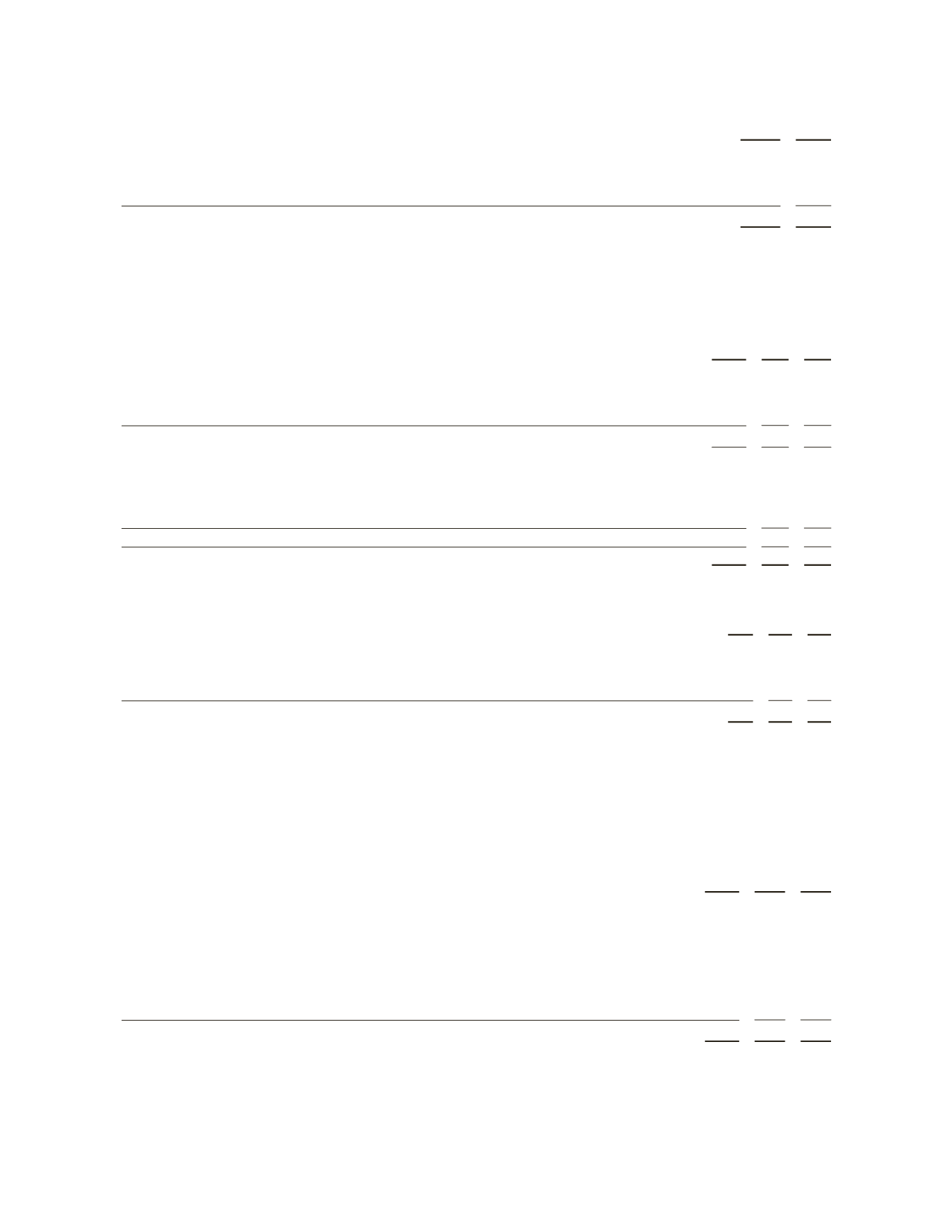

(Stated in millions)

2011

2010

Postretirement benefits

$ 440

$ 327

Intangible assets

(1,498)

(1,674)

Investments in non-US subsidiaries

(349)

(353)

Other, net

132

115

$(1,275)

$(1,585)

The above deferred tax balances at December 31, 2011 and 2010 were net of valuation allowances relating to net

operating losses in certain countries of $239 million and $263 million, respectively.

The components of

Taxes on income

were as follows:

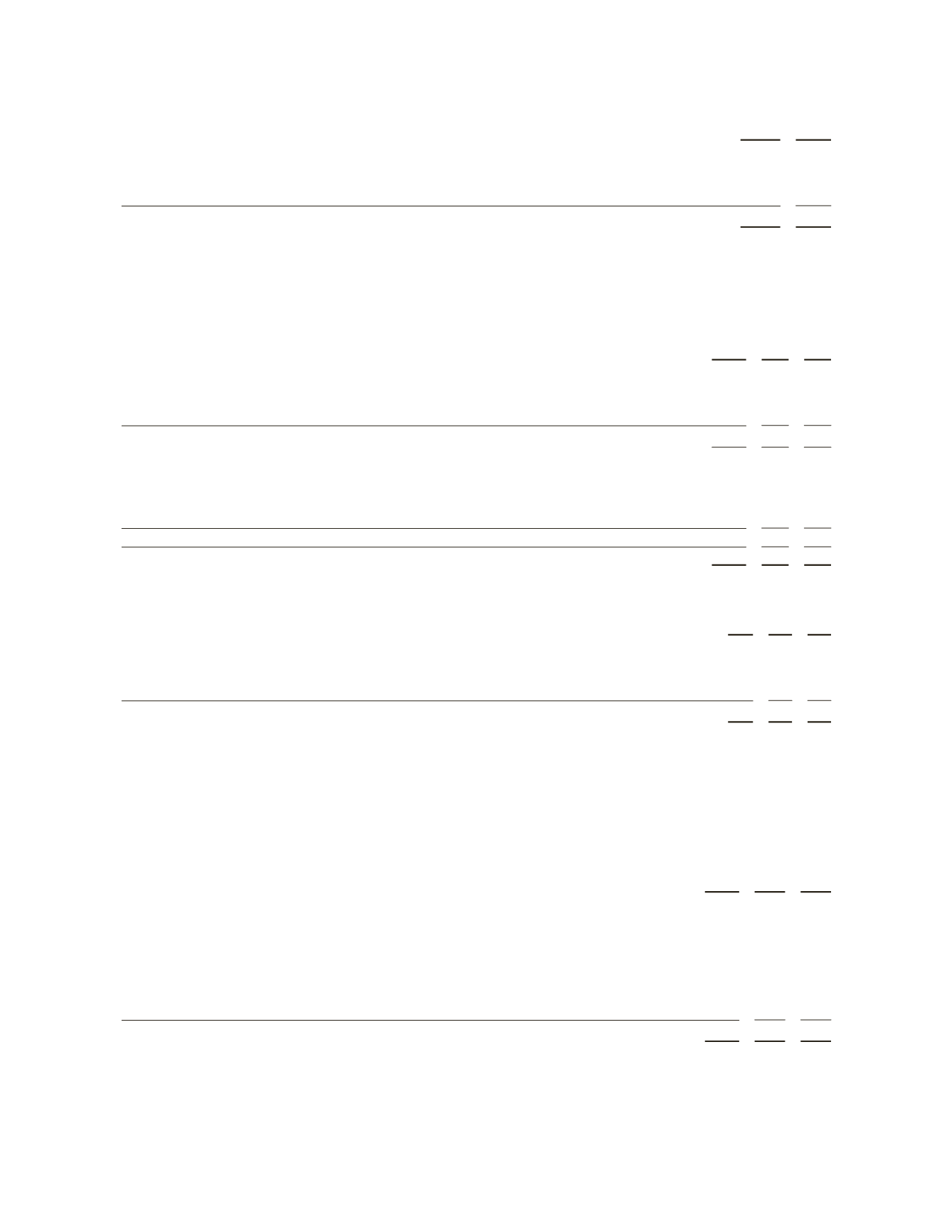

(Stated in millions)

2011

2010 2009

Current:

United States – Federal

$ 842

$ 76 $(191)

United States – State

45

14

(6)

Outside United States

693

909 594

$1,580

$ 999 $ 397

Deferred:

United States – Federal

$ (80)

$ 183 $ 247

United States – State

(7)

2

13

Outside United States

73

(281)

86

Valuation allowance

(21)

(13)

27

$ (35)

$(109) $ 373

Consolidated taxes on income

$1,545

$ 890 $ 770

A reconciliation of the United States statutory federal tax rate (35%) to the consolidated effective tax rate is:

2011

2010 2009

US statutory federal rate

35%

35% 35%

Non-US income taxed at different rates

(10)

(14) (16)

Charges and credit (See Note 3)

—

(3)

1

Other

(1)

(1) —

Effective income tax rate

24%

17% 20%

Schlumberger conducts business in more than 100 tax jurisdictions, a number of which have tax laws that are not

fully defined and are evolving. Schlumberger’s tax filings are subject to regular audit by the tax authorities. Tax

liabilities are recorded based on estimates of additional taxes which will be due upon the conclusion of these audits.

A reconciliation of the beginning and ending amount of liabilities associated with uncertain tax positions for the

years ended December 31, 2011, 2010 and 2009 is as follows:

(Stated in millions)

2011

2010 2009

Balance at beginning of year

$1,338

$1,026 $ 877

Additions based on tax positions related to the current year

153

190

178

Additions for tax positions of prior years

49

8

36

Additions related to acquisitions

48

288 —

Impact of changes in exchange rates

(18)

(3)

39

Settlements with tax authorities

(77)

(36)

(16)

Reductions for tax positions of prior years

(102)

(99)

(68)

Reductions due to the lapse of the applicable statute of limitations

(38)

(36)

(20)

Balance at end of year

$1,353

$1,338 $1,026

The amounts above exclude accrued interest and penalties of $225 million, $210 million and $168 million at

December 31, 2011, 2010 and 2009 respectively.

59