We want to do

the right thing

In a world where expectations of business are evolving rapidly, we want to be a role model for responsible growth and behaviour.

In a world where expectations of business are evolving rapidly, we want to be a role model for responsible growth and behaviour.

Rose Pitakaka,

Branch Manager, Gizo Branch

Solomon Islands

Our corporate responsibility (CR) framework was developed in consultation with more than 600 stakeholders, including staff, customers, community groups, NGOs, government and regulators.

It acknowledges the roles we can play in society – through helping individuals to build prosperity; through contributing to our local communities; and through growing our business responsibly.

| FIVE PRIORITY AREAS OF FOCUS GUIDE OUR DECISIONS, INVESTMENTS & INITIATIVES: | |

|

Responsible PracticesWe have introduced clear governance structures; are improving management of social, environmental and reputation risks and opportunities; and are supporting our customers facing hardship. |

|

Education and Employment OpportunitiesWe can make a significant and sustainable difference to the lives of disadvantaged and under-represented individuals through providing education and employment opportunities. |

|

Financial CapabilityOur programs are helping to build financial capability in our communities across our region, particularly for those on low incomes, and those from disadvantaged backgrounds. |

|

Bridging Urban & Rural Economic and Social DividesWe are playing a role in helping to bridge urban and rural divides through extending banking access and supporting financial inclusion. |

|

Urban SustainabilityWe can do much to reduce the environmental footprint of our business activities and to encourage and support our customers to reduce theirs. |

Investment and a strong focus on efficiency improvements has led to a 11% reduction in energy use in our commercial buildings since 2009.

Improving urban sustainability is an important priority for customers and communities wherever we operate. Increasingly, we live in urban centres faced with growing congestion, air quality and sanitation challenges.

ANZ seeks to better understand social and environmental pressures and to identify what we can do in our workplaces and branches to help improve sustainability. Through our business activity we also actively support customers to deliver sound environmental and social outcomes.

“The Clean Energy Council is Australia’s peak Renewable industry body, comprising more than 440 member companies operating in the fields of renewable energy and energy efficiency.

In May 2011, we were delighted to work with ANZ to stage the inaugural Clean Energy Week, the biggest clean energy conference ever held in Australia.

Clean Energy Week brought together industry, governments, stakeholders, and members of the public to celebrate clean energy – and to inform the wider community about the range of initiatives being delivered and developed by our innovative, committed members.

ANZ has a long-standing commitment to the renewable energy sector and a strong track record of financing projects and supporting innovation in urban sustainability. As the industry matures, we hope to continue working closely with ANZ to facilitate growth and to power the transition to a lower carbon economy in Australia.”

Matthew Warren,

Chief Executive,

Clean Energy Council

Our commitment to reducing ANZ’s environmental footprint has led to an improved sustainability performance, particularly in our commercial offices, which account for the majority of our carbon emissions.

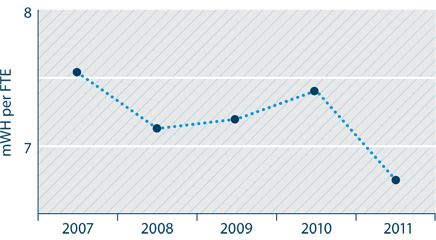

Investment and a strong focus on efficiency improvements has led to an 11% reduction in energy use in our commercial buildings since 2009. We have also cut the use of potable water in our Australian commercial offices by around one quarter over the same period.

Across our bank branch network we are investing as part of a rolling refurbishment program in a range of environmental initiatives such as more efficient lighting, controls and appliances with high levels of environmental performance and increased sub-metering.

When selecting new workplaces we are building on the strong environmental credentials of our global headquarters in Melbourne, the ANZ Centre, which was designed to produce 70% less carbon emissions than a standard office building and has achieved a ‘6 Star Green Star’ Design rating from the Green Building Council.

In Singapore we have recently moved into a new office which has been awarded Singapore’s highest environmental rating, ‘Green Mark Platinum’ and in Brisbane, we will move into a new ‘6 Star Green Star’ design rated office building in early 2012.

Despite strong gains in our environmental performance, we have faced challenges in reducing our absolute carbon emissions in Australia. ANZ’s business growth, including a number of acquisitions, has led to an increase in the absolute carbon emissions associated with the energy used at our data centres and our air travel. Business growth and ANZ’s rebranding in 2010 also affected our ability to reduce customer paper usage despite a 10% reduction in office paper.

In New Zealand, carbon emissions have reduced by 9% since 2009, well in excess of our 2.5% target. This has been achieved by improving our energy efficiency, reducing road travel, minimising our use of paper, less reliance on natural gas and an increasing use of renewable energy.

Across our global business, we remain committed to maintaining carbon neutrality through first reducing our footprint and then purchasing a range of international offsets to compensate for our unavoidable carbon emissions.

Premises energy reduction over 5 year period

|

|

PERFORMANCE |

|

Support the design, building and construction sectors in advancing urban sustainability by conducting education sessions at our 6 Star Green Star Global Headquarters. |

|

|

Maintain our carbon neutral commitment across our operations globally. |

|

|

Work towards achieving our two-year environmental |

AUS |

NZ |

|

» Absolute reduction in GHG |

|

|

|

» Premises energy per FTE |

|

|

|

» Paper consumed per FTE |

|

|

|

» Water use per FTE |

|

|

|

» Waste recycled |

|

|

|

Implement our revised Environmental Management System in a pilot market in Asia. |

|

For full commentary on progress against targets for 2011, and to view our key goals in 2012 visit: anz.com/cr-targets

Registered Office

ANZ Centre Melbourne

Level 9, 833 Collins Street

Docklands VIC 3008 Australia

Telephone +61 3 9273 5555

Facsimile +61 3 8542 5252

Company Secretary:

John Priestley

Investor Relations

Level 9, 833 Collins Street

Docklands VIC 3008 Australia

Telephone +61 3 8654 7682

Facsimile +61 3 8654 9977

Email: investor.relations@anz.com

Website: shareholder.anz.com

Group General Manager Investor Relations: Jill Craig

Corporate Affairs /

Corporate Responsibility

Level 9, 833 Collins Street

Docklands VIC 3008 Australia

Telephone +61 3 8654 3276

Facsimile +61 3 8654 9911

Group General Manager

Corporate Affairs:

Gerard Brown

Australia

Computershare Investor

Services Pty Ltd

GPO box 2975 Melbourne

VIC 3001 Australia

Telephone 1800 11 33 99

(within Australia)

+61 3 9415 4010

(International Callers)

Facsimile +61 3 9473 2500

anzshareregistry@computershare

.com.au

New Zealand

Private Bag 92119

Auckland 1142

New Zealand

Telephone 0800 174 007

Facsimile +64 9 488 8787

United Kingdom

The Pavilions

Bridgwater Road

Bristol BS99 6ZZ

United Kingdom

Telephone +44 870 702 0000

Facsimile +44 870 703 6101

United States

The Bank of New York

Mellon Corporation

Shareowner Services

BNY Mellon Shareowner Services

P.O. Box 358516

Pittsburgh, PA 15252-8516

Callers outside USA:

+1-201-680-6825

Callers within USA:

1-888-269-2377

Australia

New Zealand

Asia Cambodia, China, Hong Kong, India, Indonesia, Japan, Korea, Laos, Malaysia, The Philippines, Singapore, Taiwan, Thailand, Vietnam

Europe

Pacific American Samoa, Cook Islands, East Timor, Fiji, Guam, Kiribati, New Caledonia, Papua New Guinea, Samoa, Solomon Islands, Tonga, Vanuatu

Middle East

United Kingdom

United States Of America

You may also like to view the full Annual Report, which is available for you to download as a PDF.

Alternately, you can view the same document as an interactive document.

2 May 2012 Interim Results Announcement

10 May 2012 Interim Dividend Ex-Date

16 May 2012 Interim Dividend Record Date

2 July 2012 Interim Dividend Payment Date

25 October 2012 Annual Results Announcement

8 November 2012 Final Dividend Ex-Date

14 November 2012 Final Dividend Record Date

19 December 2012 Final Dividend Payment Date

19 December 2012 Annual General Meeting

* if there are any changes to these dates, the australian securities exchange will be notified accordingly.