Page 28 - 2017 AMETEK Annual Report (Interactive) Updated mobile

P. 28

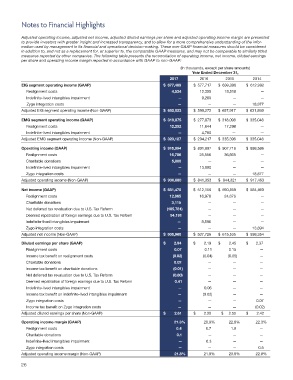

Notes to Financial Highlights

Adjusted operating income, adjusted net income, adjusted diluted earnings per share and adjusted operating income margin are presented

to provide investors with greater insight and increased transparency, and to allow for a more comprehensive understanding of the infor-

mation used by management in its financial and operational decision-making. These non-GAAP financial measures should be considered

in addition to, and not as a replacement for, or superior to, the comparable GAAP measures, and may not be comparable to similarly titled

measures reported by other companies. The following table presents the reconciliation of operating income, net income, diluted earnings

per share and operating income margin reported in accordance with GAAP to non-GAAP:

(In thousands, except per share amounts)

Year Ended December 31,

2017 2016 2015 2014

EIG segment operating income (GAAP) $ 677,489 $ 577,717 $ 639,399 $ 612,992

Realignment costs 4,534 12,355 18,518 —

Indefinite-lived intangibles impairment — 9,200 — —

Zygo integration costs — — — 18,877

Adjusted EIG segment operating income (Non-GAAP) $ 682,023 $ 599,272 $ 657,917 $ 631,869

EMG segment operating income (GAAP) $ 310,875 $ 277,873 $ 318,098 $ 335,046

Realignment costs 12,252 11,644 17,298 —

Indefinite-lived intangibles impairment — 4,700 — —

Adjusted EMG segment operating income (Non-GAAP) $ 323,127 $ 294,217 $ 335,396 $ 335,046

Operating income (GAAP) $ 915,094 $ 801,897 $ 907,716 $ 898,586

Realignment costs 16,786 25,556 36,605 —

Charitable donations 5,000 — — —

Indefinite-lived intangibles impairment — 13,900 — —

Zygo integration costs — — — 18,877

Adjusted operating income (Non-GAAP) $ 936,880 $ 841,353 $ 944,321 $ 917,463

Net income (GAAP) $ 681,470 $ 512,158 $ 590,859 $ 584,460

Realignment costs 12,965 16,978 24,676 —

Charitable donations 3,115 — — —

Net deferred tax revaluation due to U.S. Tax Reform (185,781) — — —

Deemed repatriation of foreign earnings due to U.S. Tax Reform 94,191 — — —

Indefinite-lived intangibles impairment — 8,590 — —

Zygo integration costs — — — 13,894

Adjusted net income (Non-GAAP) $ 605,960 $ 537,726 $ 615,535 $ 598,354

Diluted earnings per share (GAAP) $ 2.94 $ 2.19 $ 2.45 $ 2.37

Realignment costs 0.07 0.11 0.15 —

Income tax benefit on realignment costs (0.02) (0.04) (0.05) —

Charitable donations 0.02 — — —

Income tax benefit on charitable donations (0.01) — — —

Net deferred tax revaluation due to U.S. Tax Reform (0.80) — — —

Deemed repatriation of foreign earnings due to U.S. Tax Reform 0.41 — — —

Indefinite-lived intangibles impairment — 0.06 — —

Income tax benefit on indefinite-lived intangibles impairment — (0.02) — —

Zygo integration costs — — — 0.07

Income tax benefit on Zygo integration costs — — — (0.02)

Adjusted diluted earnings per share (Non-GAAP) $ 2.61 $ 2.30 $ 2.55 $ 2.42

Operating income margin (GAAP) 21.3% 20.9% 22.8% 22.3%

Realignment costs 0.4 0.7 1.0 —

Charitable donations 0.1 — — —

Indefinite-lived intangibles impairment — 0.3 — —

Zygo integration costs — — — 0.5

Adjusted operating income margin (Non-GAAP) 21.8% 21.9% 23.8% 22.8%

26