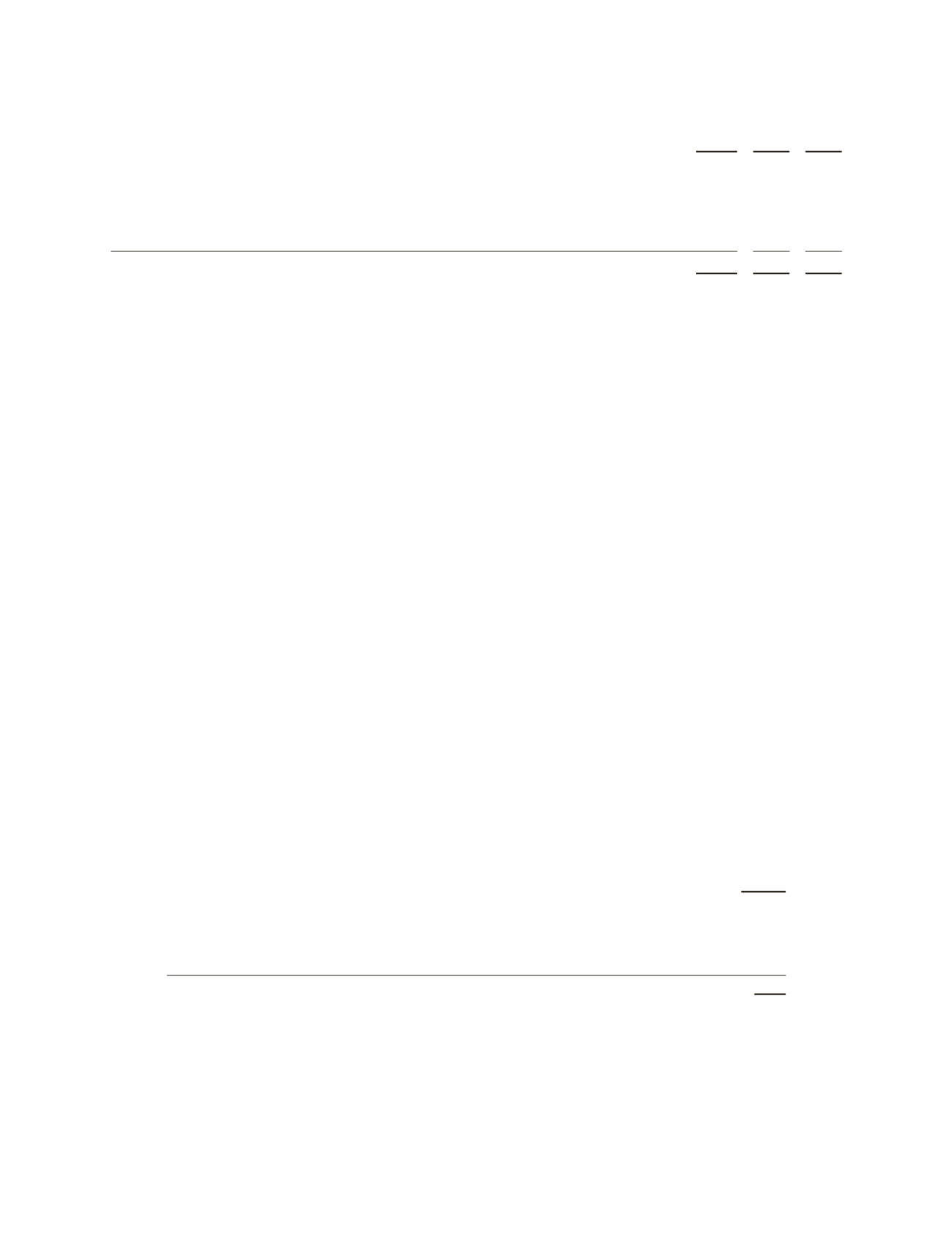

(Stated in millions)

Components of Net Debt

Dec. 31

2012

Dec. 31

2011

Dec. 31

2010

Cash

$ 1,905

$ 1,705 $ 1,764

Short-term investments

4,369

3,122 3,226

Fixed income investments, held to maturity

245

256

484

Short-term borrowings and current portion of long-term debt

(2,121)

(1,377) (2,595)

Long-term debt

(9,509)

(8,556) (5,517)

$(5,111)

$(4,850) $(2,638)

Key liquidity events during 2012, 2011 and 2010 included:

Š

During the third quarter of 2012, Schlumberger issued $1 billion of 1.25% Senior Notes due 2017 and $1 billion

of 2.40% Senior Notes due 2022.

Š

During the third quarter of 2012, Schlumberger completed the divestiture of its 56% interest in CE Franklin

Ltd. for $122 million in cash.

Š

During the second quarter of 2012, Schlumberger completed the divestiture of its Wilson distribution business

for $906 million in cash.

Š

During the third quarter of 2011, Schlumberger issued $1.1 billion of 1.95% Senior Notes due 2016, $1.6 billion

of 3.30% Senior Notes due 2021 and $300 million of Floating Rate Senior Notes due 2014 that bear interest at a

rate equal to three-month LIBOR plus 55 bps per year.

Š

During the second quarter of 2011, Schlumberger completed the divestiture of its Global Connectivity Services

business for approximately $385 million in cash.

Š

During the first quarter of 2011, Schlumberger issued $1.1 billion of 4.20% Senior Notes due 2021 and

$500 million of 2.65% Senior Notes due 2016.

Š

During the first quarter of 2011, Schlumberger repurchased all of its outstanding 9.75% Senior Notes due 2019,

8.625% Senior Notes due 2014 and 6.00% Senior Notes due 2016 for approximately $1.26 billion.

Š

As a result of the Smith acquisition on August 27, 2010, Schlumberger assumed net debt of $1.8 billion. This

amount consisted of $2.2 billion of debt (including a $0.4 billion adjustment to increase Smith’s long-term

fixed rate debt to its estimated fair value) and $0.4 billion of cash.

Š

During the second quarter of 2010, Schlumberger completed the acquisition of Geoservices for cash of

$0.9 billion. Schlumberger assumed net debt of $0.1 billion in connection with this transaction.

Š

During the third and fourth quarters of 2010, Schlumberger repurchased the following debt:

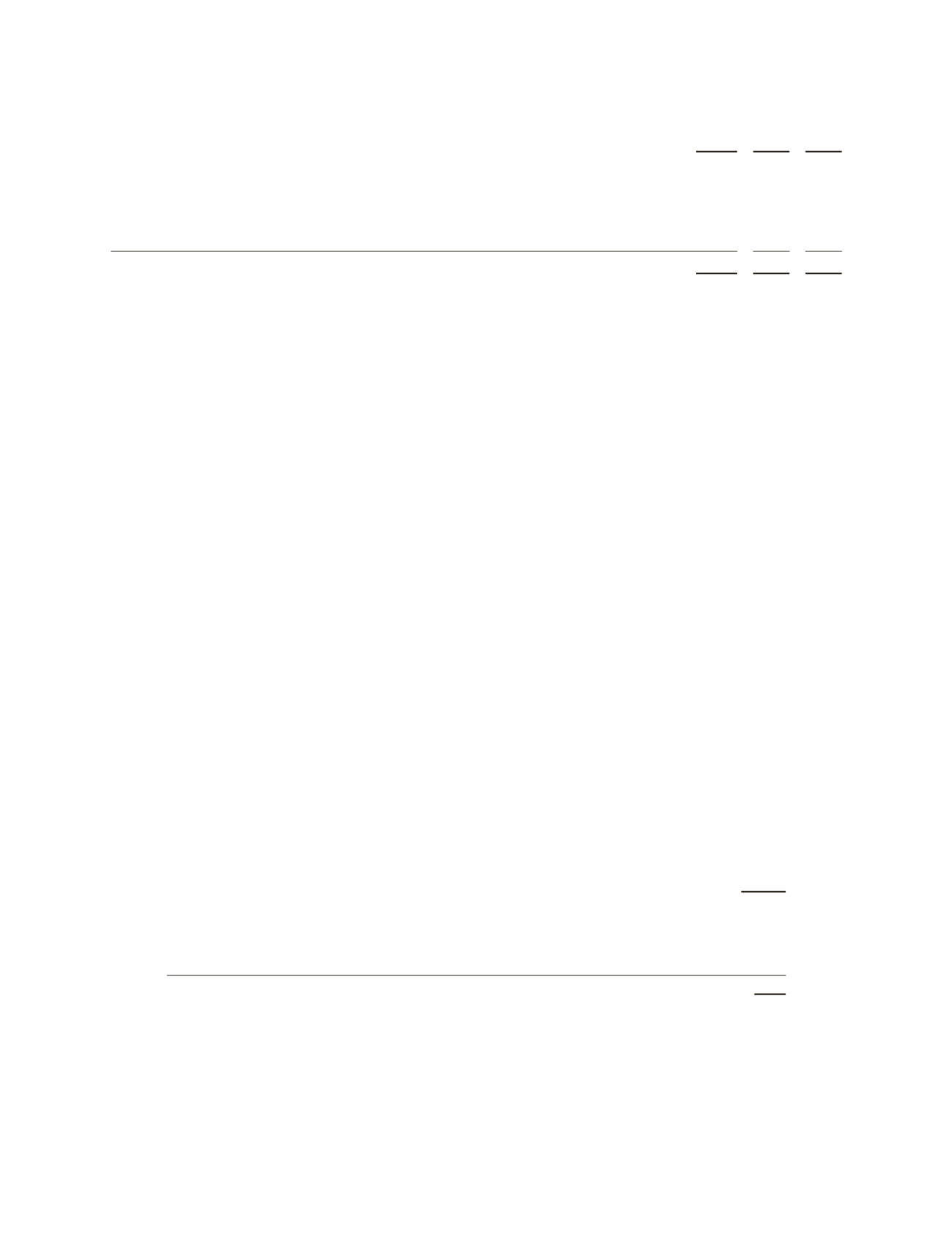

(Stated in millions)

Carrying

Value

6.50% Notes due 2012

$ 649

6.75% Senior Notes due 2011

224

9.75% Senior Notes due 2019

212

6.00% Senior Notes due 2016

102

8.625% Senior Notes due 2014

88

$1,275

The premium paid in excess of the carrying value to repurchase the $1.275 billion of debt was approximately

$67 million.

Š

Schlumberger maintains a

€

3.0 billion Euro Medium Term Note program. This program provides for the

issuance of various types of debt instruments such as fixed or floating rate notes in Euro, US dollar or other

currencies.

25