F-23

4. Long-TermObligations andCommitments

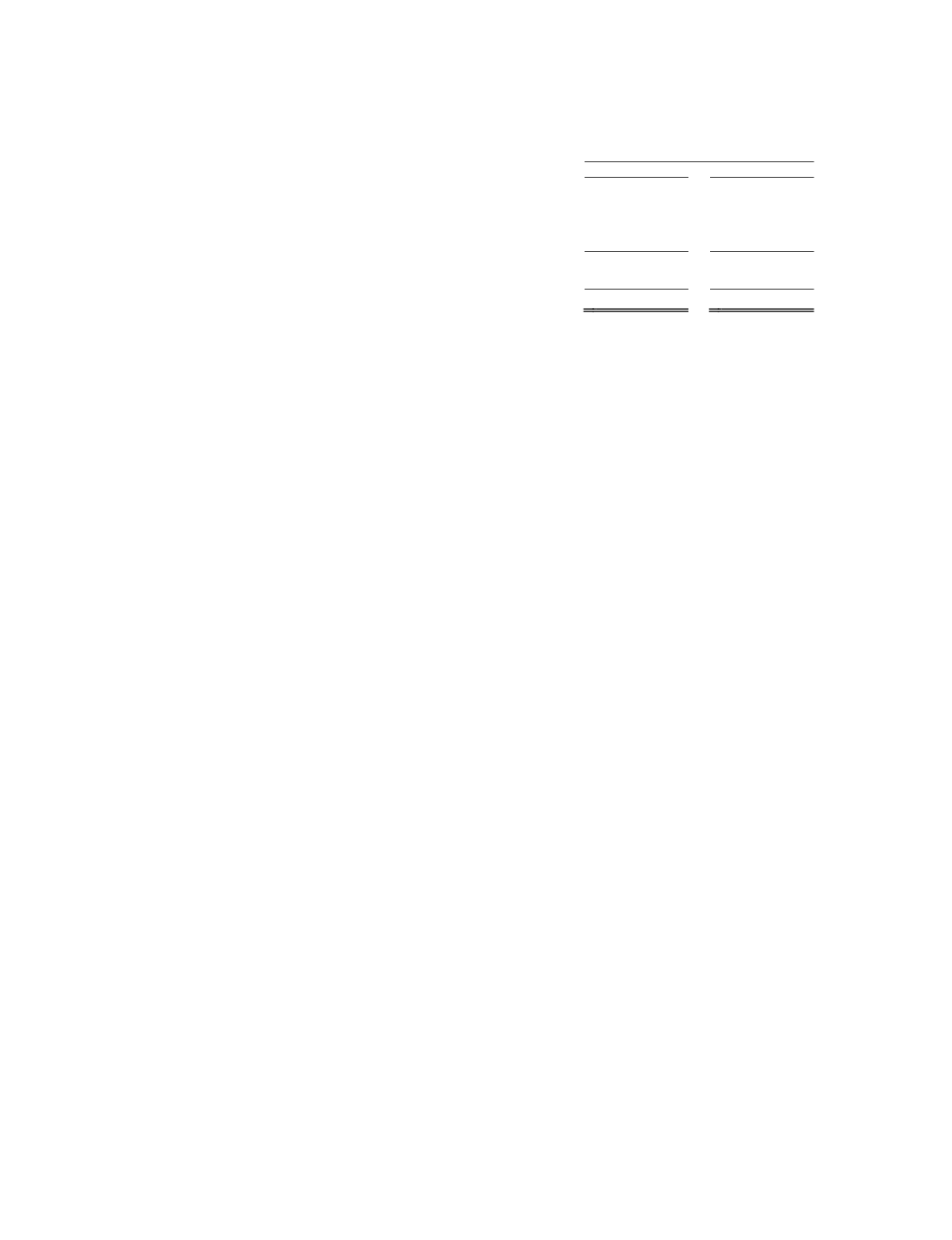

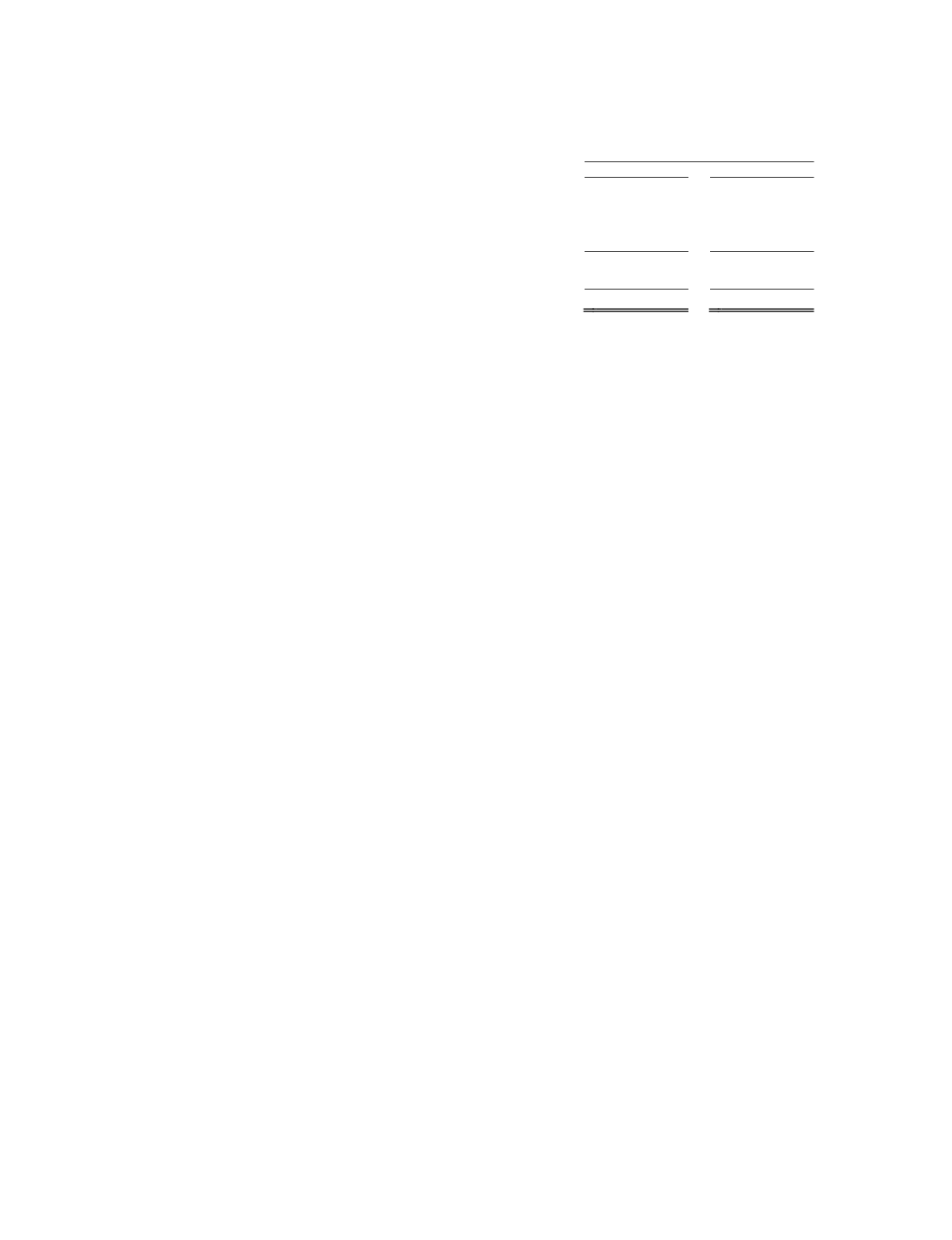

The carryingvalue of our long-termobligationswas as follows (in thousands):

December 31,

2013

2012

2¾percent convertible senior notes ............................................. $

150,334 $

143,990

Long-term financing liability for leased facility ...........................

71,288

70,550

Equipment financing arrangement ................................................

7,461

9,993

Leases and other obligations .........................................................

3,489

2,288

Total ............................................................................................. $

232,572 $

226,821

Less: current portion .....................................................................

(4,408)

(4,879)

Total Long-TermObligations ................................................... $

228,164 $

221,942

ConvertibleNotes

InAugust 2012, we completed a $201.3million convertible debt offering,which raisednet proceeds of $194.7million, after

deducting$6.6million in issuance costs. The $201.3million convertible senior notesmature in2019 andbear interest at 2¾percent,

which is payable semi-annually in arrears onApril 1 andOctober 1of eachyear. InSeptember 2012, we used a substantial portionof

the net proceeds from the issuance of the 2¾percent notes to redeem the entire $162.5million inprincipal of our 2

5

/

8

percent notes at

a price of $164.0million including accrued interest. The $162.5million convertible subordinatednotes had amaturitydate of 2027

and bore interest at 2

5

/

8

percent, whichwas payable in cash semi-annually. We recognized a $4.8million loss as a result of the

redemptionof the 2

5

/

8

percent notes. A significant portionof the loss, or $3.6million, was non-cash and related to the unamortized

debt discount anddebt issuance costs and the remainderwas related to a $1.2million early redemptionpremiumwe paid to the

holders of the 2

5

/

8

percent notes.

The 2¾percent notes are convertible at the optionof the note holders prior to July1, 2019onlyunder certain conditions. On

or after July1, 2019, the notes are initially convertible into approximately 12.1million shares of common stock at a conversion price

of approximately $16.63per share. Wewill settle conversions of the notes, at our election, in cash, shares of our common stock or a

combinationof both. We can redeem the 2¾percent notes at our option, inwhole or inpart, onor afterOctober 5, 2016 if the last

reported sale price of our common stock for at least 20 tradingdays (whether or not consecutive) during the periodof 30 consecutive

tradingdays endingon the tradingday immediatelypreceding the datewe provide the redemptionnotice exceeds 130percent of the

applicable conversionprice for the 2¾percent notes on each suchday. The redemptionprice for the 2¾ percent noteswill equal 100

percent of the principal amount being redeemed, plus accrued andunpaid interest, plus $90per each$1,000principal amount being

redeemed. Holders of the 2¾percent notesmay require us topurchase some or all of their notes upon the occurrence of certain

fundamental changes, as set forth in the indenture governing these notes, at a purchase price equal to100percent of the principal

amount of the notes tobe purchased, plus accrued andunpaid interest.

The price of our common stock exceeded the conversion thresholdprice during the quarter endedDecember 31, 2013. As a

result, the 2¾percent notes are convertible at the optionof the holders during the quarter endingMarch31, 2014. We have not

received a notice of conversion andwe donot believewewill receive a conversion request. As ofDecember 31, 2013, the if-

convertedvalue of the 2¾percent notes, which assumes that the noteswill be converted into shares of our common stock, exceeded

the principal amount by$281.0million.We didnot include the potential effect of the conversion of our convertible notes intoour

common stock in the computationof dilutednet loss per share because the effectwould have been anti-dilutive.

We account for our convertible notes using an accounting standard that requires us to assign a value toour convertible debt

equal to the estimated fair value of similar debt instrumentswithout the conversion feature and to record the remainingportion in

equity. As a result, we recordedour convertible debt at a discount, whichwe are amortizing as additional non-cash interest expense

over the expected life of the debt. We are amortizing the debt discount for our 2¾percent notes over sevenyears. Wewere

amortizing the debt discount for our 2

5

/

8

percent notes over seven years untilwe redeemed the notes inSeptember 2012. Using a

combinationof the present value of the debt’s cash flows and aBlack-Scholes valuationmodel, we determined that our nonconvertible

debt borrowing ratewas eight percent and9.3percent for the 2¾percent notes and2

5

/

8

percent notes, respectively. AtDecember 31,

2013 the principal and accrued interest payable on the 2¾percent noteswas $202.6million and the fair value basedonquotedmarket

priceswas $505.1million. Interest expense for the year endedDecember 31, 2013, 2012 and2011 included$6.3million, $8.4million

and$8.6million, respectively, of non-cash interest expense related to the amortizationof the debt discount for our convertible notes.