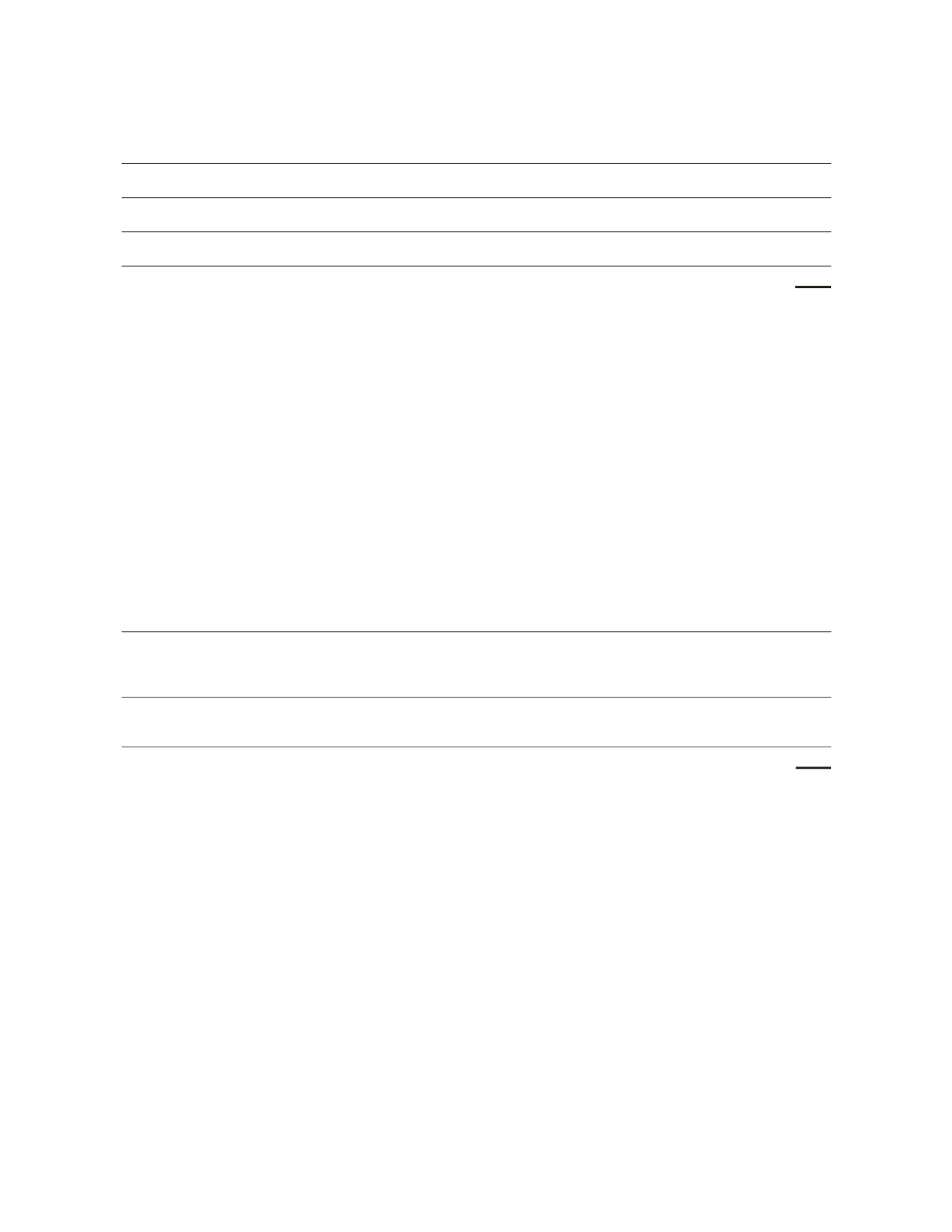

(Stated in millions, except exchange ratio and per share amounts)

Number of shares of Smith common stock outstanding as of the acquisition date

248

Number of Smith unvested restricted stock units outstanding as of the acquisition date

4

252

Multiplied by the exchange ratio

0.6966

Equivalent Schlumberger shares of common stock issued

176

Schlumberger closing stock price on August 27, 2010

$ 55.76

Common stock equity consideration

$ 9,812

Fair value of Schlumberger equivalent stock options issued

16

Total fair value of the consideration transferred

$ 9,828

Certain amounts reflect rounding adjustments

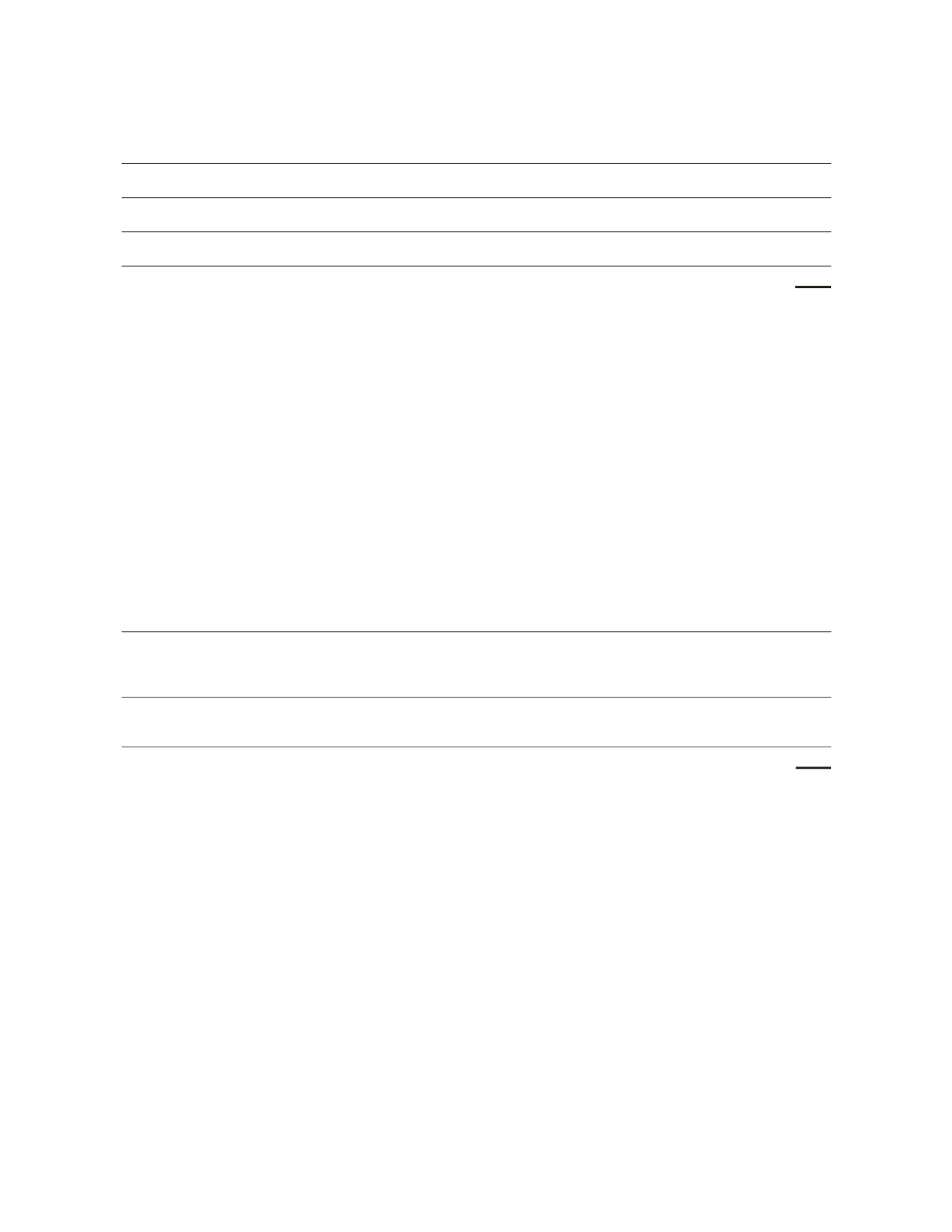

Allocation of Consideration Transferred to Net Assets Acquired

The following amounts represent the preliminary estimates of the fair value of identifiable assets acquired and

liabilities assumed in the acquisition as of December 31, 2010.

(Stated in millions)

Cash

$ 399

Receivables

1,831

Inventories

(1)

2,013

Fixed assets

2,017

Intangible assets:

Tradenames (weighted-average life of 25 years)

1,560

Technology (weighted-average life of 16 years)

1,170

Customer relationships (weighted average life of 23 years)

1,360

Other assets

429

Accounts payable and accrued liabilities

(1,460)

Long-term debt

(2)

(2,141)

Deferred taxes

(3)

(1,936)

Other liabilities

(528)

$ 4,714

Less:

Investment in M-I SWACO

(4)

(1,429)

Noncontrolling interests

(111)

Total identifiable net assets

$ 3,174

Gain on investment in M-I SWACO

(4)

(1,238)

Goodwill

(5)

7,892

Total consideration transferred

$ 9,828

The preliminary allocation of the consideration transferred to net assets acquired presented in the table above was

revised in 2011 to reflect the final allocations. The net result of adjustments made in 2011, which primarily related to

deferred taxes and accrued liabilities, was to increase goodwill by $194 million.

47