Richard K. Davis

Chairman, President and

Chief Executive Officer

U.S. Bancorp Positioned for a Strong Future

Fellow Shareholders:

U.S. Bancorp continues to invest, to grow and to prudently manage the company — building our businesses with a focus on our strong future.

I am very proud to report that our company achieved record total net revenue of $20.3 billion and record earnings of $5.6 billion for the full year 2012. These results represented a 6.2 percent increase in net revenue and a 15.9 percent increase in earnings over 2011. In addition, diluted earnings per common share were $2.84, 15.4 percent higher than the prior year.

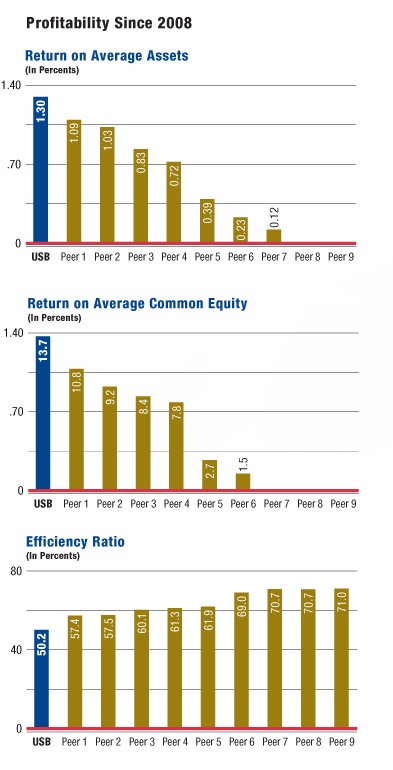

It was a very good year

We exceeded all of our past results, and surpassed, by wide margins, the performance of our peer banks in 2012 with industry-leading performance measures, including return on average assets of 1.65 percent, return on average common equity of 16.2 percent and an efficiency ratio of 51.5 percent, while, importantly, attaining positive full year operating leverage. In fact, we have held the #1 position among our peer banks in ROA, ROE and efficiency over a five-year period — five years of what many would describe as the most stressful period, historically, for our industry. We realized growth in total average loans of 6.9 percent over the prior year, as well as growth in average total deposits of 10.6 percent on a full year basis over 2011, demonstrating our company’s continuing ability to broaden and deepen relationships with our current customer base, gain new customers and, consequently, capture market share. Our fee-based businesses also realized solid growth in 2012, capitalizing on the investments we have made over the past number of years. Mortgage banking was a key contributor to our fee revenue growth, as it benefited from the low rate environment and the continuation of refinancings, as well as a growing market share. Credit quality remained strong and continued to improve as both net charge-offs and nonperforming assets declined, reflecting the high quality of our portfolio. Our industry-leading ability to generate capital continued to strengthen our already solid capital position and allowed us to return 62 percent of our earnings to our shareholders in the form of dividends and share repurchases in 2012.

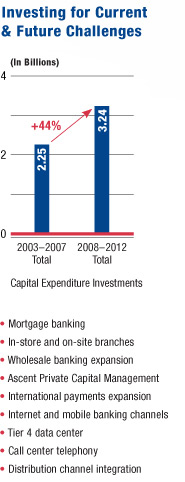

For decades, and especially since the economic downturn began, U.S. Bancorp has maintained a steady course, believing that a disciplined approach to the establishment of financial and operational policies and practices will best serve all of our constituents and sustain our company’s current momentum. We take pride in our ability to produce predictable, repeatable, and transparent earnings, which we have done consistently, despite the challenges we (and others in our industry) have faced in this uncertain economic environment. Further, we have not allowed these uncertainties to deter us from investing in opportunities for growth, in talent, in technology, in operational efficiency and in delivering higher customer satisfaction. We also have continued to make strategic acquisitions in growth businesses that increased the scale, scope or capabilities of our company’s existing business lines, preparing us for a stronger future.

Positioned for the recovery

Our customers — from individuals to small businesses, from middle market and large corporations to public institutions — are, as a group, financially healthy and productive, having adjusted to the current slow-growth, uncertain environment in which we all operate today. U.S. Bancorp is committed to serving all of our customers, helping them navigate the economic reality of today and capitalize on the future opportunities presented by the emerging recovery. We will be recognized for having “been there” for our customers, guiding them through these unprecedented economic challenges — and we strive to be even better known for our ability to partner with our customers as the economy recovers.

Earning and keeping trust in U.S. Bancorp

Following the disruption in the financial markets and the continuing economic downturn, the American people lost the trust they once had in the banking industry. Much of their loss of faith in our industry was understandable and served as a call to action for all banks to demonstrate their importance and value to the U.S. economy and to serve as genuine partners to help our citizens negotiate through these challenging times. As a leading American bank, and sensing our obligation to serve as a role model for the industry, U.S. Bank has listened and responded to our customers, developing new ways of communicating and addressing their concerns. We are creating new financial products to respond to their changing needs, and we are enhancing a number of policies and procedures to make sure our customers understand the products and services they use. We are focused on re-establishing the trust that is essential to a strong partnership and we stand ready to continue to adjust our programs to exceed our customer expectations.

Taming technology and putting it to work

Perhaps nothing moves as fast or changes more often than technology. Whether it is used to design and deliver new products and services, to improve operations, to move money around the world in a nanosecond or to create new channels of customer communication and contact, we cannot overestimate the importance of technology and the need to remain current. A high percentage of our information technology is focused on “must-do” expenditures — on operational efficiency and compliance requirements. We continue to invest significantly, however, to enhance our customers’ experience — making every interaction faster, easier, safer, more customizable and more portable than ever before, as customers gravitate to their smartphones and tablets to conduct their daily banking business. Less visible, but even more important, is our ongoing investment in technology in the face of potential cyber assault, and for information security and customer privacy.

Compliance mandates and regulatory reporting — the new normal

In the aftermath of the financial crisis, the banking industry has faced an unprecedented increase in scrutiny and regulation. Banks are confronting an abundance of new regulations designed to lower risk and increase the ability to absorb losses, so that the possibility of a future crisis can be averted or, at the very least, softened — a very worthy goal. For all the many new regulations proposed and already implemented, there are still more to come. We are in a position to manage through this new regulatory environment, and we will devote ourselves to being an advocate for reasonable change — and an active critic and partner to amend and inform less productive changes. We invest considerable time in developing our relationships with regulators and legislators, and we see our role as an active participant in the development and refinement of the many new rules that remain unfinished. The uncertainty surrounding the new banking rules and eventual impact on the industry will continue to be a concern for many. We are fully confident in our company’s ability to meet any new requirements of capital, risk or consumer protection. Hopefully, 2013 will be marked by a period of implementation and closure, as the industry moves forward and concentrates on doing what it does best — being an integral part of helping the economy recover and grow.

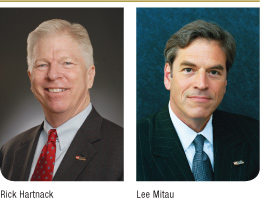

Saying farewell to two outstanding bankers and friends

Richard Hartnack, Vice Chairman of Consumer and Small Business Banking, and Lee Mitau, Executive Vice President and General Counsel, will retire from U.S. Bancorp on March 1, 2013. Rick Hartnack served as Vice Chairman, Consumer and Small Business Banking since he joined U.S. Bancorp from Union Bank of California in 2005. Lee Mitau served as Executive Vice President and General Counsel of U.S. Bancorp since 1995, joining us from the law firm of Dorsey & Whitney LLP in Minneapolis.

Rick and Lee provided many years of outstanding leadership to U.S. Bancorp and helped to lead U.S. Bank through the most turbulent period in recent history for our company and our industry. They provided enormous value to our organization, employees, customers and shareholders — we will miss their influence and camaraderie.

Rewarding our shareholders

We returned 62 percent of our earnings — a total of $3.4 billion — to our shareholders in 2012 through dividends and the repurchase of 59 million shares of stock. This was within the range of our goal to return 60 to 80 percent of our earnings to shareholders each year. I am joined by the Managing Committee and the members of the Board of Directors in looking forward to raising our dividend further. It remains one of our top priorities. With our proven ability to generate significant capital each year through solid earnings, our already strong capital position, excellent credit quality and a track record of careful stewardship, we trust that our regulators will continue to approve our annual capital distribution plans.

I want to thank you for your investment in U.S. Bancorp. We are especially pleased to have your support this year as we celebrate our national charter’s 150-year anniversary. Since 1863, we have enjoyed a rich heritage. Our past has shaped our present and our future, and we continue to be mindful of our responsibility to be a trusted partner and to help our customers achieve their financial goals, to support and strengthen the communities and this country that we serve and, importantly, to reward our shareholders. We look forward to a strong future and the opportunities it holds for us all.

Sincerely,

Richard K. Davis

Chairman, President and Chief Executive Officer

February 22, 2013