F-15

We have equity investments inprivately- andpublicly-held biotechnology companies thatwe have received as part of a

technology license or collaboration agreement. AtDecember 31, 2013we heldownership interests of less than20 percent in eachof

the respective companies.

We account for our equity investments in publicly-held companies at fair value and recordunrealizedgains and losses related

to temporary increases anddecreases in the stockof these publicly-held companies as a separate component of comprehensive income

(loss). We account for equity investments in privately-held companies under the costmethodof accountingbecausewe own less than

20percent anddonot have significant influence over their operations. The costmethod investmentswe hold are in smaller satellite

companies and realizationof our equity position in those companies is uncertain. In those circumstanceswe record a full valuation

allowance. Indetermining if andwhen a decrease inmarket value belowour cost inour equitypositions is temporaryor other-than-

temporary, we examine historical trends in the stock price, the financial condition of the company, near termprospects of the company

and our current need for cash. Ifwe determine that a decline invalue in either a public or private investment is other-than-temporary,

we recognize an impairment loss in the period inwhich the other-than-temporarydecline occurs.

Inventoryvaluation

We capitalize the costs of rawmaterials that we purchase for use in producingour drugs because until we use these raw

materials they have alternative future uses.We include in inventory rawmaterial costs for drugs thatwemanufacture for our partners

under contractual terms and thatwe use primarily in our clinical development activities and drug products.We can use eachof our

rawmaterials inmultiple products and, as a result, each rawmaterial has future economic value independent of the development status

of any single drug. For example, if one of our drugs failed, we coulduse the rawmaterials for that drug tomanufacture our other

drugs.We expense these costswhenwe deliver the drugs toour partners, or aswe provide these drugs for our own clinical trials.We

reflect our inventoryon the balance sheet at the lower of cost ormarket value under the first-in, first-outmethod.We review inventory

periodically and reduce the carryingvalue of itemswe consider tobe slowmovingor obsolete to their estimated net realizable value.

We consider several factors in estimating the net realizable value, including shelf life of rawmaterials, alternative uses for our drugs

and clinical trialmaterials, andhistoricalwrite-offs. We didnot record any inventorywrite-offs for the years endedDecember 31,

2013, 2012or 2011. Total inventory, which consistedof rawmaterials, was $8.0million and$6.1million as ofDecember 31, 2013

and2012, respectively.

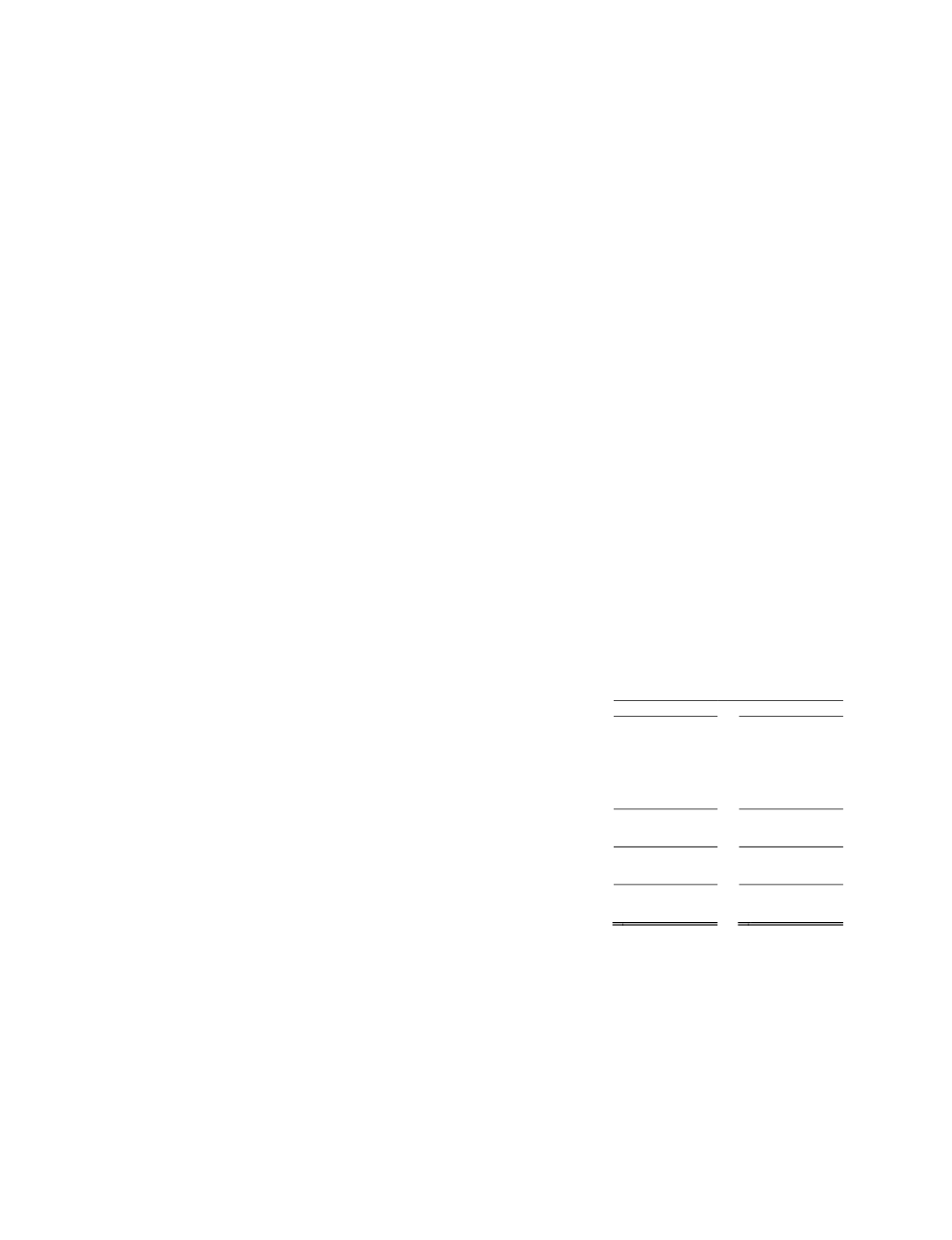

Property, plant and equipment

We carryour property, plant and equipment at cost, which consists of the following (in thousands):

December 31,

2013

2012

Equipment and computer software ...................................................... $

44,698 $

44,109

Building and building systems ............................................................

48,132

48,120

Land improvements .............................................................................

2,846

2,849

Leasehold improvements .....................................................................

35,282

34,931

Furniture and fixtures ..........................................................................

5,473

5,342

136,431

135,351

Less accumulated depreciation ............................................................

(60,431)

(54,465)

76,000

80,886

Land .....................................................................................................

10,198

10,198

$

86,198 $

91,084

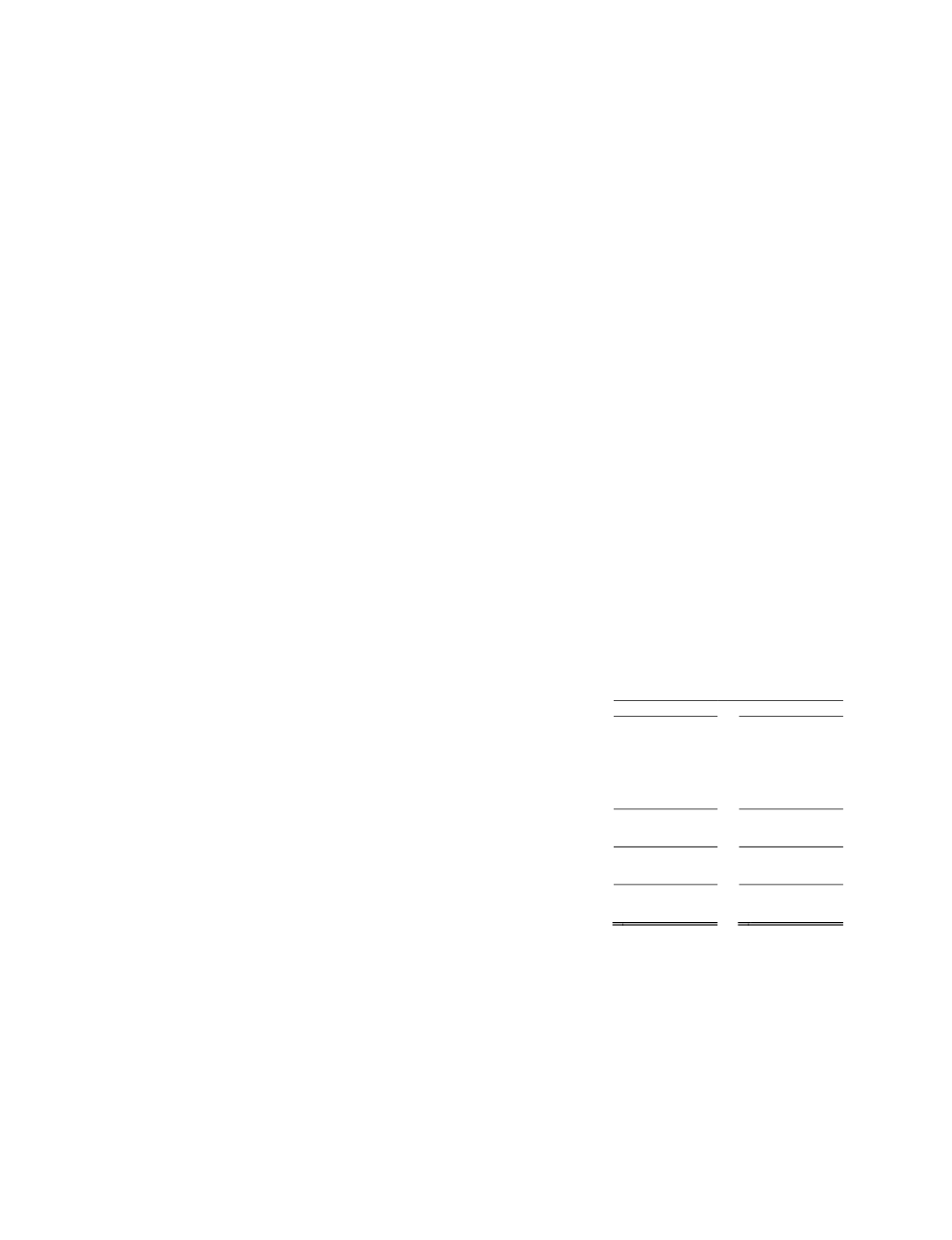

We depreciate our property, plant and equipment on the straight-linemethodover estimated useful lives as follows:

Computer software andhardware ................................................................................

3 years

Manufacturing equipment ...........................................................................................

10 years

Other equipment ..........................................................................................................

5-7 years

Furniture and fixtures ..................................................................................................

5-10 years

Building .......................................................................................................................

40 years

Building systems and improvements ...........................................................................

10-25 years

Land improvements .....................................................................................................

20 years

We depreciate our leasehold improvements using the shorter of the estimated useful life or remaining lease term.