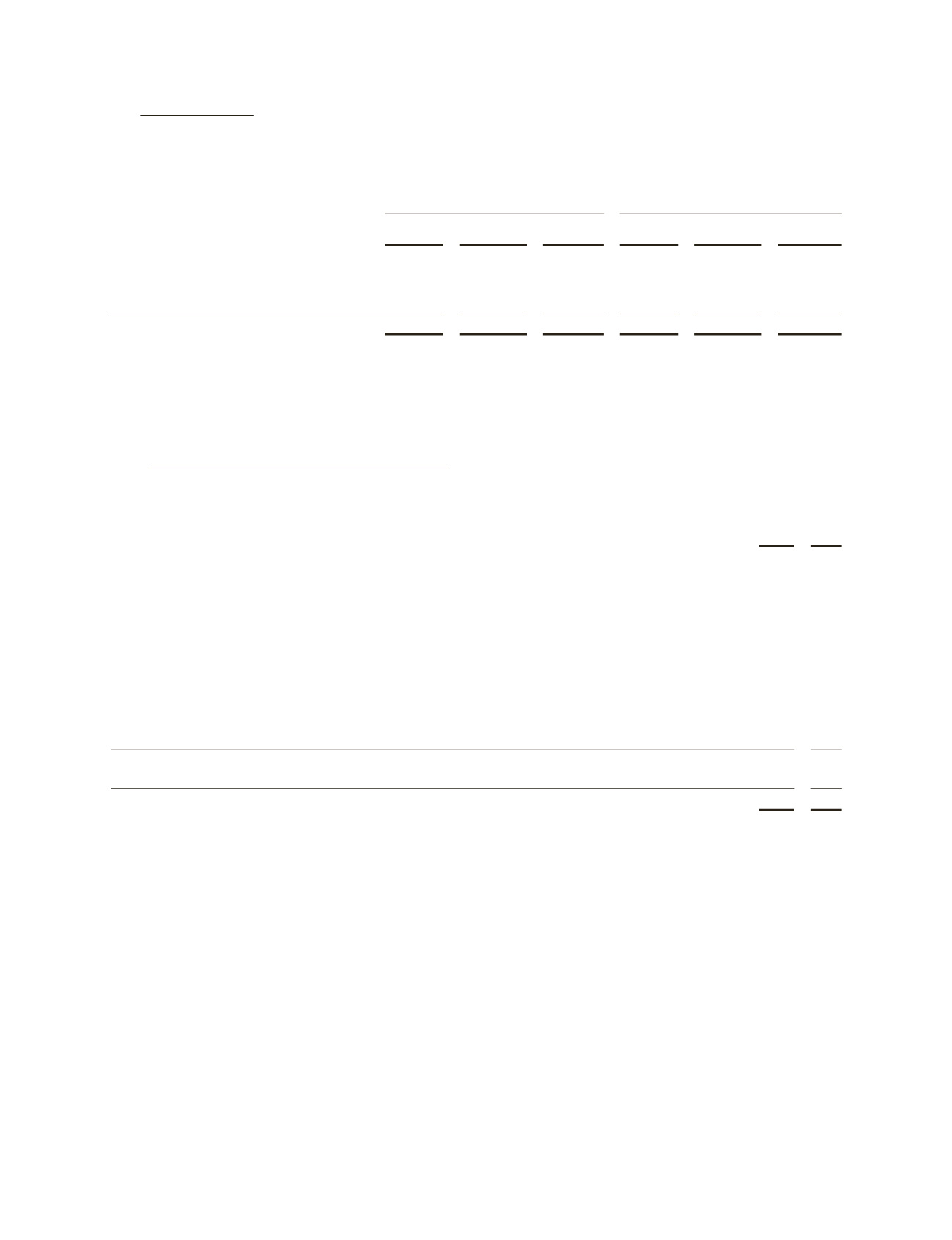

9. Intangible Assets

Intangible assets principally comprise technology/technical know-how, tradenames and customer relationships. At

December 31, intangible assets were as follows:

(Stated in millions)

2012

2011

Gross

Book Value

Accumulated

Amortization

Net Book

Value

Gross

Book Value

Accumulated

Amortization

Net Book

Value

Technology/Technical Know-How

$1,967

$ 474

$1,493

$1,875

$341

$1,534

Tradenames

1,647

188

1,459

1,677

131

1,546

Customer Relationships

2,115

312

1,803

1,954

209

1,745

Other

369

322

47

356

299

57

$6,098

$1,296

$4,802

$5,862

$980

$4,882

Amortization expense was $331 million in 2012, $324 million in 2011 and $190 million in 2010.

The weighted average amortization period for all intangible assets is approximately 20 years.

Amortization expense for the subsequent five years is estimated to be as follows: 2013 – $325 million, 2014 – $320

million, 2015 – $311 million, 2016 – $295 million and 2017 – $284 million.

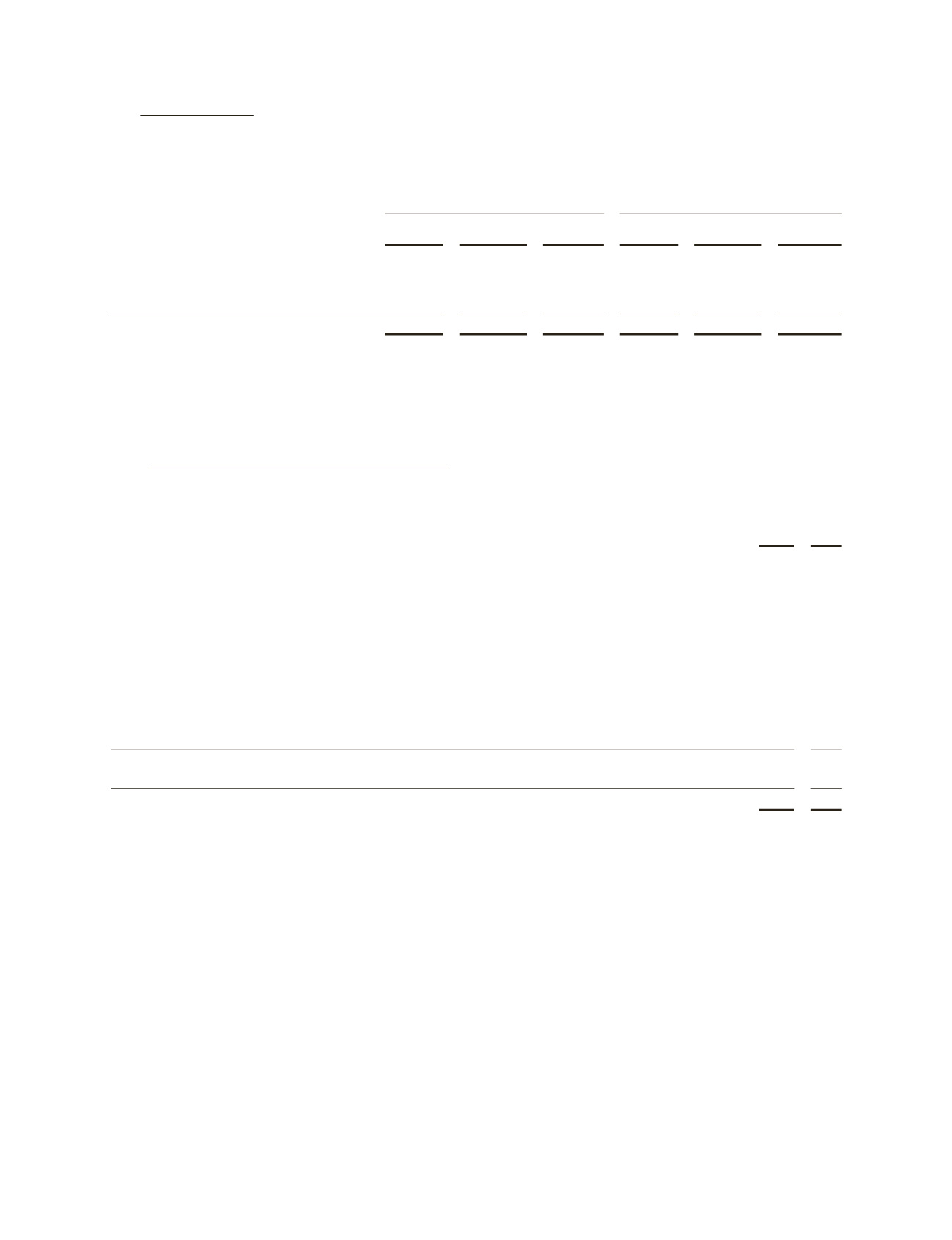

10. Long-term Debt and Debt Facility Agreements

Long-term Debt

consists of the following:

(Stated in millions)

As at December 31,

2012 2011

3.30% Senior Notes due 2021

$1,595

$1,595

4.50% Guaranteed Notes due 2014

(1)

1,324

1,297

2.75% Guaranteed Notes due 2015

(1)

1,318

1,290

1.95% Senior Notes due 2016

1,099

1,099

4.20% Senior Notes due 2021

1,099

1,099

1.25% Senior Notes due 2017

999

–

2.40% Senior Notes due 2022

998

–

5.25% Guaranteed Notes due 2013

(2)

–

649

2.65% Senior Notes due 2016

(3)

500

498

3.00% Guaranteed Notes due 2013

–

450

Floating Rate Senior Notes due 2014

(4)

300

300

Other variable rate debt

277

271

9,509

8,548

Fair value adjustment – hedging

(5)

–

8

$9,509

$8,556

(1)

Schlumberger maintains a

€

3.0 billion Euro Medium Term Note program that provides for the issuance of various

types of debt instruments such as fixed or floating rate notes in euro, US dollar or other currencies. Schlumberger

issued

€

1.0 billion 2.75% Guaranteed Notes due 2015 in the fourth quarter of 2010 under this program. Schlumberger

entered into agreements to swap these euro notes for US dollars on the date of issue until maturity, effectively

making this a US dollar denominated debt on which Schlumberger will pay interest in US dollars at a rate of 2.56%.

Schlumberger also issued

€

1.0 billion 4.50% Guaranteed Notes due 2014 in the first quarter of 2009 under this

program. Schlumberger entered into agreements to swap these euro notes for US dollars on the date of issue until

maturity, effectively making this a US dollar denominated debt on which Schlumberger will pay interest in US

dollars at a rate of 4.95%.

(2)

Schlumberger entered into agreements to swap these euro notes for US dollars on the date of issue until maturity,

effectively making this a US dollar-denominated debt on which Schlumberger pays interest in US dollars at a rate of

4.74%.

(3)

Schlumberger entered into agreements to swap these dollar notes for euros on the date of issue until maturity,

effectively making this a euro-denominated debt on which Schlumberger pays interest in euros at a rate of 2.39%.

(4)

These notes bear interest at a rate equal to three-month LIBOR plus 55 basis points per year.

48