Page 26 - 2017 AMETEK Annual Report (Interactive) Updated mobile

P. 26

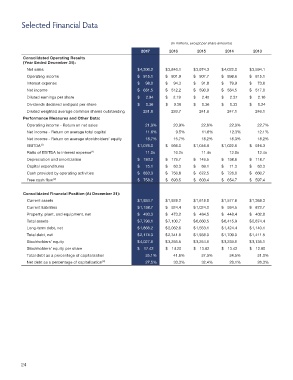

Selected Financial Data

(In millions, except per share amounts)

2017 2016 2015 2014 2013

Consolidated Operating Results

(Year Ended December 31):

Net sales $ 4,300.2 $ 3,840.1 $ 3,974.3 $ 4,022.0 $ 3,594.1

Operating income $ 915.1 $ 801.9 $ 907.7 $ 898.6 $ 815.1

Interest expense $ 98.0 $ 94.3 $ 91.8 $ 79.9 $ 73.6

Net income $ 681.5 $ 512.2 $ 590.9 $ 584.5 $ 517.0

Diluted earnings per share $ 2.94 $ 2.19 $ 2.45 $ 2.37 $ 2.10

Dividends declared and paid per share $ 0.36 $ 0.36 $ 0.36 $ 0.33 $ 0.24

Diluted weighted average common shares outstanding 231.8 233.7 241.6 247.1 246.1

Performance Measures and Other Data:

Operating income - Return on net sales 21.3% 20.9% 22.8% 22.3% 22.7%

Net income - Return on average total capital 11.6% 9.5% 11.6% 12.3% 12.1%

Net income - Return on average stockholders’ equity 18.7% 15.7% 18.2% 18.3% 18.2%

(1)

EBITDA $ 1,076.0 $ 966.0 $ 1,046.9 $ 1,022.6 $ 916.3

Ratio of EBITDA to interest expense (1) 11.0x 10.2x 11.4x 12.8x 12.4x

Depreciation and amortization $ 183.2 $ 179.7 $ 149.5 $ 138.6 $ 118.7

Capital expenditures $ 75.1 $ 63.3 $ 69.1 $ 71.3 $ 63.3

Cash provided by operating activities $ 833.3 $ 756.8 $ 672.5 $ 726.0 $ 660.7

(2)

Free cash flow $ 758.2 $ 693.5 $ 603.4 $ 654.7 $ 597.4

Consolidated Financial Position (At December 31):

Current assets $ 1,934.7 $ 1,928.2 $ 1,618.8 $ 1,577.6 $ 1,368.3

Current liabilities $ 1,138.7 $ 924.4 $ 1,024.0 $ 934.5 $ 872.7

Property, plant, and equipment, net $ 493.3 $ 473.2 $ 484.5 $ 448.4 $ 402.8

Total assets $ 7,796.1 $ 7,100.7 $ 6,660.5 $ 6,415.9 $ 5,874.4

Long-term debt, net $ 1,866.2 $ 2,062.6 $ 1,553.1 $ 1,424.4 $ 1,140.1

Total debt, net $ 2,174.3 $ 2,341.6 $ 1,938.0 $ 1,709.0 $ 1,411.5

Stockholders’ equity $ 4,027.6 $ 3,256.5 $ 3,254.6 $ 3,239.6 $ 3,136.1

Stockholders’ equity per share $ 17.42 $ 14.20 $ 13.82 $ 13.42 $ 12.80

Total debt as a percentage of capitalization 35.1% 41.8% 37.3% 34.5% 31.0%

(3)

Net debt as a percentage of capitalization 27.5% 33.3% 32.4% 29.1% 26.3%

24