F-31

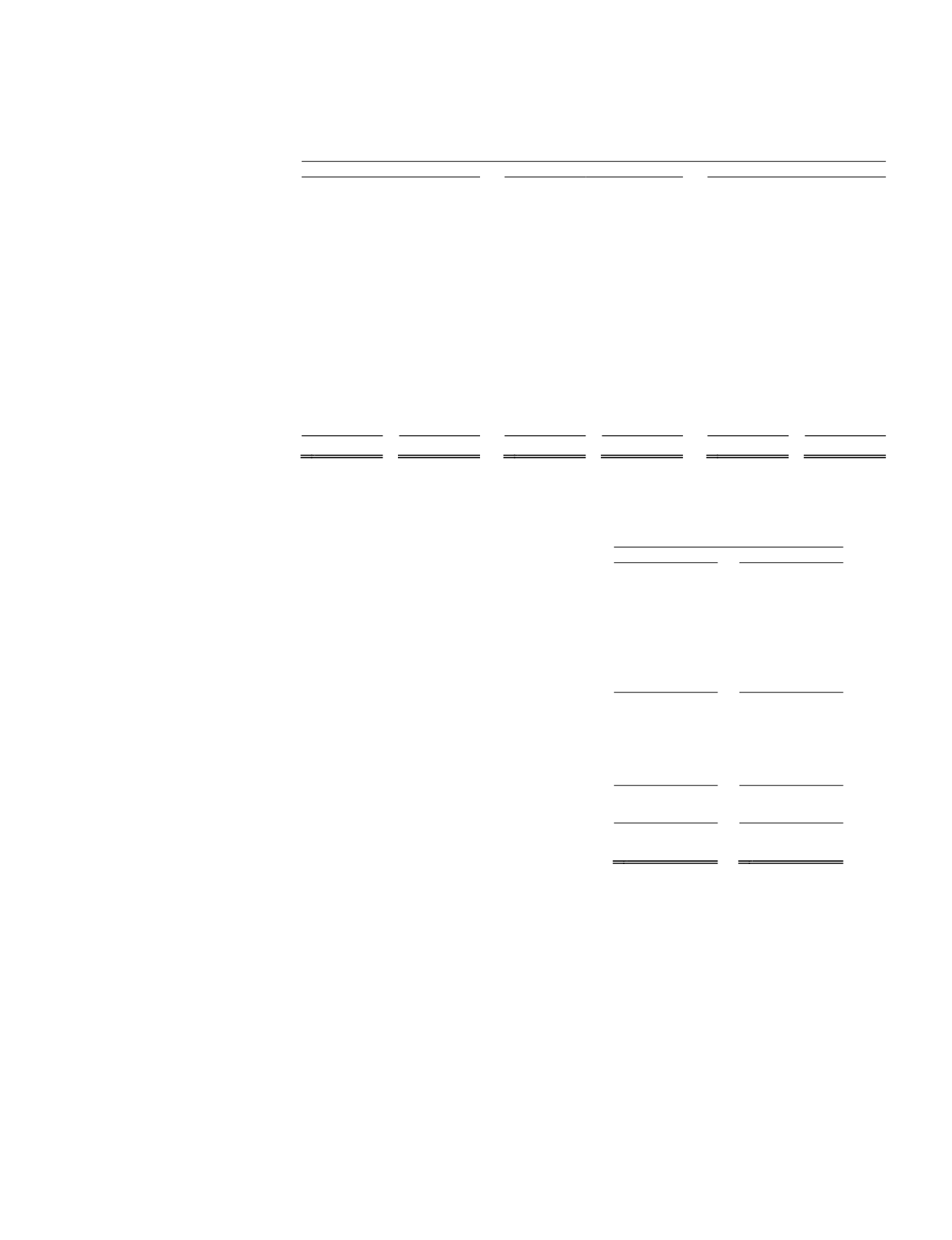

The reconciliationbetween theCompany’s effective tax rate on income from continuingoperations and the statutoryU.S. tax

rate is as follows (in thousands):

YearEndedDecember 31,

2013

2012

2011

Pre tax loss .................................... $ (66,558)

$ (74,587)

$ (84,790)

Statutory rate .................................

(23,295)

35.0%

(26,105)

35.0%

(29,677)

35.0%

State income taxnet of federal

benefit .......................................

(3,823)

5.7%

(4,284)

5.7%

(4,870)

5.7%

Net change invaluation

allowance ..................................

28,850

(43.3)% 25,269

(33.9)%

41,136

(48.5)%

Gainon Investment inRegulus

Therapeutics Inc. .......................

—

—

(6,353)

8.5%

—

—

Tax credits ....................................

(15,839)

23.8%

806

(1.1)%

(4,202)

5.0%

Noncontrolling interest .................

—

—

—

—

1,448

(1.7)%

Deferred tax true-up ......................

8,023

(12.1)% 839

(1.1)%

(4,236)

5.0%

Other .............................................

170

(0.2)% 719

(0.9)%

412

(0.5)%

Effective rate ................................. $

(5,914)

8.9% $ (9,109)

12.2% $

11

(0.0)%

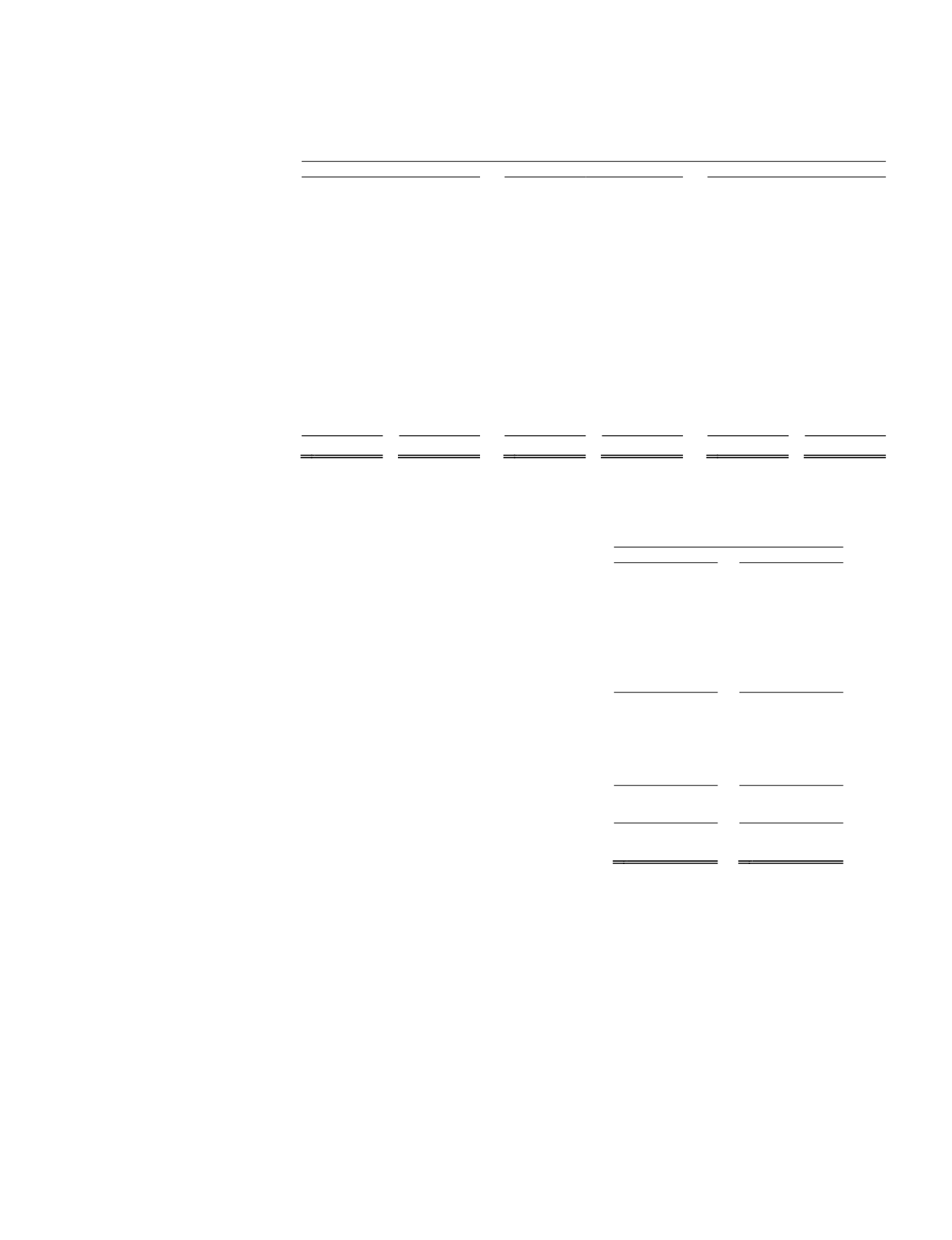

Significant components of our deferred tax assets and liabilities as ofDecember 31, 2013 and 2012 are as follows (in

thousands):

YearEndedDecember 31,

2013

2012

DeferredTaxAssets:

Net operating loss carryovers .................................................................................... $

260,462 $

244,539

R&D credits ..............................................................................................................

65,600

46,928

CapitalizedR&D .......................................................................................................

2,736

22,223

Deferred revenue .......................................................................................................

28,555

7,285

Accrued restructuring ................................................................................................

3,304

3,605

Other .........................................................................................................................

7,107

18,931

Total deferred tax assets ............................................................................................ $

367,764 $

343,511

DeferredTaxLiabilities:

Convertible debt ........................................................................................................ $

(20,895) $

(23,322)

Intangible and capital assets ......................................................................................

(4,614)

(6,784)

Net deferred tax asset ................................................................................................ $

342,255 $

313,405

Valuation allowance ..................................................................................................

(342,255)

(313,405)

Net deferreds ............................................................................................................. $

— $

—

The deferred tax assets and liabilities shown above donot include certaindeferred tax assets at December 31, 2013 and2012

that arose directly from (or the use ofwhichwas postponedby) taxdeductions related to equity compensation in excess of

compensation recognized for financial reporting. Those deferred tax assets include non-qualified stockoptions and incentive stock

optionswe issued.Wewill increase stockholders’ equityby approximately$27.8million if andwhenwe ultimately realize such

deferred tax assets.We use tax returnordering for purposes of determiningwhen excess tax benefits have been realized.

At December 31, 2013, we had federal andCalifornia tax net operating loss carryforwards of approximately $685.8million

and$894.9million, respectively. Our Federal andCalifornia tax loss carryforwardswill expire at various dates starting in2014, unless

we use thembefore then. AtDecember 31, 2013, we alsohad federal andCalifornia research anddevelopment tax credit

carryforwards of approximately$62.6million and$22.2million, respectively. Our Federal research anddevelopment tax credit

carryforwards began expiring in2004 andwill continue to expire unlesswe use themprior to expiration. Our California research and

development tax credit carryforwards are available indefinitely. In2009, we had a substantial amount of taxable income andweused

a portionof our FederalNOL carryforwards to reduce our federal income taxes. We didnot use anyof our CaliforniaNOL

carryforwards tooffset our state taxes in2009becauseCalifornia suspended the use ofNOL carryforwards for 2009. As a result, our

FederalNOL carryforwards are lower thanourCaliforniaNOL carryforwards.