GCIB serves clients around the world, providing integrated delivery of our full range of financial products and services through client managers and product partners who understand each client's unique needs.

Clients include 98 percent of the U.S. Fortune 500, 80 percent of the Fortune Global 500 and one in three midsize companies in the United States. In 2006, Bank of America was the fifth-largest underwriter of U.S. debt, equity and equity-related securities. It ranks No. 1 in share of both U.S. and global treasury revenues. GCIB businesses also include the leading bank-owned asset-based lender and the No. 1 provider of financial services to commercial real estate businesses.

Next: Global Wealth & Investment Management

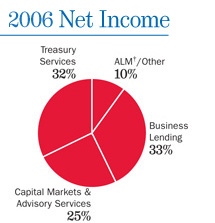

*Fully taxable-equivalent basis

†ALM=Asset and Liability Management