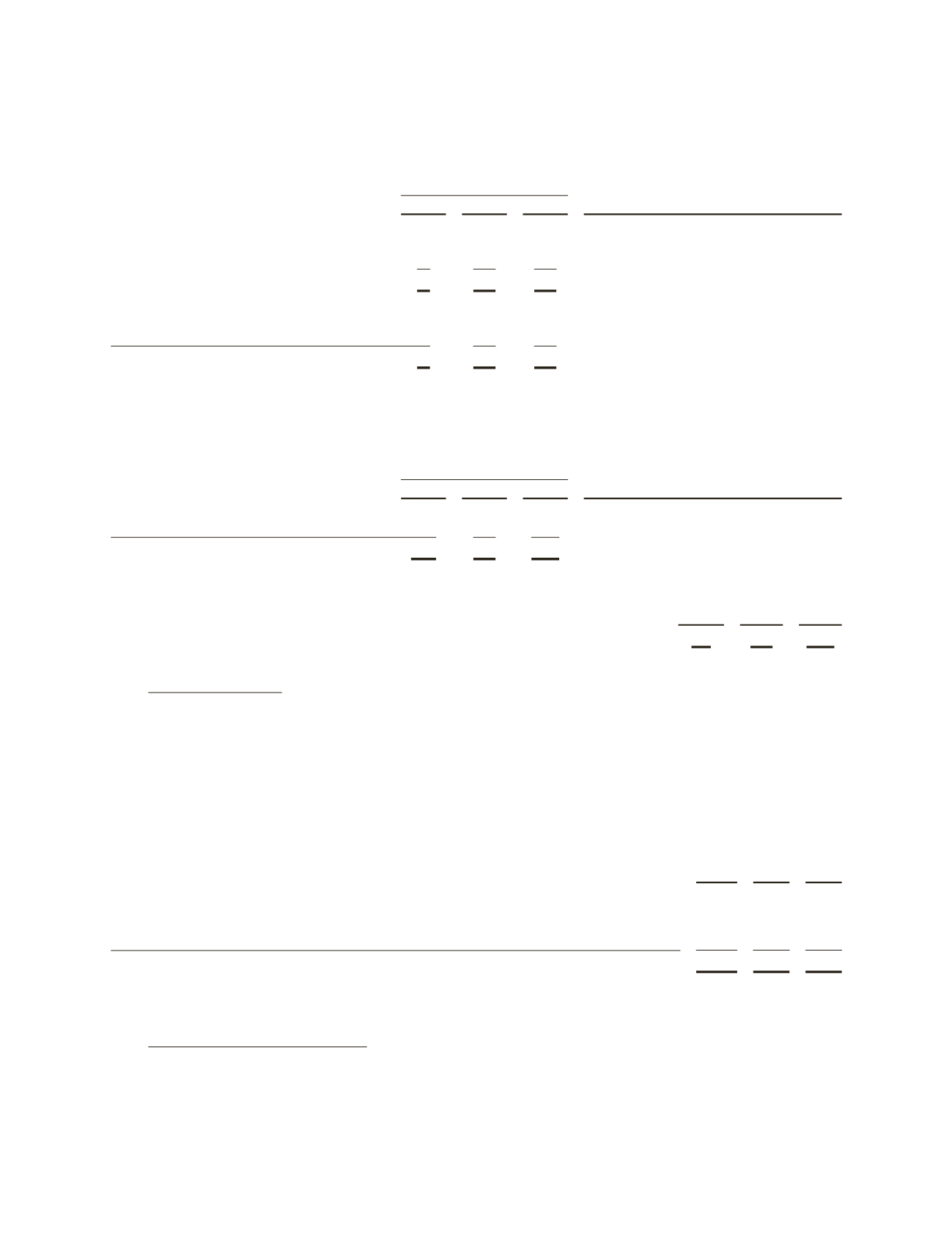

The effect of derivative instruments designated as fair value hedges and not designated as hedges on the

Consolidated Statement of Income

was as follows:

(Stated in millions)

Gain (Loss) Recognized in

Income

2012

2011

2010 Consolidated Statement of Income Classifiaction

Derivatives designated as fair value hedges:

Foreign exchange contracts

$–

$ –

$ (8)

Cost of revenue

Interest rate swaps

1

9

22

Interest expense

$1

$ 9

$ 14

Derivatives not designated as hedges:

Foreign exchange contracts

$5

$(17)

$(13)

Cost of revenue

Commodity contracts

1

(5)

1

Cost of revenue

$6

$(22)

$(12)

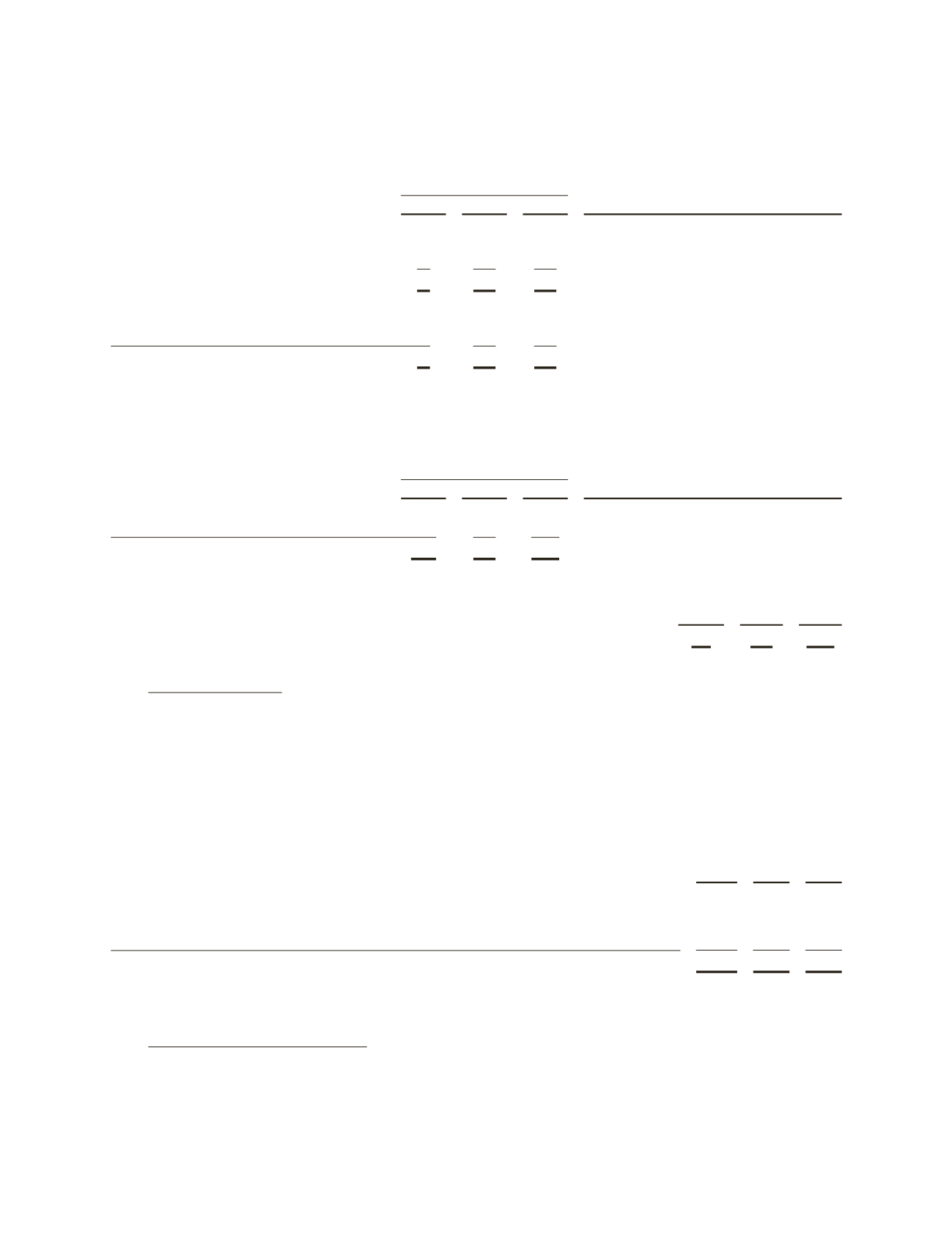

The effect of derivative instruments in cash flow hedging relationships on income and

Accumulated other

comprehensive loss

(AOCL) was as follows:

(Stated in millions)

Gain (Loss) Reclassified from

AOCL into Income

2012

2011

2010 Consolidated Statement of Income Classification

Foreign exchange contracts

$ 49

$(25)

$(260)

Cost of revenue

Foreign exchange contracts

(13)

17

(14)

Research & engineering

$ 36

$ (8)

$(274)

(Stated in millions)

Gain (Loss) Recognized in AOCL

2012

2011

2010

Foreign exchange contracts

$92

$(79)

$(269)

12. Stockholders’ Equity

Schlumberger is authorized to issue 4,500,000,000 shares of common stock, par value $0.01 per share, of which

1,328,255,773 and 1,333,775,406 shares were outstanding on December 31, 2012 and 2011, respectively. Holders of

common stock are entitled to one vote for each share of stock held. Schlumberger is also authorized to issue

200,000,000 shares of preferred stock, par value $0.01 per share, which may be issued in series with terms and

conditions determined by the Board of Directors. No shares of preferred stock have been issued.

Accumulated Other Comprehensive Loss

consists of the following:

(Stated in millions)

2012 2011 2010

Currency translation adjustments

$ (918)

$ (993) $ (912)

Fair value of derivatives

30

(26)

45

Pension and other postretirement benefit plans

(3,141)

(2,538) (1,901)

Unrealized gains on marketable securities

141

–

–

$(3,888)

$(3,557) $(2,768)

Other comprehensive loss was $331 million, $789 million and $94 million in 2012, 2011 and 2010, respectively.

13. Stock-based Compensation Plans

Schlumberger has three types of stock-based compensation programs: stock options, a restricted stock and

restricted stock unit program (collectively referred to as “restricted stock”) and a discounted stock purchase plan

(“DSPP”).

51