|

1. Organization

HealthExtras, Inc. (the "Company" or "HealthExtras") is a Delaware

corporation organized on July 9, 1999 and the successor to certain

predecessor companies (the "Predecessor Companies"). The Predecessor

Companies include: Sequel Newco, Inc., Sequel Newco Joint Venture

(the Joint Venture), Health Extras Partnership (HEP), Sequel Newco,

LLP (SN LLP) and HealthExtras LLC. Through December 31, 1998,

the Company was considered to be a development stage enterprise.

The Company commenced business operations with its health benefits

program on November 1, 1998; however, all operating revenues were

deferred and were recognized in 1999 in order to coincide with

the program member benefits.

Sequel Newco, Inc. (Sequel), an Iowa Corporation, was originally

incorporated on October 23, 1996 as PB Newco II, Inc. Sequel's

business, which consisted of developing and evaluating international

and domestic healthcare management service opportunities, was

contributed to the Joint Venture as of January 1, 1997. The Joint

Venture was originally formed on December 1, 1996 and its business

involved the development of provider software applications and

the development of international healthcare management opportunities.

Effective

April 7, 1997, the Joint Venture was merged into a limited liability

partnership, SN LLP. SN LLP continued the business of the Joint

Venture, i.e., the development of provider software applications

and the develop-ment of international healthcare management opportunities.

HEP

was originally formed on April 7, 1997 and its business involved

the development of supplemental catastrophic health benefit programs.

Effective August 1, 1998, SN LLP and HEP were merged into HealthExtras

LLC, a Maryland limited liability company, with HealthExtras,

LLC being the surviving business entity.

On

May 27, 1999, HealthExtras, LLC, which was then a Maryland limited

liability company, contributed substantially all of its assets

to HealthExtras, LLC, a Delaware limited liability company, and

Capital Z Healthcare Holding Corp. invested $5 million in that

entity in exchange for a 20% ownership interest.

On

December 17, 1999, in connection with the closing of the initial

public offering of 5,500,000 shares of the Company's common stock

at an initial public offering price of $11.00 per share, HealthExtras

LLC was merged into the Company with the Company being the surviving

entity (the "Reorganization") and the members of HealthExtras

LLC received an aggregate 22,100,000 shares of the Company's common

stock in exchange for their member interests. The net proceeds

received by the Company from the initial public offering (net

of underwriting commissions and expenses of $5.6 million) were

approximately $54.9 million.

back

to top>>

2. Summary of significant accounting policies

Basis

of presentation

The accompanying financial statements include the accounts of

the Company and the Predecessor Companies.

Cash

and cash equivalents

Cash

and cash equivalents consist of cash and investments in highly

liquid instruments with maturities of three months or less when

purchased.

Marketable securities

The Company has purchased certain marketable securities of a certain

related entity. Management considers all of the common stock purchased

to be available for sale as defined by SFAS No. 115, "Accounting

for Certain Investments in Debt and Equity Securities.'' Available

for sale securities are reported at fair value, with net unrealized

gains and losses reported as a component of other comprehensive

income. During 1997, the Company engaged in the trading of marketable

securities. Trading securities are reported at fair value, with

net unrealized gains and losses reported in the statement of operations

and comprehensive loss. Realized gains and losses on the sale

of trading securities are determined using the specific identification

method. For the year ended December 31, 1997, net realized gains

of $732,977 were recorded. All trading securities were sold prior

to December 31, 1997.

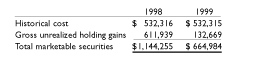

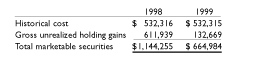

The historical cost, gross unrealized holding gains and fair value

of marketable securities available for sale as of December 31,

1998, and 1999 are as follows:

Fixed

assets

Fixed assets are stated at cost. Depreciation is computed

using the straight-line method over the estimated useful lives

of the assets, which range from three to seven years. Leasehold

improvements are amortized using the straight-line method over

the shorter of the estimated lives of the assets or the lease

term.

Concentration of credit risk

Financial instruments that potentially subject the Company to

significant concentrations of credit risk consist principally

of cash and cash equivalents. The Company maintains such amounts

in bank accounts which, at times, may exceed federally insured

amounts. The Company has not experienced any losses related to

its cash or cash equivalents and believes it is not exposed to

any significant credit risk on its cash or cash equivalents.

Use of estimates

The preparation of financial statements in conformity with generally

accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. Actual results

could differ from those estimates.

Contributions

Contributions made, including unconditional promises to give,

are recognized as expenses in the period made or promised.

Income taxes

Prior to the Reorganization, no provision for federal or state

income taxes was made in the accompanying financial statements

since the Company was treated as a partnership for federal and

state Income tax purposes.

Upon the Reorganization, the Company became subject to federal

and state income taxes. No provision for federal or state income

taxes has been made for the period from December 17, 1999 to December

31, 1999 as the Company incurred an operating loss for the period.

The Company records deferred tax assets and liabilities based

on temporary differences between the financial statement and the

tax bases of assets and liabilities using enacted tax rates in

effect in the year in which the differences are expected to reverse.

Net loss per share

Basic net loss per share is based on the weighted average

number of shares outstanding during the year. Diluted net loss

per share is based on the weighted average number of shares and

dilutive common stock equivalent shares outstanding during the

year. All outstanding stock options at December 31, 1999 were

excluded from the computation of diluted net loss per share because

the exercise price of the stock options exceeded the average market

price of the common shares, and therefore, were antidilutive.

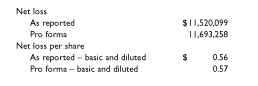

Pro forma basic and diluted net loss per share and weighted average

shares outstanding reflect the formation of HealthExtras, Inc.

and merger with HealthExtras, LLC in exchange for Company common

stock as if the merger was effective January 1, 1997.

Pro forma basic net loss per share is computed based on the weighted

average number of outstanding shares of common stock. Pro forma

diluted net loss per share adjusts the pro forma basic shares

weighted average for the potential dilution that could occur if

stock options or warrants, if any, were exercised. Pro forma diluted

net loss per share is the same as pro forma basic net loss per

share because there were no dilutive securities outstanding at

December 31, 1997 and 1998.

Revenue and direct expense recognition

The primary determinant of revenue recognition is monthly program

enrollment. In general, revenue is recognized based on the number

of members enrolled in each reporting period multiplied by the

applicable monthly fee for their specific membership program.

The revenue recognized by HealthExtras includes the cost of membership

features supplied by others, including the insurance components.

Direct expenses consist of the costs that are a direct function

of a period of membership and a specific set of program features.

The coverage obligations of our benefit suppliers and the related

expense are determined monthly, as are the remaining direct expenses.

Revenue from program benefits and related direct expenses (principally

bank marketing and processing fees and the cost of the benefits

provided to program members) are initially deferred for 90 days,

the period during which a program member is generally entitled

to obtain a refund. If a member requests a refund, HealthExtras

retains any interest earned on funds held during the refunded

membership period. Revenue and direct expenses attributable to

the initial deferral are recognized in the subsequent month. After

the initial deferral period, revenue is recognized as earned and

direct expenses as incurred.

HealthExtras has historically maintained a prepaid balance for

the benefits included in its programs. The carrying value of the

prepayment is adjusted at the end of each quarter based on factors

including enrollment levels in each product, enrollment trends,

and the remaining portion of the unexpired prepayment period.

In the event that a period of coverage was purchased in advance,

and there were insufficient members to utilize the coverage, the

value would expire and be expensed by HealthExtras without any

related revenue. HealthExtras believes that current enrollment

levels will allow the balance at December 31, 1999 to be fully

utilized prior to expiration.

HealthExtras' members always enroll for an annual period but may

chose to pay either annually or in monthly installments. There

is no interest charged under the monthly option but members who

pay annually receive a reduced rate that reflects lower administrative,

transaction and maintenance costs.

Marketing agreements

The Company defers the amount of payments under marketing and

similar agreements. Expense is recognized straight-line over the

term of the agreements.

Segment reporting

The Company operates in only one market segment as a provider

of health and disability benefit programs to individuals. The

Company has no major customers and operates only in the United

States.

back

to top>>

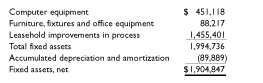

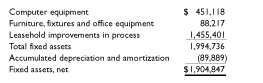

3. Fixed assets

Fixed assets as of December 31, 1999 consist of the following:

back

to top>>

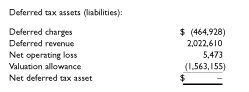

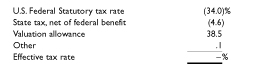

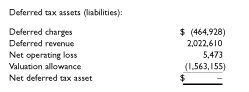

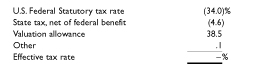

4. Income taxes

No provision for federal and state income taxes have been recorded

for the period from December 17, 1999 to December 31, 1999 as

the Company incurred an operating loss for the period. A summary

of the components of deferred income taxes at December 31, 1999

computed at an effective tax rate of 38.6% as follows:

The

Company has a net operating loss carryforward of approximately

$14,400 as of December 31, 1999. The effective tax rate for the

period from December 17, 1999 to December 31, 1999 varies from

the U.S. Federal Statutory tax rate principally due to the following:

back

to top>>

5.

Stockholders' equity

Stock

(member interests) grants

In

February 1999, certain management employees were granted effective

member interests aggregating 1.87% (equivalent to 413,333 common

shares, post Reorganization) of the Company, after giving effect

to an existing commitment to sell a 20% interest in the Company

to a third party for $5,000,000 cash. Such grants vest over a

four-year period commencing March 1, 1999. The Company recorded

the estimated fair value of such interests of $467,573 ($1.13

per post Reorganization common share) as stockholders' equity

and deferred compensation expense. During the year ended December

31, 1999, amortization of deferred compensation expensed amounted

to $97,341. The remainder of the deferred compensation expense

will be amortized over the vesting period for the interests.

Stock

option plan

In connection with the Reorganization and initial public offering,

the Company established the HealthExtras, Inc. 1999 Stock Option

Plan ("SOP"). The maximum number of shares of the Company's common

stock reserved for issuance pursuant to the exercise of options

under the SOP is 4,000,000 shares. All officers, employees and

independent contractors of the Company are eligible to receive

option awards. A Committee of the Board of Directors determines

award amounts, option prices and vesting periods, subject to the

provisions of the SOP.

Concurrent with the Reorganization and initial public offering,

stock options to purchase 2,956,000 shares of the Company's common

stock, all at an exercise price of $13.20 per share, were issued

to certain officers and employees of the Company. These stock

options vest ratably over a period of four years. None of the

stock options are exercisable and all remain outstanding as of

December 31, 1999. The contractual life of all of the stock options

is ten years.

During 1995, the Financial Accounting Standards Board issued Financial

Accounting Standard No. 123 ("FAS 123"), "Accounting for Stock-Based

Compensation." This pronouncement requires that the Company calculate

the fair value of stock options and shares issued under employee

stock purchase plans at the date of grant using an option-pricing

model. The Company has elected the "pro forma, disclosure only"

option permitted under FAS 123, instead of recording a charge

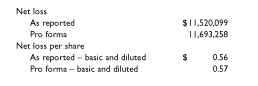

to operations. The following table reflects pro forma net loss

and net loss per share for the year ended December 31, 1999 had

the Company elected to adopt the fair value approach of FAS 123:

The

exercise price of each option granted in 1999 exceeded the market

price of the Company's common stock at the date of grant. The

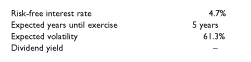

grant date fair value of each option granted was $5.70 per share.

The estimated fair value of each option was calculated using the

modified American Black-Scholes economic option-pricing model.

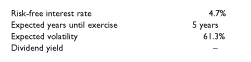

The following table summarizes the weighted-average of the assumptions

used for stock options granted during 1999:

6. Bank line of credit

In

1998, the Company entered into a credit facility with a bank totaling

$2,000,000 and bearing interest at the prime rate (8.5% as of

December 31, 1999). The facility extends to February 2000, is

collateralized by substantially all the Company's assets and has

been guaranteed by United Payors & United Providers, Inc. As of

December 31, 1998, the Company had borrowed $1,750,000 under this

credit facility. As of December 31, 1999, all amounts due under

the credit facility have been paid. The Company terminated the

credit facility in January 2000.

Loan guarantee fees have been imputed based on the monthly amounts

outstanding under the credit line at an annual rate of 2%. The

imputed loan guarantee fees have been recorded as interest expense

in the statement of operations and as members' capital. Such fees

amounted to $0, and $45,453 for the years ended December 31, 1998,

and 1999, respectively.

back

to top>>

7.

Lease Commitments

The

Company has entered into an agreement dated December 22, 1999,

to lease office space under a non-cancelable sublease agreement

with United Payors & United Providers, Inc. The sublease agreement

provides for annual escalations and for the payment by the Company

of its proportionate share of the increase in the costs of operating

the building. For financial reporting purposes, the Company will

recognize rent expense on a straight-line basis over the term

of the sublease. Future minimum lease payments under the sublease

are as follows:

back

to top>>

8. Commitments

During

1997, the Company entered into two marketing agreements each with

an initial three-year term whereby the Company committed to make

$3,030,000 of non-refundable payments, payable in three equal

installments, to certain individuals in exchange for their participation

in various marketing campaigns. Under both marketing agreements,

the Company has the option to extend and renew the agreements

for an additional two-year period, which would result in additional

guaranteed minimum payments by the Company of approximately $2,034,000.

Under the marketing agreements, the Company must pay annual fees

of $1.00 and $0.10, respectively, per program member that subscribes

to the benefits promoted by the individuals when program members

exceed the number of program members covered under the guaranteed

payments referenced above. Such payments are for the initial three-year

term of the marketing agreements and shall continue for a 10-year

period thereafter.

Additionally, during 1997, the Company pledged to contribute $300,000

to a charitable foundation payable in equal installments of $100,000

commencing on August 1, 1997. The contribution commitment was

made to support education and research in the areas of paralysis

and related rehabilitation efforts. The contribution was made

independent of any direct or indirect obligation on the part of

the recipient to further HealthExtras' business or program marketing.

Through December 31, 1998, the Company paid $100,000 to the charitable

foundation. As of December 31, 1999, the entire pledge has been

satisfied.

During 1998, the Company entered into various agreements with

participating companies in the amount of $1,260,900, whereby the

Company committed to provide minimum enrollment in its programs.

The Company has historically maintained a prepaid expense balance

with respect to benefit features of its programs. Direct expense

is recognized based on the actual membership levels in each program.

The deferred amount at the end of each quarter is adjusted to

reflect advances, if any, made during the period, expenses recognized

and remaining coverage periods and membership levels to which

such advances can be applied. The Company has deferred expense

recognition for $879,300 and $731,786 in minimum and advance payments

at December 31, 1998 and 1999, respectively, with respect to these

commitments in order to match related future revenue recognition.

A liability of $546,562 for the unpaid amount included in accrued

benefit expense on the balance sheet as of December 31, 1998 was

paid during 1999.

During July 1998, the Company entered into an agreement for a

mass marketing campaign requiring a minimum payment of $100,000

which is included in sales and marketing expense for the year

ended December 31, 1998. A liability of $100,000 for such payment

included in accrued expenses on the balance sheet as of December

31, 1998 was paid during 1999.

The Company has entered into three-year employment agreements

with five of its executive officers. The annual base salaries

under these agreements range from $120,000 to $210,000, and one

executive will be entitled to a bonus equal to one percent of

the Company's annual after-tax profits. The Company's minimum

aggregate payments under these employment agreements are expected

to be $837,000 annually. In the ordinary course of business, the

Company may become subject to legal proceedings and claims. The

Company is not aware of any legal proceedings or claims which,

in the opinion of management, will have a material effect on the

financial condition or results of operations of the Company.

back

to top>>

9.

Related party transactions

For corporate business purposes, the Company utilizes the services

of an aircraft owned by Southern Aircraft Leasing, which is owned

by the Chairman of the Board of the Company. For the years ended

December 31, 1997, 1998 and 1999, the Company paid $105,703, $97,638,

and $156,185, respectively, for utilizing the services of the

aircraft.

The Company holds available for sale securities in a corporation

for which the Chairman of the Board of the Company is the Chairman

of the Board and Co-Chief Executive Officer. Investments held

were $1,144,255, and $664,984 as of December 31, 1998 and 1999,

respectively.

The Chairman of the Board of the Company, from time to time, loaned

the Company funds, in excess of his pro-rata share of capital

contributions, in order to underwrite operating expenses. This

loan amounted to $1,334,429 at December 31, 1998. Interest has

been imputed on the monthly outstanding balance of the loan at

an annual rate of 10%. The imputed interest has been recorded

as interest expense in the statement of operations and as stockholders'

equity. Imputed interest expense amounted to $476,346, $173,868,

and $150,109 for the years ended December 31, 1997, 1998, and

1999, respectively. All funds advanced have been repaid as of

December 31, 1999.

Effective January 1, 1999, the Company entered into an agreement

with United Payors & United Providers, Inc. ("UP&UP"), a corporation

for which the Chairman of the Board of the Company is Chairman

of the Board and Co-Chief Executive Officer, whereby UP&UP provides

administrative services for the Company and is reimbursed for

the costs incurred. Prior to January 1, 1999, the Company had

an unwritten arrangement with UP&UP to provide similar services.

The amount paid by the Company for such services were $76,661,

$866,385, and $3.3 million, for the years ended December 31, 1997,

1998 and 1999, respectively. Under a revised agreement dated December

22, 1999, services to be provided by UP&UP subsequent to March

31, 2000, will be limited primarily to services relating to information

technology and communications and will be paid on a cost plus

fee basis.

From time to time the Company owes UP&UP for the costs of administrative

services. Such amounts payable do not bear interest. Interest

on amounts due UP&UP has been imputed at an annual rate of 10%

and has been recorded as interest expense in the statement of

operations and as stockholders' equity. Such expense amounted

to $6,845, $64,611, and $72,501 for the years ended December 31,

1997, 1998 and 1999, respectively.

The Company also signed a five-year royalty agreement effective

January 1, 1999 relating to the Company's program members accessing

the UP&UP provider network. In return for providing network access

to UP&UP's national network of healthcare providers, the Company

will pay UP&UP $1.00 per member per month for the initial year

of membership, which amount escalates in stages for subsequent

membership years to a maximum of $1.50 per member per month in

the fourth year of continued membership and thereafter. However,

the Company can terminate these payments by conveying $25 million

in market value of the Company's common stock to UP&UP. Amounts

paid under this agreement in 1999 approximated $529,000.

back

to top>>

|