Page 25 - 2017 AMETEK Annual Report (Interactive) Updated mobile

P. 25

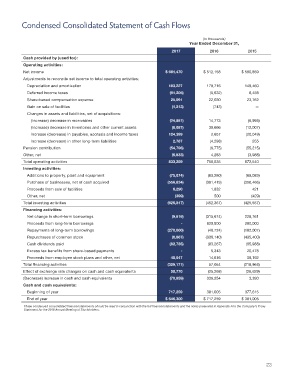

Condensed Consolidated Statement of Cash Flows

(In thousands)

Year Ended December 31,

2017 2016 2015

Cash provided by (used for):

Operating activities:

Net income $ 681,470 $ 512,158 $ 590,859

Adjustments to reconcile net income to total operating activities:

Depreciation and amortization 183,227 179,716 149,460

Deferred income taxes (91,205) (5,632) 6,458

Share-based compensation expense 25,091 22,030 23,762

Gain on sale of facilities (1,213) (743) —

Changes in assets and liabilities, net of acquisitions:

(Increase) decrease in receivables (24,581) 14,773 (6,995)

(Increase) decrease in inventories and other current assets (6,087) 38,666 (12,007)

Increase (decrease) in payables, accruals and income taxes 124,399 2,657 (20,049)

Increase (decrease) in other long-term liabilities 2,787 (4,298) 255

Pension contribution (54,796) (6,775) (55,215)

Other, net (5,833) 4,283 (3,988)

Total operating activities 833,259 756,835 672,540

Investing activities:

Additions to property, plant and equipment (75,074) (63,280) (69,083)

Purchase of businesses, net of cash acquired (556,634) (391,419) (356,466)

Proceeds from sale of facilities 6,290 1,832 421

Other, net (399) 500 (429)

Total investing activities (625,817) (452,367) (425,557)

Financing activities:

Net change in short-term borrowings (9,616) (315,674) 226,761

Proceeds from long-term borrowings - 820,900 200,000

Repayments of long-term borrowings (270,000) (48,724) (182,007)

Repurchases of common stock (6,867) (336,140) (435,400)

Cash dividends paid (82,735) (83,267) (85,988)

Excess tax benefits from share-based payments - 5,343 20,478

Proceeds from employee stock plans and other, net 40,047 14,616 39,192

Total financing activities (329,171) 57,054 (216,964)

Effect of exchange rate changes on cash and cash equivalents 50,770 (25,268) (26,629)

(Decrease) increase in cash and cash equivalents (70,959) 336,254 3,390

Cash and cash equivalents:

Beginning of year 717,259 381,005 377,615

End of year $ 646,300 $ 717,259 $ 381,005

These condensed consolidated financial statements should be read in conjunction with the full financial statements and the notes presented in Appendix A to the Company’s Proxy

Statement for the 2018 Annual Meeting of Stockholders.

23