The world will need more potash, and Ed Raffey and his co-workers know how to get more to market quickly. Ed is standing 3,000 feet underground at Esterhazy, the world's largest potash mine. At Esterhazy, four-rotor and two-rotor miners produce an average of 800 tonnes of ore per hour. Two years ago, Esterhazy had five of the four-rotor miners. By 2012, there will be nine. By then, Esterhazy's capacity will have increased by more than 20%. When it comes to growth, the math is simple and the advantage to Mosaic is significant.

As one of the world's three largest producers of potash, Mosaic is taking advantage of compelling economics and long-term demand trends by pursuing an ambitious capacity expansion program. Our multibillion-dollar investment, which spans more than a decade, will leverage Mosaic's existing facilities and infrastructure at our three mines in Saskatchewan – mines that, combined, possess another 100 years' worth of potash reserves.

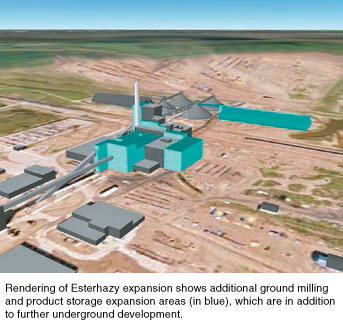

Mosaic's brownfield expansion program began in 2006 with an incremental 1.1 million tonnes added at Esterhazy. Two more phased expansions at Esterhazy are expected to add another 1.8 million tonnes between 2013 and 2016. Over three million tonnes are scheduled to come on line at Colonsay and Belle Plaine between 2011 and 2020.

Once the expansion program is complete, Mosaic's capacity will increase by over five million tonnes – a nearly 50% increase from the current level. An additional 1.3 million tonnes are currently being produced at Esterhazy for a third party under a tolling agreement. This tonnage will revert to Mosaic at no cost when the agreement expires. Collectively, Mosaic's annual capacity will be approximately 17 million tonnes once the expansions are complete and the toll agreement expires, ensuring Mosaic will remain one of the premier potash companies in the world.

Expanding With a Capital Cost Advantage

Mosaic's brownfield expansions are driven by potash dynamics that offer enticing potential. Global potash demand is expected to grow about 3% per year during the next decade. Demand in countries with emerging economies, where the need for food is greatest, is likely to be even higher due to historical underutilization rates by farmers in these areas. Potash deposits are limited to just a few geographical regions of the world. And, the product offers attractive returns for farmers and producers.

The cost of entry, however, is another matter. Construction of a two-million tonne greenfield mine is estimated to take five to seven years and would require an estimated $3.5 billion investment. The costs and risks associated with a greenfield mine appear to be even higher when compared to the significant competitive advantages of a brownfield expansion.

POTASH: A Limited Resource

Where in the world is all the potash? Actually, this essential nutrient is produced in just a few places - 12 countries, to be exact. Today, the largest deposits, which were formed when ancient seas evaporated and left behind crystallized potassium salts, are in Belarus, Canada and Russia. Large potash-consuming countries, including Brazil, India and the United States, produce little or no potash and rely on imports for their potash needs.

Incremental tonnage can be added to an existing mine and brought to market within a short period of time. Capital costs are a fraction of those associated with a greenfield project. Risks, such as ore quality or mine management issues, are generally known. New personnel training requirements are limited. And, because potash has a relatively flat cost curve, expansion leverages existing mine assets to drive a lower cost per tonne. In short, return on invested capital can be exceptional.

Balancing Ambition and Prudence

Mosaic's expansion program is as prudent as it is ambitious. All expansion projects will be executed in multiple phases. The projects are carefully planned, with continual assessments of decision points and return hurdles. Should the long-term market outlook change, the rate of expansion could be adjusted. In fact, a flexible business model is another attractive attribute of the potash business. Excess production can easily be reduced in a relatively short amount of time, as was the case in fiscal 2009 when the potash market softened. We responded quickly by adjusting production to more closely align with market demand.

Potash demand is expected to increase by at least 20 million tonnes between now and 2020. After all our planned expansions are completed, Mosaic will have the capacity to meet approximately 20% of the world's projected potash needs. With reserves that are estimated to span more than a century, Mosaic will be providing potash that meets the world's needs for years to come, and in the process, will grow value for its shareholders.

Esterhazy At-A-Glance

- World's largest potash mine

- Annual capacity of 5.3 million tonnes

- Additional 1.8 million tonnes by 2020

- Additional 1.3 million tonnes currently allocated under tolling agreement – reverting at no cost upon expiration

- Among most efficient mines in industry

- Excellent ore reserves