F-19

The Revolving Loan Facility includes two sub-facilities: (i) a $10,000 letter of credit sub-facility pursuant to which the bank

may issue letters of credit, and (ii) a $5,000 swingline sub-facility.

Under our previous Line of Credit, the maximum amount we could borrow was $35,000, limited by certain credit sub-facilities.

Interest was calculated at a floating per annum rate equal to one-half of one percentage point (0.5%) above the prime rate.

As of December 31, 2013, there were no borrowings on our Revolving Loan Facility, and we had $30,000 of unused borrowing

availability. As of December 31, 2012, we had $6,000 of borrowings outstanding under the Line of Credit and had approximately

$25,400 of unused borrowing availability under our Line of Credit.

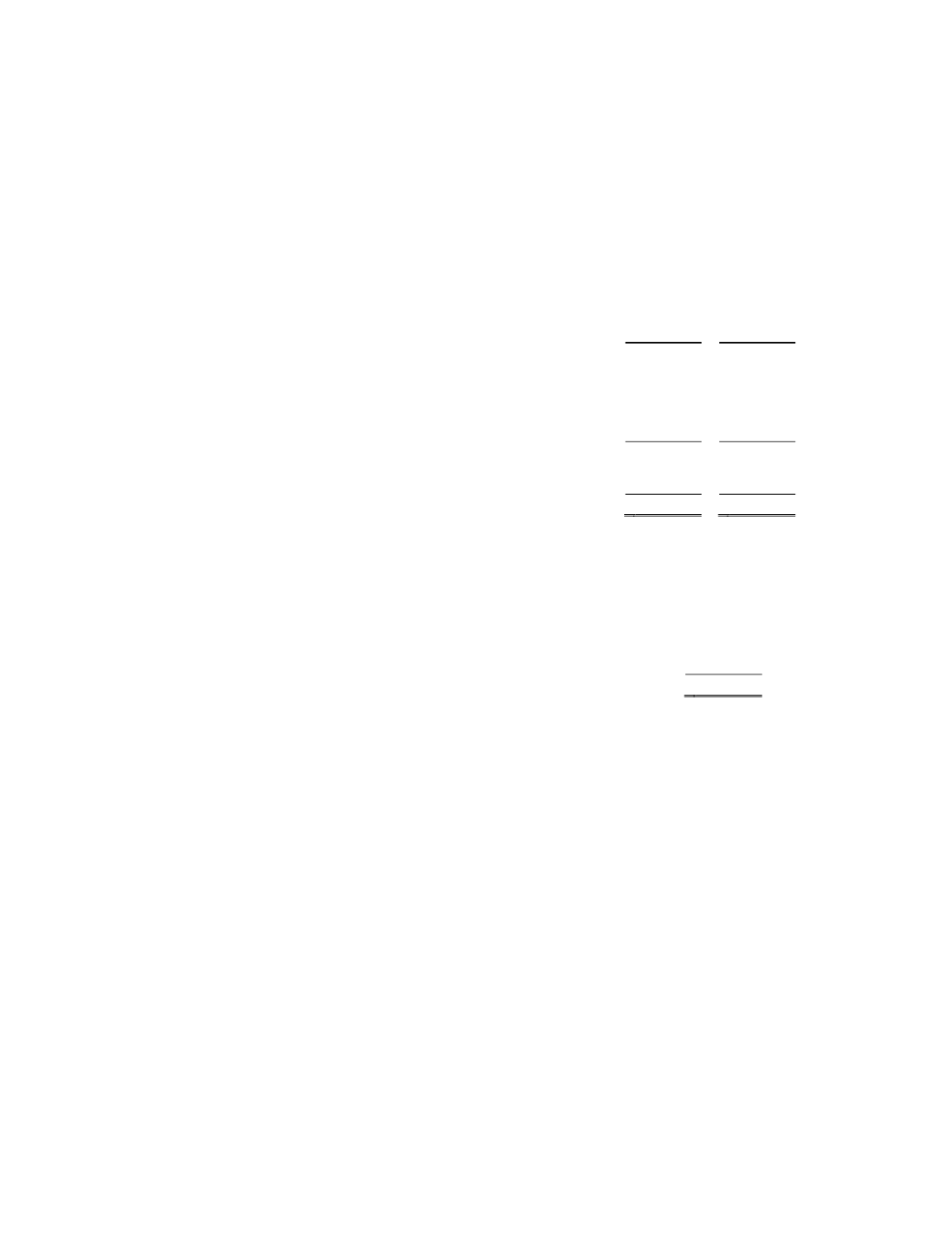

12. Long-Term Debt

Long-term debt consisted of at December 31:

2013

2012

Senior credit facility .................................................................................. $ 66,084 $

—

7.75% Convertible notes ...........................................................................

50,000

—

4.5% Convertible notes .............................................................................

14,562

93,500

Bank term loan paid in full June 26, 2013.................................................

—

41,779

Promissory notes payable to microDATA sellers .....................................

4,809

14,010

Total long-term debt ........................................................................ 135,455 149,289

Less: current portion.................................................................................. (25,089) (16,784)

Non-current portion of long-term debt ............................................ $ 110,366 $ 132,505

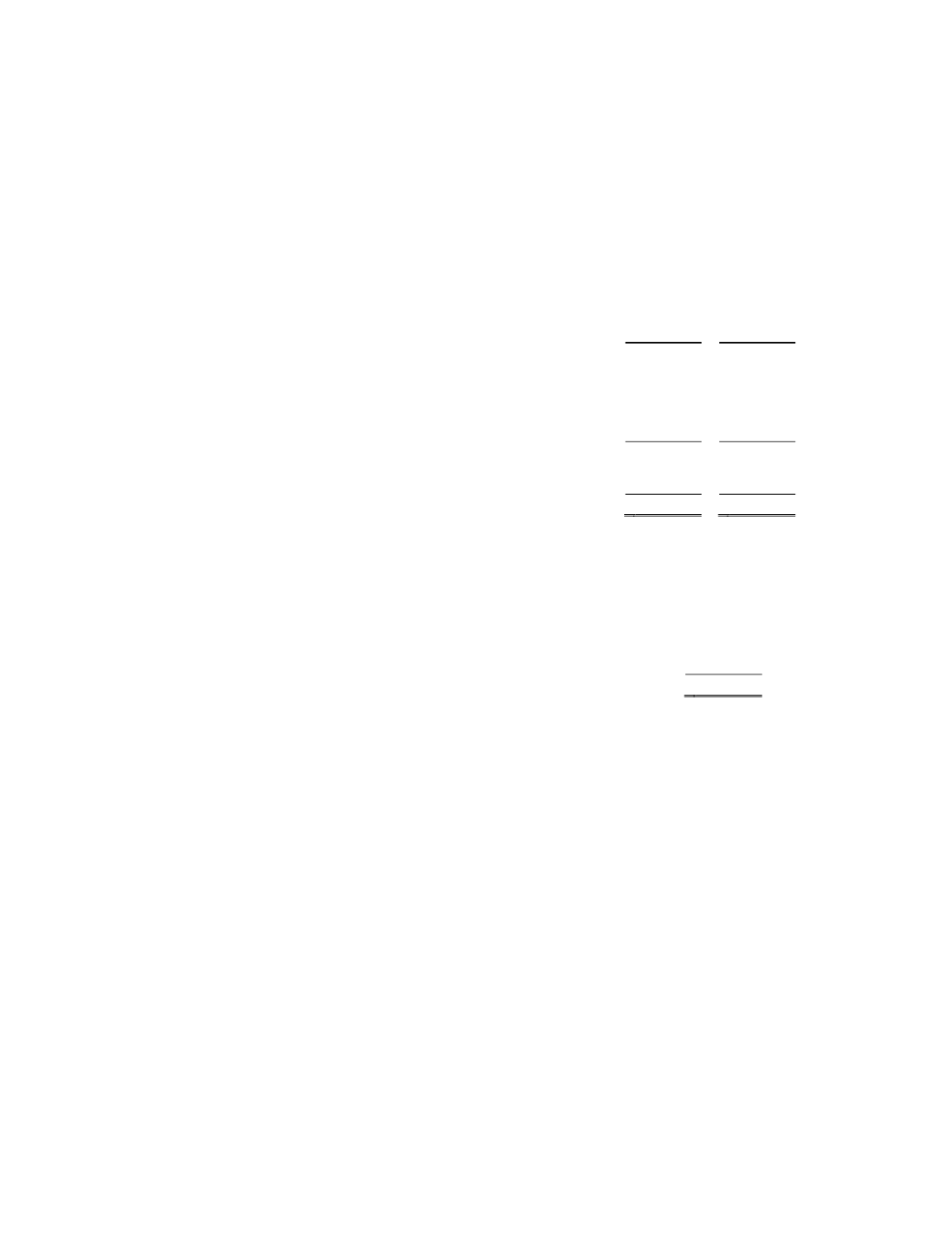

Aggregate maturities of long-term debt at December 31, 2013 are as follows:

2014 ................................................................................................................. $ 25,089

2015 .................................................................................................................

3,325

2016 .................................................................................................................

3,740

2017 .................................................................................................................

6,153

2018 .................................................................................................................

97,148

Total long-term debt............................................................................... $ 135,455

Senior credit facilities

On June 25, 2013, we closed on new $130,000 Senior Credit Facilities (the “Senior Credit Facilities”) which included (i) a

$56,500 term loan A facility (“Term Loan A Facility”), (ii) a $43,500 delayed draw term loan facility (“Delayed Draw Term Loan

Facility”), and (iii) a $30,000 revolving loan facility (“Revolving Loan Facility”). The Senior Credit Facilities also include a $25,000

incremental loan arrangement subject to the Company’s future needs and bank approval, although no assurances can be given that this

incremental loan amount will be available to us when and if needed.

We borrowed $56,500 under the Term Loan A Facility at closing for (i) repayment of the remaining balance under 2012 Term

Loan, which was terminated, (ii) approximately $16,000 for on-going working capital and other general corporate purposes, and

(iii) fees and expenses associated with the new facility. On September 30, 2013, we borrowed $10,000 under the Delayed Draw Term

Loan Facility and used the proceeds towards the retirement of the 4.5% Convertible Senior Notes, discussed below.

Additional liquidity is available through the undrawn $30,000 Revolving Loan Facility, to be used for our on-going working

capital and other general corporate purposes, replacing the previous line of credit which has been paid off and terminated, see Line of

Credit Note 11.

Loans borrowed under the Term Loan A Facility, the Revolving Loan Facility or the Delayed Draw Term Loan Facility may be

borrowed at rates based on the Eurodollar/LIBOR (beginning at L +3.75%) or Alternate Base Rate (ABR) (beginning at ABR +

2.75%), which may be adjusted as provided in the Credit Agreement.