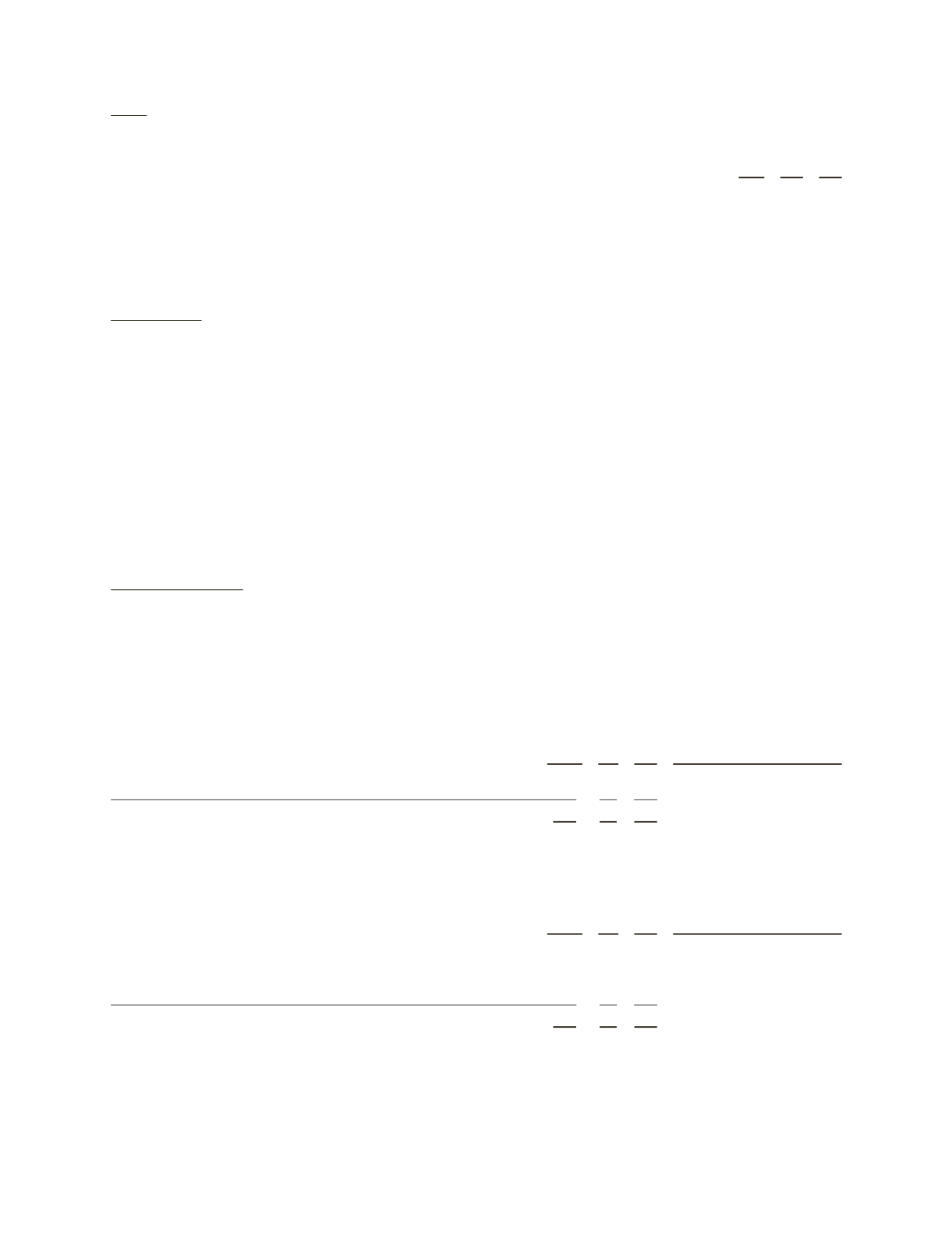

Other

Research & engineering

and

General & administrative

expenses, as a percentage of

Revenue

, were as follows:

2012

2011 2010

Research & engineering

2.8%

2.9% 3.4%

General & administrative

1.0%

1.1% 1.2%

Although

Research & engineering

decreased as a percentage of revenue in 2011 as compared to 2010, it increased in

absolute dollars by $154 million. This increase in absolute dollars was driven in large part by the impact of the Smith

acquisition.

Income Taxes

The Schlumberger effective tax rate was 24.0% in 2012, 24.2% in 2011, and 17.1% in 2010.

The Schlumberger effective tax rate is sensitive to the geographic mix of earnings. When the percentage of pretax

earnings generated outside of North America increases, the Schlumberger effective tax rate will generally decrease.

Conversely, when the percentage of pretax earnings generated outside of North America decreases, the Schlumberger

effective tax rate will generally increase.

The effective tax rate for both 2011 and 2010 was impacted by the charges and credits described in Note 3 to the

Consolidated Financial Statements

. Excluding the impact of these charges and credits, the effective tax rate in 2011

was 23.8% compared to 20.5% in 2010. This increase in the effective tax rate, excluding the impact of the charges and

credits, was primarily attributable to the fact that Schlumberger generated a larger proportion of its pretax earnings in

North America in 2011 as compared to 2010 as a result of improved market conditions and the effect of a full year’s

activity from the acquired Smith businesses.

Charges and Credits

Schlumberger recorded significant charges and credits in continuing operations during 2012, 2011 and 2010. These

charges and credits, which are summarized below, are more fully described in Note 3 to the

Consolidated Financial

Statements

.

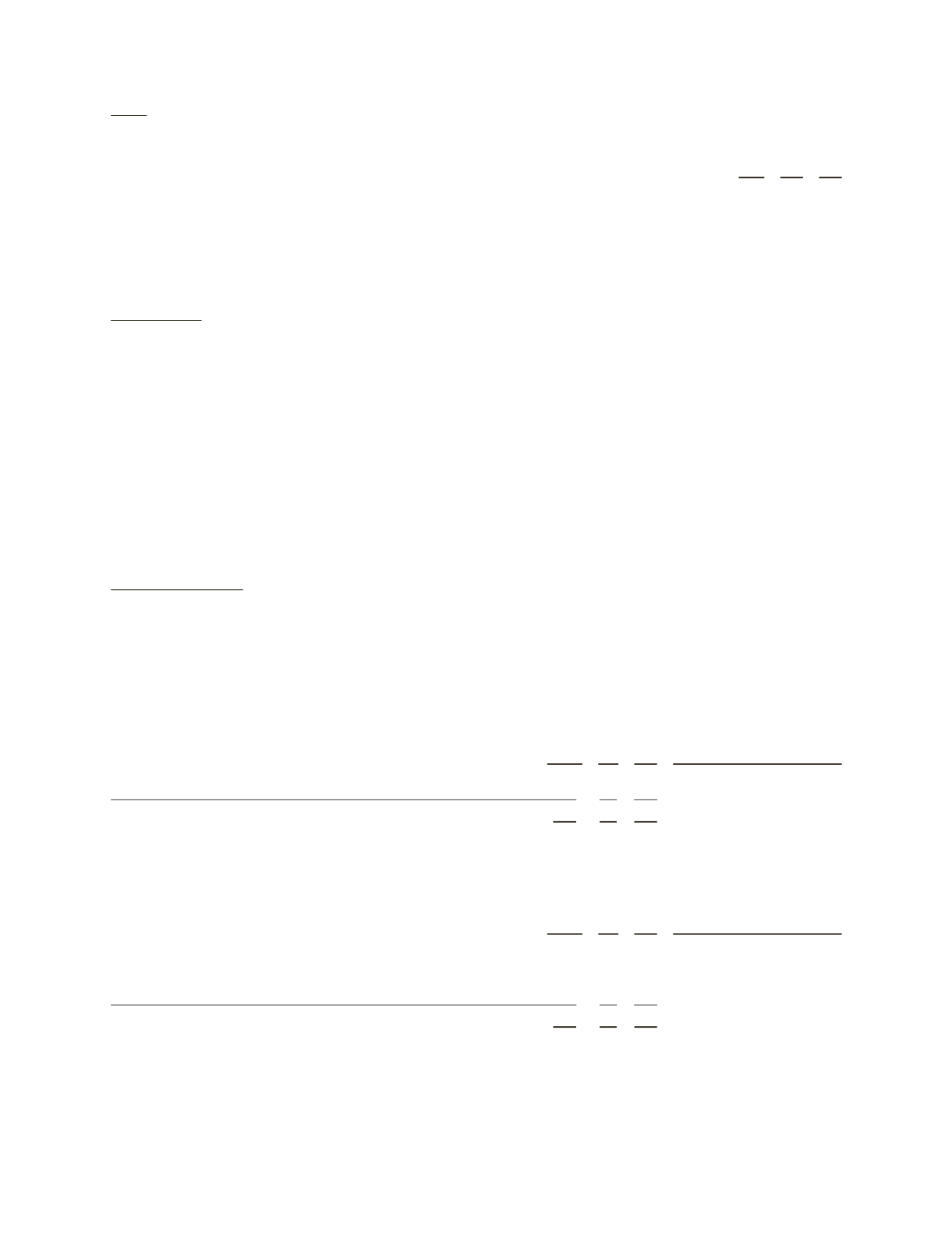

The following is a summary of the 2012 charges and credits:

(Stated in millions)

Pretax Tax Net

Consolidated Statement

of Income Classification

Merger-related integration costs

$128 $16 $112

Merger & integration

Workforce reduction

33

6

27

Restructuring & other

$161 $22 $139

The following is a summary of the 2011 charges and credits:

(Stated in millions)

Pretax Tax Net

Consolidated Statement

of Income Classification

Merger-related integration costs

$113 $18 $ 95

Merger & integration

Donation to the Schlumberger Foundation

50

10

40

General & administrative

Write-off of assets in Libya

60

– 60

Cost of revenue

$223 $28 $195

23