Page 27 - 2017 AMETEK Annual Report (Interactive) Updated mobile

P. 27

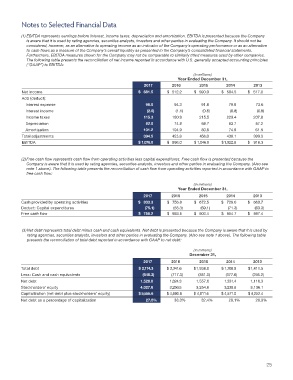

Notes to Selected Financial Data

(1) EBITDA represents earnings before interest, income taxes, depreciation and amortization. EBITDA is presented because the Company

is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. It should not be

considered, however, as an alternative to operating income as an indicator of the Company’s operating performance or as an alternative

to cash flows as a measure of the Company’s overall liquidity as presented in the Company’s consolidated financial statements.

Furthermore, EBITDA measures shown for the Company may not be comparable to similarly titled measures used by other companies.

The following table presents the reconciliation of net income reported in accordance with U.S. generally accepted accounting principles

(“GAAP”) to EBITDA:

(In millions)

Year Ended December 31,

2017 2016 2015 2014 2013

Net income $ 681.5 $ 512.2 $ 590.9 $ 584.5 $ 517.0

Add (deduct):

Interest expense 98.0 94.3 91.8 79.9 73.6

Interest income (2.0) (1.1) (0.8) (0.8) (0.8)

Income taxes 115.3 180.9 215.5 220.4 207.8

Depreciation 82.0 74.8 68.7 63.7 57.2

Amortization 101.2 104.9 80.8 74.9 61.5

Total adjustments 394.5 453.8 456.0 438.1 399.3

EBITDA $ 1,076.0 $ 966.0 $ 1,046.9 $ 1,022.6 $ 916.3

(2) Free cash flow represents cash flow from operating activities less capital expenditures. Free cash flow is presented because the

Company is aware that it is used by rating agencies, securities analysts, investors and other parties in evaluating the Company. (Also see

note 1 above). The following table presents the reconciliation of cash flow from operating activities reported in accordance with GAAP to

free cash flow:

(In millions)

Year Ended December 31,

2017 2016 2015 2014 2013

Cash provided by operating activities $ 833.3 $ 756.8 $ 672.5 $ 726.0 $ 660.7

Deduct: Capital expenditures (75.1) (63.3) (69.1) (71.3) (63.3)

Free cash flow $ 758.2 $ 693.5 $ 603.4 $ 654.7 $ 597.4

(3) Net debt represents total debt minus cash and cash equivalents. Net debt is presented because the Company is aware that it is used by

rating agencies, securities analysts, investors and other parties in evaluating the Company. (Also see note 1 above). The following table

presents the reconciliation of total debt reported in accordance with GAAP to net debt:

(In millions)

December 31,

2017 2016 2015 2014 2013

Total debt $ 2,174.3 $ 2,341.6 $ 1,938.0 $ 1,709.0 $ 1,411.5

Less: Cash and cash equivalents (646.3) (717.3) (381.0) (377.6) (295.2)

Net debt 1,528.0 1,624.3 1,557.0 1,331.4 1,116.3

Stockholders’ equity 4,027.6 3,256.5 3,254.6 3,239.6 3,136.1

Capitalization (net debt plus stockholders’ equity) $ 5,555.6 $ 4,880.8 $ 4,811.6 $ 4,571.0 $ 4,252.4

Net debt as a percentage of capitalization 27.5% 33.3% 32.4% 29.1% 26.3%

25