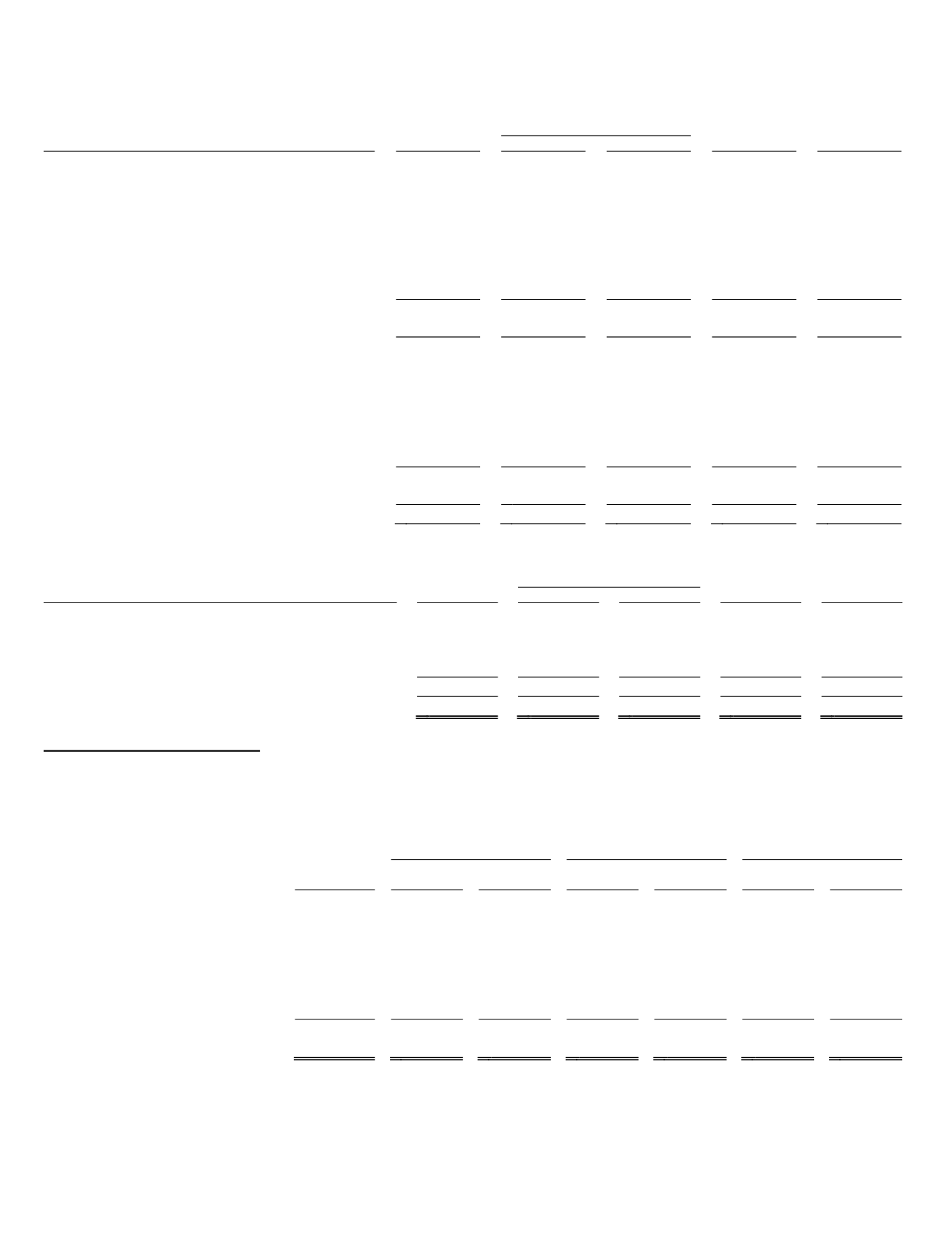

F-22

Other-Than-

Temporary

Amortized

Unrealized

Impairment

Estimated

December 31, 2012

Cost

Gains

Losses

Loss

FairValue

Available-for-sale securities:

Corporate debt securities(1) ............................ $ 115,249 $

81 $

(9) $

— $ 115,321

Debt securities issuedbyU.S. government

agencies(1) ..................................................

12,100

2

(66)

—

12,036

Debt securities issuedby theU.S. Treasury ....

1,000

1

—

—

1,001

Debt securities issuedby states of the

UnitedStates andpolitical subdivisions of

the states ......................................................

16,560

18

(2)

—

16,576

Total securitieswith amaturityof one

year or less ..............................................

144,909

102

(77)

—

144,934

Corporate debt securities .................................

80,166

112

(92)

—

80,186

Debt securities issuedbyU.S. government

agencies .......................................................

8,034

38

—

—

8,072

Debt securities issuedby theU.S. Treasury ....

12,424

27

—

—

12,451

Debt securities issuedby states of the

UnitedStates and political subdivisions

of the states .................................................

8,306

31

(16)

—

8,321

Total securitieswith amaturityofmore

thanone year ...........................................

108,930

208

(108)

—

109,030

Total available-for-sale securities ........... $ 253,839 $

310 $

(185) $

— $ 253,964

Other-Than-

Temporary

Cost

Unrealized

Impairment

Estimated

December 31, 2012

Basis

Gains

Losses

Loss

FairValue

Equity securities:

Regulus Therapeutics Inc. ..................................... $ 15,526 $ 18,096 $

— $

— $ 33,622

Securities included inother current assets ............

1,579

4,175

—

(880)

4,874

Securities includeddeposits and other assets ........

625

—

—

—

625

Total equity securities ....................................... $ 17,730 $ 22,271 $

— $

(880) $ 39,121

Total available-for-sale and equity securities ........... $ 271,569 $ 22,581 $

(185) $

(880) $ 293,085

(1)

Includes investments classified as cash equivalents onour consolidatedbalance sheet.

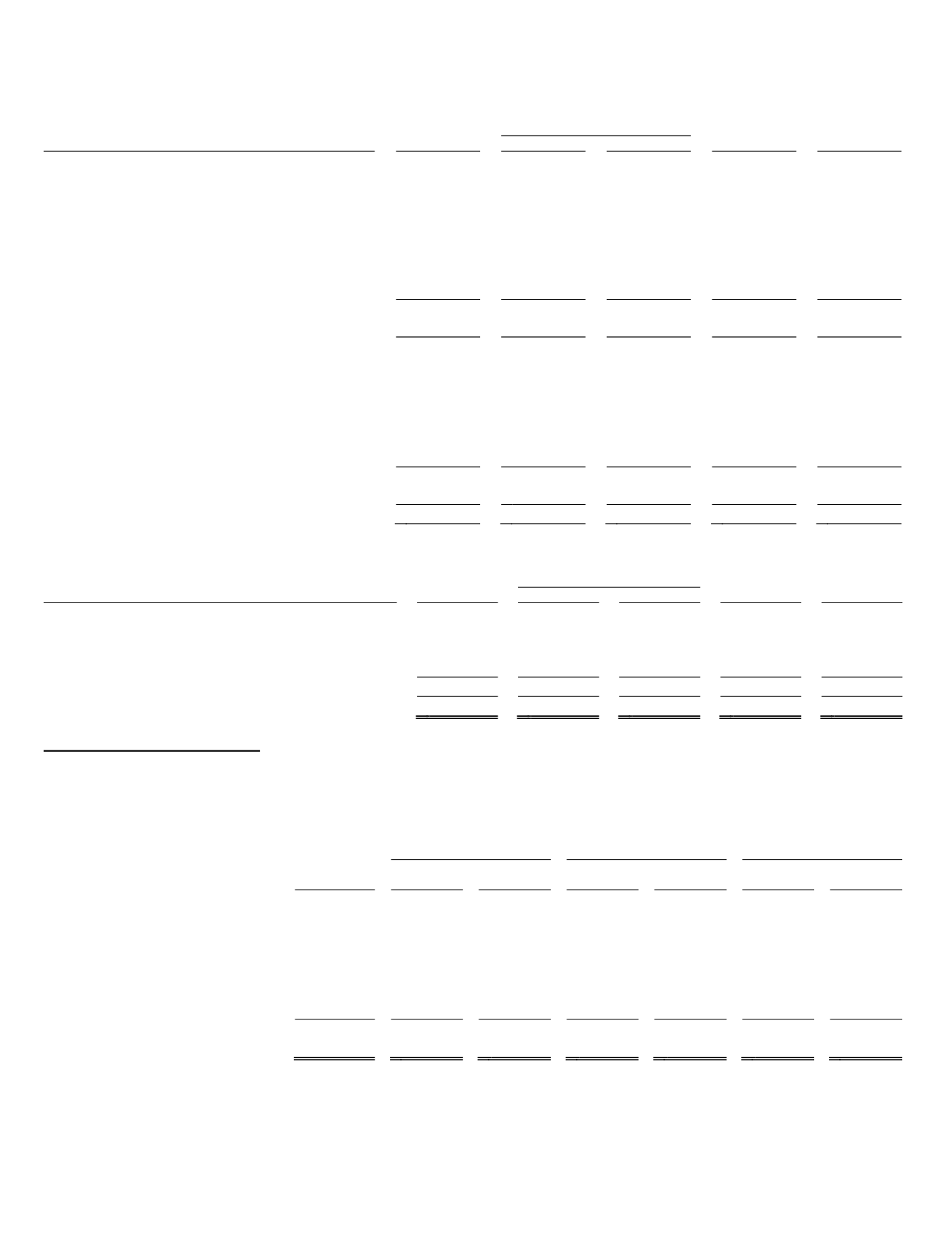

Investmentswe consider to be temporarily impaired at December 31, 2013 are as follows (in thousands):

Less than 12months of

temporary impairment

More than 12months of

temporary impairment

Total temporary

impairment

Number of

Investments

Estimated

FairValue

Unrealized

Losses

Estimated

FairValue

Unrealized

Losses

Estimated

FairValue

Unrealized

Losses

Corporate debt securities ..............

148 $ 213,469 $ (412) $ 8,228 $

(8) $ 221,697 $ (420)

Debt securities issuedbyU.S.

government agencies ................

8

49,437

(143)

—

—

49,437

(143)

Debt securities issuedby states

of theUnitedStates and

political subdivisions of the

states .......................................

7

6,964

(52)

4,130

(4)

11,094

(56)

Total temporarily

impaired securities ...................

163 $ 269,870 $ (607) $ 12,358 $

(12) $ 282,228 $ (619)

We believe that the decline in value of these securities is temporary andprimarily related to the change inmarket interest

rates since purchase. We believe it ismore likely thannot thatwewill be able tohold these securities tomaturity. Thereforewe

anticipate full recoveryof their amortized cost basis atmaturity.