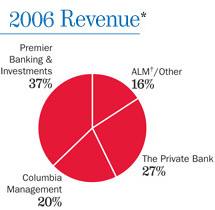

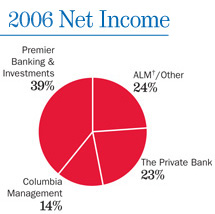

Premier Banking & Investments delivers integrated banking and investment solutions through a network of approximately 4,400 client advisors serving affluent clients with $100,000 in investable assets or $500,000 in investable assets including a first mortgage. These clients can receive tailored services including financial planning, customized products and relationship pricing through two key areas, Premier Banking and Banc of America Investment Services, Inc.® (BAI), a full-service and online brokerage.

The Private Bank provides integrated wealth-management solutions to high-net-worth individuals, middle-market institutions and charitable organizations with investable assets of greater than $3 million. The Family Wealth Advisors division of The Private Bank serves ultra-high-net-worth individuals and families with $50 million or more in investable assets. Clients of The Private Bank access wealth strategy, credit, deposit, investment, trust and specialty asset management services through relationship teams based in 32 states. More wealthy individuals and families choose The Private Bank to provide personal trust and wealth-management solutions than any other institution (VIP Forum, 2006).

Columbia Management, Bank of America's asset management organization, provides investment management solutions to institutional clients and individual investors. These include separately managed accounts, liquidity strategies, and mutual funds across a variety of investment disciplines within equities, fixed income and cash. As of December 31, 2006, Columbia Management and its affiliates managed assets of $542.9 billion.

*Fully taxable-equivalent basis