As of December 31, 2012, Schlumberger had approximately $6.3 billion of cash and short-term investments on hand.

Schlumberger had separate committed debt facility agreements aggregating $4.1 billion with commercial banks, of

which $3.8 billion was available and unused as of December 31, 2012. This included $3.5 billion of committed facilities

which support commercial paper borrowings in the United States and Europe. Schlumberger believes that these

amounts are sufficient to meet future business requirements for at least the next 12 months.

Schlumberger did not have any commercial paper borrowings outstanding as of December 31, 2012.

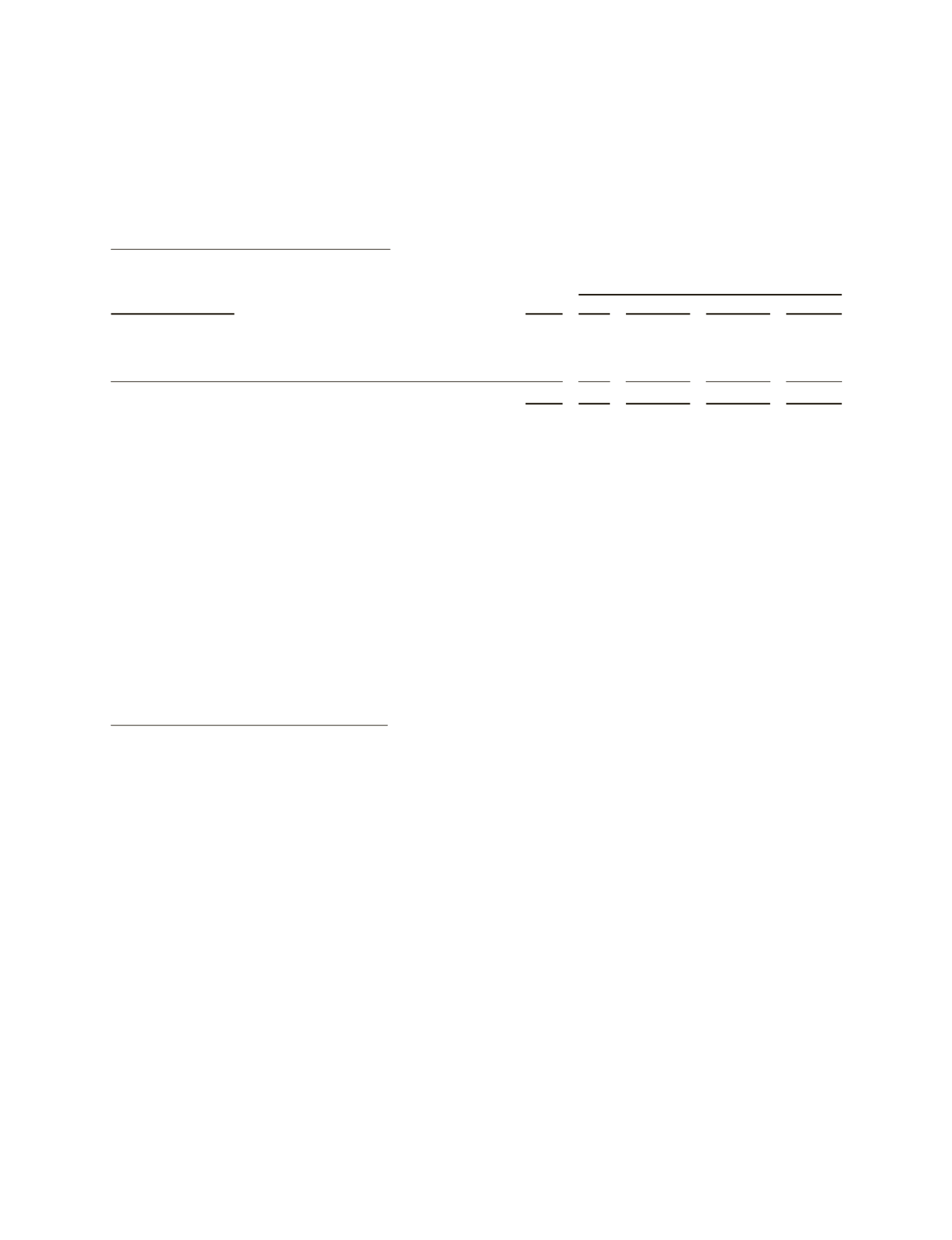

Summary of Major Contractual Obligations

(Stated in millions)

Payment Period

Contractual Obligations

Total

2013 2014 – 2015 2016 – 2017 After 2017

Debt

(1)

$11,630 $2,121

$2,975

$2,842

$3,692

Interest on fixed rate debt obligations

(2)

1,445

292

425

282

446

Operating leases

1,615

371

442

283

519

Purchase obligations

(3)

1,574 1,432

138

4

–

$16,264 $4,216

$3,980

$3,411

$4,657

(1)

Excludes future payments for interest.

(2)

Excludes interest on $1.6 billion of variable rate debt, which had a weighted average interest rate of 3.6% as of December 31, 2012.

(3)

Represents an estimate of contractual obligations in the ordinary course of business. Although these contractual obligations are considered

enforceable and legally binding, the terms generally allow Schlumberger the option to reschedule and adjust its requirements based on

business needs prior to the delivery of goods.

Refer to Note 18

Pension and Other Benefit Plans

of the

Consolidated Financial Statements

for details regarding

Schlumberger’s pension and other postretirement benefit obligations.

As discussed in Note 14

Income Taxes

of the

Consolidated Financial Statements

, included in the Schlumberger

Consolidated Balance Sheet

at December 31, 2012 is approximately $1.45 billion of liabilities associated with uncertain

tax positions in the over 100 jurisdictions in which Schlumberger conducts business. Due to the uncertain and complex

application of tax regulations, combined with the difficulty in predicting when tax audits throughout the world may be

concluded, Schlumberger cannot make reliable estimates of the timing of cash outflows relating to these liabilities.

Schlumberger has outstanding letters of credit/guarantees which relate to business performance bonds,

custom/excise tax commitments, facility lease/rental obligations, etc. These were entered into in the ordinary course of

business and are customary practices in the various countries where Schlumberger operates.

Critical Accounting Policies and Estimates

The preparation of financial statements and related disclosures in conformity with accounting principles generally

accepted in the United States requires Schlumberger to make estimates and assumptions that affect the reported

amounts of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts of

revenue and expenses. The following accounting policies involve “critical accounting estimates” because they are

particularly dependent on estimates and assumptions made by Schlumberger about matters that are inherently

uncertain. A summary of all of Schlumberger’s significant accounting policies is included in Note 2 to the

Consolidated

Financial Statements

.

Schlumberger bases its estimates on historical experience and on various assumptions that are believed to be

reasonable under the circumstances, the results of which form the basis for making judgments about the carrying

values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these

estimates under different assumptions or conditions.

Multiclient Seismic Data

The WesternGeco business capitalizes the costs associated with obtaining multiclient seismic data. The carrying

value of the multiclient seismic data library at December 31, 2012 and 2011 was $518 million and $425 million,

respectively. Such costs are charged to

Cost of revenue

based on the percentage of the total costs to the estimated total

revenue that Schlumberger expects to receive from the sales of such data. However, under no circumstances will an

individual survey carry a net book value greater than a 4-year, straight-line amortized value.

The carrying value of surveys is reviewed for impairment annually as well as when an event or change in

circumstance indicates an impairment may have occurred. Adjustments to the carrying value are recorded when it is

27