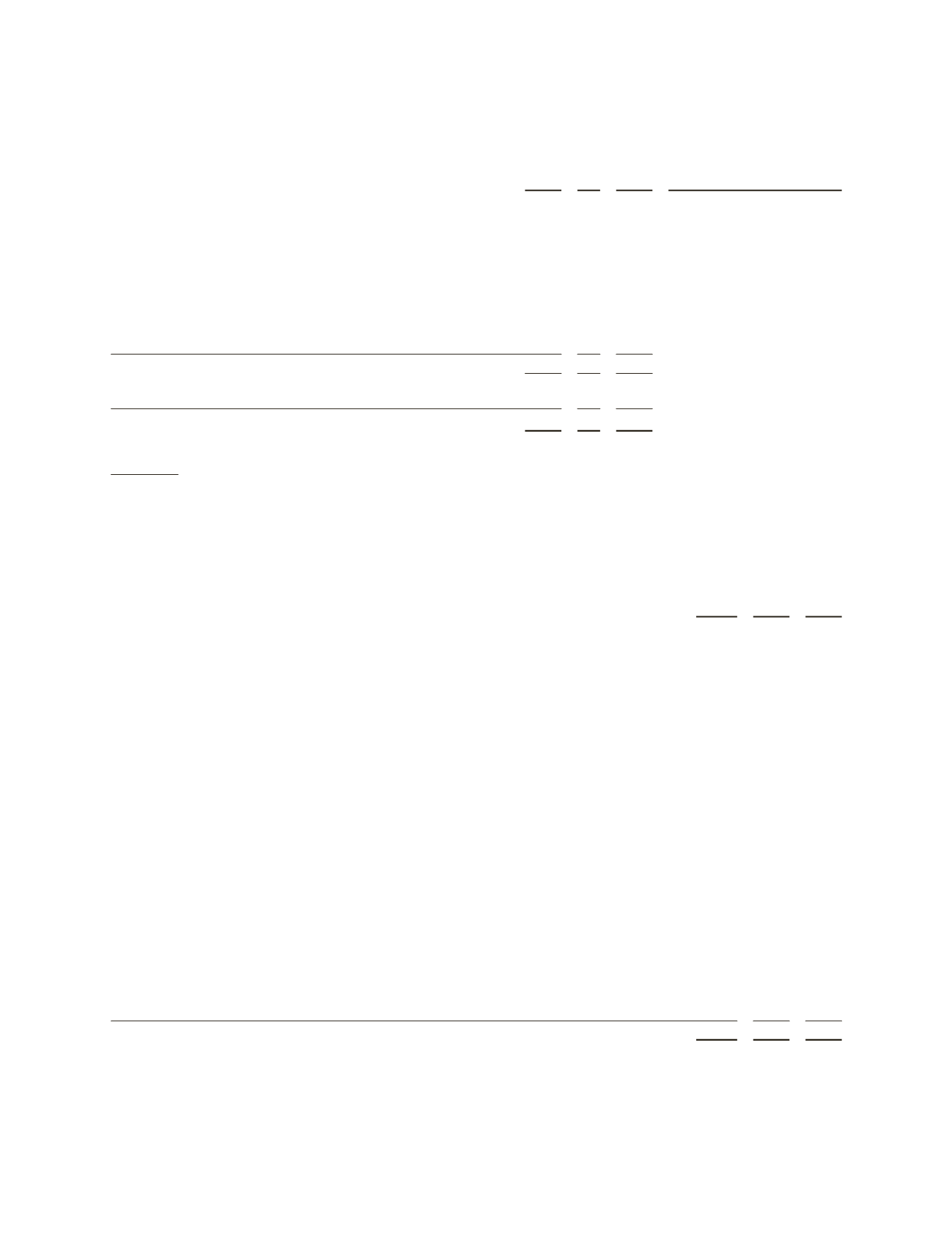

The following is a summary of the 2010 charges and credits:

(Stated in millions)

Pretax Tax Net

Consolidated Statement

of Income Classification

Restructuring and Merger-related Charges:

Severance and other

$ 90 $ 13 $ 77

Restructuring &other

Impairment relating to WesternGeco’s first generation Q-Land acquisition

system

78

7

71

Restructuring & other

Other WesternGeco-related charges

63

–

63

Restructuring & other

Professional fees and other

107

1

106

Merger & integration

Merger-related employee benefits

54 10

44

Merger & integration

Inventory fair value adjustments

153 56

97

Cost of revenue

Mexico restructuring

40

4

36

Restructuring & other

Repurchase of bonds

60 23

37

Restructuring & other

Total restructuring and merger-related charges

645 114

531

Gain on investment in M-I SWACO

(1,270) (32) (1,238)

Gain on Investment in M-I SWACO

Impact of elimination of tax deduction related to Medicare Part D subsidy

– (40)

40

Taxes on income

$ (625) $ 42 $ (667)

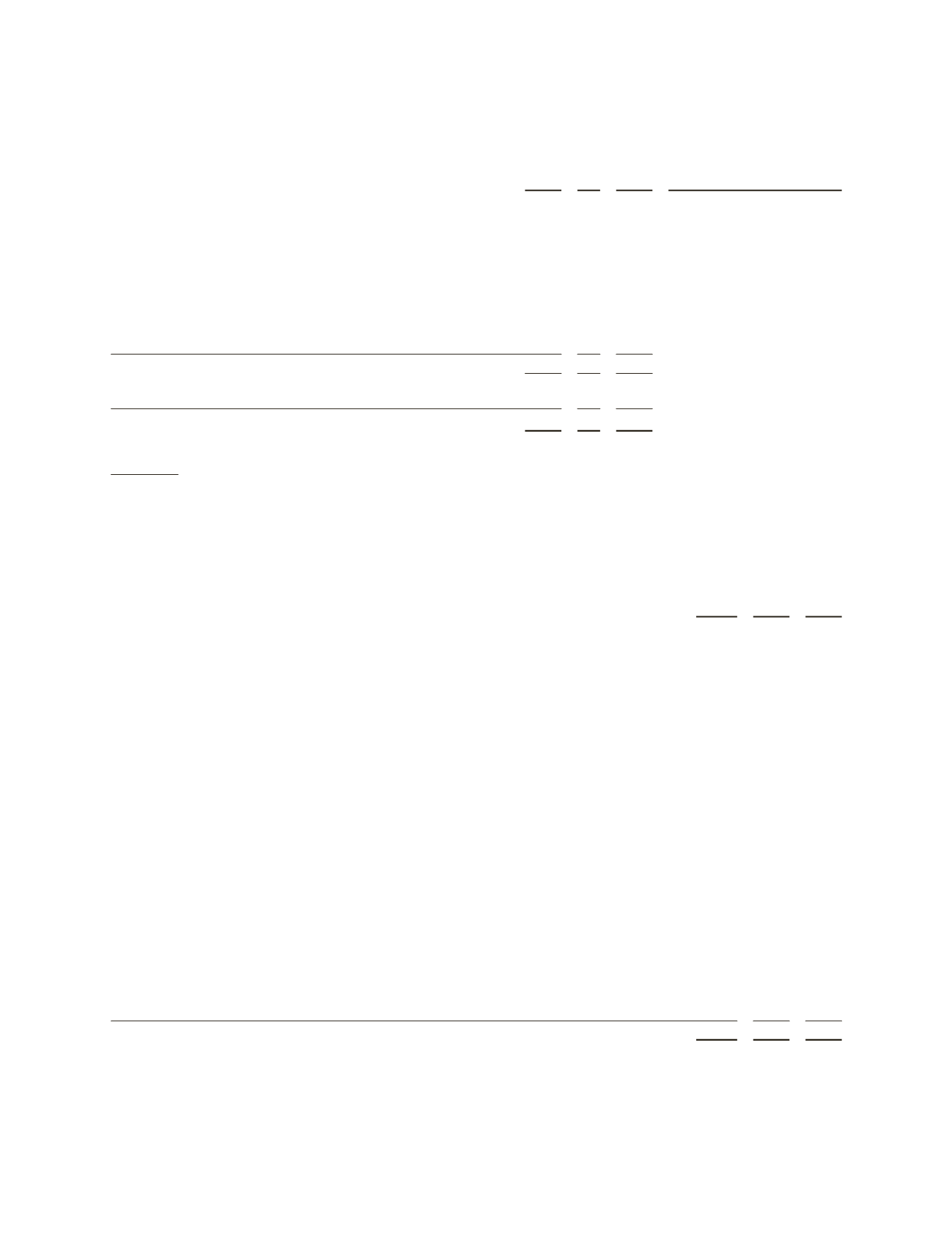

Cash Flow

Net Debt represents gross debt less cash, short-term investments and fixed income investments, held to maturity.

Management believes that Net Debt provides useful information regarding the level of Schlumberger’s indebtedness by

reflecting cash and investments that could be used to repay debt.

Details of Net Debt follow:

(Stated in millions)

2012

2011

2010

Net Debt, beginning of year

$(4,850)

$(2,638) $ (126)

Income from continuing operations

5,468

4,730 4,253

Depreciation and amortization

(1)

3,500

3,274 2,757

Gain on M-I SWACO investment

–

– (1,270)

Pension and other postretirement benefits expense

404

365

299

Excess of equity income over dividends received

(61)

(64)

(85)

Stock -based compensation expense

335

271

198

Other non-cash items

97

203

327

Pension and other postretirement benefits funding

(673)

(601)

(868)

(Increase) decrease in working capital

(1,968)

(2,144)

267

Capital expenditures

(4,695)

(4,008) (2,912)

Multiclient seismic data capitalized

(351)

(289)

(326)

Dividends paid

(1,432)

(1,300) (1,040)

Stock repurchase program

(972)

(2,998) (1,717)

Proceeds from employee stock plans

410

438

401

Net debt assumed in merger with Smith

–

– (1,829)

Geoservices acquisition, net of debt acquired

–

– (1,033)

Business acquisitions and other transactions

(845)

(610)

(212)

Proceeds from divestiture of Wilson distribution business

906

–

–

Proceeds from divestiture of CE Franklin business

122

–

–

Proceeds from divestiture of Global Connectivity Services business

–

385

–

Discontinued operations

(152)

22

(24)

Conversion of debentures

–

–

320

Translation effect on net debt

(45)

23

30

Other

(309)

91

(48)

Net Debt, end of year

$(5,111)

$(4,850) $(2,638)

(1) Includes multiclient seismic data costs.

24