F-28

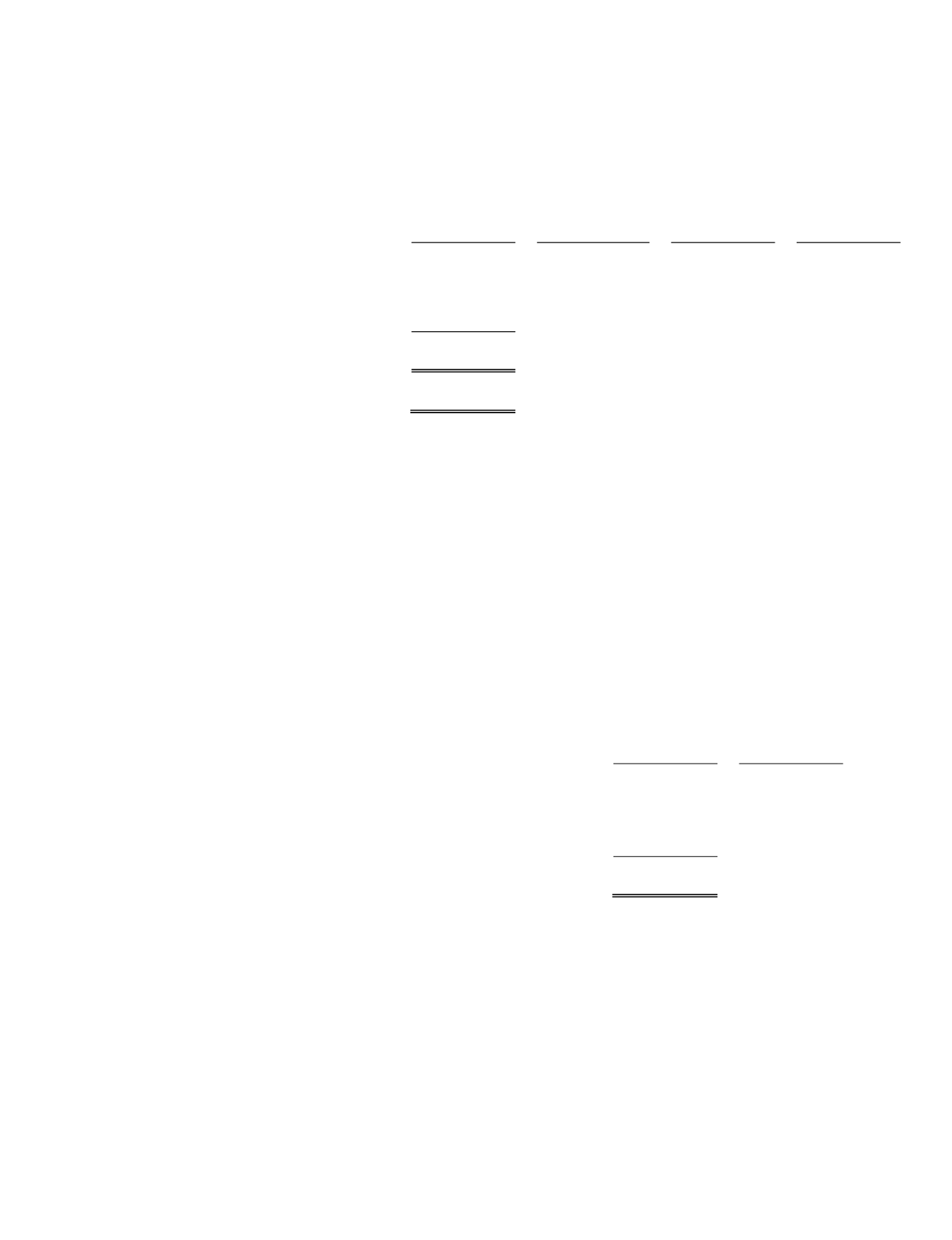

StockOptionActivity

The following table summarizes the stock option activity for the year endedDecember 31, 2013 (in thousands, except per

share and contractual life data):

Number of

Shares

Weighted

AverageExercise

Price

PerShare

Average

Remaining

Contractual Term

Aggregate

Intrinsic

Value

(Years)

Outstanding atDecember 31, 2012 .........................

10,823 $

11.30

Granted ...............................................................

1,911 $

15.88

Exercised .............................................................

(5,216) $

11.89

Cancelled/forfeited/expired .................................

(239) $

11.19

Outstanding atDecember 31, 2013 .........................

7,279 $

12.08

4.28 $

202,078

Exercisable atDecember 31, 2013 ..........................

3,948 $

11.52

3.13 $

111,685

Theweighted-average estimated fair values of options grantedwere $7.10, $3.55 and $4.85 for the years endedDecember 31,

2013, 2012 and2011, respectively. The total intrinsic value of options exercisedduring the years endedDecember 31, 2013, 2012 and

2011were $69.6million, $7.6million and$686,000, respectively, whichwe determined as of the date of exercise. The amount of cash

received from the exercise of stock optionswas $62.0million, $8.7million and$2.8million for the years endedDecember 31, 2013,

2012 and 2011, respectively. For the year endedDecember 31, 2013, theweighted-average fair value of options exercisedwas $25.24.

As ofDecember 31, 2013, total unrecognized compensation cost related tonon-vested stock-based compensation planswas $9.6

million.Wewill adjust the total unrecognized compensation cost for future changes in estimated forfeitures.We expect to recognize

this cost over aweighted average periodof 1.1 years.

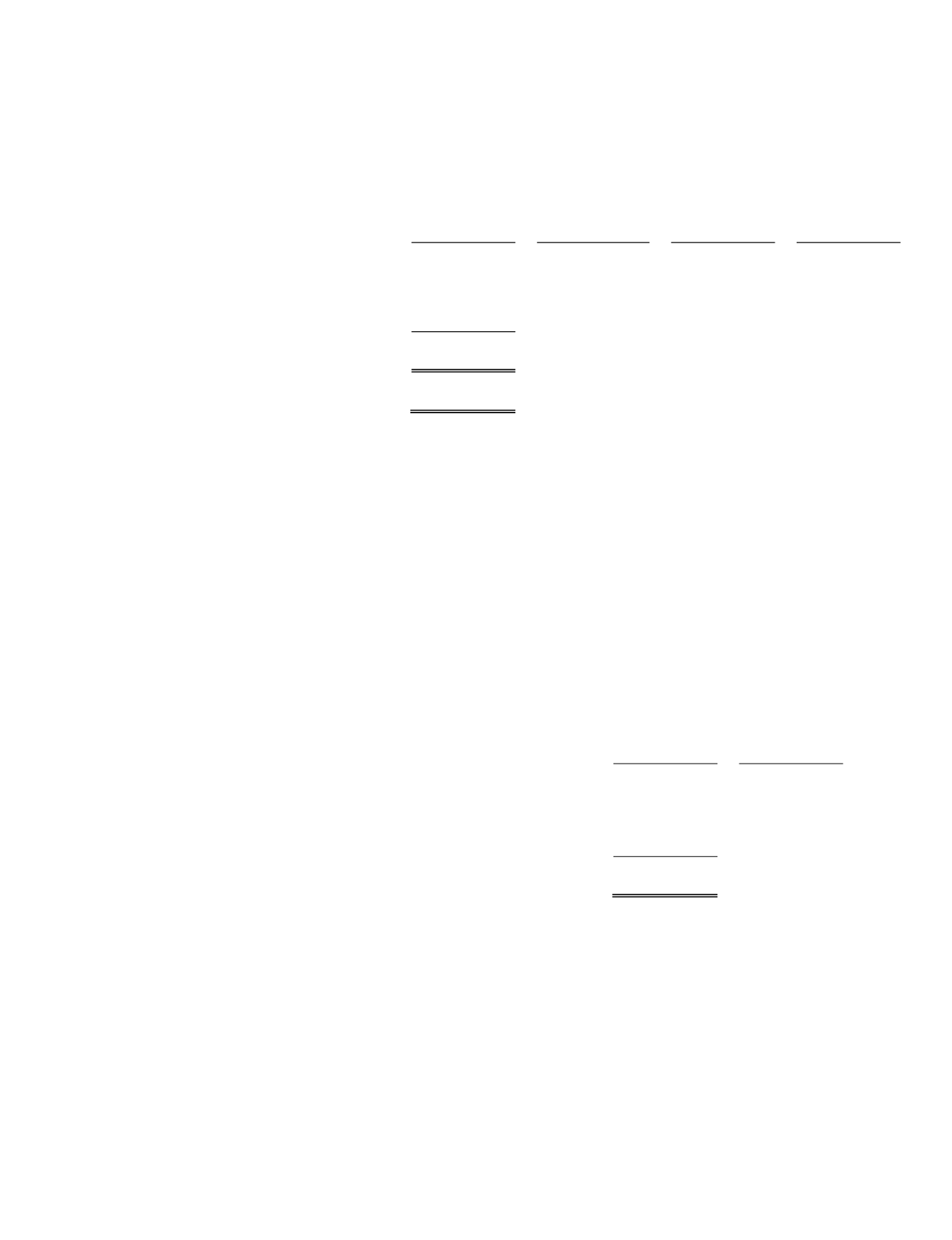

RestrictedStockUnitActivity

The following table summarizes the restricted stock unit, or RSU, activity for the year endedDecember 31, 2013 (in

thousands, except per share data):

Number of

Shares

Weighted

Average

GrantDate

FairValue

Per Share

Non-vested atDecember 31, 2012 ...............................................

188 $

8.37

Granted .....................................................................................

297 $

17.42

Vested .......................................................................................

(47) $

16.64

Cancelled/forfeited ...................................................................

(13) $

11.78

Non-vested atDecember 31, 2013 ...............................................

425 $

13.67

For the years endedDecember 31, 2013 and2012, theweighted-average grant date fair value of RSUs granted to employees

was $16.94 and$8.22per RSU, respectively, and theweighted-average grant date fair value of RSUs granted toour Boardof

Directorswas $27.95 and $12.94 per RSU, respectively. As ofDecember 31, 2013, total unrecognized compensation cost related to

RSUswas $3.5million.Wewill adjust the total unrecognized compensation cost for future changes in estimated forfeitures.We

expect to recognize this cost over aweighted average period of 1.5 years.