Item13. Certain Relationships and Related Transactions, and Director Independence

Certain Relationships and Related Transactions

We have provided some of the information below because our stockholders may find it useful, but by

including a transaction in this section, we do not necessarily mean that the transaction qualifies as a related party

transaction under the securities laws.

Dr. Rosanne Crooke, the wife of Dr. Stanley Crooke, our Chairman and Chief Executive Officer, is a

non-executive officer of Isis working part time at 30 hours per week. The Compensation Committee approves Dr.

Rosanne Crooke’s compensation. Her compensation is commensurate with the compensation of other employees

at the same level at Isis. For the fiscal years ended 2014, 2013, and 2012, she received the following

compensation:

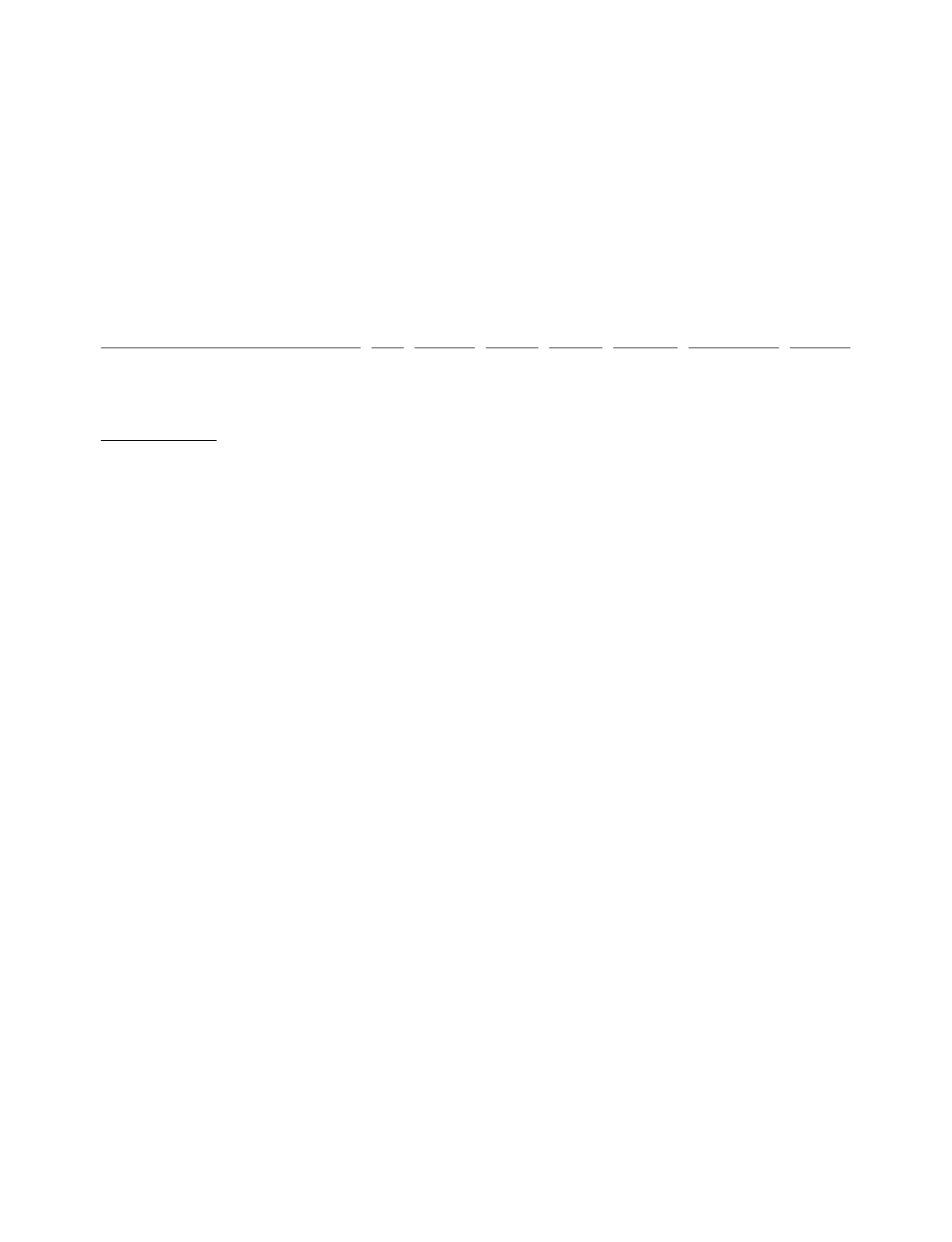

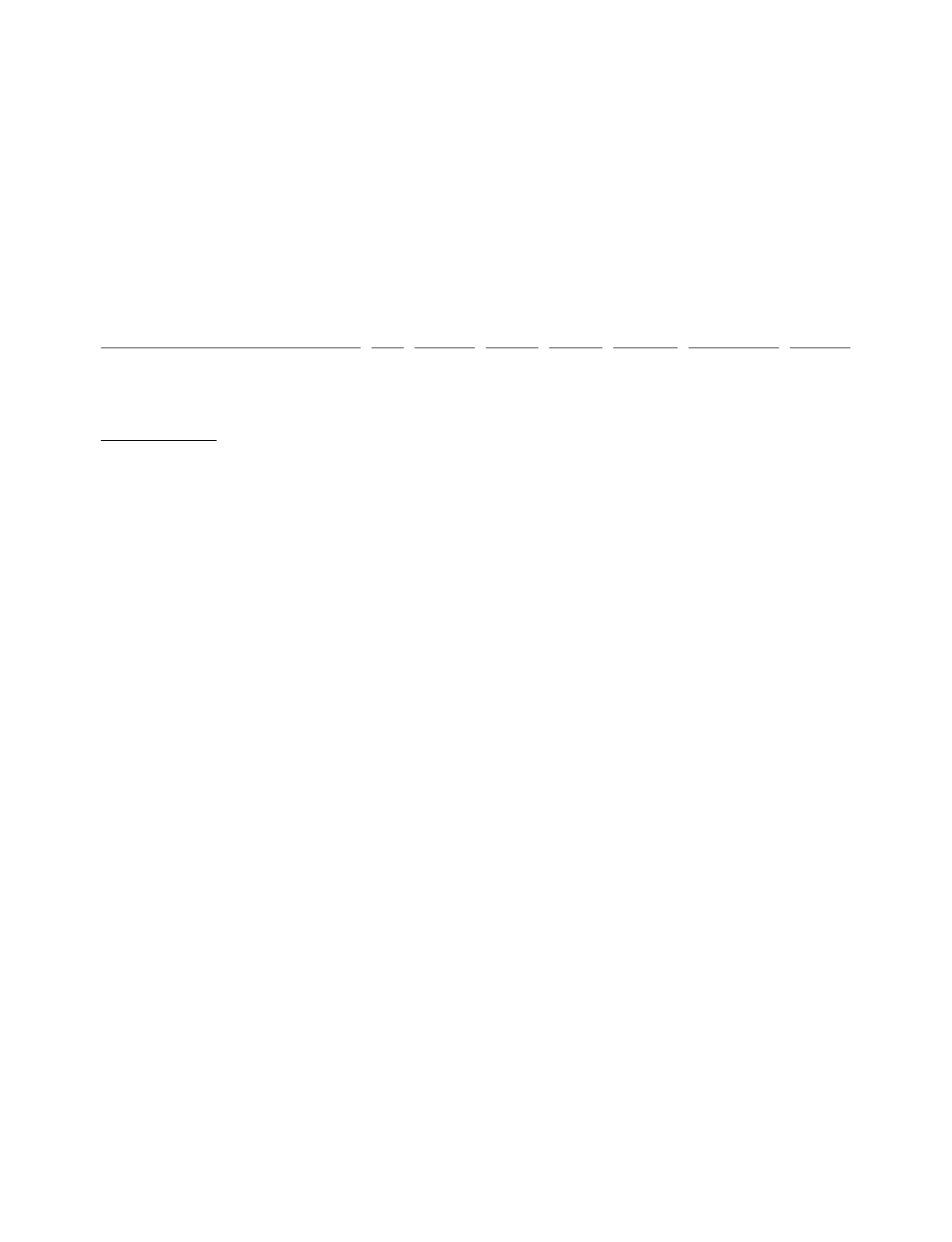

Name and

Principal

Position

Year

Salary

($)

Bonus

(1)

($)

Stock

Awards

(2)

($)

Option

Awards

(2)(4)

($)

All Other

Compensation

(3)

($)

Total

($)

Rosanne Crooke . . . . . . . . . . . . . . . . . . . 2014 $210,814 $82,349 $67,487 $146,488 $5,912 $513,050

Vice President, Cardiovascular

2013 $203,685 $89,367 $23,457 $ 48,906 $3,777 $369,192

Diseases Drug Discovery Research 2012 $197,369 $59,211 $ 9,622 $ 36,692 $4,517 $307,411

(1) We present bonuses in the years they were earned, not in the year paid. Bonuses represent compensation for achievements and are not

necessarily paid in the year they are earned; for example, in January 2015 we paid bonuses for 2014 performance.

(2) Amounts represent the aggregate expense recognized for financial statement reporting purposes in accordance with FASBTopicASC

718 (‘‘ASC 718’’) for stock and option awards granted to Dr. Crooke. ASC 718 expense for the option awards is based on the fair

value of the awards on the date of grant using an option-pricing model. The fair value of RSUs is based on the market price of our

common stock on the date of grant. For more information, please see Note 5,

Stockholders’ Equity

, regarding assumptions underlying

valuation of equity awards.

(3) Includes AD&D, Basic Life, Medical, Dental, Vision, and 401(k) matching contributions which are available to all employees.

(4) These amounts represent the estimated fair values of stock option grants we recognized as share-based compensation expense. The

estimated fair value amounts were determined using the Black-Scholes option-valuation model and are not indicative of whether Dr.

Rosanne Crooke will realize the estimated fair value or any financial benefits from the award. The applicable amounts represent:

•

11,404 shares at $7.25 per share received on January 3, 2012;

•

10,000 shares at $10.82 per share received on January 2, 2013; and

•

8,500 shares at $39.87 per share received on January 2, 2014.

One of our Directors, Mr. Muto, who was elected to the Board inMarch 2001, is a partner at Cooley LLP,

our outside legal counsel. We paid Cooley LLP an aggregate of $425,119 in fees in 2014 for legal services,

which amount is substantially less than five percent of Cooley’s gross revenues for its 2014 fiscal year.

We have entered into indemnity agreements with each of our executive officers and Directors and certain

non-executive officers which provide, among other things, that we will indemnify such officer or Director, under

the circumstances and to the extent provided for therein, for expenses, damages, judgments, fines and settlements

he or she may be required to pay in actions or proceedings which he or she is or may be made a party by reason

of his or her position as a Director, officer or other agent of Isis, and otherwise to the fullest extent permitted

under Delaware law and our bylaws. Our bylaws provide that we will indemnify our Directors and executive

officers to the fullest extent not prohibited by Delaware law or any other applicable law, except that we will

generally not be required to indemnify a Director or executive officer in connection with any proceeding initiated

by such Director or executive officer.

Policies and Procedures Regarding Related Party Transactions

Acommittee of the Board composed entirely of independent Directors approves transactions with related

persons, as defined under SEC regulations. The Compensation Committee of the Board approves all

compensation we pay to employees that may qualify as a related person and theAudit Committee approves all

other related party transactions, as specified in its charter. The committees only approve related-party transactions

at committee meetings, or by unanimous written consent in lieu of a meeting, and record the approvals in the

minutes of the committee.

123