developments. There will be exploration activity around the potential that shale gas offers in many other parts of the

world.

Increased activity coupled with the greater technology needs of higher exploration, deepwater, and tight gas activity –

particularly outside North America – will make 2011 a stronger year for Schlumberger. The importance of risk reduction

and the minimization of drilling cost make the acquisitions of Geoservices and Smith major contributors to our future

growth in this scenario.

The following discussion and analysis of results of operations should be read in conjunction with the

Consolidated

Financial Statements

.

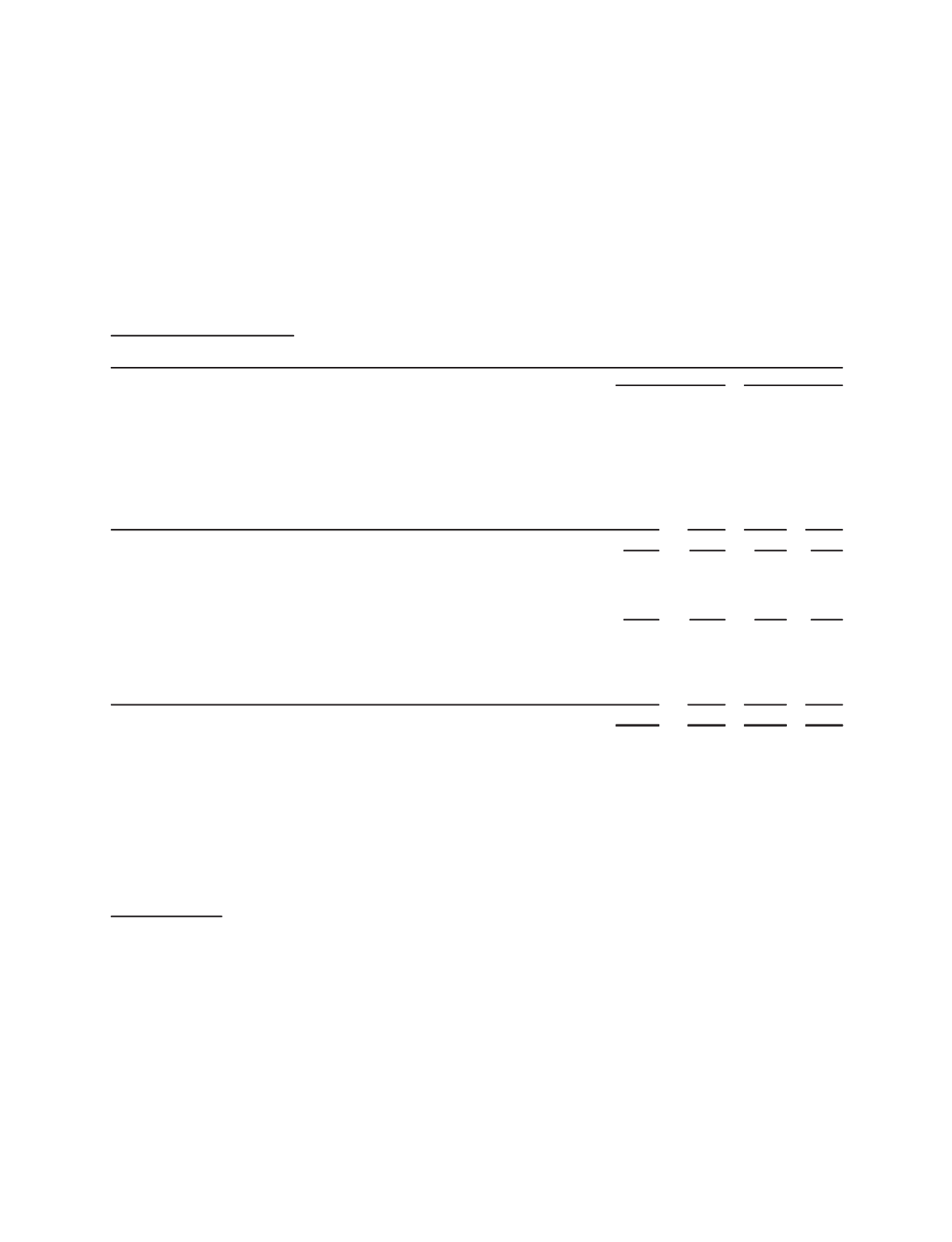

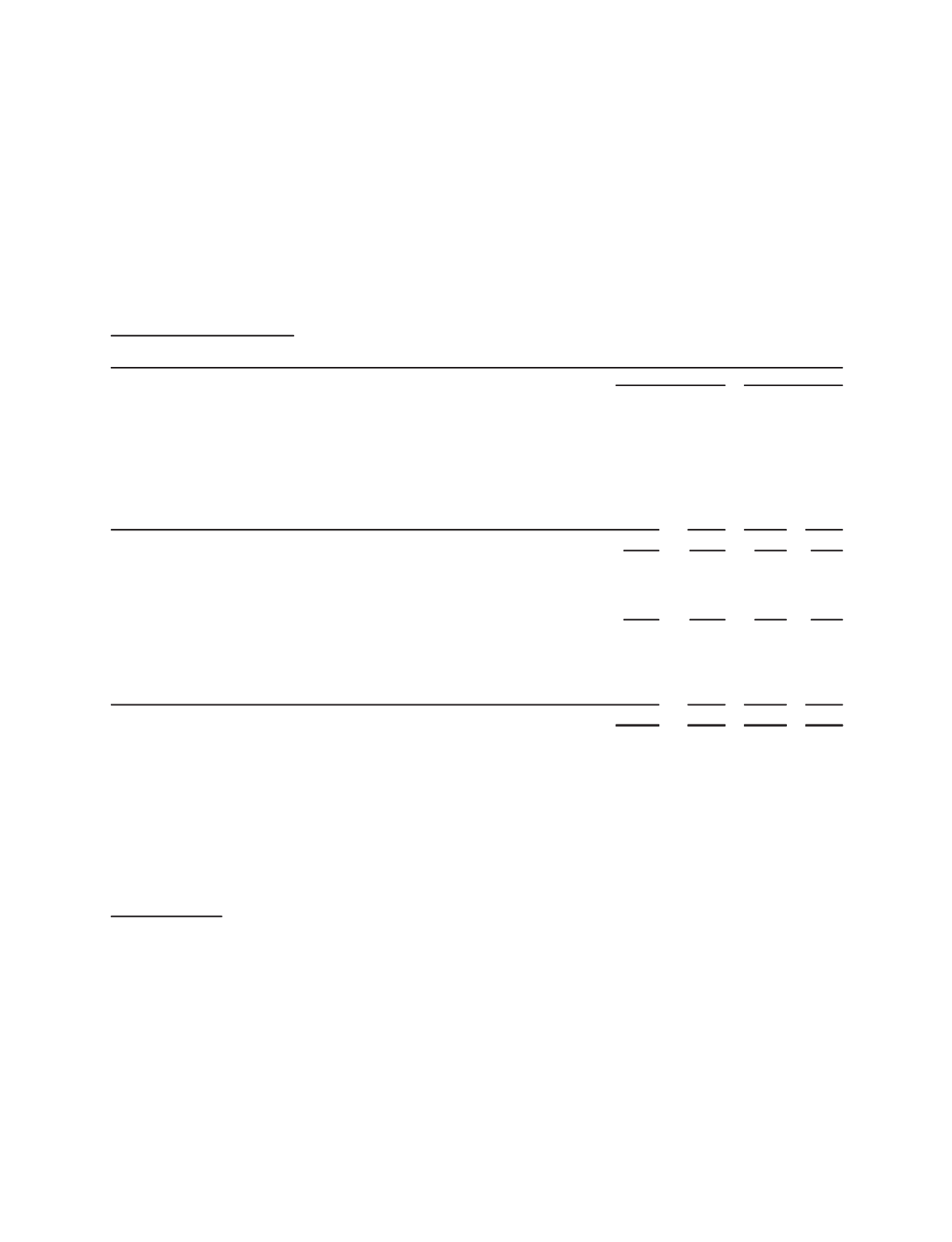

Fourth Quarter 2010 Results

Revenue

Income

before

taxes

Revenue

Income

before

taxes

Fourth Quarter 2010

Third Quarter 2010

(Stated in millions)

OILFIELD SERVICES

North America

$1,604 $ 385

$1,259 $ 219

Latin America

1,050

174

1,071

159

Europe/CIS/Africa

1,783

339

1,734

317

Middle East & Asia

1,491

434

1,402

425

Elims/Other

81

(1)

71

(18)

6,009

1,331

5,537

1,102

WESTERNGECO

560

113

478

40

M-I SWACO

(1)

1,185

149

383

48

SMITH OILFIELD

(1)

729

106

228

27

DISTRIBUTION

(1)

576

21

199

9

9,059

1,720

6,825

1,226

Corporate

(2)

8

(156)

20

(81)

Interest income

(3)

9

10

Interest expense

(4)

(58)

(51)

Charges & credits

(5)

(180)

836

$9,067 $1,335

$6,845 $1,940

(1) The third quarter of 2010 includes one month of post-merger activity following the Smith transaction on August 27, 2010. See Note 4 to the

Consolidated Financial Statements

for further details.

(2) Comprised principally of corporate expenses not allocated to the segments, interest on postretirement medical benefits, stock-based compen-

sation costs, amortization expense associated with intangible assets recorded as a result of the merger with Smith and certain other nonoperating

items.

(3) Excludes interest income included in the segments’ income (fourth quarter 2010 – $1 million; third quarter 2010 – $2 million).

(4) Excludes interest expense included in the segments’ income (fourth quarter 2010 - $2 million; third quarter 2010 – $- million).

(5) Charges and credits are described in detail in Note 3 to the

Consolidated Financial Statements

.

Oilfield Services

Fourth-quarter revenue of $6.01 billion increased 9% sequentially. Sequentially, North America Area revenue

increased 27% on strong activity on land in the US and Canada as well as from the early payout of an IPM gain

share project. In the Middle East & Asia Area, revenue grew on year-end equipment, Schlumberger Information

Solutions (SIS) software sales, and on higher activity in the Iraq, East Asia and Indonesia GeoMarkets. Europe/CIS/

Africa Area revenue increased from stronger activity in the North Sea, West & South Africa, Caspian and Continental

Europe GeoMarkets, as well as from year-end SIS software sales. These increases were partially offset by a decrease in

Latin America Area revenue primarily due to continuing weakness in the Mexico/Central America GeoMarket.

All Technologies recorded sequential growth, most notably Well Services due to continuing strong activity in North

America, and SIS and Artificial Lift from year-end sales. IPM revenue also increased as a result of the early payout on the

IPM project in North America.

19

Part II, Item 7