therefore requiring an entity to develop its own assumptions.

Our Level 3 investments include investments in the equity securities of publicly-heldbiotechnology companies forwhichwe

calculated a lackofmarketability discount because therewere restrictions onwhenwe could trade the securities. Themajorityof our

securities have been classified asLevel 2.We obtain the fair value of our Level 2 investments fromour custodianbankor from a

professional pricing service. We validate the fair value of our Level 2 investments byunderstanding the pricingmodel usedby the

custodianbanks or professional pricing service provider and comparing that fair value to the fair value basedonobservablemarket

prices. During the years endedDecember 31, 2013 and2012 therewere no transfers between our Level 1 andLevel 2 investments.We

use the endof reportingperiodmethod for determining transfers between levels.

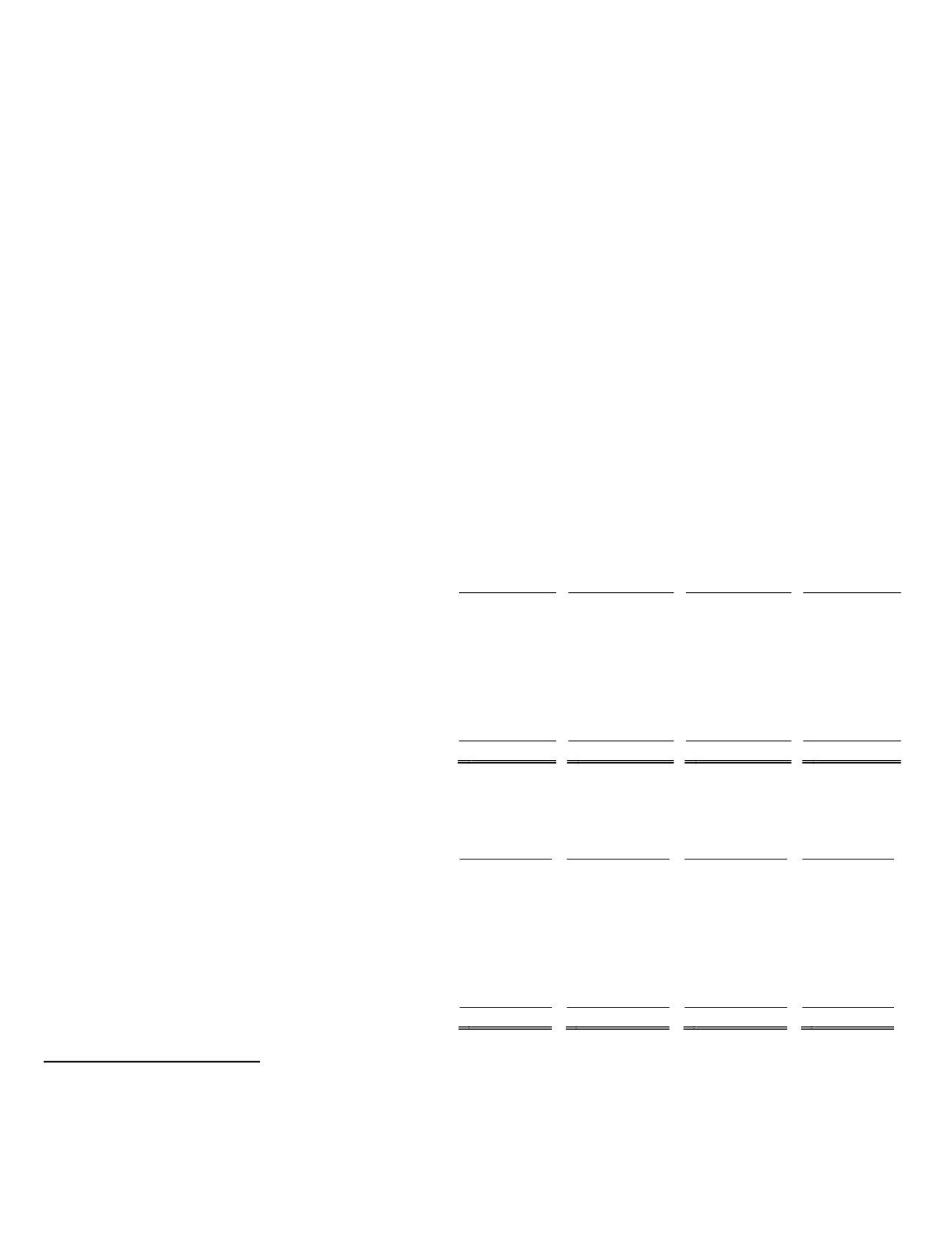

Wemeasure the followingmajor security types at fair value on a recurringbasis.We breakdown the inputs used tomeasure

fair value for these assets atDecember 31, 2013 and2012 as follows (in thousands):

AtDecember 31,

2013

QuotedPrices in

ActiveMarkets

(Level 1)

SignificantOther

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Cash equivalents (1) .............................................................. $ 146,357 $

133,233 $

13,124 $

—

Corporate debt securities (2) .................................................

394,773

—

394,773

—

Debt securities issuedbyU.S. government agencies (2) ......

64,432

—

64,432

—

Debt securities issuedby theU.S. Treasury (2) ....................

15,328

15,328

—

—

Debt securities issuedby states of theUnitedStates and

political subdivisions of the states (2) ...............................

22,255

—

22,255

—

Investment inRegulus Therapeutics Inc. ..............................

52,096

52,096

—

—

Equity securities (3) ..............................................................

1,276

1,276

—

—

Total .................................................................................. $ 696,517 $

201,933 $

494,584 $

—

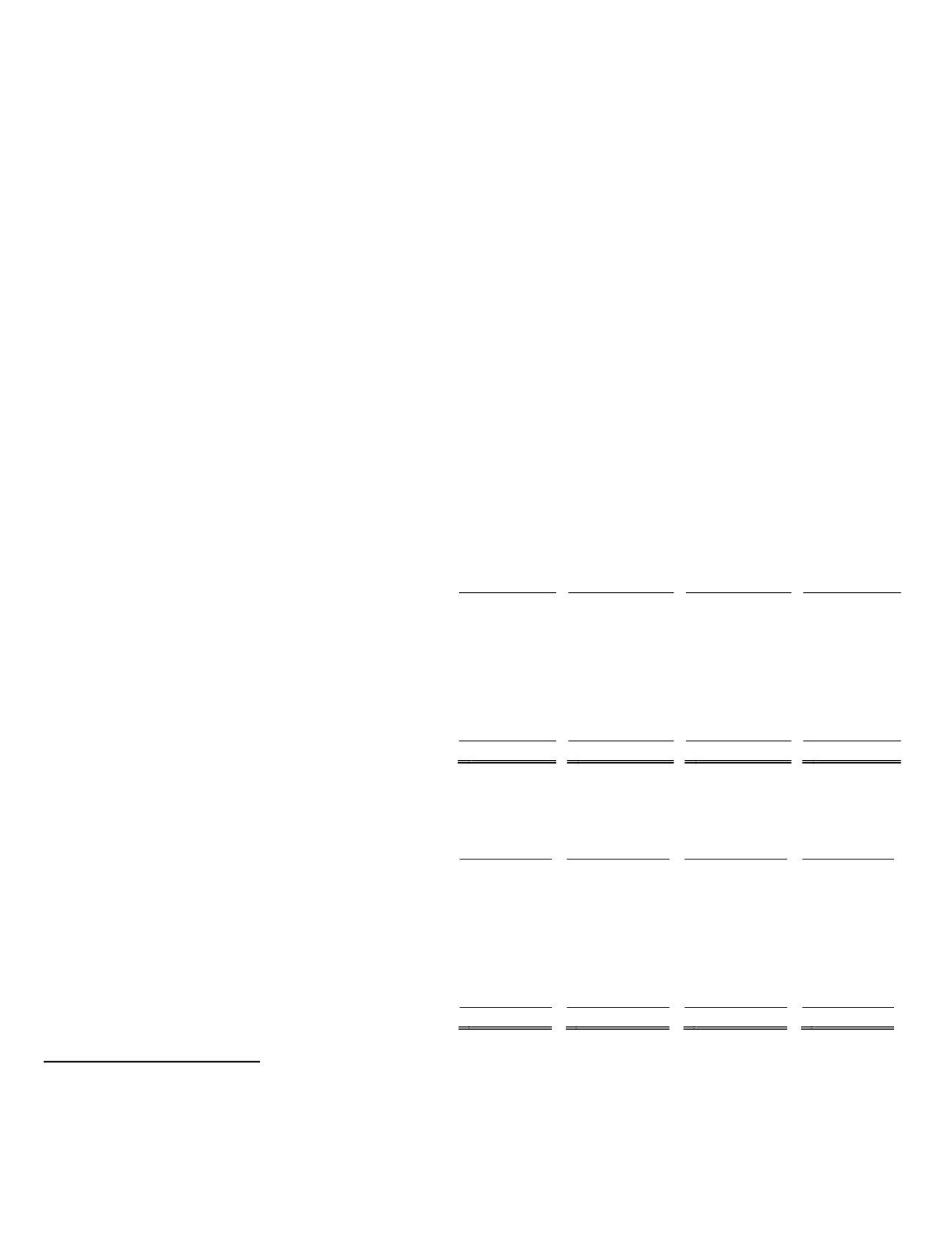

AtDecember 31,

2012

QuotedPrices in

ActiveMarkets

(Level 1)

SignificantOther

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Cash equivalents (1) .............................................................. $ 105,496 $

101,496 $

4,000 $

—

Corporate debt securities (2) .................................................

193,507

—

193,507

—

Debt securities issuedbyU.S. government agencies (2) ......

18,108

—

18,108

—

Debt securities issuedby theU.S. Treasury (2) ....................

13,452

13,452

—

—

Debt securities issuedby states of theUnitedStates and

political subdivisions of the states (2) ...............................

24,897

—

24,897

—

Investment inRegulus Therapeutics Inc. ..............................

33,622

—

—

33,622

Equity securities (3) ..............................................................

4,874

4,146

—

728

Total .................................................................................. $ 393,956 $

119,094 $

240,512 $ 34,350

(1)

Included in cash and cash equivalents on our consolidatedbalance sheet.

(2)

Included in short-term investments onour consolidatedbalance sheet.

(3)

Included inother current assets onour consolidatedbalance sheet.