F-30

DividendYield.

We base the dividend yield assumptiononour history and expectationof dividendpayouts.We have not

paiddividends in the past anddonot expect to in the future.

Volatility.

We use an average of the historical stockprice volatility of our stock for theBlack-Scholesmodel.We computed

the historical stockvolatilitybasedon the expected termof the awards.

ExpectedLife.

The expected termof stockoptionswe have granted represents the periodof time that we expect them to be

outstanding.We estimated the expected termof optionswe have grantedbasedonhistorical exercise patterns.

Forfeitures.

We reduce stock-based compensation expense for estimated forfeitures. We estimate forfeitures at the time of

grant and revise, if necessary, in subsequent periods if actual forfeitures differ from those estimates. We estimate forfeitures basedon

historical experience. Our historical forfeiture estimates have not beenmateriallydifferent fromour actual forfeitures.

Warrants

InApril 2006, we granted themembers of SymphonyGenIsisHoldingsLLCwarrants topurchase 4.25million shares of

common stock at an exercise price of $8.93per share. InApril 2011, SymphonyGenIsisHoldingsLLC exercised the remaining

warrants andnone remain outstanding.

6. IncomeTaxes

We have net deferred tax assets relating primarily to net operating loss carryforwards, orNOL’s, and research and

development tax credit

s. Subject to certain limitations, wemayuse these deferred tax assets tooffset taxable income in

future periods. Sincewe have a historyof losses and the likelihoodof future profitability is not assured, we have provided a full

valuation allowance for the deferred tax assets inour balance sheet as ofDecember 31, 2013. Ifwe determine that we are able to

realize a portionor all of these deferred tax assets in the future, wewill record an adjustment to increase their recordedvalue and a

corresponding adjustment to increase income or additional paid in capital, as appropriate, in that same period.

Intraperiod tax allocation rules require us to allocate our provision for income taxes between continuingoperations andother

categories of earnings, such as other comprehensive income. Inperiods inwhichwe have a year-to-date pre-tax loss from continuing

operations andpre-tax income inother categories of earnings, such as other comprehensive income, wemust allocate the tax provision

to the other categories of earnings.We then record a related tax benefit in continuingoperations. During2013 and2012, we recorded

unrealizedgains onour investments in available-for-sale securities inother comprehensive income net of taxes. As a result, for the

years endedDecember 31, 2013 and2012,we recorded a $5.9million and$9.1million tax benefit, respectively, in continuing

operations and a $5.9million and$9.1million tax expense, respectively, inother comprehensive income.

We are subject to taxation in theUnitedStates andvarious state jurisdictions. Our tax years for 1998 and forward are subject

to examinationby theU.S. tax authorities andour taxyears for 1991 and forward are subject to examinationby theCalifornia tax

authorities due to the carryforwardof unutilizednet operating losses and research anddevelopment credits. Our tax years for 2006 and

2007 are currentlybeing audited byCalifornia’s FranchiseTaxBoard, or FTB. We donot expect that the results of these

examinationswill have amaterial effect on our financial conditionor results of operations.

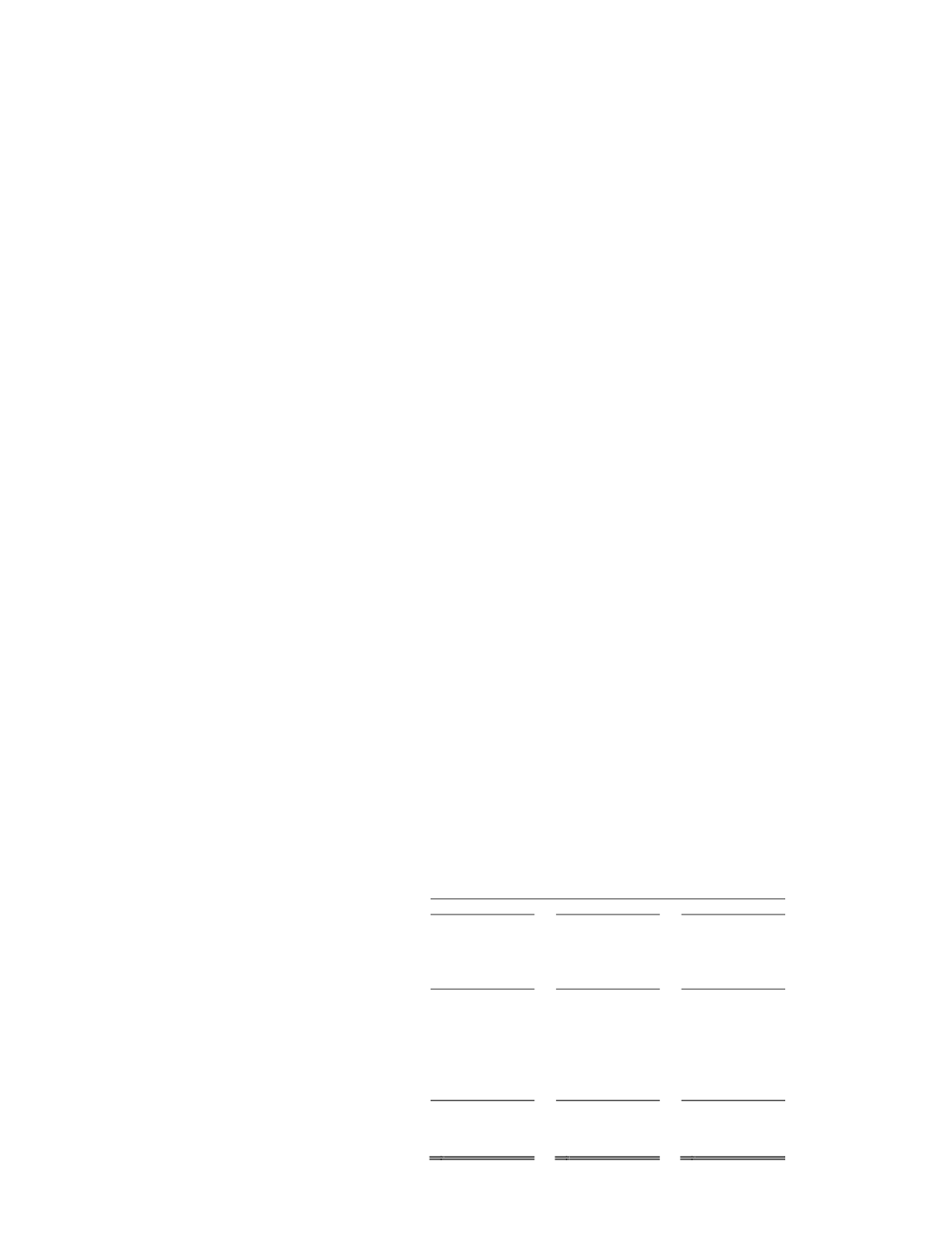

The provision for income taxes on income from continuingoperationswere as follows (in thousands):

YearEndedDecember 31,

2013

2012

2011

Current:

Federal ............................................. $

— $

— $

—

State .................................................

2

2

11

Total current ....................................

2

2

11

Deferred:

Federal .............................................

(5,082)

(7,827)

—

State .................................................

(834)

(1,284)

—

Foreign ............................................

—

—

—

Total deferred ..................................

(5,916)

(9,111)

—

IncomeTaxExpense (Benefit) ........ $

(5,914) $

(9,109) $

11

carryforward