Part II, Item 5

PART II

Item 5. Market for Schlumberger’s Common Stock, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

As of January 31, 2011, there were approximately 23,924 stockholders of record. The principal United States market

for Schlumberger’s common stock is the NYSE, where it is traded under the symbol “SLB”.

Schlumberger’s common stock is also traded on the Euronext Paris, Euronext Amsterdam, London and SIX Swiss

stock exchanges.

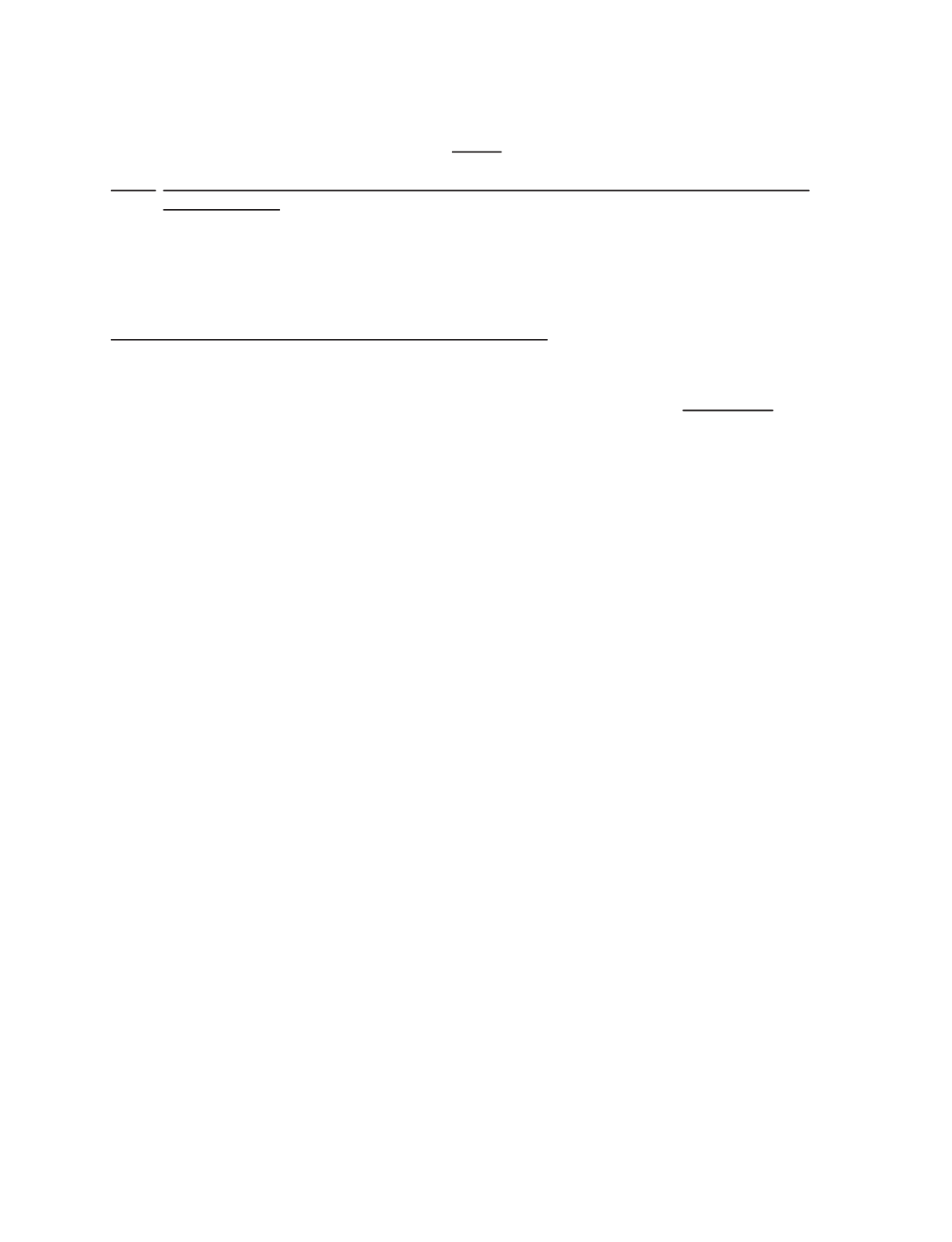

Common Stock, Market Prices and Dividends Declared per Share

Quarterly high and low prices for Schlumberger’s common stock as reported by the NYSE (composite transactions),

together with dividends declared per share in each quarter of 2010 and 2009, were:

High

Low

Dividends

Declared

Price Range

2010

QUARTERS

First

$72.00 $59.42 $0.210

Second

73.99 51.67

0.210

Third

63.72 52.91

0.210

Fourth

84.11 60.57

0.210

2009

QUARTERS

First

$ 49.25 $ 35.05 $ 0.210

Second

63.78

39.11

0.210

Third

63.00

48.13

0.210

Fourth

71.10

56.00

0.210

On January 21, 2011, Schlumberger announced that its Board of Directors had approved an increase in the quarterly

dividend of 19%, to $0.25.

There are no legal restrictions on the payment of dividends or ownership or voting of such shares, except as to shares

held as treasury stock. Under current legislation, stockholders are not subject to any Curaçao withholding or other

Curaçao taxes attributable to the ownership of such shares.

The following graph compares the yearly percentage change in the cumulative total stockholder return on

Schlumberger common stock, assuming reinvestment of dividends on the last day of the month of payment into

common stock of Schlumberger, with the cumulative total return on the Standard & Poor’s 500 Index (S&P 500 Index)

and the cumulative total return on the Philadelphia Oil Service Index (OSX) over the five-year period ending on

December 31, 2010. The stockholder return set forth below is not necessarily indicative of future performance. The

following graph and related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall

such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities

Exchange Act of 1934, except to the extent that Schlumberger specifically incorporates it by reference into such filing.

14