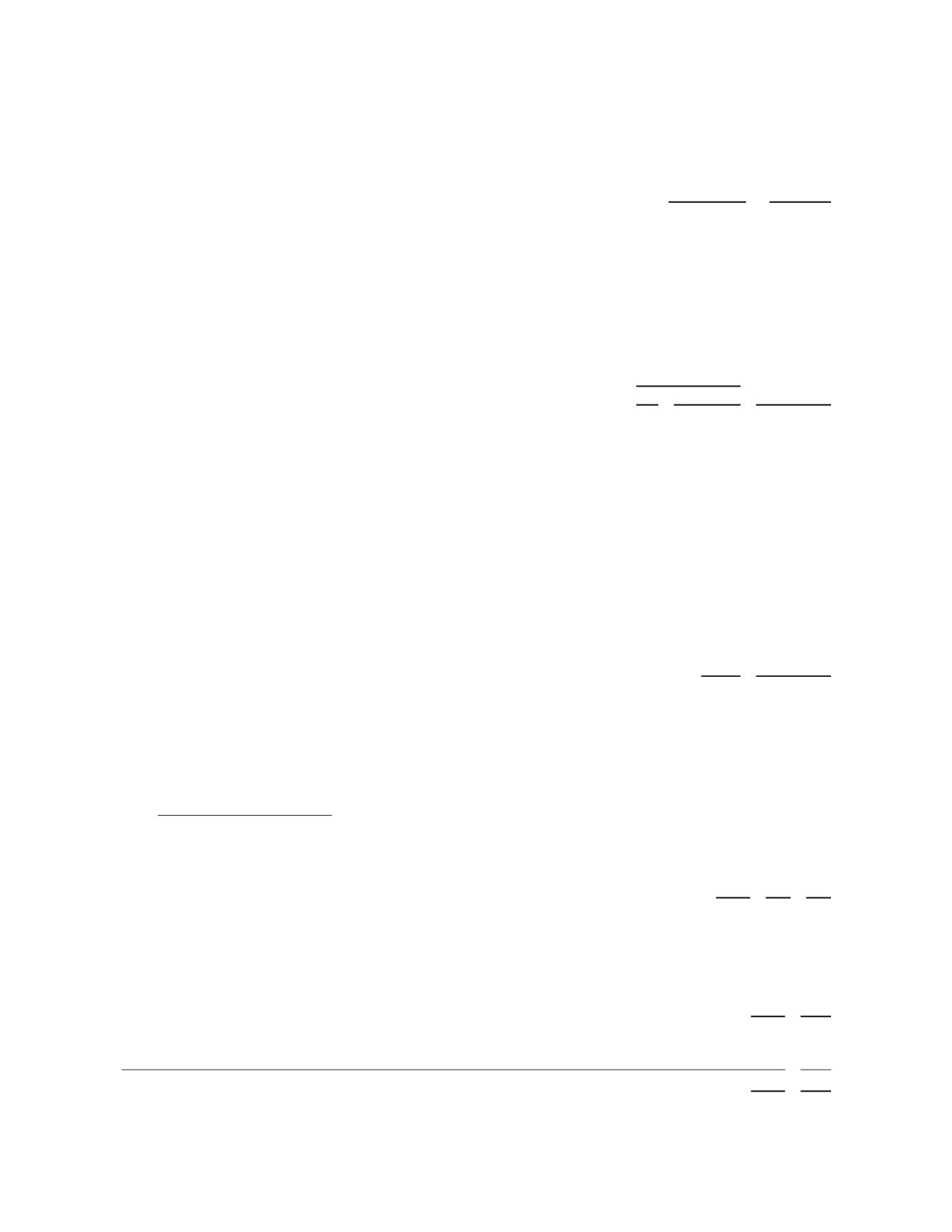

Assumed health care cost trend rates have a significant effect on the amounts reported for the US postretirement

medical plan. A one percentage point change in assumed health care cost trend rates would have the following effects:

(Stated in millions)

One percentage

point increase

One percentage

point decrease

Effect on total service and interest cost components

$ 16

$ (13)

Effect on accumulated postretirement benefit obligation

$196

$(160)

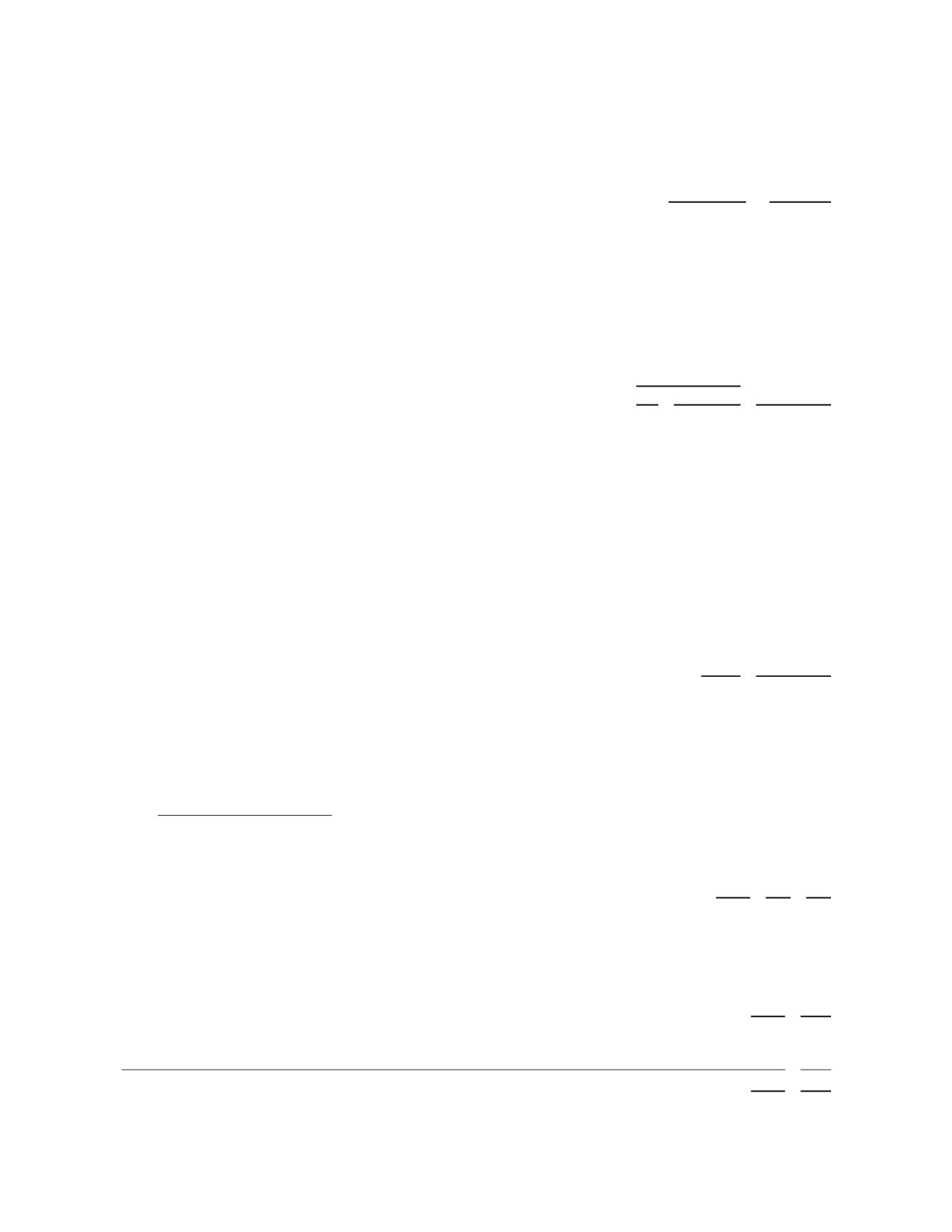

Other Information

The expected benefits to be paid under the US and International pension plans as well as the postretirement

medical plan (which is disclosed net of the annual Medicare Part D subsidy, which ranges from $3 million to $6 million

per year) were as follows:

(Stated in millions)

Pension Benefits

Postretirement

Medical Plan

US International

2012

$135

$ 156

$ 45

2013

139

168

49

2014

143

183

52

2015

149

197

55

2016

155

215

59

2017- 2021

911

1,250

352

Included in

Accumulated other comprehensive loss

at December 31, 2011 are non-cash pretax charges which have

not yet been recognized in net periodic benefit cost. The estimated amounts that will be amortized from the estimated

portion of each component of

Accumulated other comprehensive loss

which is expected to be recognized as a

component of net periodic benefit cost during the year-ending December 31, 2012 are as follows:

(Stated in millions)

Pension

Plans

Postretirement

Medical

Plan

Net actuarial losses

$104

$18

Prior service cost (credit)

$132

$(8)

In addition to providing defined pension benefits and a postretirement medical plan, Schlumberger and its

subsidiaries have other deferred benefit programs, primarily profit sharing and defined contribution pension plans.

Expenses for these programs were $582 million, $403 million and $418 million in 2011, 2010 and 2009, respectively.

19. Supplementary Information

Cash paid for interest and income taxes was as follows:

(Stated in millions)

2011 2010 2009

Interest

$ 294

$234 $249

Income taxes

$1,836

$571 $665

Accounts payable and accrued liabilities

are summarized as follows:

(Stated in millions)

2011 2010

Payroll, vacation and employee benefits

$1,597

$1,414

Trade

3,389

2,649

Other

2,593

2,425

$7,579

$6,488

69